Gold has always held a special place in Indian households – not just as a symbol of culture and security, but also as a valuable financial asset. Leveraging this deep-rooted affinity, Muthoot Finance Ltd has built itself into the largest gold loan NBFC in India, offering quick, collateralized credit to millions of households. In a financial landscape where credit demand is rising but formal penetration is still evolving, Muthoot’s ability to bridge liquidity needs with a simple, trusted product makes it a structural beneficiary of India’s credit inclusion journey.

But does Muthoot Finance offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | MUTHOOTFIN |

| Industry/Sector | Financial Services (NBFC) |

| CMP | 2830.10 |

| Market Cap (₹ Cr.) | 1,13,620 |

| P/E | 18.44 (Vs Industry P/E of 19.94) |

| 52 W High/Low | 2,874.90 / 1,756.05 |

| EPS (TTM) | 153.30 |

About Muthoot Finance Ltd

Founded in 1939 and headquartered in Kochi, Muthoot Finance Ltd is the flagship company of the Muthoot Group and the largest gold loan company globally. With over 5,600+ branches across India, Muthoot provides secured loans against household gold jewellery, serving primarily retail and SME borrowers. Its core strength lies in accessibility, transparency, and brand trust, making it a preferred choice for quick credit.

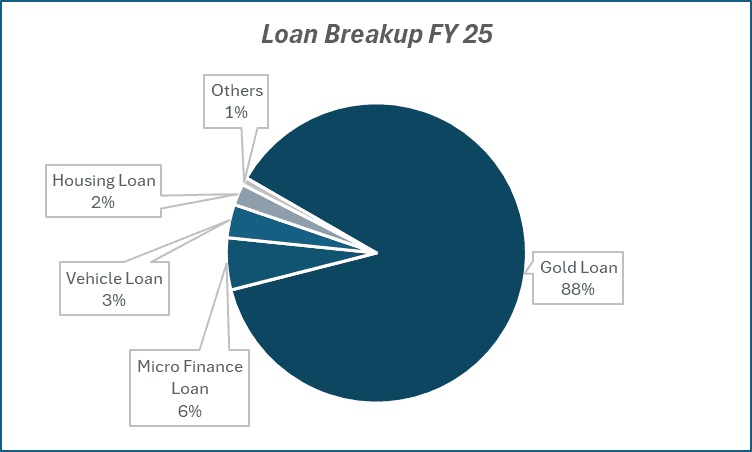

Key business segments

Muthoot Finance Ltd. operates primarily in the following key business segments:

- Gold Loans – Core segment, accounting for ~90% of AUM.

- Other Secured Loans – Small portfolio of housing finance, microfinance, and vehicle loans through subsidiaries.

- Overseas Operations – Small but growing presence in financial services abroad.

Primary growth factors for Muthoot Finance

Muthoot Finance key growth drivers:

- Financial Inclusion: Rising demand for quick, collateral-backed loans among unbanked and underbanked households.

- Gold Price Appreciation: Higher collateral values boost ticket sizes and loan growth.

- Expanding Distribution Network: Continuous addition of branches in semi-urban and rural areas.

- Diversification Initiatives: Growth in housing finance, microfinance, and vehicle loans.

- Digital Enablement: Increasing use of mobile apps and online gold loan services for younger customers.

Detailed competition analysis for Muthoot Finance

Key financial metrics – TTM;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Muthoot Finance Ltd. | 22190.44 | 16445.35 | 74.11% | 6130.95 | 27.63% | 18.44 |

| Shriram Finance Ltd. | 43778.40 | 31553.83 | 72.08% | 9597.97 | 21.92% | 11.38 |

| JIO Financial Services | 2237.55 | 1661.27 | 74.25% | 1262.27 | 56.41% | 120.78 |

| Aditya Birla Capital | 41420.09 | 14867.97 | 35.90% | 3032.96 | 7.32% | 21.25 |

| Cholafin Ltd. | 27300.47 | 19069.10 | 69.85% | 4450.48 | 16.30% | 27.61 |

Key insights on Muthoot Finance

- Muthoot’s business model is highly resilient, with gold loans offering low NPAs due to collateral-backed lending.

- The company enjoys best-in-class margins and high return ratios, supported by its strong branch-led model.

- While competition from banks and NBFCs is rising, Muthoot’s brand recall, distribution depth, and customer trust provide a strong moat.

- Subsidiaries in housing finance and microfinance provide diversification, though gold loans remain the growth anchor.

