In a country where discretionary incomes are rising and luxury aspirations are increasingly mainstream, Ethos Ltd. has carved a strong niche in India’s underpenetrated premium watch and lifestyle accessories market. As the exclusive retailer for over 60 global luxury watch brands, Ethos is not just selling timepieces – it’s capturing a share of evolving Indian consumer aspirations.

From physical luxury retailing to digital discovery and engagement, Ethos is building a premium omnichannel experience that could ride India’s premiumization and wealth creation wave for years to come.

But does Ethos offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | ETHOS |

| Industry/Sector | Retail |

| CMP | 2,855.00 |

| Market Cap (₹ Cr.) | 7,639 |

| P/E | 79.60 (Vs Industry P/E of 95.09) |

| 52 W High/Low | 3,389.38 / 1,923.08 |

| EPS (TTM) | 35.99 |

| Dividend Yield | 0.00% |

About Ethos

Founded in 2003, Ethos Ltd. is India’s largest luxury and premium watch retailer, with a growing footprint across Tier-1 and emerging metro cities. The company is a strategic partner for global watch brands including Rolex, Omega, Rado, Tissot, Longines, and Hublot, and operates through 55+ luxury watch boutiques across India.

Ethos is part of the KDDL Group, and has gradually transformed itself into a digitally enabled luxury lifestyle platform, offering not only watches but also pre-owned timepieces and fine accessories.

Key business segments

Ethos operates primarily in the following key business segments:

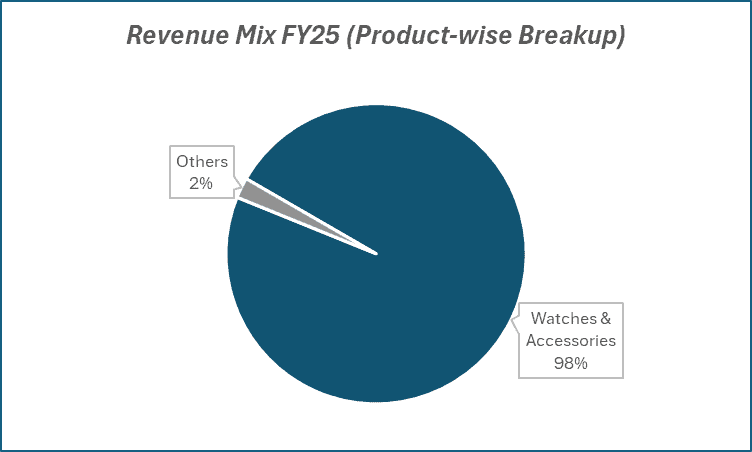

- Luxury & Premium Watches – Over 60 global brands, including exclusive brand boutiques.

- Certified Pre-Owned Watches (CPO) – Curated, authenticated resale platform with growing traction.

- Accessories & Lifestyle – Fine writing instruments, leather goods, and other luxury items.

- E-Commerce Platform – One of the few digital-first luxury watch platforms in India with live consultations, video selling, and virtual try-ons.

Primary growth factors for Ethos

Ethos key growth drivers:

- India’s Luxury Market Boom: Discretionary consumption in urban India is witnessing robust growth, with millennials driving luxury purchases.

- Premiumization Trend: Higher income households are moving up the value chain toward aspirational and luxury products.

- Expansion in Pre-Owned Watches: CPO business is seeing early success, tapping into value-conscious luxury seekers.

- Omnichannel Play: Digital-first approach backed by high-end physical presence provides a seamless buying experience.

- Brand Partnerships: Exclusive tie-ups with global watchmakers ensure high brand recall and premium positioning.

- New Store Expansion: Rapid boutique openings in metros and mini-metros help widen brand reach and category adoption.

Detailed competition analysis for Ethos

Key financial metrics – FY25;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Ethos Ltd. | 1251.63 | 190.07 | 15.19% | 98.15 | 7.84% | 79.60 |

| Trent Ltd. | 17134.61 | 2758.45 | 16.10% | 1447.91 | 8.45% | 123.27 |

| Vishal Mega Mart Ltd. | 10716.34 | 1530.18 | 14.28% | 631.97 | 5.90% | 103.60 |

| Arvind Fashions Ltd. | 4619.84 | 602.00 | 13.03% | 34.40 | 0.74% | -188.45 |

| V Mart Retail Ltd. | 3253.86 | 377.11 | 11.59% | 45.77 | 1.41% | 132.38 |

Key insights on Ethos

- Ethos derives over 70% of its revenues from premium and luxury watches, a segment expected to grow at 15–20% CAGR.

