India’s healthcare sector is in the midst of a major structural shift – driven by rising healthcare awareness, increasing insurance penetration, government-backed schemes, and lifestyle-related health conditions. As one of the country’s leading private hospital chains, Fortis Healthcare is well-positioned to benefit from this long-term transformation. With a renewed focus on asset efficiency, specialty care, and digital health, Fortis is transitioning from a recovery phase to a growth-driven healthcare platform.

But does Fortis Healthcare offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | FORTIS |

| Industry/Sector | Healthcare (Hospital & Services) |

| CMP | 747.00 |

| Market Cap (₹ Cr.) | 58,026 |

| P/E | 74.48 (Vs Industry P/E of 66.93) |

| 52 W High/Low | 781.00 / 453.00 |

| EPS (TTM) | 10.26 |

| Dividend Yield | 0.13% |

About Fortis Healthcare

Fortis Healthcare is one of India’s largest integrated healthcare delivery providers. It operates under the brand names Fortis Hospitals and SRL Diagnostics. The company was originally part of the Ranbaxy Group and has undergone multiple ownership changes over the years. Today, it is majority-owned by Malaysia-based IHH Healthcare, which has brought in financial discipline, global best practices, and operational streamlining.

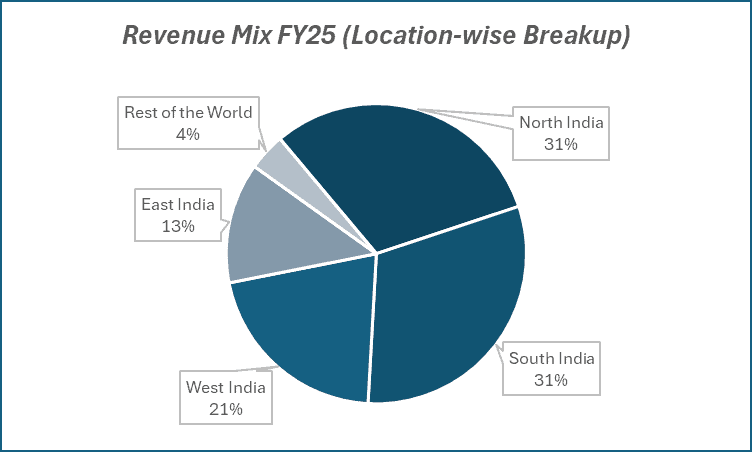

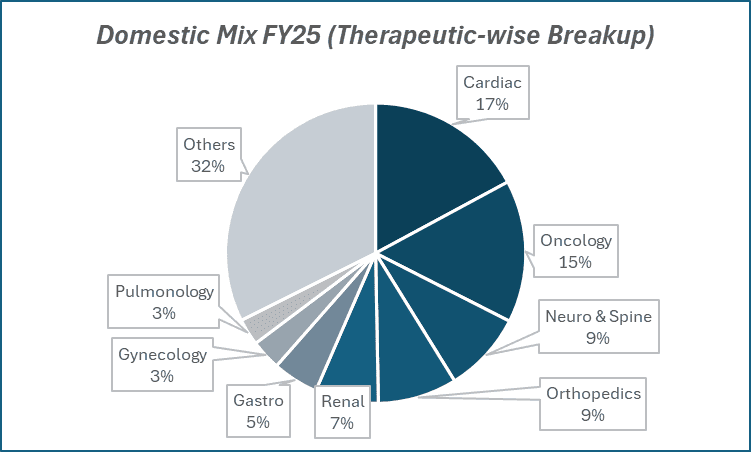

Fortis’ core strength lies in its extensive hospital network, brand recognition in key metros and tier-1 cities, and its presence across high-margin specialties like cardiology, neurology, oncology, and orthopedics.

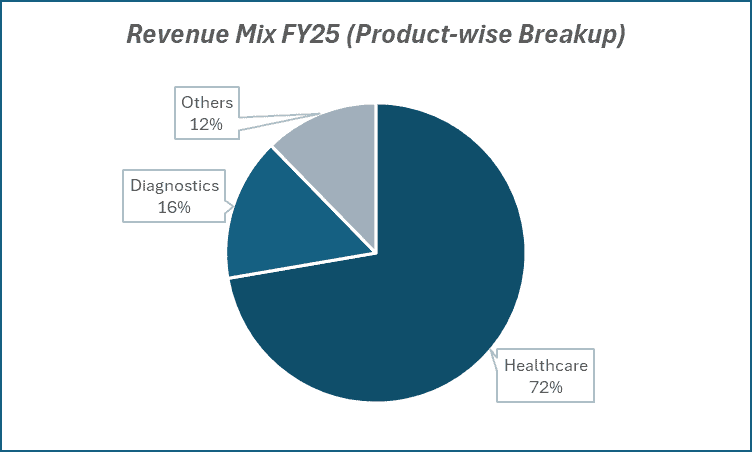

Key business segments

Fortis Healthcare operates primarily in the following key business segments:

- Hospital Business (Core): Operates 27+ hospitals and 4,300+ operational beds across India, with a focus on tertiary and quaternary care in metros and Tier-1 cities.

