The Indian banking sector is undergoing a structural shift, with retail-focused franchises gaining prominence over traditional corporate-heavy banks. Among these evolving players, IDFC First Bank has emerged as a strong contender, backed by its transformation journey, robust retail loan book, and focus on profitability. Once seen as a corporate-focused lender, the bank has been reshaping itself into a customer-centric retail powerhouse.

But does IDFC First Bank offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | IDFCFIRSTB |

| Industry/Sector | Financial Services (Private Banking) |

| CMP | 72.48 |

| Market Cap (₹ Cr.) | 53,188 |

| P/E | 41.07 (Vs Industry P/E of 13.23) |

| 52 W High/Low | 78.45 / 52.46 |

| EPS (TTM) | 1.77 |

About IDFC First Bank Ltd

Established in 2015 through the merger of IDFC Bank and Capital First, IDFC First Bank is a private-sector bank headquartered in Mumbai. It has positioned itself as a retail-focused bank, offering a full suite of products including savings accounts, personal loans, credit cards, home loans, and MSME financing. Over the years, the bank has steadily increased its retail loan mix while reducing dependence on large-ticket corporate lending, thereby building a more stable and diversified loan book.

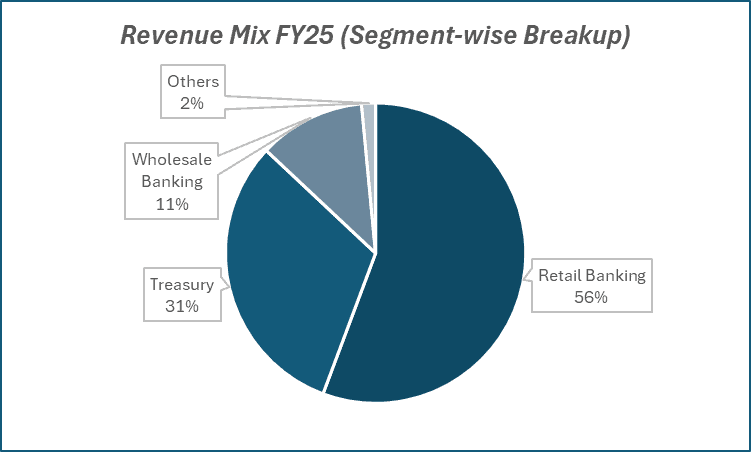

Key business segments

IDFC First Bank Ltd. operates primarily in the following key business segments:

- Retail Banking – Consumer loans, home loans, gold loans, credit cards, personal loans, and SME/MSME financing.

- Wholesale Banking – Lending to corporates, infrastructure projects, and financial institutions (though reducing in share).

- Treasury & Investments – Managing liquidity, investments in government securities, and hedging interest rate risks.

- Other Services – Digital banking, wealth management, and transaction banking services.

Primary growth factors for IDFC First Bank

IDFC First Bank key growth drivers:

- Retail Loan Growth – Rapid expansion in consumer and SME lending has improved loan book granularity and margins.

- CASA Growth – Strong traction in Current and Savings Accounts (CASA), improving cost of funds and margin stability.

- Digital Banking Push – A robust digital platform enabling customer acquisition, cross-selling, and lower service costs.

- Credit Card Expansion – Strong growth in cards-in-force and spends, positioning the bank in a high-margin retail segment.

- Improving Asset Quality – Declining NPAs with prudent underwriting and diversified retail exposure.

Detailed competition analysis for IDFC First Bank

Key financial metrics – TTM;

| Company | NII(₹ Cr.) | NIM (%) | PAT Margin (%) | GNPA (%) | NNPA (%) | P/B |

| IDFC First Bank Ltd. | 19531.55 | 5.71% | 2.89% | 1.97% | 0.55% | 1.37 |

| IndusInd Bank Ltd. | 18263.50 | 3.46% | 1.81% | 3.64% | 1.12% | 0.91 |

| IDBI Bank Ltd. | 14594.28 | 3.68% | 22.48% | 2.93% | 0.21% | 1.94 |

| Axis Bank Ltd. | 56549.88 | 3.80% | 17.61% | 1.57% | 0.45% | 1.76 |

| Kotak Mahindra Bank | 38081.72 | 4.65% | 18.12% | 1.48% | 0.34% | 2.46 |

Key insights on IDFC First Bank

- The bank has successfully pivoted from a corporate-heavy to retail-led model, now deriving a majority of its loan book from retail customers.

