The pharmaceutical sector in India is globally recognized for its cost efficiency and manufacturing prowess, but companies that combine scale, integration, and global reach stand out. Granules India is one such player, transitioning from being a bulk drug supplier to a fully integrated pharmaceutical manufacturer with a strong international footprint. With consistent operational focus, backward integration, and diversified presence across APIs, formulations, and CRAMS, Granules continues to expand its relevance in the global healthcare supply chain.

But does Granules India offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | GRANULES |

| Industry/Sector | Healthcare |

| CMP | 560.00 |

| Market Cap (₹ Cr.) | 13,524 |

| P/E | 27.42 (Vs Industry P/E of 34.29) |

| 52 W High/Low | 628.00 / 422.00 |

| EPS (TTM) | 19.76 |

| Dividend Yield | 0.28% |

About Granules India Ltd.

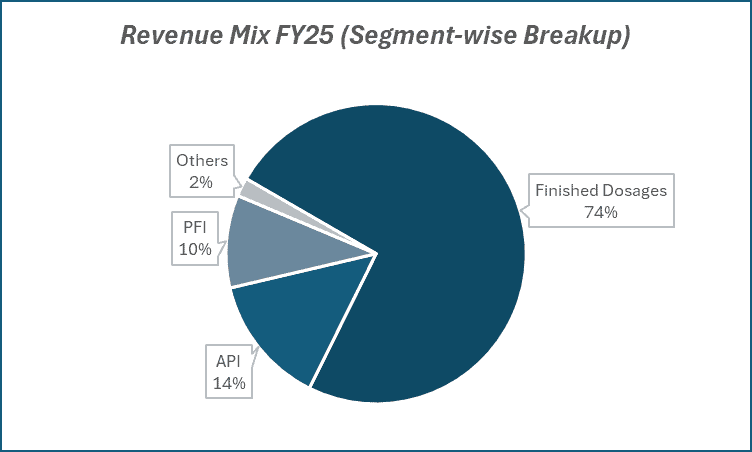

Founded in 1991 and headquartered in Hyderabad, Granules India is a vertically integrated pharmaceutical company engaged in the manufacturing of Active Pharmaceutical Ingredients (APIs), Pharmaceutical Formulation Intermediates (PFIs), and Finished Dosages (FDs). The company has a strong presence in regulated markets such as the US, Europe, and emerging markets, supported by multiple USFDA and EU-approved manufacturing facilities.

Key business segments

Granules India Ltd. operates primarily in the following key business segments:

- APIs (Active Pharmaceutical Ingredients) – Large-scale production of key molecules like Paracetamol, Ibuprofen, Metformin, and Guaifenesin.

- PFIs (Pharmaceutical Formulation Intermediates) – Granules’ proprietary advantage, offering customized bulk intermediates to formulation players.

- Finished Dosages (FDs) – Direct formulations for global markets, including tablets and capsules across multiple therapeutic categories.

- Contract Research and Manufacturing (CRAMS) – Partnerships with global innovators for custom manufacturing, adding high-margin growth potential.

Primary growth factors for Granules India Ltd.

Granules India Ltd. key growth drivers:

- Backward integration into key APIs ensures cost leadership.

- Expanding formulations portfolio in the US and EU markets.

- Increased focus on complex generics and value-added products.

- Growing CRAMS and CDMO opportunities with global pharmaceutical companies.

- Capacity expansion across API and formulations to scale exports.

Detailed competition analysis for Granules India Ltd.

Key financial metrics – TTM;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Granules India Ltd. | 4511.85 | 932.68 | 20.67% | 479.50 | 10.63% | 27.42 |

| Natco Pharma Ltd. | 4395.80 | 1962.20 | 44.64% | 1695.20 | 38.56% | 8.52 |

| Caplin Point | 1988.73 | 672.87 | 33.83% | 566.92 | 28.51% | 27.66 |

| Concord Biotech Ltd. | 1188.27 | 486.45 | 40.94% | 357.29 | 30.07% | 47.96 |

| Jubilant Pharmova | 7403.50 | 1211.80 | 16.37% | 457.60 | 6.18% | 38.54 |

Key insights on Granules India Ltd.

- Granules’ ability to integrate APIs to finished dosages gives it a margin advantage over peers.

- It has a strong track record in regulated markets, with US FDA-compliant plants.

- Shift toward formulations and specialty molecules is expected to drive margin expansion.

- A diversified product basket reduces dependence on a single molecule, mitigating concentration risk.

