Grasim Industries, one of India’s most diversified conglomerates under the Aditya Birla Group, has evolved far beyond its roots in textiles. With interests spanning cement, financial services, chemicals, and most recently paints, Grasim has positioned itself as a structural growth play on India’s industrial and consumption story. The company’s transformation journey, marked by strategic investments and steady leadership, makes it a compelling stock to track in the coming decade.

But does Grasim Industries offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | GRASIM |

| Industry/Sector | Construction Materials |

| CMP | 2877.90 |

| Market Cap (₹ Cr.) | 1,96,288 |

| P/E | 47.40 (Vs Industry P/E of 34.13) |

| 52 W High/Low | 2,898.40 / 2276.95 |

| EPS (TTM) | 60.61 |

| Dividend Yield | 0.35% |

About Grasim Industries

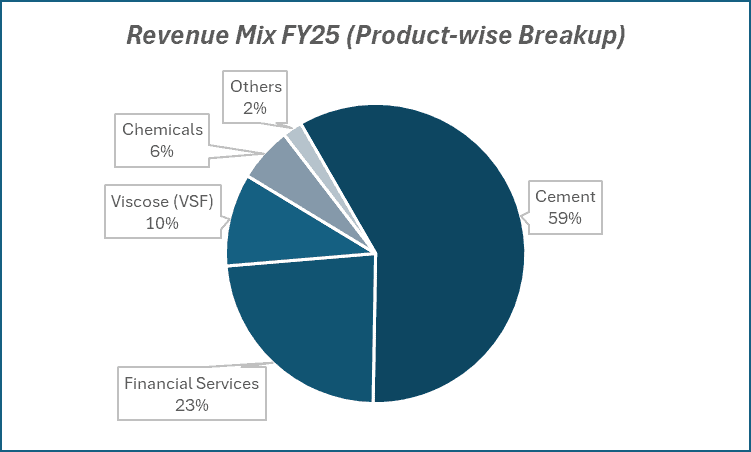

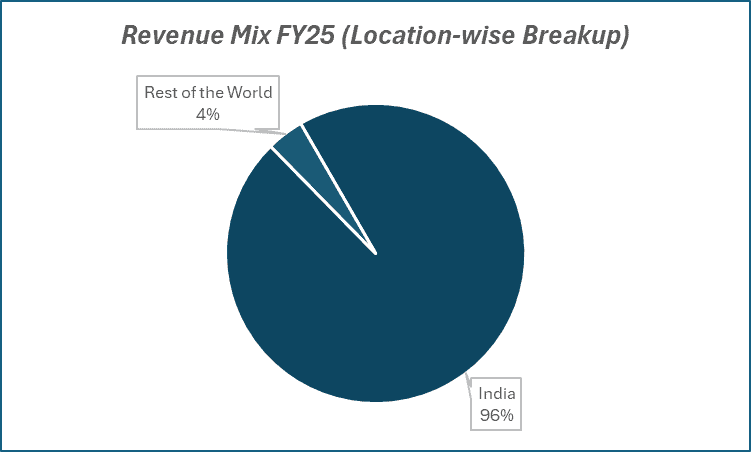

Founded in 1947, Grasim started as a textile manufacturer and has since diversified into multiple industries. Today, it operates across cement (through a majority stake in UltraTech Cement), viscose staple fibre (VSF), chemicals, paints, and financial services (via Aditya Birla Capital). Its diversified portfolio provides both defensive resilience and cyclical growth exposure, making it one of India’s most balanced large-cap industrial companies.

Key business segments

Grasim Industries operates primarily in the following key business segments:

- Cement (UltraTech Cement): India’s largest cement producer with pan-India operations, contributing a significant share of Grasim’s consolidated earnings.

- Viscose Staple Fibre (VSF): A global leader in man-made cellulosic fibre, catering to apparel and textiles.

- Chemicals: A major player in caustic soda, epoxy resins, and specialty chemicals, serving multiple end-user industries.

- Financial Services: Through Aditya Birla Capital, offers lending, asset management, insurance, and advisory services.

- Paints (New Venture): Entered decorative paints with “Birla Opus,” aiming to disrupt the market with premium products and nationwide rollout.

Primary growth factors for Grasim Industries

Grasim Industries key growth drivers:

- Paints Foray: Grasim’s bold ₹10,000+ crore investment in Birla Opus paints is expected to make it the second-largest player, capitalizing on premiumization and housing demand.

- Cement Expansion: UltraTech’s capacity expansion projects enhance leadership in a growing infrastructure-driven economy.