- Diagnostics (SRL Diagnostics): One of India’s largest diagnostics chains with a strong B2B and B2C presence, offering pathology and radiology services across India.

- Day-Care & Other Services: Includes fertility clinics, day care centers, and specialty health services.

Primary growth factors for Fortis Healthcare

Fortis Healthcare key growth drivers:

- Rising Healthcare Demand: Higher lifestyle diseases, medical tourism, and aging population increasing demand for tertiary and quaternary care.

- Operational Efficiency: Asset-light expansion and operational turnaround in underperforming hospitals improve margin profile.

- Diagnostics Growth: SRL’s brand and scale offer strong growth potential in preventive care and home diagnostics.

- Insurance & Ayushman Bharat: Increased coverage under private and public health insurance is expanding the paying customer base.

- Digital Integration: Fortis is enhancing its digital presence for OPD consultations, health monitoring, and telemedicine.

Detailed competition analysis for Fortis Healthcare

Key financial metrics – FY25;

| Company | Revenue(₹ Cr.) | Operational Beds | Hospital Occupancy Rate (%) | Average Length of Stay(Days) | Avg. Daily Revenue / Occupied Bed (₹) | P/E (TTM) |

| Fortis Healthcare | 7782.75 | 4750 | 69% | 4.2 | 69722 | 74.48 |

| Narayana Hrudayalaya | 5482.98 | 5583 | 47% | 4.5 | 46301 | 47.48 |

| Global Health Ltd. | 3692.32 | 2480 | 61% | 3.2 | 63629 | 69.64 |

| Apollo Hospitals | 21794.00 | 8025 | 67% | 3.3 | 63569 | 68.88 |

| Max Healthcare | 7028.46 | 4654 | 75% | 4.0 | 77100 | 107.06 |

Key insights on Fortis Healthcare

- Stable Growth: Sales CAGR of 11% over the last 5 years reflects consistent performance in a defensive sector.

- Strong Profitability: Profit CAGR of 70.4% over the same period indicates a sharp turnaround and improving operating leverage.

- Turnaround Under IHH: Steady improvement in key metrics like occupancy, ARPOB, and EBITDA margins under IHH’s leadership.

- Premiumization Drive: Focus on high-end specialties and metro locations is enhancing the case mix and increasing revenue per patient.

- SRL Diagnostics Optionality: Potential spinoff or partial monetization of SRL could unlock significant value.

- Capital Discipline: Debt reduction, improved cash flows, and ROCE-focused capital allocation point to stronger governance and financial prudence.

Recent financial performance of Fortis Healthcare for Q4 FY25

| Metric | Q4 FY24 | Q3 FY25 | Q4 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 1785.88 | 1928.26 | 2007.20 | 4.09% | 12.39% |

| EBITDA (₹ Cr.) | 381.04 | 375.12 | 435.47 | 16.09% | 14.28% |

| EBITDA Margin (%) | 21.34% | 19.45% | 21.70% | 225 bps | 36 bps |

| PAT (₹ Cr.) | 198.82 | 252.24 | 183.38 | -27.30% | -7.77% |

| PAT Margin (%) | 11.13% | 13.08% | 9.14% | -394 bps | -199 bps |

| Adjusted EPS (₹) | 2.37 | 3.28 | 2.44 | -25.61% | 2.95% |

Fortis Healthcare financial update (Q4 FY25)

Financial performance

- Reported revenue of ₹2,007 crore, up 12.4% YoY, driven by growth in ARPOB (Average Revenue Per Occupied Bed) and improved case mix across specialties.

- Net profit declined by 7.8% YoY to ₹183 crore due to exceptional losses, despite a strong operating performance.

- Hospital business contributed ~84% of consolidated revenue and EBITDA, with strong EBITDA growth of ~25% YoY.

- ARPOB (Average Revenue Per Occupied Bed) rose ~9% YoY to ₹2.42 crore per annum; occupancy improved to 69% from 65% in FY24.

Business highlights

- Strong growth in key specialties like oncology (+25% YoY) and neurology (+19% YoY); focus areas contributed ~62% of revenue.

- Digital channels now account for ~30% of hospital revenue, up from ~25% YoY.

- International business saw 17% YoY growth, contributing 8.1% to hospital revenue.

- Agilus Diagnostics delivered margin recovery post-rebranding, with normalized EBITDA margin at 22%.

- Continued network expansion through new beds, equipment upgrades, and acquisitions like Shrimann Hospital in Punjab.

Outlook

- Management guided for 14–15% revenue growth in FY26, led by ARPOB improvement (~5–6%) and higher volumes from brownfield expansions.

- SRL Diagnostics (Agilus) poised for further scaling through network expansion and focus on preventive care testing.

- Recent acquisition of Shrimann Hospital in Jalandhar and ongoing brownfield expansions to increase bed count to ~1,600 over next 2–3 years.

