While much of the investment focus in India has shifted to digital and new-age businesses, JK Paper offers a compelling opportunity in an old-economy sector that is evolving to stay relevant. The company, with its stronghold in writing and printing paper, is successfully diversifying into packaging boards—a segment seeing robust demand from e-commerce, FMCG, and sustainable packaging trends. With efficient operations, backward integration, and a healthy balance sheet, JK Paper stands out as a value-driven, dividend-paying, and cash-generating business with long-term relevance.

But does JK Paper offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | JKPAPER |

| Industry/Sector | Paper & Paper Products |

| CMP | 394.85 |

| Market Cap (₹ Cr.) | 6,689 |

| P/E | 16.74 (Vs Industry P/E of 15.95) |

| 52 W High/Low | 599.00 / 275.75 |

| EPS (TTM) | 24.19 |

| Dividend Yield | 1.27% |

About JK Paper

JK Paper Ltd., part of the JK Organisation, is one of India’s leading integrated paper manufacturers, with operations spanning over five decades. The company operates three major manufacturing facilities – in Odisha, Gujarat, and Telangana – with a combined capacity of over 700,000 TPA.

It caters to both domestic and international markets with a portfolio of premium writing & printing paper, packaging board, and specialty paper. With strong backward integration in pulp and energy and ongoing capacity expansion, JK Paper has emerged as a cost-efficient player with improving product diversification.

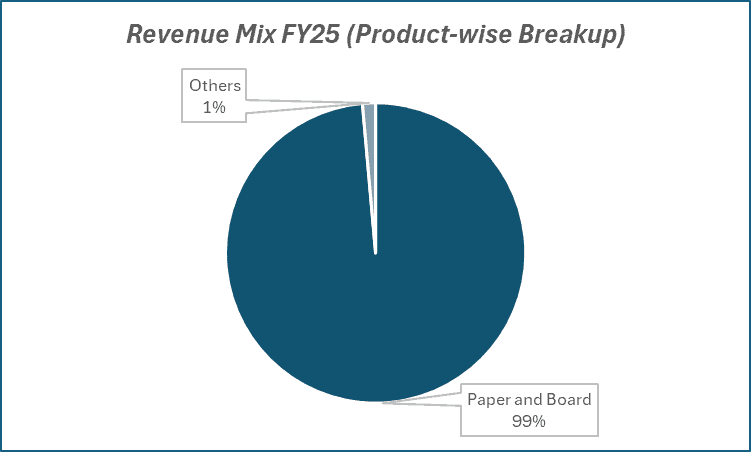

Key business segments

JK Paper operates primarily in the following key business segments:

- Writing & Printing Paper – Core product line catering to education, publishing, and office use.

- Packaging Board – Fast-growing segment used in FMCG, food, pharma, and e-commerce packaging.

- Pulp & Specialty Paper – High-quality pulp for internal use and sale, along with niche products like coated board and maplitho.

Primary growth factors for JK Paper

JK Paper key growth drivers:

- Educational & Publishing Demand: A large and growing student population keeps demand for writing and printing paper resilient.

- Packaging Boom: Surge in demand for sustainable, paper-based packaging from FMCG and e-commerce players.

- Backward Integration: In-house pulp, power, and water treatment drive operational efficiency and margin resilience.

- Capacity Expansion: Newer projects and acquisitions (e.g., Horizon Packs, Securipax) bolster packaging segment footprint.

- Export Potential: Growing global shift from plastic to paper-based products opens export opportunities.

Detailed competition analysis for JK Paper

Key financial metrics – FY25;

| Company | Revenue(₹ Cr.) | Manufacturing Capacity (MTPA) | Capacity Utilization (%) | EBITDA Margin (%) | PAT Margin (%) | P/E (TTM) |

| JK Paper Ltd. | 6718.07 | 761000 | 105.00% | 13.82% | 6.13% | 16.74 |

| West Coast Paper Mills | 4062.29 | 303766 | 95.00% | 11.84% | 8.26% | 11.77 |

| Seshasayee Paper | 1754.38 | 255000 | 96.64% | 6.35% | 5.87% | 17.59 |

| Andhra Paper | 1541.24 | 241000 | 103.86% | 8.73% | 5.77% | 18.63 |

| TN Newsprint | 4490.91 | 60000 | 70.00% | 9.53% | 0.08% | 326.30 |

Key insights on JK Paper

- JK Paper is among the lowest-cost producers in the Indian paper industry, thanks to scale, captive power, and raw material security.