- Textile Consumption: Rising demand for sustainable and man-made fibres positions Grasim’s VSF segment strongly.

- Chemicals Scale-Up: Growing use of caustic soda and specialty chemicals in industrial value chains adds a stable revenue stream.

- Financial Services Growth: Aditya Birla Capital’s scaling across lending, insurance, and wealth management offers a strong diversification buffer.

Detailed competition analysis for Grasim Industries

Key financial metrics – TTM;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Grasim Industries | 152741.04 | 30385.59 | 19.89% | 8351.41 | 5.47% | 47.40 |

| Ultratech Cement | 77166.83 | 13934.14 | 18.06% | 7012.17 | 9.09% | 53.56 |

| Ambuja Cements | 37022.35 | 6651.92 | 17.97% | 5330.89 | 14.40% | 33.36 |

| Shree Cements | 19439.75 | 4339.45 | 22.32% | 1489.01 | 7.66% | 72.60 |

| JK Cement | 12424.11 | 2228.60 | 17.94% | 1011.00 | 8.14% | 53.07 |

Key insights on Grasim Industries

- Diversified Portfolio: Balanced mix of cyclical (cement, VSF) and structural (chemicals, financial services) businesses ensures stability.

- Paints Optionality: Entry into paints with Birla Opus offers a potential disruptor in a high-growth, high-margin industry.

- Cash Flow Strength: Strong cash generation from UltraTech Cement provides funding for large capex without stressing leverage.

- Market Leadership: Global leadership in VSF and India’s largest cement producer gives it strong competitive positioning.

- Sustainability Focus: Increasing investments in green energy, recycling, and circular economy initiatives support long-term ESG credentials.

Recent financial performance of Grasim Industries for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 34609.75 | 44267.26 | 40118.08 | -9.37% | 15.92% |

| EBITDA (₹ Cr.) | 6682.35 | 8750.10 | 8822.26 | 0.82% | 32.02% |

| EBITDA Margin (%) | 19.31% | 19.77% | 21.99% | 222 bps | 268 bps |

| PAT (₹ Cr.) | 2033.90 | 2804.84 | 2698.41 | -3.79% | 32.67% |

| PAT Margin (%) | 5.88% | 6.34% | 6.73% | 39 bps | 85 bps |

| Adjusted EPS (₹) | 16.19 | 21.98 | 20.85 | -5.14% | 28.78% |

Grasim Industries financial update (Q1 FY26)

Financial performance

- Consolidated revenue up 16% YoY to ₹40,118 crore; EBITDA up 36% YoY to ₹6,430 crore.

- Standalone revenue hit a record ₹9,223 crore (+34% YoY).

- Cement (UltraTech) volumes +10% YoY; EBITDA/ton +37% YoY to ₹1,248.

- Chemicals revenue +16% YoY to ₹2,391 crore; EBITDA +36% YoY to ₹422 crore.

Business highlights

- Paints (Birla Opus): Double-digit QoQ growth; India’s No. 3 brand with 65% premium mix; Kharagpur plant launch by Q2 FY26.

- B2B E-commerce (Birla Pivot): ARR on track for ₹8,500 crore by FY27; strong repeat orders and customer additions.

- Chemicals: Specialty volumes at record highs; ECH & CPVC projects to be completed in Q3 FY26.

- Renewables: Installed capacity doubled YoY to 1.9 GW.

Outlook

- Paints to gain scale and drive growth.

- Cement margin expansion supported by efficiency and capacity additions.

- Chemicals growth aided by specialty projects.

- Strong capex pipeline to fuel multi-sector expansion.

Recent Updates on Grasim Industries

- Launch of Birla Opus decorative paints brand with a pan-India rollout strategy.

- Commissioning of new VSF expansion plants, enhancing global market share.

- Ongoing UltraTech Cement capacity expansion projects targeting 200+ MTPA capacity.

- Strategic investments in sustainability – green energy and circular economy initiatives.

Company valuation insights – Grasim Industries

Grasim Industries is currently trading at a TTM P/E of 47.4x, at a premium to the industry average of 34.1x, while delivering a 1-year return of 8.2% versus Nifty 50’s -2.4%.

The stock’s appeal lies in its strong leadership in UltraTech Cement, robust growth in chemicals, and promising scale-up of new businesses such as Birla Opus paints and Birla Pivot e-commerce. The paints business has quickly emerged as India’s third-largest decorative brand, with 65% revenue contribution from premium products and pan-India reach across 8,000+ towns. Chemicals delivered a strong EBITDA beat in Q1FY26, while B2B e-commerce continues to scale towards its $1bn revenue run rate by FY27. Capacity additions in cement, premiumisation in paints, and specialty chemicals projects are expected to drive growth momentum.

