In a market where consumption trends are evolving rapidly and pricing power is being tested, Godrej Consumer Products (GCPL) sits at the intersection of daily necessity and aspirational consumption. With strong household brands, a diversified emerging market footprint, and improving profitability levers, GCPL is positioning itself for a more resilient and scalable growth phase.

But does Godrej Consumer Products Ltd. offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | GODREJCP |

| Industry/Sector | FMCG/CD/Services |

| CMP | 1191.00 |

| Market Cap (₹ Cr.) | 1,21,930 |

| P/E | 66.60 (Vs Industry P/E of 51.90) |

| 52 W High/Low | 1309.00 / 979.50 |

| EPS (TTM) | 17.81 |

| Dividend Yield | 2.11% |

About Godrej Consumer Products Ltd.

Godrej Consumer Products is a leading FMCG company with a strong presence across home care, personal care, and hair care categories. The company operates in India, Indonesia, Africa, and other emerging markets, with a strategy focused on daily-use products, affordability, and brand-led penetration.

GCPL’s portfolio combines mass and premium offerings, supported by deep distribution reach and a strong brand franchise. Over the years, the company has consciously pivoted toward capital efficiency, margin improvement, and simplification of its product portfolio.

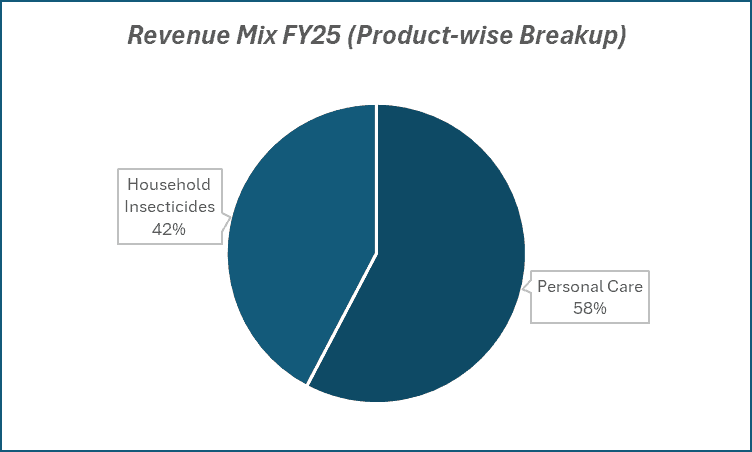

Key business segments

Godrej Consumer Products Ltd. operates primarily in the following key business segments:

- India Consumer Business: Includes household insecticides, soaps, and hair color, with leadership positions across several categories driven by strong brands and wide rural-urban penetration.

- Indonesia Business: A significant growth engine with a strong presence in household insecticides and personal wash categories, benefiting from rising consumption and brand expansion.

- Africa, USA & Middle East (AUME): Focused on hair care and personal care products, with long-term growth potential driven by under-penetration and improving execution.

Primary growth factors for Godrej Consumer Products Ltd.

Godrej Consumer Products Ltd. key growth drivers:

- India & Indonesia volume recovery, supported by easing input costs and a calibrated price–volume reset.

- Premiumization in hair color and personal care, lifting realizations and mix-led growth.

- Innovation across formats and pack sizes, driving penetration, affordability, and repeat consumption.

- Strong cost discipline and supply-chain efficiencies, delivering operating leverage and margin expansion.

- Structural growth in international markets (Indonesia & Africa) as per-capita consumption and distribution scale up.

Detailed competition analysis for Godrej Consumer Products Ltd.

Key financial metrics – TTM;

| Company | Sales (₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E |

| Godrej Consumer Ltd. | 14853.33 | 2943.05 | 19.81% | 1822.00 | 12.27% | 66.60 |

| Hindustan Unilever Ltd. | 64243.00 | 14761.00 | 22.98% | 10930.00 | 17.01% | 49.07 |

| Dabur India Ltd. | 12781.29 | 2364.65 | 18.50% | 1781.62 | 13.94% | 49.23 |

| Colgate Palmolive Ltd. | 5877.91 | 1870.37 | 31.82% | 1325.91 | 22.56% | 43.29 |

| Gillette India Ltd. | 2970.55 | 826.48 | 27.82% | 573.99 | 19.32% | 45.35 |

Key insights on Godrej Consumer Products Ltd.

- GCPL has transitioned from aggressive expansion to a phase of execution discipline and margin optimization.

- Management focus on cash flows, ROCE improvement, and steady volume growth improves earnings visibility.

- Household insecticides and hair color continue to be strong, stable cash generators.

- Soaps and personal care are scaling up gradually, with an improving profitability trajectory.

- Diversified geographic exposure adds resilience against India-specific demand cycles, though currency and global macro risks remain key monitorables.

