After a period of strong momentum, the Indian pharma space has seen cycles of regulatory challenges, pricing pressures, and demand normalisation. Yet, within this landscape, Laurus Labs stands out as a company that’s not just reacting – but reinventing. From being a leading supplier of APIs for antiretroviral (ARV) therapies, Laurus has rapidly transformed into a diversified player across CDMO, formulations, biotech, and ingredients, positioning itself to capture multiple growth waves in the coming decade.

But does Laurus Labs offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | LAURUSLABS |

| Industry/Sector | Healthcare (Pharmaceuticals & Drugs) |

| CMP | 777.70 |

| Market Cap (₹ Cr.) | 41,938 |

| P/E | 116.87 (Vs Industry P/E of 35.36) |

| 52 W High/Low | 777.90 / 414.00 |

| EPS (TTM) | 6.64 |

| Dividend Yield | 0.15% |

About Laurus Labs

Incorporated in 2005 and headquartered in Hyderabad, Laurus Labs Ltd. is an integrated pharmaceutical and biotech company engaged in the development, manufacturing, and sale of APIs, formulations, specialty ingredients, and contract development & manufacturing services (CDMO).

Initially known for its scale in HIV and Hepatitis C APIs, Laurus has since diversified aggressively. It now operates across APIs, formulations, CDMO, and synthesis for global innovators, and is making deep inroads into biotechnology and enzymes through its subsidiary Laurus Bio.

Key business segments

Laurus Labs operates primarily in the following key business segments:

- APIs (Active Pharmaceutical Ingredients) – High-volume APIs in ARVs, oncology, anti-diabetics, and cardiovascular therapies.

- Formulations – Generic oral solids and complex products supplied to global institutions and regulated markets.

- CDMO / Synthesis – Custom research and manufacturing services for global innovators, especially in non-ARV molecules.

- Laurus Bio (Biotech) – Focused on recombinant proteins, enzymes, and fermentation-based ingredients for food and pharma.

Primary growth factors for Laurus Labs

Laurus Labs key growth drivers:

- Global CDMO Demand: Rising demand for cost-efficient and compliant contract manufacturing from innovators.

- Product & Market Diversification: Moving away from ARV dependence into high-growth areas like oncology, diabetes, and biotech.

- Laurus Bio Scale-Up: The company is making capex investments in fermentation platforms to serve the biotech and clean-label ingredients market.

- Capacity Expansion: Ongoing greenfield and brownfield investments to enhance backward integration and vertical scale.

- Regulatory Approvals: Filing of complex ANDAs and expansion into regulated markets supports the formulations segment.

Detailed competition analysis for Laurus Labs

Key financial metrics – FY25;

| Company | Revenue(₹ Cr.) | EBITDA Margin (%) | PAT Margin (%) | ROE(%) | ROCE(%) | P/E (TTM) |

| Laurus Labs | 5553.96 | 19.00% | 6.38% | 4.15% | 6.64% | 116.87 |

| Piramal Pharma | 9151.18 | 15.79% | 0.20% | 0.24% | 5.07% | 295.07 |

| JB Chemicals | 3917.99 | 26.34% | 16.83% | 21.49% | 25.23% | 38.74 |

| Ajanta Pharma | 4648.10 | 27.10% | 19.80% | 23.49% | 32.22% | 36.47 |

| Gland Pharma | 5616.50 | 22.59% | 12.44% | 9.26% | 13.63% | 44.19 |

Key insights on Laurus Labs

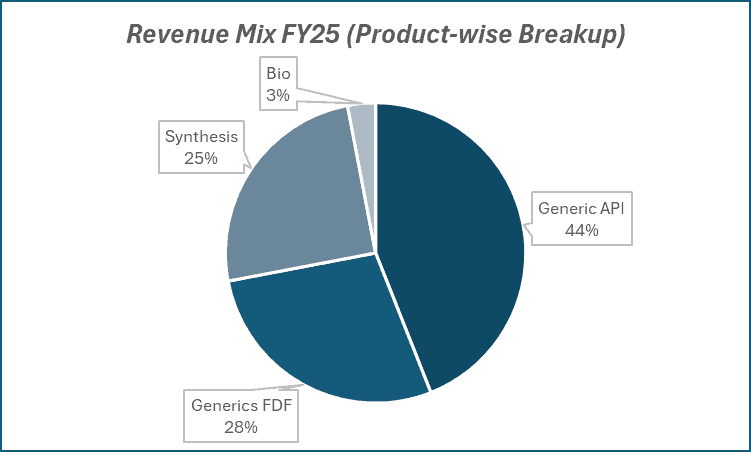

- Laurus was once over-dependent on ARV APIs (~70% revenue contribution), but has now reduced this to <50% through focused diversification.

