India’s healthcare sector is at a turning point, rising incomes, increased insurance penetration, and growing awareness of quality medical care are reshaping patient behavior and industry dynamics. Amid this transformation, Max Healthcare Institute Ltd has emerged as one of the country’s most efficient and well-managed hospital chains. With a strong focus on high-end tertiary care, operational excellence, and strategic expansion, Max Healthcare stands out as a leading play on India’s healthcare and wellness growth story.

But does Max Healthcare Institute offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | MAXHEALTH |

| Industry/Sector | Healthcare (Hospitals) |

| CMP | 1184.10 |

| Market Cap (₹ Cr.) | 1,15,084 |

| P/E | 100.35 (Vs Industry P/E of 68.35) |

| 52 W High/Low | 1314.30 / 888.90 |

| EPS (TTM) | 11.80 |

| Dividend Yield | 0.13% |

About Max Healthcare Institute Ltd.

Founded in 2001 and headquartered in New Delhi, Max Healthcare Institute Ltd operates one of India’s largest healthcare networks with a presence primarily in North India. The company runs over 17 hospitals and healthcare facilities, offering comprehensive tertiary and quaternary care services across key specialities such as oncology, cardiology, neurosciences, orthopaedics, liver and kidney transplants, and robotic surgeries.

Post its merger with Radiant Life Care in 2020, Max Healthcare has achieved scale, improved profitability, and strengthened its position in the premium hospital segment. The company is part of the Max Group and backed by KKR, which holds a significant stake and has supported its expansion and strategic consolidation.

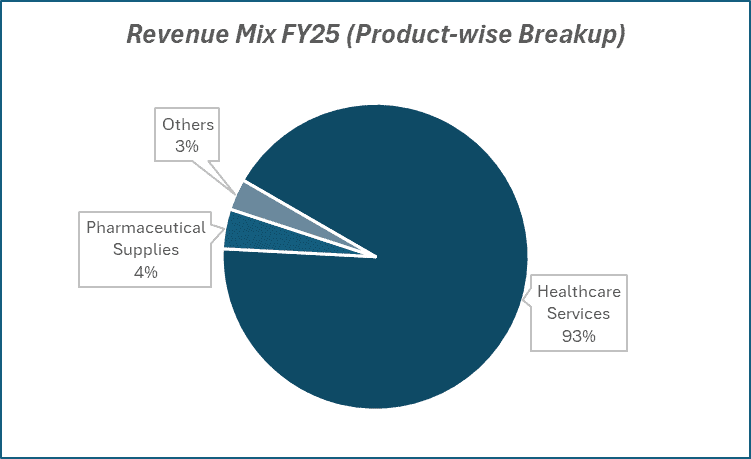

Key business segments

Max Healthcare Institute Ltd. operates primarily in the following key business segments:

- Hospitals & Healthcare Services: Core business offering inpatient and outpatient treatments across multi-specialty hospitals in Delhi NCR, Mumbai, and northern India.

- Medical Education & Research: Training programs and collaborations aimed at developing clinical excellence and research innovation.

- Diagnostics & Labs: Integrated diagnostic and pathology services within hospitals and standalone centers.

- Health Insurance Partnerships: Collaborations with leading insurers to enhance patient accessibility and affordability.

Primary growth factors for Max Healthcare Institute Ltd.

Max Healthcare Institute Ltd. key growth drivers:

- Premiumization of Healthcare: Rising preference for high-quality tertiary care, with increasing footfall in metro and tier-1 hospitals.

- Capacity Expansion: Ongoing addition of ~1,000 beds over the next few years through brownfield and greenfield projects.

- Operational Efficiency: Strong ARPOB (Average Revenue Per Occupied Bed) growth driven by a better case mix and high-margin specialties.

- Medical Tourism: Growing international patient base, especially from South Asia, Africa, and the Middle East.

- Policy Tailwinds: Government focus on healthcare infrastructure, Ayushman Bharat coverage, and medical insurance growth supporting industry demand.

Detailed competition analysis for Max Healthcare Institute Ltd.