- The company has shifted from a cyclical to a more diversified model, with packaging boards now contributing a rising share of revenues.

- Consistent operating margins (~20–23%), strong RoCE (~18–20%), and declining debt profile reflect disciplined capital management.

- Recent investments in corrugated and high-end board capacities open up new B2B revenue streams.

- It has a solid track record of dividend payouts and free cash flow generation, supporting investor returns even in downcycles.

Recent financial performance of JK Paper for Q4 FY25

| Metric | Q4 FY24 | Q3 FY25 | Q4 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 1718.61 | 1631.99 | 1689.50 | 3.52% | -1.69% |

| EBITDA (₹ Cr.) | 358.95 | 167.51 | 216.67 | 29.35% | -39.64% |

| EBITDA Margin (%) | 20.89% | 10.26% | 12.82% | 256 bps | -807 bps |

| PAT (₹ Cr.) | 278.60 | 65.29 | 77.05 | 18.01% | -72.34% |

| PAT Margin (%) | 16.21% | 4.00% | 4.56% | 56 bps | -1165 bps |

| Adjusted EPS (₹) | 16.27 | 3.86 | 4.50 | 16.58% | -72.34% |

JK Paper financial update (Q4 FY25)

Financial performance

- Revenue stood at ₹1,689.5 crore, down 1.7% YoY, but improved 3.5% QoQ.

- FY25 revenue was marginally up 1% YoY to ₹6,718 crore, reflecting soft demand and pricing pressure.

- PAT declined sharply by 72.3% YoY to ₹77.1 crore in Q4; FY25 PAT dropped 63.6% to ₹412 crore.

- EBITDA margin contracted to 12.8% (down 806 bps YoY); FY25 margin at 13.8% vs 24.3% in FY24.

- ROE dropped to 7.9% and ROCE to 7.1% for FY25 amid subdued profitability and higher input costs.

Business highlights

- Sales volumes were largely flattish at ~2.06 lakh MT, impacted by increased low-cost imports and weak NSR.

- Margins were impacted due to elevated wood costs and competitive pressure from imports.

- Acquired 60% stake in Radhesham Wellpack Pvt. Ltd. (corrugated packaging) & 62.14% in Quadragen Vethealth Pvt. Ltd. (animal health).

- Operating costs rose 8.3% YoY due to higher raw material and interest expenses.

- Despite challenges, sequential growth in EBITDA (up 29.3% QoQ) reflects early signs of operational recovery.

Outlook

- Earnings recovery to be gradual, led by volume growth, NSR improvement, and integration of acquisitions.

- JK Paper has guided for ~10% revenue growth in FY26 with an EBITDA margin of 16.3%, PAT of ₹637.5 crore, and ROE of 11.2%.

- Continued focus on cost optimization and leveraging scale benefits from new businesses.

- Management remains cautious but optimistic on gradual industry recovery.

Recent Updates on JK Paper

- Acquired 62% in Quadragen Vethealth (₹460 cr) to enter the animal health and nutrition space.

- Bought 60% stake in Radhesham Wellpack to expand its corrugated packaging footprint in Western India.

- Merged packaging subsidiaries (Horizon Packs, Securipax, JKPL Utility) to streamline operations and improve efficiency.

Company valuation insights – JK Paper

JK Paper is currently trading at an EV/EBITDA of 8.1x, reflecting near-term headwinds from margin compression and subdued paper realizations. The stock has declined 27% over the last year, underperforming the Nifty 50’s 3% return, as earnings were impacted by elevated raw material costs and competitive pressures from cheaper imports.

The company is focusing on recovery through volume growth, NSR stabilization, and operational efficiencies. Strategic diversification into corrugated packaging (Radhesham Wellpack) and animal nutrition (Quadragen Vethealth) is expected to broaden the growth base, though these ventures may initially dilute margins. With EBITDA margins projected to expand to 18.2% by FY27 and return ratios showing improvement, earnings recovery appears likely over the medium term.

Applying a 5x EV/EBITDA multiple to the FY27E EBITDA of ₹1,419 crore, we arrive at a 12-month target price of ₹440, implying ~14% upside from current levels. A shorter-term target of ₹415 suggests a 7% potential upside over three months, supported by sequential operating improvement, recovery in NSR, and integration synergies from recent acquisitions.

Major risk factors affecting JK Paper

- Raw Material Volatility: Any significant rise in wood pulp or energy costs could pressure margins.