- NIMs (Net Interest Margins) have improved significantly, supported by lower cost of funds and higher-yielding retail loans.

- Profitability metrics are showing a steady uptrend, though operating leverage is still being built out.

- The bank is among the few mid-sized private banks to focus heavily on financial inclusion through small-ticket retail lending and digital outreach.

Recent financial performance of IDFC First Bank for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| NII (₹ Cr.) | 4695.44 | 4907.61 | 4933.15 | 0.52% | 5.06% |

| Op. Income (₹ Cr.) | 1847.00 | 1794.79 | 2230.27 | 24.26% | 20.75% |

| Op. Margin (%) | 39.34% | 36.57% | 45.21% | 864 bps | 587 bps |

| PAT (₹ Cr.) | 642.64 | 295.60 | 453.47 | 53.41% | -29.44% |

| PAT Margin (%) | 6.20% | 2.61% | 3.82% | 121 bps | -238 bps |

| Adjusted EPS (₹) | 0.91 | 0.40 | 0.62 | 55.00% | -31.87% |

IDFC First Bank financial update (Q1 FY26)

Financial performance

- NII stood at ₹4,933 crore, up 5.1% YoY, supported by healthy loan growth but offset by margin compression (NIM at 5.71%, down 51 bps YoY).

- Net profit came in at ₹454 crore, down 29.4% YoY due to elevated provisions.

- Cost-to-income ratio improved to 68.7% (down 146 bps YoY).

- Deposits rose 26.4% YoY to ₹2.65 lakh crore, with CASA ratio at 48% (up 140 bps YoY).

Business highlights

- Gross advances grew 21% YoY to ₹2.49 lakh crore, led by retail (↑17.4% YoY; 58% of book).

- Vehicle loans (+23.8% YoY), LAP (+23.6% YoY), and credit cards (+36.0% YoY) showed strong traction, while rural finance declined (-2.4% YoY).

- Non-interest income surged 37.5% YoY driven by treasury gains (₹495 crore).

- Asset quality remained stable with GNPA at 1.97% and NNPA at 0.55%; microfinance GNPA stood elevated at 9.7%.

- Provision coverage ratio was healthy at 72.3%.

- The bank plans to raise ₹7,500 crore equity capital in the coming quarter.

Outlook

- Credit cost is guided at ~2% for FY26.

- NIM expected to recover to ~5.8% by Q4 FY26, aided by improving loan mix.

- Operating expense growth projected at 12–13%.

- Focus remains on scaling granular retail and MSME lending, while strengthening CASA franchise.

- Collection efficiency in microfinance improved to 99%, providing comfort on asset quality.

Recent Updates on IDFC First Bank

- Branch Expansion – Continued to expand its branch network in semi-urban and rural areas to strengthen retail penetration.

- Credit Card Partnerships – Collaborations with fin-techs and co-branded partnerships to boost card penetration.

- Capital Raising Plans – Ongoing efforts to strengthen its balance sheet to fund growth and maintain capital adequacy.

- Digital Investments – Rolling out AI-based credit assessment tools for faster loan processing.

Company valuation insights – IDFC First Bank

IDFC First Bank is currently trading at a P/B of 1.4x, with a 1-year return of 1.3% versus Nifty 50’s 0.4%.

The bank is well-positioned to deliver healthy growth, supported by improving asset quality, strong deposit traction, and operating leverage benefits. Credit costs are expected to moderate as microfinance stress subsides, while steady CASA accretion and TD repricing should aid margin recovery from H2FY26. Cost-to-income ratio is projected to improve meaningfully as investments made begin to deliver scale benefits, driving ROA/ROE expansion to 1.0–1.2%/9–12% by FY27-28.

