Hero MotoCorp, the world’s largest two-wheeler manufacturer by volume, has long been synonymous with motorcycles in India. Known for its market dominance in the commuter bike segment, the company is now accelerating into its next phase of growth by diversifying into premium motorcycles, scooters, and the fast-evolving electric vehicle (EV) space. With a deep rural penetration, a strong dealer network, and a renewed focus on brand premiumization, Hero is gearing up to ride India’s mobility transformation.

But does Hero Motocorp offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | HEROMOTOCO |

| Industry/Sector | Automobile (Two Wheelers) |

| CMP | 4754.50 |

| Market Cap (₹ Cr.) | 95,122 |

| P/E | 18.45 (Vs Industry P/E of 24.61) |

| 52 W High/Low | 6,426.25 / 3,344.00 |

| EPS (TTM) | 251.81 |

| Dividend Yield | 3.46% |

About Hero Motocorp

Founded in 1984 (formerly Hero Honda), Hero MotoCorp has been a market leader in the Indian two-wheeler segment for over two decades. The company operates multiple manufacturing facilities across India and exports to over 40 countries. Its portfolio spans commuter motorcycles, premium bikes, scooters, and now EVs under the Vida brand.

Key business segments

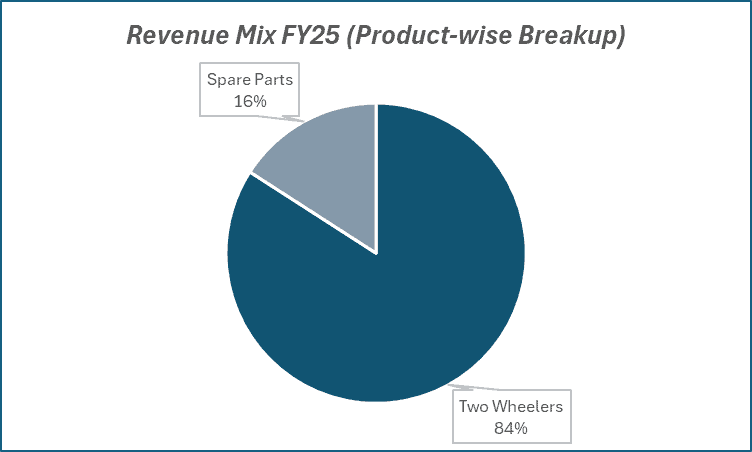

Hero Motocorp operates primarily in the following key business segments:

- Commuter Motorcycles – The core segment, with iconic brands like Splendor, HF Deluxe, and Passion dominating rural and semi-urban markets.

- Premium Motorcycles – Expanding offerings through Harley-Davidson collaboration and X-series bikes to capture higher-margin segments.

- Scooters – Brands like Maestro, Pleasure+, and Destini cater to urban and female-centric demand.

- Electric Two-Wheelers – The Vida V1 electric scooter marks the company’s EV foray, with plans for a broader electric portfolio.

- International Business – Growing presence in Asia, Africa, and Latin America.

Primary growth factors for Hero Motocorp

Hero Motocorp key growth drivers:

- Rural Market Strength – Hero’s deep rural penetration positions it to benefit from rural income recovery and higher disposable incomes.

- Premiumization Push – Entry into 300cc+ motorcycles and stylish commuter-premium crossovers to lift ASPs and margins.

- EV Expansion – Scaling up Vida’s presence with improved product range, competitive pricing, and charging network partnerships.

- Export Growth – Leveraging cost-competitive manufacturing to expand market share in overseas markets.

- Government Push for Green Mobility – FAME subsidies and state EV policies supporting demand for electric scooters.

Detailed competition analysis for Hero Motocorp

Key financial metrics – TTM;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Hero Motocorp Ltd. | 40440.38 | 5897.46 | 14.58% | 4526.79 | 11.19% | 18.45 |

| Bajaj Auto Ltd. | 52195.83 | 10890.23 | 20.86% | 8508.86 | 16.30% | 30.14 |

| Eicher Motors Ltd. | 19519.14 | 4749.38 | 24.33% | 4155.84 | 21.29% | 32.07 |

| TVS Motor Ltd. | 46188.36 | 7040.86 | 15.24% | 2594.05 | 5.62% | 59.06 |

| Atul Auto | 740.40 | 54.76 | 7.40% | 19.64 | 2.65% | 50.81 |

Key insights on Hero Motocorp

- Maintains over 30% domestic two-wheeler market share, supported by unparalleled distribution and after-sales reach.

- The rural and commuter segment recovery will be key for volume growth in the near term, especially in FY26.

- Premiumization strategy is gaining traction, with Harley-Davidson co-developed models and X-series bikes boosting brand equity.

- Strategic investments in Ather Energy and charging infrastructure partnerships reflect a long-term EV vision.

- Cost control and localization initiatives help protect margins amidst raw material volatility.