Recent financial performance of Granules India Ltd. for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 1179.87 | 1197.43 | 1210.11 | 1.06% | 2.56% |

| EBITDA (₹ Cr.) | 259.27 | 252.36 | 246.72 | -2.23% | -4.84% |

| EBITDA Margin (%) | 21.97% | 21.07% | 20.39% | -68 bps | -158 bps |

| PAT (₹ Cr.) | 134.65 | 152.03 | 112.64 | -25.91% | -16.35% |

| PAT Margin (%) | 11.41% | 12.70% | 9.31% | -339 bps | -210 bps |

| Adjusted EPS (₹) | 5.56 | 6.27 | 4.64 | -26.00% | -16.55% |

Granules India Ltd. financial update (Q1 FY26)

Financial performance

- Revenue: ₹1,210 crore (+3% YoY), includes ₹29 crore from Senn Chemicals.

- Gross Margin: 64.9% (+593 bps YoY), supported by Senn Chemicals consolidation.

- EBITDA: ₹247 crore (~20.4% margin), down YoY due to higher remediation/professional costs.

- R&D Spend: ₹68 crore (5.6% of sales).

- Net Debt: ₹948 crore post Senn Chemicals acquisition.

- ROCE: 16%, slightly lower due to higher capital employed.

Business highlights

- Remediation: Final stages at Gagillapur facility; FDA re-inspection expected by Dec’25. Cleared by German & Danish regulators.

- Capacity Expansion: Genome Valley formulations facility cleared by US FDA, unlocking 40% higher capacity (10 bn doses). Ramp-up by Q1FY27.

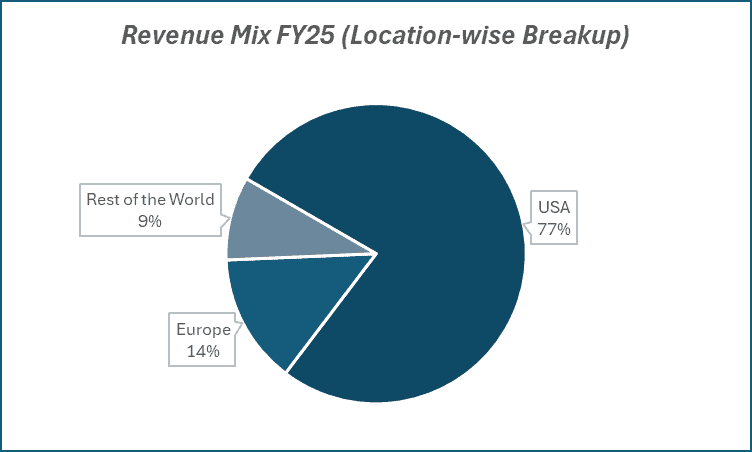

- Europe Business: Sales improving; expected to contribute 15–20% of revenue ahead.

- Peptides/CDMO: Strategic entry via Senn Chemicals & Ascelis Peptides; current order book CHF 15–20 mn. India peptide R&D CoE at IIT Hyderabad to start Oct ’25; commercial plant by FY27.

- API Segment: Not a core focus; mainly in-house, though paracetamol & PFIs showing recovery.

Outlook

- Short term: Margins to remain under pressure from remediation expenses; revenue growth supported by Genome Valley and EU sales ramp-up.

- Medium to long term: Strong growth visibility from peptide/CDMO diversification, expanded US/EU capacity, and new launches. FY27 was targeted as a breakout growth year.

- Execution focus: Timely FDA clearance at Gagillapur, smooth scale-up at Genome Valley, and profitable turnaround of peptide platform within 12–18 months.

- Investor sentiment: Positive bias, driven by confidence in remediation progress, capacity additions, and structural pivot into high-value segments (peptides, CDMO).

Recent Updates on Granules India Ltd.

- Expansion of API capacities, particularly for Paracetamol and Metformin, to meet growing global demand.

- Increased regulatory approvals for new formulations in the US market.

- Investments in green chemistry and sustainable manufacturing practices.

- Advancing pipeline of complex generics and niche formulations.

Company valuation insights – Granules India Ltd.

Granules India is currently trading at a TTM P/E of 27.4x, below the industry average of 34.3x, with a 1-year return of -5.7% versus the Nifty 50’s -1.6%.

The company’s investment case lies in its strategic pivot from a pure generics player to a diversified pharma platform spanning formulations, Europe/US launches, and high-value peptides/CDMO via Senn Chemicals and Ascelis Peptides. With remediation at Gagillapur nearing completion and Genome Valley expansion unlocking a 40% increase in capacity, Granules is positioned to return to a growth trajectory. Entry into oncology and ADHD filings, coupled with 15–20% revenue contribution from Europe, adds further visibility. Resolution of regulatory overhangs remains a key re-rating catalyst.

Using a 23x FY27E EPS of ₹30, we set a 12-month target price of ₹690 (23% upside from current levels). For the short term, we assign a 3-month target of ₹600 (~7% upside). Upside triggers include timely FDA clearance at Gagillapur, faster scale-up at Genome Valley, and profitable turnaround of the peptides/CDMO platform.

