Maruti Suzuki India Ltd has been the undisputed leader of the Indian passenger vehicle industry for decades, shaping how India drives. From the iconic Maruti 800 to the advanced hybrid and CNG models of today, the company has successfully evolved with shifting consumer preferences, changing fuel dynamics, and increasing competition. With its deep market penetration, cost efficiency, and innovation-driven approach, Maruti continues to power ahead in India’s expanding automobile landscape.

But does Maruti Suzuki India offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | MARUTI |

| Industry/Sector | Automobile |

| CMP | 16,265.00 |

| Market Cap (₹ Cr.) | 5,12,005 |

| P/E | 34.56 (Vs Industry P/E of 28.03) |

| 52 W High/Low | 16,435.00 / 10,725.00 |

| EPS (TTM) | 462.24 |

| Dividend Yield | 0.84% |

About Maruti Suzuki India Ltd.

Founded in 1981 as a joint venture between the Government of India and Japan’s Suzuki Motor Corporation, Maruti Suzuki is India’s largest passenger car manufacturer, commanding over 40% market share. The company’s product portfolio spans entry-level hatchbacks, sedans, SUVs, and MPVs, catering to both urban and rural consumers.

Headquartered in Gurugram, Maruti operates several manufacturing plants in Haryana and Gujarat, with a cumulative capacity exceeding 2 million vehicles annually. Suzuki’s global expertise in compact car technology, combined with Maruti’s local adaptability, makes it a cornerstone of India’s automotive ecosystem.

Key business segments

Maruti Suzuki India Ltd. operates primarily in the following key business segments:

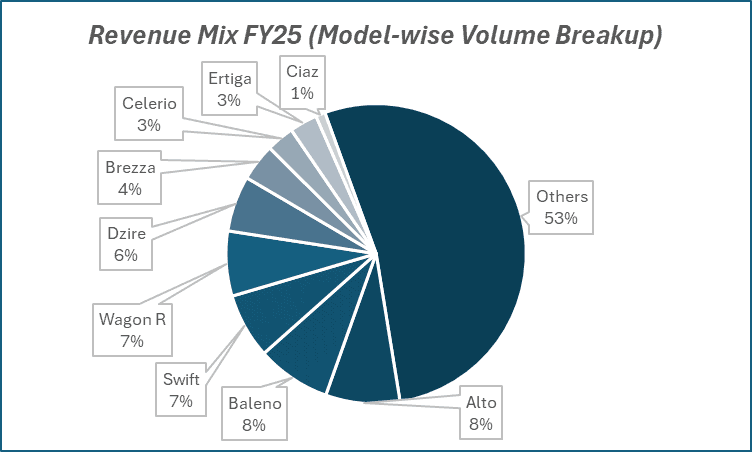

- Passenger Vehicles: Core segment including popular models like Alto, Swift, WagonR, Baleno, Brezza, and Ertiga, contributing the majority of revenue.

- Light Commercial Vehicles (LCV): The Super Carry range caters to small businesses and last-mile logistics.

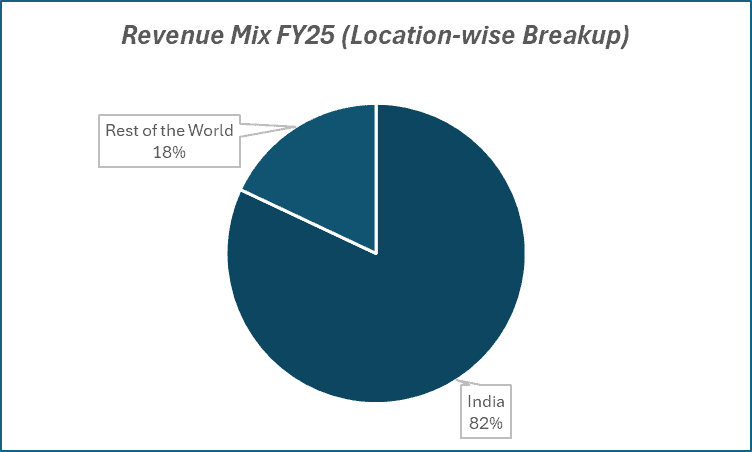

- Exports: Supplies vehicles to over 100 countries, with Africa, Latin America, and Asia as key markets.

- After-Sales Services: Through its 3,000+ dealer network, the company earns recurring revenue from service, parts, and accessories.

Primary growth factors for Maruti Suzuki India Ltd.

Maruti Suzuki India Ltd. key growth drivers:

- SUV and Premium Shift: Increasing focus on SUVs (Brezza, Fronx, Grand Vitara) and premium vehicles through its NEXA channel to boost margins.