- Gross margins are strong (~37–40%), with higher contribution from own brand outlets and online sales.

- The CPO (pre-owned) watch business is margin accretive and has potential to become a ₹100+ crore vertical in 3–4 years.

- The digital platform contributes ~15–18% of revenue, with robust traffic and conversion growth.

- The company is investing in data analytics, loyalty programs, and clienteling platforms to enhance customer lifetime value.

Recent financial performance of Ethos for Q4 FY25

| Metric | Q4 FY24 | Q3 FY25 | Q4 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 252.52 | 369.93 | 311.32 | -15.84% | 23.29% |

| EBITDA (₹ Cr.) | 35.98 | 57.02 | 47.61 | -16.50% | 32.32% |

| EBITDA Margin (%) | 14.25% | 15.42% | 15.29% | -13 bps | 104 bps |

| PAT (₹ Cr.) | 20.93 | 29.73 | 24.11 | -18.90% | 15.19% |

| PAT Margin (%) | 8.29% | 8.04% | 7.74% | -30 bps | -55 bps |

| Adjusted EPS (₹) | 8.30 | 11.64 | 8.98 | -22.85% | 8.19% |

Ethos financial update (Q4 FY25)

Financial performance

- Revenue stood at ₹1,252 crore in FY25, up 25.3% YoY, driven by strong performance across luxury watch, lifestyle, and pre-owned segments.

- EBITDA (pre-Ind AS) rose 23.5% YoY to ₹161 crore, reflecting operating leverage and improving scale.

- Profit before tax (pre-Ind AS) increased 21.3% YoY to ₹141 crore, despite elevated inventory levels due to strategic expansion.

- Inventory increased from ₹440 crore to ₹593 crore YoY, attributed to boutique additions, City of Time, and luxury jewellery foray; normalization expected as new stores ramp up.

Business highlights

- Added 14 new boutiques; total now 73 across 26 cities. Targeting 100+ boutiques in FY26.

- Opened City of Time (22,000 sq. ft.) in Gurgaon and first Messika boutique in Delhi, entering luxury jewellery.

- Expanded Rimowa with a second boutique in Delhi; Mumbai store billed ₹20–24 crore.

- Pre-owned segment grew 30%+ YoY; new boutiques planned in Mumbai and Bangalore.

- Set up a UAE subsidiary (Ficus Trading) for global pre-owned and aftersales service; secured Favre Leuba retail rights.

- 50% forex exposure hedged; expects benefits from EFTA pact with Switzerland.

Outlook

- Management reiterates long-term vision to grow revenue 10x over the next decade, driven by strategic store additions, luxury lifestyle diversification, and international presence.

- Confident on demand outlook, April witnessed strong momentum, May expected to normalize post temporary geopolitical disruptions.

- Expansion to remain capital-efficient, with brand partnerships and customer experience as core priorities.

Recent Updates on Ethos

- Launched ‘City of Time’ in Gurgaon, India’s largest horological experience centre (22,000+ sq. ft.), enhancing brand visibility and customer engagement across multiple luxury watch brands and services.

- Opened first Messika boutique in Delhi, marking Ethos’ entry into the international luxury jewellery segment, broadening its high-margin product portfolio.

- Established UAE subsidiary (Ficus Trading LLC) to explore international opportunities in the pre-owned watch segment and aftersales services, setting the stage for global expansion.

- Reaffirmed plan to surpass 100 boutiques in FY26, supporting its long-term vision of 10x revenue growth in 10 years through sustained premium retail footprint expansion.

Company valuation insights – Ethos

Ethos Ltd is currently trading at a TTM P/E of 79.6x, which is at a discount to the industry average of 95.1x, suggesting some investor caution despite the company’s steady growth trajectory. Over the past year, the stock has delivered a return of -7.3%, underperforming the Nifty 50’s 2.7% gain.

This underperformance has been driven by concerns over elevated working capital, macro volatility, and short-term pressure on gross margins due to currency fluctuations. However, with robust expansion plans (targeting 100 stores by FY26), improving gross margins, and rising contribution from higher-margin verticals like certified pre-owned watches and luxury lifestyle (Rimowa, Messika), Ethos remains well-positioned for long-term re-rating. The company is also bolstering its brand positioning and customer experience through premium flagship stores and digital engagement, which should drive brand equity and operating leverage.