Recent financial performance of Godrej Consumer Products Ltd. for Q2 FY26

| Metric | Q2 FY25 | Q1 FY26 | Q2 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Sales (₹ Cr.) | 3666.33 | 3661.86 | 3825.09 | 4.46% | 4.33% |

| EBITDA (₹ Cr.) | 759.64 | 694.56 | 733.33 | 5.58% | -3.46% |

| EBITDA Margin (%) | 20.72% | 18.97% | 19.17% | 20 bps | -155 bps |

| PAT (₹ Cr.) | 491.31 | 452.45 | 459.34 | 1.52% | -6.51% |

| PAT Margin (%) | 13.40% | 12.36% | 12.01% | -35 bps | -139 bps |

| Adjusted EPS (₹) | 4.80 | 4.42 | 4.49 | 1.58% | -6.46% |

Godrej Consumer Products Ltd. financial update (Q2 FY26)

Financial performance

- Resilient topline growth: Consolidated revenue grew 4% YoY in INR, with 3% underlying volume growth, despite GST-led channel disruptions and international headwinds.

- Margins held steady: EBITDA margin at 19.2%, reflecting disciplined cost control even as pricing resets and mix pressures weighed on near-term profitability.

- Earnings stability: Net profit (before exceptions) declined marginally 6% YoY, underscoring operational resilience during a transition quarter.

- Cash flow focus intact: Strong cash discipline continues, supporting balance-sheet strength and reinvestment flexibility.

Business highlights

- India business navigating GST reset: India sales grew 4% with 3% volume growth; ex-soaps, volumes delivered double-digit growth, highlighting strong underlying demand.

- Home care strength: Home care grew 6%, led by air fresheners and fabric care; personal care softness largely attributable to GST-led soaps disruption.

- Household insecticides outperform: Delivered double-digit volume growth with market share gains across formats; incense sticks emerged as a key growth driver.

- Premium portfolio traction: Hair color and personal care continue to anchor profitability, supported by innovation and premiumization.

Outlook

- H2 improvement expected: Management guides for sequential recovery in H2 FY26, aided by GST normalization, pricing curve benefits, and media cost savings.

- Margin normalization path: India standalone EBITDA margins expected to trend back toward the 24–26% normative band (lower end initially), with consolidated margins improving gradually.

- Balanced growth trajectory: Near-term recalibration in Indonesia to be offset by steady demand in India and Africa, supporting durable, cash-accretive growth and long-term value creation.

Recent Updates on Godrej Consumer Products Ltd.

- Continued streamlining of international operations with sharper focus on priority markets and core categories.

- Product portfolio rationalisation to improve mix, execution efficiency, and profitability.

- Strengthening digital distribution and analytics-led demand planning, enhancing forecasting accuracy and supply-chain responsiveness.

- Greater emphasis on sustainability and ESG initiatives, aligning operations with long-term responsible growth.

- Packaging and product innovation tailored to evolving consumer preferences and regulatory expectations.

Company valuation insights – Godrej Consumer Products Ltd.

Godrej Consumer Products trades at a TTM P/E of 66.6x, above the consumer staples industry average of 51.9x, with a 1-year return of 10.7%, broadly in line with the NIFTY 50’s 10.1%. While valuations remain optically rich, they reflect GCPL’s strong brand franchise, improving earnings visibility, and expectations of a margin-led recovery post recent disruptions.

The investment case is underpinned by volume recovery in India post GST normalization, margin tailwinds from easing palm oil prices and media efficiency gains, and portfolio premiumisation across household insecticides, hair color, and emerging personal care categories. The company is also expanding its addressable market through selective new category entries (toilet cleaners, men’s grooming via Muuchstac) while addressing profitability gaps in international markets, particularly Indonesia and Africa. This transition from growth-at-any-cost to execution discipline, ROCE improvement, and cash-flow focus strengthens medium-term earnings durability.

Applying a 55x multiple to FY27E EPS of ₹26, we arrive at a 12-month target price of ₹1,430, implying 20% upside from current levels. A 3-month target of ₹1,250 suggests 5% upside, supported by sequential improvement in volumes and margins through H2 FY26 as operational normalisation gains traction.

Major risk factors affecting Godrej Consumer Products Ltd.

- Input cost volatility: Particularly in palm oil and crude-linked derivatives, could weigh on gross margins.

- Currency fluctuations: In key international markets such as Indonesia and Africa pose risks to reported earnings.

- Intensifying competition: In soaps, household insecticides, and hair care may constrain pricing power and margin expansion.

- Execution risks in international operations: Especially amid macro and channel challenges, remain monitorables.

- Slower-than-expected demand recovery: Could delay volume-led growth and operating leverage benefits.