- CNG and Hybrid Leadership: Rising CNG penetration and hybrid launches align with India’s shift toward cleaner mobility.

- Export Expansion: Leveraging Suzuki’s global network to strengthen exports from India as a manufacturing hub.

- Rural Demand: Rural markets contribute over 40% of sales, supported by rising incomes and expanding dealer reach.

- New Capacity and Models: Upcoming models in EV and hybrid categories expected to drive the next growth phase.

Detailed competition analysis for Maruti Suzuki India Ltd.

Key financial metrics – TTM;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Maruti Suzuki Ltd. | 155738.80 | 19541.90 | 12.55% | 14311.10 | 9.19% | 34.56 |

| M&M Ltd. | 167522.29 | 31502.87 | 18.81% | 13212.85 | 7.89% | 28.73 |

| Hyundai Motor Ltd. | 69192.89 | 8953.76 | 12.94% | 5640.21 | 8.15% | 35.46 |

| TATA Motors Ltd. | 438935.00 | 51310.00 | 11.69% | 21297.00 | 4.85% | 11.65 |

Key insights on Maruti Suzuki India Ltd.

- Maruti maintains one of the strongest balance sheets in the auto sector, with zero debt and healthy cash reserves.

- The company’s asset-light strategy through its Gujarat plant (owned by Suzuki) ensures scalability with limited capital strain.

- Increasing contribution from SUVs and premium products is structurally improving realization and operating margins.

- Strategic investments in EV infrastructure and battery localization position Maruti for a smoother electric transition.

- Robust distribution network and unmatched service ecosystem sustain long-term customer loyalty.

Recent financial performance of Maruti Suzuki India Ltd. for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 35779.40 | 40920.10 | 38605.20 | -5.66% | 7.90% |

| EBITDA (₹ Cr.) | 5106.60 | 4844.00 | 4622.60 | -4.57% | -9.48% |

| EBITDA Margin (%) | 14.27% | 11.84% | 11.97% | 13 bps | -230 bps |

| PAT (₹ Cr.) | 3702.10 | 3839.20 | 3756.90 | -2.14 | 1.48% |

| PAT Margin (%) | 10.35% | 9.38% | 9.73% | 35 bps | -62 bps |

| Adjusted EPS (₹) | 119.58 | 124.40 | 120.62 | -3.04% | 0.87% |

Maruti Suzuki India Ltd. financial update (Q1 FY26)

Financial performance

- Revenue: ₹38,605 crore (+7.9% YoY), driven by robust SUV and hybrid demand across segments.

- EBITDA: ₹4,623 crore (12.0% margin), down 9.5% YoY.

- Passenger Vehicles: Volumes up 5.6% YoY, led by Brezza, Ertiga, and Grand Vitara; hybrids form ~15% of PV sales.

- Exports: 78,500 units (down6% YoY) due to weaker Africa and Latin America markets; remains strong in ASEAN.

- Net Profit: ₹3,757 crore (+1.5% YoY), supported by higher realization per vehicle and lower commodity costs.

- Net Cash: ₹65,000 crore (up 8% QoQ), reflecting strong cash generation and lean working capital management.

Business highlights

- Domestic Demand: Strong retail momentum in SUVs and hybrids; small car segment remains muted.

- Market Share: Maintained ~42% overall, with gains in compact SUV and MPV categories.

- New Launches: Swift Hybrid, Fronx CNG, and Jimny AT variants strengthen premium mix.

- Exports: Focus on expanding presence in Latin America and Africa with locally suited models.

- Production: 573,000 units produced (+4% YoY); Gujarat plant utilization at 85%, Manesar at peak levels.

- Dealer Network: Expanded to 3,000+ outlets; rural penetration increased by 8% YoY.

Outlook

- Short term: Margin stability to continue with soft commodity costs and favorable product mix.

- Medium to long term: Sustained growth visibility from hybrid and EV launches, rising SUV penetration, and premiumisation trend.

- Investor sentiment: Positive, driven by strong earnings visibility, cash position, and leadership in the evolving mobility ecosystem.

Recent Updates on Maruti Suzuki India Ltd.

- Maruti announced plans to launch its first electric SUV in FY26, manufactured at its new Kharkhoda facility.

- The company signed an MoU with SBI for auto financing digitization, enhancing loan accessibility for rural customers.

- Continued expansion of CNG offerings, with over 15 models now available in the CNG variant, the highest in the industry.

- Focused push on export volume growth, targeting over 300,000 units annually by FY27.