Key financial metrics – TTM;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Max Healthcare | 7513.08 | 1984.20 | 26.41% | 1147.58 | 15.27% | 100.35 |

| Apollo Hospitals | 22550.50 | 3198.60 | 14.18% | 1595.50 | 7.08% | 69.09 |

| Fortis Healthcare | 8090.57 | 1736.09 | 21.46% | 888.33 | 10.98% | 86.77 |

| Aster DM Healthcare | 4214.46 | 808.35 | 19.18% | 371.17 | 8.81% | 104.84 |

| Global Health | 3862.07 | 917.73 | 23.76% | 534.04 | 13.83% | 67.80 |

Key insights on Max Healthcare Institute Ltd.

- ARPOB continues to improve, reflecting a shift toward high-end specialities and value-based care.

- Bed occupancy levels remain robust, averaging 75–80% across major facilities.

- Operating margins (EBITDA) among the best in the industry, supported by efficient cost structures.

- Strong balance sheet with negligible debt, enabling strategic acquisitions and capacity additions.

- Increasing contribution from international patients and diagnostics provides diversification and steady cash flow.

Recent financial performance of Max Healthcare Institute Ltd. for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 1542.95 | 1909.74 | 2027.57 | 6.17% | 31.41% |

| EBITDA (₹ Cr.) | 387.41 | 511.62 | 522.91 | 2.21% | 34.98% |

| EBITDA Margin (%) | 25.11% | 26.79% | 25.79% | – 100 bps | 68 bps |

| PAT (₹ Cr.) | 236.27 | 319.00 | 307.97 | -3.46% | 30.35% |

| PAT Margin (%) | 15.31% | 16.70% | 15.19% | -151 bps | -12 bps |

| Adjusted EPS (₹) | 2.43 | 3.28 | 3.17 | -3.35% | 30.45% |

Max Healthcare Institute Ltd. financial update (Q1 FY26)

Financial performance

- Revenue: ₹2,028 crore (+31% YoY), driven by strong growth across hospitals, diagnostics, and international business, supported by higher occupancy and ARPOB expansion.

- EBITDA: ₹523 crore (+35% YoY), maintaining a healthy margin of 26% on account of operational efficiency and favorable payor mix.

- PAT: ₹308 crore (+30% YoY), reflecting sustained profitability and disciplined cost management despite continued investments in expansion projects.

- ARPOB: ₹70,500 (+9% YoY), supported by improved case mix, growth in high-end specialties, and steady price realization across metro hospitals.

- Occupancy: 75% (flat YoY), indicating resilient patient demand even as new capacity came online, with metros like Delhi NCR and Mumbai leading utilization.

Business highlights

- Added 240 new beds across key hospitals, with major brownfield expansions progressing at Saket, Mohali, and Gurugram to support double-digit capacity growth

- Commissioned Max Dwarka and integrated Jaypee Hospital (Noida) and Alexis Hospital (Nagpur), further strengthening the North and West India footprint

- Expanded diagnostics presence under Max Lab to 50+ cities with 700+ pickup points, driving strong volume and revenue growth

- Scaled Max@Home services with increased patient coverage and new offerings in physiotherapy and chronic care management

- Advanced digital initiatives through the Max MyHealth platform, enhancing patient engagement and contributing 29% of hospital revenue

Outlook

- Margins expected to remain stable at 25%, supported by strong operating leverage, efficiency improvements, and disciplined cost management.

- Ongoing brownfield and greenfield expansions across key metros to drive sustained double-digit capacity and revenue growth.