- Capital allocation remains disciplined: ₹700 crore capex in FY25, acquisition of Fortis brand, and strategic divestments of low-ROI assets.

Recent Updates on Fortis Healthcare

- Expansion & Acquisition Plans: Fortis is bidding for Sahyadri Hospitals, aiming to raise ₹5,000 Cr from foreign lenders to fund the acquisition; bidding deadline is June 22.

- Strong Results & Outlook: The stock rallied ~10% on May 22 post Q4 FY25 results, driven by an upbeat FY26 outlook focused on bed expansion, margin improvement, and diagnostics growth.

Company valuation insights – Fortis Healthcare

Fortis Healthcare is currently trading at a TTM P/E of 74.48, above the industry average of 66.93, supported by strong investor sentiment and a robust 1-year return of 62.68% (vs Nifty 50’s 6.71%).

While valuations appear rich, they are justified by improving fundamentals – hospital EBITDA margins expanded 190 bps YoY in FY25, with further scope for upside driven by; a better case and payor mix, cost optimisation through asset divestments like the Richmond unit, scale-up at Manesar, and contribution from upcoming brownfield bed additions.

The consolidation of an 89.2% stake in Agilus Diagnostics is also expected to drive margin and revenue acceleration from FY26 onward. Management guides for a 21% EBITDA CAGR over FY25–27E, reflecting high visibility on growth.

At 30x FY27E EV/EBITDA, we arrive at a 12-month target price of ₹910, implying a 21% upside from current levels. A 3-month target of ₹840 offers 12% near-term upside.

Major risk factors affecting Fortis Healthcare

- Regulatory Pricing Pressure: Government control on treatment costs or drug prices may cap revenue growth.

- Execution Risks: Delays in new hospital ramp-up or underperformance in diagnostics can affect profitability.

- Litigation Overhang: Historical promoter disputes or regulatory scrutiny may linger, though reduced post-IHH.

Technical analysis of Fortis Healthcare share

Fortis Healthcare is currently trading in a well-defined ascending channel, reflecting its ongoing uptrend. The stock has seen a sharp up move following its Q4 results and is firmly positioned above its 50-day, 100-day, and 200-day EMAs, indicating a structurally strong bullish setup.

The MACD is positive at 22.27, with the MACD line already above the signal line – a clear confirmation of sustained bullish momentum. The RSI at 61.43 signals strong buying interest, while Relative RSI readings over the 21-day and 55-day periods (0.09 and 0.13) highlight the stock’s recent outperformance relative to the broader market.

The ADX at 33.54 confirms a strong ongoing trend, enhancing the conviction in the uptrend. A breakout above ₹800 could unlock further upside toward ₹910, while ₹710 remains a critical support zone to monitor.

- RSI: 61.43 (Strong Buying Interest)

- ADX: 33.54 (Strong Trend)

- MACD: 22.27 (Positive)

- Resistance: ₹800

- Support: ₹710

Fortis Healthcare stock recommendation

Current Stance: Buy with a target price of ₹840 over a 3-month horizon and ₹910 over a 12-month horizon. Fortis Healthcare offers a compelling play on India’s premium healthcare delivery space, driven by improving profitability, ongoing capacity expansions, and a sharper strategic focus on operational efficiency and asset quality.

Why buy now?

Margin expansion underway with scope for further improvement from better case mix and cost optimisation.

Agilus Diagnostics scale-up expected to accelerate growth post 89.2% stake consolidation.

Brownfield bed additions and ramp-up at Manesar to drive volume-led revenue growth.

Asset rationalisation through divestments supports capital efficiency and margin focus.

Strong specialty mix with rising share of high-end procedures like oncology and robotic surgeries.

Portfolio fit

Fortis adds a strong defensive growth element to the portfolio, with a focus on premiumisation, rising healthcare demand, and diagnostic scale-up. It aligns well with portfolios seeking steady earnings compounding, healthcare exposure, and structural tailwinds in India's organised healthcare space. With visibility on margin expansion and a 21% EBITDA CAGR projected over FY25–27E, Fortis is well-placed to deliver meaningful upside.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebFortis Healthcare: Budget 2025-26 opportunities

- Healthcare Infra Push – Higher allocation supports Fortis’ expansion and capacity utilization.

- Insurance & Ayushman Bharat – Boosts patient volumes via broader coverage.

- Digital Health Mission – Aids Fortis’ digital and telemedicine initiatives.

- Medical Talent Upskilling – Eases talent shortages, supports quality care.

- PPP Focus – Opens growth in tier-2/3 cities through collaborations.

Final thoughts

Fortis Healthcare isn’t just a recovery story – it’s evolving into a well-run, specialty-focused healthcare platform with levers across both hospitals and diagnostics. With stronger governance, better capital efficiency, and expanding medical demand, Fortis is increasingly aligning itself with India’s healthcare aspirations.

As India spends more on health – and quality care becomes a priority – Fortis may find itself in the right place, at the right time, with the right strategy.