- The CDMO and Synthesis business has scaled well, with multi-year contracts and visibility from global customers.

- Gross margins remain strong, aided by cost efficiencies and process chemistry depth.

- Biotech optionality via Laurus Bio makes it one of the few listed Indian players with exposure to enzymes and synthetic biology.

- Despite temporary pressure from ARV demand normalization, Laurus continues to deliver robust volume growth in non-ARV categories.

Recent financial performance of Laurus Labs for Q4 FY25

| Metric | Q4 FY24 | Q3 FY25 | Q4 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 1439.67 | 1415.05 | 1720.30 | 21.57% | 19.49% |

| EBITDA (₹ Cr.) | 241.49 | 285.15 | 420.60 | 47.50% | 74.17% |

| EBITDA Margin (%) | 16.77% | 20.15% | 24.45% | 430 bps | 768 bps |

| PAT (₹ Cr.) | 75.32 | 90.61 | 233.87 | 158.11% | 210.50% |

| PAT Margin (%) | 5.23% | 6.40% | 13.59% | 719 bps | 836 bps |

| Adjusted EPS (₹) | 1.40 | 1.71 | 4.33 | 153.22% | 209.29% |

Laurus financial update (Q4 FY25)

Financial performance

- Revenue rose 19.5% YoY to ₹1,720 crore.

- EBITDA margins expanded 768 bps YoY, led by improved mix and operating leverage.

- PAT stood at ₹234 crore, up 210.5% YoY.

- FY25 Revenue grew 10.2% YoY to ₹5,554 crore; PAT jumped 110.7% to ₹354 crore.

- Gross margin improved 370 bps to 55.4%.

Business highlights

- CDMO–Small Molecules grew ~95% YoY in Q4; FY25 revenue at ₹1,374 crore, up 49%.

- FDF segment grew ~27% YoY; driven by CMO contracts and new launches.

- API de-grew 8% YoY in Q4 but grew 29% QoQ; FY25 API revenue down 4%.

- Capex in FY25 was ₹659 crore; net debt at ₹2,594 crore (2.3x EBITDA).

- Fermentation plant to go live in June 2025 (₹250 crore investment).

Outlook

- Strong growth expected in FY26, led by CDMO scale-up and better mix.

- Margins to improve with better asset utilization.

- FY26 capex guidance: ₹1,000 crore.

- Diversifying into cell & gene therapy, animal health, and crop sciences.

- Long-term goal: evolve into a global CDMO/CMO leader.

Recent Updates on Laurus Labs

- The share price is up ~21% in a month, with 11 straight days of gains; trading at 52-week highs on strong CDMO growth outlook.

- CareEdge Ratings revised outlook to stable from negative, citing improved FY25 results and CDMO momentum.

Company valuation insights – Laurus Labs

Laurus Labs is currently trading at a TTM P/E of 116.9x, well above the industry average of 35.4x, reflecting investor optimism around its CDMO-led transformation. Despite this premium valuation, the stock has delivered a robust 63.9% return over the past year, significantly outperforming the broader market (Nifty 50 return: 4.7%).

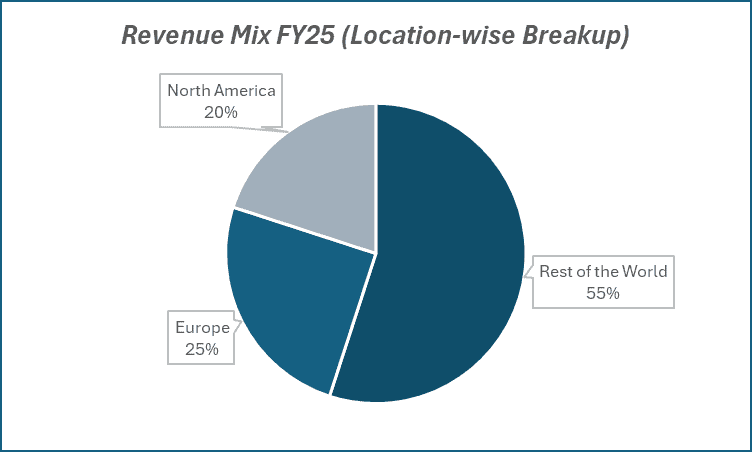

This elevated multiple factors in the company’s sharp margin recovery, asset monetization through high-value CDMO contracts, and a maturing pipeline with late-stage programs for global clients. With steady momentum in FDF and Custom Synthesis, and a strategic shift away from low-margin APIs, Laurus is poised for scalable, high-margin growth.