Company valuation insights – Maruti Suzuki India Ltd.

Maruti Suzuki is currently trading at an EV/EBITDA of 20x, with a 1-year return of +27.5% versus the Nifty 50’s +1.2%.

The investment case lies in robust demand recovery, GST-led affordability, and a strong product cycle led by SUVs and hybrids. The recent GST cuts on small cars have boosted enquiries and bookings, reinforcing Maruti’s leadership in entry and compact segments. New launches like Victoris and E-Vitara, along with strong export momentum (+37% YoY in Q1FY26) and deeper rural reach, are expected to drive growth.

With margins seen expanding to 12.2% by FY27E and a debt-free balance sheet, Maruti remains well positioned for sustained earnings growth.

We value Maruti Suzuki at 19x FY27E EV/EBITDA, setting a 12-month target price of ₹19,500 (20% upside) and a 3-month target of ₹17,300 (~6% upside). Key triggers include margin expansion, volume traction post-GST cuts, and continued export strength.

Major risk factors affecting Maruti Suzuki India Ltd.

- Competition: Intensifying presence of global OEMs and EV-first players like Tata Motors and Hyundai could pressure market share.

- Raw Material Inflation: Volatility in steel, aluminum, and semiconductor supply could impact margins.

- Regulatory Shifts: Faster EV adoption or stricter emission norms may require higher R&D and capex investments.

- Rural Dependence: Any downturn in rural demand due to monsoon volatility could affect volumes.

Technical analysis of Maruti Suzuki India Ltd. share

Maruti Suzuki has broken out of a prolonged sideways channel about a month ago and has since been in a steady uptrend, confirming the presence of strong bullish momentum.

The stock trades well above its 50-day, 100-day, and 200-day EMAs, underscoring a firmly positive trend across all timeframes. Sustaining above these averages will further strengthen the medium- to long-term bullish outlook.

Momentum indicators confirm this setup. The MACD at 371.22 remains firmly positive, signaling strong upward momentum. The RSI at 68.85 indicates healthy buying interest, while relative RSI readings of 0.06 (21-day) and 0.29 (55-day) highlight consistent outperformance versus the broader market. The ADX at 55.28 reflects a very strong trend, validating the ongoing bullish structure.

A decisive breakout above ₹17,500 could open room for a rally toward ₹19,500 (12-month fundamental target). On the downside, ₹14,900 serves as key support, holding above this level will be essential to sustain the uptrend.

- RSI: 68.85 (Strong Buying Interest)

- ADX: 55.28 (Very Strong Trend)

- MACD: 371.22 (Positive)

- Resistance: ₹17,500

- Support: ₹14,900

Maruti Suzuki India Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹17,300 (~6% upside) and a 12-month target of ₹19,500 (~20% upside).

Why buy now?

GST-driven demand boost: Lower tax rates on small cars are spurring strong retail enquiries and bookings, reviving entry and compact car demand.

Premiumisation & hybrids: Growing SUV and hybrid mix to lift realizations and sustain double-digit margin expansion.

Export momentum: Overseas volumes up 37% YoY in Q1FY26, with continued strength expected in FY26–27.

Earnings visibility: ~15% earnings CAGR expected over FY25–27E, supported by higher volumes, cost control, and favorable mix.

Portfolio fit

Maruti Suzuki combines structural growth with cyclical recovery, driven by rising affordability, strong rural demand, and an expanding hybrid/SUV portfolio. Backed by a debt-free balance sheet and steady margin gains, it remains a core large-cap auto play offering stability and long-term compounding potential.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebMaruti Suzuki India Ltd.: Budget 2025-26 opportunities

- Auto Push: Higher infrastructure and vehicle spending to boost PV demand, especially in compact and mid-size segments.

- GST 2.0 Reforms: Lower GST on small cars (28% to 18%) improves affordability and revives first-time buyer demand.

- EV & Hybrid Focus: FAME III and PLI extensions support Maruti’s hybrid lineup and upcoming eVX EV launch.

- Rural Support: Increased rural spending and tax relief to lift consumption in Maruti’s key semi-urban markets.

- Localization Drive: Make-in-India incentives aid cost efficiency and export competitiveness.

Final thoughts

Maruti Suzuki’s journey is not just about cars, it’s about transforming how India moves. As the company embraces electrification, premiumization, and export-led growth, it stands at the cusp of a new growth cycle. For investors, Maruti represents a blend of stability and innovation, offering consistent earnings, solid cash flows, and long-term leadership in one of the world’s fastest-growing auto markets.