We value Grasim using a SoTP approach, with UltraTech Cement accounting for ~61% of fair value. This yields a 12-month target price of ₹3,500, implying a 21% upside from current levels. A shorter-term target of ₹3,100 suggests a 7% upside over 3 months, supported by continued margin recovery in cement, strong paint ramp-up, and steady chemical profitability.

Major risk factors affecting Grasim Industries

- Execution Risks: Paints business scalability and distribution execution remain untested.

- Cyclical Exposure: Cement and VSF businesses are vulnerable to demand cycles and commodity price swings.

- Competitive Intensity: Aggressive competition in paints (Asian Paints, Berger Paints) could limit early gains.

- Regulatory Risks: Environmental norms in chemicals and cement could raise compliance costs.

Technical analysis of Grasim Industries share

Grasim Industries is currently trading in a sideways channel, with the price consolidating near the upper trendline. A decisive breakout above this level could trigger a strong up move. The stock is trading comfortably above its 50-day, 100-day, and 200-day EMAs, suggesting that the broader trend remains positive, and a sustained move higher could set the stage for a medium- to long-term uptrend.

Momentum indicators are supportive of further gains. The MACD is positive at 20.86, with the MACD line above the signal line, indicating continuing upward momentum. The RSI at 65.13 reflects strong buying interest, though nearing overbought territory. Relative RSI scores of -0.01 (21-day) and 0.01 (55-day) point to performance largely in line with the broader market.

The ADX at 16.79 indicates a trend is developing, with scope for strengthening if price breaks above the upper resistance.

A breakout above ₹3,100 could open the door for a rally toward ₹3,500, which also aligns with the 12-month fundamental target. On the downside, ₹2,600 serves as a strong support level, and holding above it will be critical for sustaining bullish momentum.

- RSI: 65.13 (Strong Buying Interest)

- ADX: 16.79 (Moderate Trend)

- MACD: 20.86 (Positive)

- Resistance: ₹3,100

- Support: ₹2,600

Grasim Industries stock recommendation

Current Stance: Buy, with a 3-month target of ₹3,100 (~7% upside) and a 12-month target of ₹3,500 (~21% upside).

Why buy now?

Multi-engine growth: Core businesses of cement (UltraTech) and chemicals delivering robust performance, while new segments Birla Opus paints and Birla Pivot e-commerce are scaling strongly.

Paints leadership: Birla Opus has quickly emerged as India’s No. 3 decorative brand with 65% premium product mix, pan-India distribution across 8,000+ towns, and capacity set to expand with the upcoming Kharagpur plant.

Chemical strength: Specialty chemicals volumes at record highs, with new ECH & CPVC projects scheduled for commissioning in FY26, supporting profitability.

B2B digital platform: Birla Pivot is on track to achieve a $1bn revenue run rate by FY27, strengthening Grasim’s digital presence in building materials.

Portfolio fit

Grasim provides a diversified play on India’s growth across cement, chemicals, paints, and B2B e-commerce. Its scale, sectoral leadership, and capex pipeline position it as a resilient compounder with long-term margin expansion potential.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebGrasim Industries: Budget 2025-26 opportunities

- Infrastructure Push: Higher capital outlay for roads, housing, and urban infrastructure to drive cement demand through UltraTech.

- Housing & Urban Development: Policy incentives for affordable housing and smart cities to support long-term cement and paints consumption.

- Manufacturing Incentives: PLI and capex-linked schemes for chemicals and specialty materials to aid cost competitiveness and capacity expansion.

- Renewables & Sustainability: Budget thrust on green energy transition to benefit Grasim’s renewable capacity and sustainability-linked chemical products.

- Digital & MSME Ecosystem: Support for digital platforms and MSMEs aligns with growth of Birla Pivot e-commerce, expanding its supplier and customer base.

Final thoughts

Grasim Industries is no longer just a cement and fibre company, it is transforming into a multi-industry powerhouse with a disruptive paints foray, a strong presence in chemicals, and a deep financial services platform. Investors looking for a combination of defensive balance, cyclical exposure, and structural growth optionality should keep Grasim on their radar. As India’s housing, infrastructure, and consumption cycles accelerate, Grasim is poised to ride multiple growth waves simultaneously.