Applying a 55× multiple to our FY27E EPS of ₹17, we arrive at a 12-month target price of ₹935, implying ~20% upside from current levels. A 3-month target of ₹850 offers a ~9% near-term upside, backed by continued earnings visibility, operating leverage, and upcoming capacity-led ramp-ups.

Major risk factors affecting Laurus Labs

- ARV Volume Volatility: ARV business remains exposed to institutional buying cycles and price competition.

- Execution Risks in CDMO/Bio: New verticals require scaling and regulatory consistency – delays can impact growth visibility.

- Margin Pressures: Higher input costs and energy inflation may pressure short-term profitability.

- Biotech Competition: Laurus Bio faces competition from global leaders and startups; IP and innovation cycle matters.

Technical analysis of Laurus Labs share

Laurus Labs has recently broken out of a long-term ascending channel, delivering a sharp 21% rally in the past month, including 11 consecutive days of positive closes – a clear signal of strong upward momentum. The stock is now trading near its 52-week high, firmly above its 50-day, 100-day, and 200-day EMAs, confirming a well-entrenched uptrend.

The MACD remains positive at 33.53, with the MACD line comfortably above the signal line – indicating sustained bullish momentum. The RSI is elevated at 82.91, showing strong buying pressure, while Relative RSI readings of 0.18 (21-day) and 0.14 (55-day) reflect consistent outperformance relative to the broader market. An ADX value of 40.15 underscores a very strong trend, adding conviction to the bullish setup.

A break above ₹850 could open up further upside toward ₹935, while ₹710 serves as a critical support level to watch for any trend reversal.

- RSI: 82.91 (Strong Buying Interest)

- ADX: 40.15 (Very Strong Trend)

- MACD: 33.53 (Positive)

- Resistance: ₹850

- Support: ₹710

Laurus Labs stock recommendation

Current Stance: Buy, with a 3-month target of ₹850 (~9% upside) and a 12-month target of ₹935 (~20% upside) based on 55× our FY27E EPS estimate of ₹17.

Why buy now?

CDMO momentum: Strong growth in custom synthesis with 110+ active projects and rising big pharma partnerships.

Margin turnaround: Q4 FY25 margins surged on better mix and operating leverage - signaling a shift to profitable growth.

Capacity-driven visibility: New blocks and fermentation facilities to drive scale-up in FY 26–27.

Portfolio fit

Laurus Labs is a high-growth pharma play transitioning into a global CDMO leader. Its improving margins, diversified revenue, and innovation focus make it a strong addition for investors seeking scalable, high-quality healthcare exposure.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebLaurus Labs: Budget 2025-26 opportunities

- PLI & API push: Government focus on Make-in-India APIs and CDMO to benefit Laurus’ core segments.

- R&D support: Increased allocation for pharma innovation aligns with Laurus’ high-value CDMO pipeline.

- Bio & fermentation boost: New schemes to aid Laurus’ biologics and fermentation-led capacity expansion.

- Export incentives: Infrastructure and trade support to enhance Laurus’ global competitiveness.

- Skilling support: Workforce development in life sciences to ease hiring for advanced roles.

Final thoughts

Laurus Labs is more than a pharma company – it’s a business undergoing strategic evolution. From a dependable API manufacturer to a multi-vertical platform with innovation, manufacturing depth, and global partnerships, Laurus is positioning itself as a next-generation health and wellness enabler.

For investors, it offers a balanced mix of stability (core pharma), scalability (CDMO), and optionality (biotech) – all supported by a credible management team, strong R&D backbone, and proven execution. If you’re looking for a future-focused pharma pick with structural tailwinds and turnaround potential, Laurus Labs deserves a long-term look.