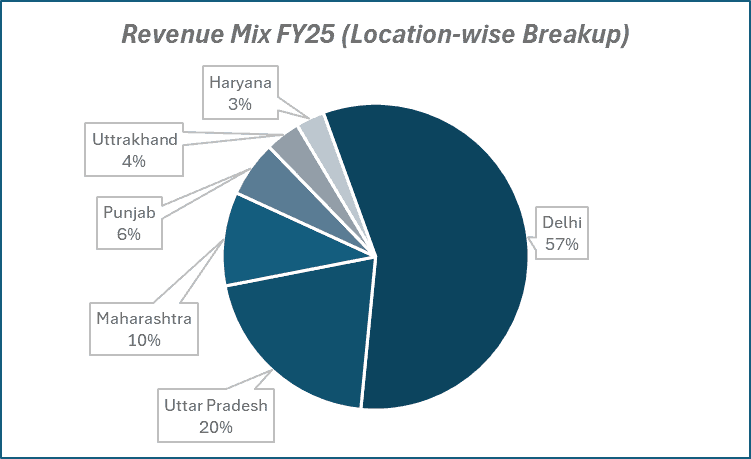

- Dominant position in Delhi NCR and Mumbai, along with rising international and institutional demand, to reinforce growth momentum.

- Capital-light verticals like Max Lab and Max@Home, coupled with continued digital transformation, to enhance long-term scalability and profitability.

- Robust cash generation and healthy balance sheet to fund expansion while maintaining strong shareholder returns and financial resilience.

Recent Updates on Max Healthcare Institute Ltd.

- Announced plans to add new hospitals in Gurgaon and Western India to strengthen geographical presence.

- Acquired additional land in Delhi NCR to expand its bed capacity by ~600 beds.

- Introduced advanced robotic surgery programs and AI-assisted diagnostics to enhance clinical precision.

- Collaborated with leading medical universities for oncology research and clinical education.

Company valuation insights – Max Healthcare Institute Ltd.

Max Healthcare trades at a TTM P/E of 100.4x, notably higher than the industry average of 68.4x, with a 1-year return of 22.3% versus the Nifty 50’s 6.0%.

The investment case for Max Healthcare rests on its strong execution, premium mix, and capacity expansion plans. The company continues to deliver steady revenue and margin growth, driven by higher occupancy (75%), rising ARPOB levels (₹70,500), and a disciplined cost structure. It remains a leader in the North India market and is now scaling across Mumbai, Nagpur, and Delhi through 1,500 planned bed additions (1,000 brownfield + 500 greenfield). Continued integration of acquired assets, strong traction in Max@Home, and consistent improvement in EBITDA margins reinforce confidence in earnings visibility.

Key growth drivers include sustained demand for premium healthcare, higher surgical and international patient mix, and strategic expansion in metros with improving payor mix. The company’s healthy ROE (16.5% FY27E) and conservative leverage provide additional comfort.

We value Max Healthcare at 58x FY27E EPS of ₹25, arriving at a 12-month target price of ₹1,450 (22% upside from current levels). For the short term, we assign a 3-month target of ₹1,260 (6% upside). Key upside triggers include margin expansion from new facilities, sustained occupancy improvement, and a favourable pricing mix in high-value procedures.

Major risk factors affecting Max Healthcare Institute Ltd.

- Regulatory Risks: Price controls on medical procedures, stents, or drugs could impact profitability.

- Execution Risks: Delay in capacity expansion or integration of new facilities may affect growth.

- Talent Retention: Dependence on specialist doctors and medical professionals could lead to cost pressure.

- Policy Changes: Shifts in healthcare insurance regulations or government reimbursement schemes could influence patient mix.

- Geographical Concentration: Heavy presence in North India exposes the company to regional risks.

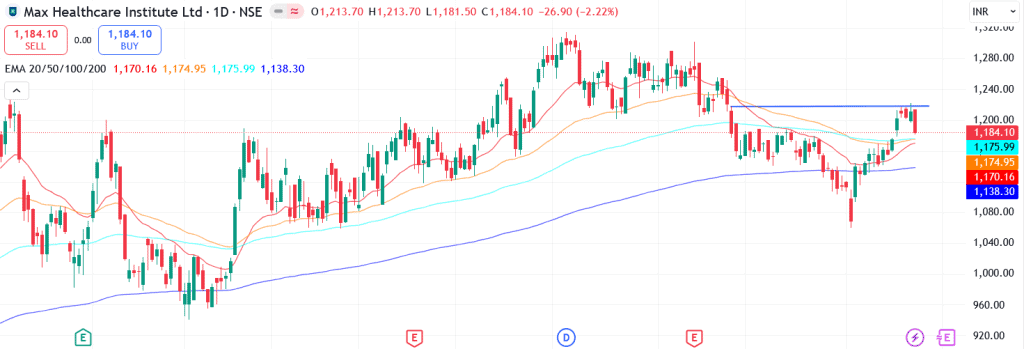

Technical analysis of Max Healthcare Institute Ltd. share

Max Healthcare is forming a rounding bottom pattern, with the price currently hovering near the neckline. A breakout above this neckline could trigger a strong upward move, confirming the start of a fresh momentum phase.