Applying 1.4x FY27E BV, we derive a 12-month target price of ₹88, implying a ~20% upside from current levels. A near-term target of ₹82 offers ~12% upside over the next 3 months, underpinned by expected NIM recovery, steady 20% loan growth, and declining credit costs. Delivery on operational efficiency and stable asset quality remain key re-rating triggers.

Major risk factors affecting IDFC First Bank

- Execution Risks – Sustaining high growth while maintaining asset quality remains a key challenge.

- Credit Risk – Retail lending can face stress during prolonged economic downturns.

- Competition – Larger private banks pose significant competition in digital and retail lending.

Technical analysis of IDFC First Bank share

Following its recent correction, IDFC First Bank has regained upward momentum and is back in an ascending trend, signaling potential for further upside. The stock is trading above its 50-day, 100-day, and 200-day EMAs, reinforcing a constructive medium- to long-term outlook.

The MACD stands positive at 0.17, with the MACD line already above the signal line, suggesting that bullish momentum is strengthening. RSI at 58.99 reflects healthy buying interest, while relative RSI values of 0.04 (21-day) and 0.04 (55-day) indicate steady outperformance versus the broader market. The ADX at 26.45 confirms that a strong trend is building up.

A breakout above the key resistance at ₹76 could pave the way for an upside toward ₹82 and ₹88, aligning with its 12-month fundamental target. On the downside, ₹70 remains a crucial support; sustaining above this level will be essential to maintain the bullish structure.

- RSI: 58.99 (Strong Buying Interest)

- ADX: 26.45 (Strong Trend)

- MACD: 0.17 (Positive Momentum)

- Resistance: ₹76

- Support: ₹70

IDFC First Bank stock recommendation

Current Stance: Buy, with a 3-month target of ₹82 (~12% upside) and a 12-month target of ₹88 (~20% upside).

Why buy now?

Margin recovery in sight: NIMs expected to improve from H2 FY26, supported by steady CASA accretion and TD repricing benefits.

Strong loan growth: Retail-led loan book poised to sustain ~20% growth, backed by a robust digital and branch expansion strategy.

Asset quality improvement: Credit costs likely to moderate as microfinance stress eases, reinforcing balance sheet strength.

Operating leverage benefits: Investments made in technology and branch expansion are set to drive cost-to-income ratio improvement over FY26–28.

Profitability expansion: ROA/ROE expected to rise to 1.0–1.2% / 9–12% by FY27–28, unlocking long-term value.

Portfolio fit

IDFC First Bank is building a differentiated retail banking franchise with a strong digital ecosystem, improving asset quality, and sustainable growth visibility. Its disciplined approach towards deposit mobilization and loan growth, coupled with moderating credit costs and operating leverage benefits, position it well for consistent profitability expansion. With improving margins and better efficiency metrics, IDFC First Bank presents a compelling opportunity to ride India’s retail banking growth story.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebIDFC First Bank: Budget 2025-26 opportunities

- Retail & MSME Credit Growth: Government push on MSME financing, housing, and rural credit to directly boost IDFC First Bank’s retail-focused loan portfolio.

- Lower Funding Costs: Measures to ease liquidity and reduce deposit competition could support NIM recovery and strengthen spreads.

- Digital Banking Incentives: Budgetary support for fintech adoption, UPI infrastructure, and digital inclusion can accelerate the bank’s tech-led growth and customer acquisition.

- Capital Market & Infra Financing: Policy focus on infra projects and capital market deepening to create opportunities in corporate banking, fee income, and treasury gains.

- Regulatory & Tax Benefits: Any relief in banking sector taxation or relaxation in prudential norms could improve profitability and capital adequacy.

Final thoughts

Imagine a young professional applying for a personal loan on their smartphone and getting it disbursed in minutes, or a small business owner in a Tier-II town using a digital-first platform for working capital financing. These stories define IDFC First Bank’s transformation – from a corporate lender to a retail-driven, customer-first bank. For investors, it’s not just a banking stock, but a play on India’s retail credit expansion and digital financial inclusion. The journey is still in progress, and if executed well, it could deliver meaningful long-term rewards.