Recent financial performance of Hero Motocorp for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 10210.79 | 9969.81 | 9727.75 | -2.43% | -4.73% |

| EBITDA (₹ Cr.) | 1461.28 | 1440.75 | 1412.90 | -1.93% | -3.31% |

| EBITDA Margin (%) | 14.31% | 14.45% | 14.52% | 7 bps | 21 bps |

| PAT (₹ Cr.) | 1086.35 | 1097.71 | 1076.21 | -1.96% | -0.93% |

| PAT Margin (%) | 10.64% | 11.01% | 11.06% | 5 bps | 42 bps |

| Adjusted EPS (₹) | 52.31 | 58.07 | 85.26 | 46.82% | 62.99% |

Hero Motocorp financial update (Q1 FY26)

Financial performance

- Revenue from operations at ₹9,728 crore (down 4.7% YoY); consolidated profit at ₹1,706 crore (up 65.3% YoY, aided by ₹722 crore one-time gain).

- Gross margin up ~100 bps YoY on pricing and premium mix; EBITDA margin (ICE) at 16.8%, overall at 14.5% post EV investments.

- ASP rose 6% YoY; commodity costs up 5.5% YoY, expected rangebound in Q2.

Business highlights

- Vahan market share improved to ~30.9% (+100 bps QoQ).

- Record 9.7% share in 125 cc scooters in June; HF Deluxe gained 800 bps market share with new Pro variant.

- EV share doubled YoY to 7% in Q1, >10% in July; Vida V2 launched under Battery-as-a-Service model.

- International volumes up 27% YoY with market share gains.

Outlook

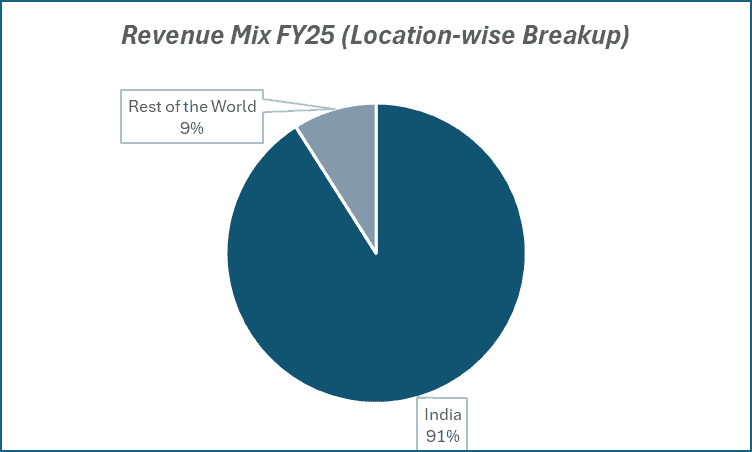

- Festive and rural demand to drive growth; aim to outpace industry with ~10% revenue from international markets.

- EBITDA margin guidance at 14–16%; multiple Harley-Davidson launches lined up.

- Preparing for ABS mandate across all new two-wheelers.

Recent Updates on Hero Motocorp

- Hero to launch a new feature-rich 125cc bike with car-like cruise control, targeting budget and mid-segment buyers.

- July 2025 dispatches up 21% YoY to 4.5 lakh units, with scooters and EVs leading growth.

- Honda overtakes Hero in July retail sales, holding 25.51% market share versus Hero’s 25.05%.

Company valuation insights – Hero Motocorp

Hero MotoCorp is currently trading at a TTM P/E of 18.45, below the industry average of 24.61, with a 1-year return of -6.3% versus Nifty 50’s 2.0%. The company’s medium-term growth visibility is supported by a strong new launch pipeline across motorcycles, scooters, and EVs, a gradual rural recovery aided by favorable monsoons and budgetary tax cuts, and robust export expansion plans targeting 40% YoY growth in FY26. Stable margins (FY25 EBITDA margin at 14.2%, expected to rise to 14.5% by FY27E) are backed by price hikes, premiumisation, and LEAP cost savings, offsetting input cost pressures.

The domestic business is seeing sustained market share recovery in the entry and 125cc segments, while EV adoption is accelerating with Vida’s market share doubling YoY to 7% in Q1FY26 and crossing 10% in July. International operations remain a strong growth lever, with volumes up 27% YoY in Q1 and a medium-term target of 10% contribution to revenue and volumes.

We value Hero MotoCorp at 20x FY27E EPS of ₹285 to arrive at a 12-month target price of ₹5,700, implying a 20% upside from current levels. A short-term target of ₹5,200 implies a 9% upside over 3 months, supported by festive-season demand recovery, premium product launches, and expanding EV and export footprints.

Major risk factors affecting Hero Motocorp

- Sluggish Rural Demand – Prolonged rural slowdown could weigh on volumes.

- Premium Segment Competition – Aggressive entry by peers like Bajaj, TVS, and Royal Enfield in mid-premium bikes.