Applying a target P/E of 45x on FY27E EPS of ₹75, we arrive at a 12-month target price of ₹3,375, implying an ~18% upside from current levels. A near-term target of ₹3,050 indicates a 7% upside over the next three months, supported by recovery in volumes, stabilization in margins, and improving unit economics across new stores and segments.

Major risk factors affecting Ethos

- Discretionary Spending Cyclicality: Luxury consumption is vulnerable to economic slowdowns or consumer sentiment dips.

- High Working Capital Needs: Inventory-heavy models, especially in luxury, could strain the balance sheet in a demand slump.

- Dependence on Imports: Any disruption in global supply chains or forex volatility could impact margins.

- Concentration Risk: A large share of sales comes from a few high-end brands. Changes in brand partnerships or policies could affect performance.

Technical analysis of Ethos share

After establishing a well-defined ascending trend channel, Ethos continues to exhibit a strong bullish structure. The stock witnessed a sharp 15% upside move post its robust Q4FY25 results, which acted as a key trigger for the ongoing rally. Currently, Ethos is trading well above its 50-day, 100-day, and 200-day EMAs, signaling sustained bullish momentum and supporting a positive medium-term outlook.

The MACD remains positive at 44.34, with the MACD line positioned above the signal line, reinforcing the likelihood of continued upside. The RSI at 60.02 reflects strong buying interest, while Relative RSI values of 0.10 (21-day) and 0.18 (55-day) highlight consistent outperformance relative to the broader market. Furthermore, the ADX at 23.06 confirms that a strong trend is emerging and gaining traction.

A decisive breakout above ₹3,000 could pave the way for a rally toward ₹3,375, which aligns with the stock’s 12-month fundamental target. On the downside, ₹2,680 remains a critical support level; sustaining above this will be important to preserve the current trend structure.

- RSI: 60.02 (Strong Buying Interest)

- ADX: 23.06 (Trend Building Strength)

- MACD: 44.34 (Positive Momentum)

- Resistance: ₹3,000

- Support: ₹2,680

Ethos stock recommendation

Current Stance: Buy, with a 3-month target of ₹3,050 (~7% upside) and a 12-month target of ₹3,375 (~18% upside), based on a forward P/E-based valuation (45x FY27E EPS of ₹75).

Why buy now?

Aggressive expansion: Ethos is on track to cross 100 boutiques by FY26, with flagship luxury formats enhancing brand visibility.

Multiple growth engines: Scaling of pre-owned watches, luxury lifestyle brands, and international expansion via Dubai offer strong optionality.

Improving fundamentals: Better margin outlook, FX hedging, and strategic inventory planning address recent concerns around profitability and working capital.

Portfolio fit

Ethos offers differentiated exposure to India’s luxury consumption theme, with strong brand positioning, margin expansion potential, and long-term earnings visibility - ideal for investors seeking premium discretionary plays.If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dEthos: Budget 2025-26 opportunities

- Luxury Retail Push: Government’s support for premium retail infrastructure in Tier 1 and 2 cities can aid Ethos’s store expansion strategy.

- Boost to Tourism & Hospitality: Incentives to luxury travel and hospitality sectors drive demand for high-end accessories like luxury watches and luggage (Rimowa).

- Custom Duty Rationalization: EFTA implementation and favorable duty adjustments on Swiss imports can improve gross margins on imported watches.

- Startup & Brand Support: Incentives for homegrown brands and design-focused ventures support Ethos’s own-brand ambitions like Favre Leuba.

- Digital Commerce Initiatives: Policies promoting omnichannel retail and digital marketing help Ethos scale customer reach and improve ROI on digital spends.

Final thoughts

Ethos Ltd. is not just India’s luxury watch retailer – it is a story of evolving aspirations, digital luxury retail innovation, and first-mover advantage in an underpenetrated but fast-scaling segment.

With increasing formalization of luxury retail, expanding purchasing power, and rising millennial/Gen Z appetite for luxury and identity-driven purchases, Ethos is well-positioned to compound over the long term.

As India enters a new consumption curve, Ethos could be a quiet multi-year compounder for portfolios seeking premium retail exposure with digital leverage and brand-driven moats.