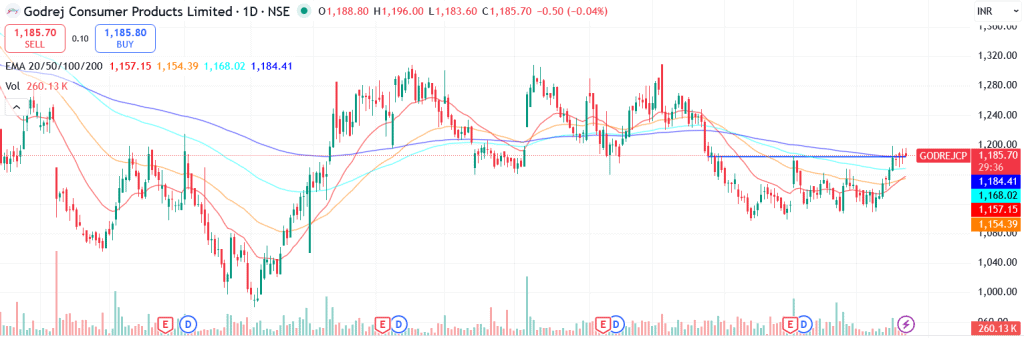

Technical analysis of Godrej Consumer Products Ltd. share

Godrej Consumer Products has formed a double bottom pattern and is currently trading around the neckline. A decisive breakout above this zone could signal the start of a fresh upward leg.

The stock is trading comfortably above its 50-, 100-, and 200-day EMAs, reinforcing a strong long-term uptrend and indicating sustained buying support across timeframes.

Momentum indicators support the bullish setup. MACD at 11.93 remains firmly positive with the MACD line above the signal line, pointing to continued underlying strength.

RSI at 64.86 reflects strong buying momentum while still leaving room for further upside. Relative RSI readings (0.06 / –0.04 over 21- and 55-day periods) indicate short-term outperformance; a confirmed breakout could translate this into potential long-term outperformance. ADX at 18.60 suggests a range-bound phase currently, but a breakout above resistance could trigger a strong directional move.

A decisive move above ₹1,250 could open the path toward ₹1,430 (12-month target). On the downside, ₹1,110 remains the key support; holding above this level keeps the bullish structure intact.

- RSI: 64.86 (Strong Buying Momentum)

- ADX: 18.60 (Range-bound, breakout watch)

- MACD: 11.93 (Positive)

- Resistance: ₹1,250

- Support: ₹1,110

Godrej Consumer Products Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹1,250 (5% upside) and a 12-month target of ₹1,430 (20% upside), based on 55x FY27E EPS of ₹26.

Why buy now?

Volume recovery ahead: India volumes expected to improve in H2 FY26 post GST normalization, with soaps turning positive.

Margin recovery visibility: Easing input costs, media efficiencies, and operating leverage support a return toward normalized margins.

Strong cash engines: Household insecticides and hair color provide stable cash flows and earnings resilience.

Growth optionality: New categories (toilet cleaners, men’s grooming) expand TAM while remaining capital-efficient.

International upside: Africa continues to outperform, while Indonesia offers recovery potential as pricing pressure eases.

Portfolio fit

Godrej Consumer Products offers defensive growth exposure within large-cap FMCG, combining strong brands, improving volume momentum, and visible margin recovery. With cash-flow strength, disciplined execution, and calibrated category expansion, the stock provides an attractive medium-term risk–reward for portfolios seeking stable compounding with recovery-led upside.Godrej Consumer Products Ltd.: Budget 2025-26 opportunities

- Rural consumption support: Higher allocations toward rural development, income support, and employment schemes can boost demand for GCPL’s mass and value FMCG categories.

- Tax relief led consumption uplift: Personal tax relief and higher disposable incomes support discretionary spending, aiding premiumisation in hair color and personal care.

- Manufacturing & logistics push: Investments in logistics, warehousing, and supply-chain infrastructure improve distribution efficiency and reduce costs across GCPL’s operations.

- Ease of doing business reforms: Simplified compliance and digitisation lower operational friction, supporting faster launches and better execution across categories.

- Sustainability & ESG focus: Policy emphasis on sustainable packaging, waste reduction, and energy efficiency aligns with GCPL’s ESG initiatives and brand positioning.

Final thoughts

Godrej Consumer Products represents a blend of stability and growth, anchored in everyday consumption while offering long-term upside from emerging markets. As margins stabilize and volumes recover, GCPL’s focus on capital efficiency, brand strength, and disciplined execution positions it well for steady compounding. For investors seeking a resilient FMCG name with emerging-market optionality, GCPL offers a compelling consumption-led story worth tracking closely.