- EV Adoption Risks – Slower-than-expected uptake in electric scooters may delay return on EV investments.

- Raw Material Price Volatility – Fluctuations in steel, aluminium, and rubber prices can impact margins.

- Regulatory Changes – Stricter emission norms may increase compliance costs.

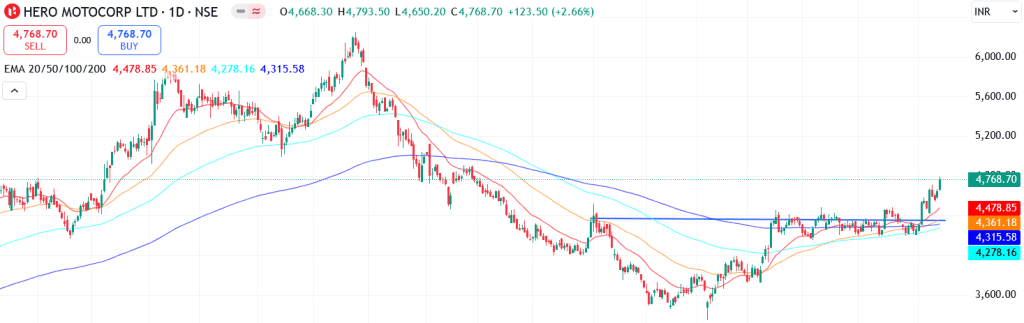

Technical analysis of Hero Motocorp share

Hero MotoCorp has recently broken out above the neckline of a cup and handle pattern post Q1 FY26 results, delivering an impressive ~7% move and confirming the breakout. This signals the start of a potential sustained uptrend.

The stock trades comfortably above its 50-day, 100-day, and 200-day EMAs, underscoring the presence of an established upward trend.

Momentum indicators are strong. The MACD is firmly positive at 92.78, with the MACD line positioned above the signal line, reflecting ongoing bullish momentum. The RSI stands at 67.96, highlighting strong buying interest, while relative RSI scores of 0.10 (21-day) and 0.10 (55-day) point to consistent outperformance versus the broader market.

The ADX at 19.50 suggests a moderate trend, which could accelerate if the price moves above key resistance.

A breakout above ₹5,200 could pave the way toward ₹5,700, in line with the 12-month fundamental target. On the downside, ₹4,200 remains a crucial support level, and holding above it will be key to maintaining the bullish structure.

- RSI: 67.96 (Strong Buying Interest)

- ADX: 19.50 (Moderate Trend)

- MACD: 92.78 (Firmly Positive)

- Resistance: ₹5,200

- Support: ₹4,200

Hero Motocorp stock recommendation

Current Stance: Buy, with a 3-month target of ₹5,200 (~9% upside) and a 12-month target of ₹5,700 (~20% upside).

Why buy now?

Rural recovery tailwinds: Gradual pick-up in rural demand aided by favorable monsoons and tax cuts, benefiting Hero’s dominant entry-level portfolio.

Premiumisation & new launches: Strong pipeline in the 125cc+ motorcycle and scooter segments, along with premium channel expansion, to drive ASP growth.

EV scale-up: Rapid adoption of the Vida EV range with market share doubling YoY; Battery-as-a-Service model improving affordability and penetration.

Export growth: Aggressive push in international markets targeting 40% volume growth in FY26, with a medium-term goal of 10% revenue contribution.

Portfolio fit

Hero MotoCorp is India’s largest two-wheeler manufacturer with a well-diversified portfolio across segments, growing EV presence, and expanding global footprint. Its combination of stable margins, strong brand equity, and multiple growth levers, rural recovery, premiumisation, EV adoption, and exports, makes it an attractive pick for investors seeking a mix of cyclical demand recovery and structural growth drivers.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebHero Motocorp: Budget 2025-26 opportunities

- Rural Demand Boost: Higher rural infrastructure allocation, increased MSPs, and farm sector support to drive two-wheeler demand in entry and commuter segments.

- EV Incentives: Extended FAME subsidies, GST benefits, and battery manufacturing incentives to accelerate adoption of Hero’s Vida EV range.

- Manufacturing Push: PLI scheme expansion for auto and EV components to lower costs and enhance competitiveness in domestic and export markets.

- Export Facilitation: Trade agreements and simplified export procedures to open new markets and boost Hero’s international sales.

- Skill & R&D Support: Government funding for skilling programs and R&D in electric mobility and connected vehicle technologies to strengthen Hero’s product innovation pipeline.

Final thoughts

Picture a brand that has been the first ride for millions of Indians, from farmers in Punjab to office-goers in Bangalore. Hero MotoCorp isn’t just selling motorcycles; it’s selling accessibility, aspiration, and now, innovation. As it blends its rural stronghold with premium aspirations and an EV future, the company is positioning itself for a new growth era. For investors, Hero offers a balance of stability from its core business and optionality from its EV and premium ambitions, a ride worth considering for the long haul.