- Cyclicality in Paper Prices: Industry remains partially commodity-linked, exposing it to global price swings.

- Digital Substitution: Long-term headwinds in printing paper due to rising digitization, though offset by packaging.

- Environmental & Regulatory Norms: Increasing focus on emissions and water use may raise compliance costs.

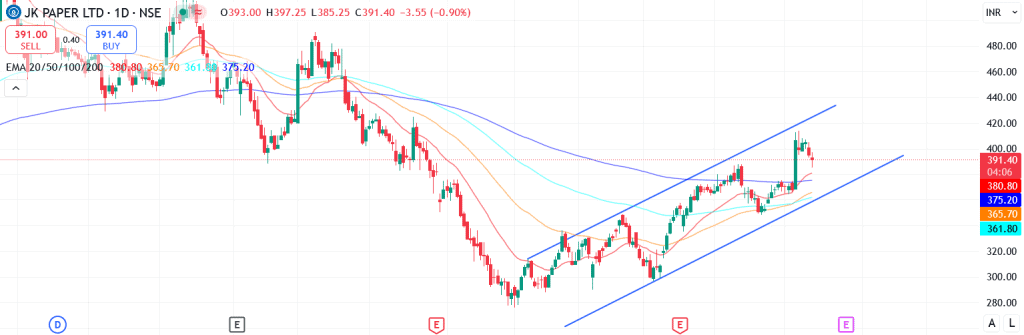

Technical analysis of JK Paper share

After undergoing a sharp ~37% correction during Dec ’24 to Feb ’25, JK Paper has entered a sustained recovery phase, forming an ascending trend channel backed by strong Q4 results. The price structure suggests continuation of this uptrend, with improving volume and momentum indicators adding confirmation.

The stock is currently trading well above its 50-day, 100-day, and 200-day EMAs, reflecting strong underlying strength and reinforcing its medium-term bullish setup.

The MACD remains positive at 10.74, with the MACD line placed firmly above the signal line – indicating sustained bullish momentum. The RSI at 62.41 points to strong buying interest, while Relative RSI at 0.02 (21-day) and 0.11 (55-day) reflects steady outperformance versus the broader market. Additionally, the ADX at 32.12 confirms a strong trend, adding further credibility to the bullish structure.

A breakout above ₹415 could pave the way toward ₹440, while ₹370 remains a key support level that will be critical for trend validation.

- RSI: 62.41 (Strong Buying Interest)

- ADX: 32.12 (Strong Trend)

- MACD: 10.74 (Positive)

- Resistance: ₹415

- Support: ₹370

JK Paper stock recommendation

Current Stance: Buy, with a 3-month target of ₹415 (~7% upside) and a 12-month target of ₹440 (~14% upside), based on 5x our FY27E EV/EBITDA.

Why buy now?

Packaging diversification: Growing contribution from packaging board and corrugated segments supports structural margin stability.

Cost efficiency: Strong backward integration in pulp and energy ensures resilient margins even in down cycles.

Healthy balance sheet: Low debt, robust RoCE, and consistent dividend payout offer strong shareholder value.

Portfolio fit

JK Paper combines defensive cash flows with exposure to packaging and education-driven demand. For investors seeking value with growth, strong FCF, and a steady dividend yield, it fits well in portfolios targeting industrials, consumption, and sustainable packaging themes.If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dJK Paper: Budget 2025-26 opportunities

- Education Spend Boost: Higher allocation to education expected to support writing & printing paper demand.

- Sustainable Packaging Focus: Push for eco-friendly packaging to benefit JK’s board and corrugated segments.

- MSME & Manufacturing Drive: Incentives for MSMEs and local manufacturing to lift industrial packaging needs.

- E-commerce & Logistics Expansion: Growth in logistics and warehousing to fuel corrugated box consumption.

- Agroforestry & Raw Material Support: Support for farm forestry and sustainability to aid pulp sourcing and cost efficiency.

Final thoughts

JK Paper is quietly transitioning from being just a paper producer to a multi-category fiber-based materials company. With strong fundamentals, a clear diversification strategy, and expanding relevance in the packaging ecosystem, it’s turning what used to be a cyclical business into a stable, cash-generating enterprise.

For investors seeking steady growth, consistent cash flows, dividends, and exposure to India’s packaging megatrend, JK Paper offers a rare blend of value and resilience – an old-economy business with a new-economy edge.