The stock is trading well above its 50-day, 100-day, and 200-day EMAs, reaffirming a robust bullish trend. Sustaining above these key averages would strengthen the medium- to long-term positive outlook.

Momentum indicators are aligned with the bullish bias. The MACD at 9.80 remains positive, with the line above the signal line, a sign of continued upward momentum. The RSI at 53.89 indicates healthy buying interest, while relative RSI scores of 0.02 (21-day) and 0.01 (55-day) reflect steady outperformance versus the broader market. The ADX at 19.14 further suggests that the uptrend is gradually strengthening.

A decisive move above ₹1,260 could open the path toward ₹1,450 (12-month fundamental target). On the downside, ₹1,100 acts as a crucial support, holding above this level is key to maintaining the bullish structure.

- RSI: 53.89 (Healthy Buying Interest)

- ADX: 19.14 (Trend Gaining Strength)

- MACD: 9.80 (Positive)

- Resistance: ₹1,260

- Support: ₹1,100

Max Healthcare Institute Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹1,260 (~6% upside) and a 12-month target of ₹1,450 (~22% upside).

Why buy now?

Strong Operating Momentum: Revenue up 31% YoY in Q1 FY26 with higher occupancy (76%) and steady ARPOB at ₹78,000 driving growth.

Expansion Visibility: Adding ~1,500 beds (1,000 brownfield + 500 greenfield) across Mumbai, Delhi, and Nagpur doubling capacity over 4–5 years.

Margin Expansion: EBITDA margins expected to improve from to 28.0% (FY27E) aided by operational leverage and higher case complexity.

Digital & Home-care Growth: Max@Home scaling fast with 22% YoY growth and expanding presence in 15 cities.

Financial Strength: ROE at 16.5% (FY27E), low leverage (D/E 0.2×), and healthy cash flows fund expansion without stressing the balance sheet.

Portfolio fit

Max Healthcare offers a steady, scalable, and high-quality play on India’s structural healthcare growth. Its dominant North India presence, rising premium mix, and disciplined cost control provide consistent compounding potential. For investors seeking exposure to India’s formalising and premiumising healthcare ecosystem, Max Healthcare serves as a core portfolio holding combining earnings visibility and defensiveness.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebMax Healthcare Institute Ltd.: Budget 2025-26 opportunities

- Healthcare Infrastructure Push: Increased government allocation toward hospital infrastructure, diagnostics, and PPP models to expand capacity and patient volumes.

- Insurance Penetration: Higher funding for Ayushman Bharat 2.0 and private health-insurance incentives to expand the insured patient base and improve cash-payor mix.

- Medical Tourism: Policy support and simplified visa norms expected to boost international patient inflow, benefiting premium hospital chains like Max.

- Digital Health Mission: Increased budget for digital-records and tele-consultation platforms to accelerate adoption of Max@Home and Max Lab networks.

- Skill & R&D Support: Incentives for medical education, clinical research, and health-tech startups to strengthen Max Healthcare’s specialty depth and innovation edge.

Final thoughts

Max Healthcare’s story is one of strategic clarity and disciplined growth. From a regional hospital network to a national healthcare powerhouse, it has consistently focused on clinical excellence, operational efficiency, and patient-centric innovation. As India’s healthcare industry expands with rising affordability and awareness, Max Healthcare is not just curing ailments, it’s building the infrastructure for a healthier, more resilient India. For investors seeking long-term stability with structural growth potential, Max Healthcare offers a prescription for sustainable returns.