Major risk factors affecting Granules India Ltd.

- High dependence on a few molecules like Paracetamol poses product concentration risk.

- Regulatory risks in the US and EU remain a constant overhang.

- API price volatility and raw material dependency from China can impact margins.

- Currency fluctuations may affect export realizations.

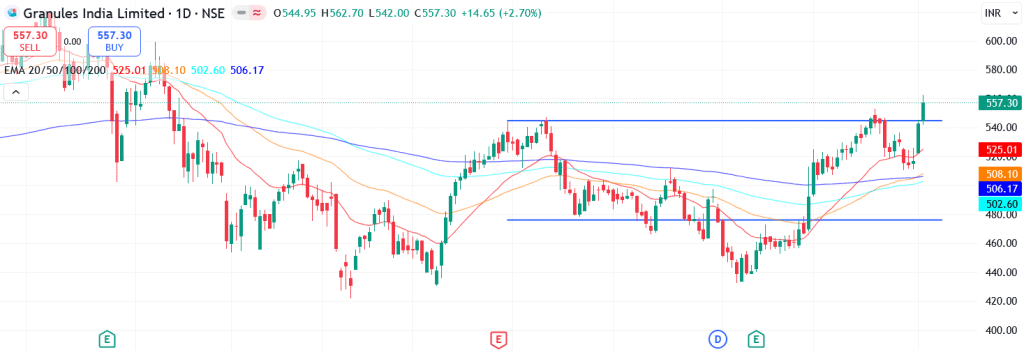

Technical analysis of Granules India Ltd. share

Granules is currently trading in a sideways channel but has recently broken above the upper trendline with a 3% up-move, signaling the potential start of strong upward momentum.

The stock is well placed above its 50-day, 100-day, and 200-day EMAs, reaffirming that the broader trend remains positive. A sustained move above these levels could pave the way for a firm medium- to long-term uptrend.

Momentum indicators highlight a strengthening bullish bias. The MACD at 10.93 is positive, with the line crossing above the signal line, pointing to a possible momentum build-up. The RSI at 68.58 indicates strong buying interest, while relative RSI scores of 0.07 (21-day) and 0.15 (55-day) show consistent outperformance versus the market. The ADX at 34.58 further confirms the presence of a strong and strengthening trend.

A breakout above ₹600 could trigger a rally toward ₹690 (12-month fundamental target). On the downside, ₹520 serves as a crucial support, and sustaining above this level will be vital for preserving the bullish structure.

- RSI: 68.58 (Strong Buying Interest)

- ADX: 34.58 (Strong Trend)

- MACD: 10.93 (Positive)

- Resistance: ₹600

- Support: ₹520

Granules India Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹600 (~7% upside) and a 12-month target of ₹690 (~23% upside).

Why buy now?

Regulatory clarity: Gagillapur remediation nearing completion; FDA clearance expected by Dec’25.

Capacity boost: Genome Valley adds 40% formulation capacity, ramp-up by Q1FY27.

Diversification: Entry into peptides/CDMO with Senn & Ascelis targets a $130 bn market.

Geographic mix: Europe to contribute 15–20% of revenue; US pipeline gaining traction.

Margin expansion: Gross margin up ~600 bps YoY; further gains from high-value launches.

Portfolio fit

Granules India offers investors a turnaround and growth story in Indian pharma, blending stability from core APIs/Formulations with strong structural upside from capacity expansion and entry into high-value peptides/CDMO. With regulatory resolution, geographic diversification, and specialty product launches, the company is positioned for a multi-year growth cycle. At current valuations, Granules provides an attractive entry point into a pharma player transitioning toward a higher-margin, innovation-led model.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebGranules India Ltd.: Budget 2025-26 opportunities

- Healthcare & PLI: Higher allocation to healthcare and pharma PLI supports capacity expansion and exports.

- R&D Push: Government focus on innovation and clinical trials aligns with Granules’ peptide, oncology, and ADHD pipeline.

- CDMO Incentives: Policy support for domestic CDMO boosts growth prospects for Senn Chemicals and Ascelis Peptides.

- Export Boost: Incentives for pharma exports aid Granules’ push in US and Europe (15–20% revenue target).

- Sustainability Focus: ESG and green chemistry initiatives complement Granules’ global compliance and sustainability edge.

Final thoughts

Granules India represents the story of an Indian mid-cap pharma company steadily moving up the value chain. From a bulk drug supplier to a global integrated manufacturer, the company has laid the groundwork for sustainable growth through backward integration, global compliance, and expanding formulations footprint. For investors seeking exposure to the healthcare sector with a mix of scalability and profitability, Granules offers an exciting mid-cap opportunity that could see significant upside as it strengthens its specialty pipeline and global presence.