- Debt reduction and robust liquidity management support financial stability.

Recent financial performance of Muthoot Finance for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 4473.86 | 5621.75 | 6450.13 | 14.74% | 44.17% |

| EBITDA (₹ Cr.) | 3247.43 | 4046.95 | 5008.81 | 23.77% | 54.24% |

| EBITDA Margin (%) | 72.59% | 71.99% | 77.65% | 566 bps | 506 bps |

| PAT (₹ Cr.) | 1195.66 | 1443.93 | 1974.25 | 36.73% | 65.12% |

| PAT Margin (%) | 26.73% | 25.68% | 30.61% | 493 bps | 388 bps |

| Adjusted EPS (₹) | 28.99 | 36.81 | 50.22 | 36.43% | 73.23% |

Muthoot Finance financial update (Q1 FY26)

Financial performance

- Revenue ₹6,450 cr, up 44.2% YoY on strong growth in gold loan demand and improved yields.

- PAT ₹1,974 cr, up 65.1% YoY, marking the company’s highest-ever quarterly consolidated profit.

- Consolidated AUM stood at ₹1.33 lakh cr, up 37% YoY, led by robust 40% growth in gold loan AUM to ₹1.13 lakh cr.

- NIM expanded to 12.15% (vs 11.27% QoQ; 11.51% YoY), aided by NPA recoveries of ₹400 cr.

- Active customer base rose to 64.6 lakh (vs 59.1 lakh YoY); gold tonnage reached record 209 tonnes.

Business highlights

- Gold loan auctions moderated to ₹13 cr vs ₹68 cr YoY, reflecting stronger recoveries. Loan ticket sizes above ₹3 lakh now account for 40% of AUM, indicating rising share of high-value customers.

- Subsidiary trends were mixed: Housing finance AUM rose 41% YoY to ₹3,096 cr, though PAT declined to ₹2 cr (vs ₹7.7 cr YoY). Microfinance AUM fell 22.6% YoY to ₹7,706 cr, but asset quality improved with stage-3 down to 4.44% (vs 4.98% QoQ).

- Muthoot Money reported sharp AUM growth of 202% YoY to ₹5,000 cr with asset quality gains (stage-3 at 0.96% vs 1.67% YoY); branch network expanded to 997 from 674 YoY.

Outlook

- Management expects borrowing costs to ease in coming quarters, supporting NIM stability.

- Gold loan business remains the key growth driver, with continued traction in high-ticket loans and new customer acquisitions.

- Subsidiaries are expected to scale steadily with risk-based lending models and branch expansion, though asset quality in housing and microfinance remains under watch.

- Overall, management guided for sustained double-digit AUM growth in FY26 with focus on profitability, diversification, and cost efficiencies.

Recent Updates on Muthoot Finance

- Expanded digital lending initiatives, allowing customers to renew and top-up gold loans through mobile apps.

- Increased focus on microfinance subsidiaries, catering to women borrowers in rural and semi-urban areas.

- Announced plans to expand the housing finance arm with affordable housing loans.

- Strengthened partnerships for digital payment solutions to enhance customer convenience.

Company valuation insights – Muthoot Finance

Muthoot Finance is currently trading at a P/B multiple of 5.2x, well above its historical average, supported by its dominant position in the gold loan market, robust asset growth, and industry-leading return ratios. The stock has delivered a 43% return over the past year, significantly outperforming the Nifty 50’s -2%, driven by healthy AUM growth, margin expansion, and improving asset quality.

The company is well-positioned to capitalize on India’s resilient demand for gold-backed credit, aided by higher gold prices, favorable RBI regulations (LTV raised to 85% for loans below ₹2.5 lakh), and declining borrowing costs. With gold loan AUM growing at ~15% CAGR, strong NIMs (12.1% in Q1FY26), stable asset quality, and operating efficiencies, Muthoot is expected to sustain double-digit earnings growth through FY27. ROE is projected to improve from 19.7% in FY25 to 22.6% in FY26 before stabilizing at ~21.5% in FY27, supported by healthy spreads and efficient capital deployment.

Applying a 3x multiple to FY27E BV, we derive a 12-month target price of ₹3,400, implying a 20% upside from current levels. A near-term target of ₹3,200 suggests a 12% upside over the next six months, underpinned by sustained gold loan momentum, margin stability, and easing funding costs.

Major risk factors affecting Muthoot Finance

- Gold Price Volatility – Sharp corrections in gold prices can impact collateral value and loan growth.

- Competition – Rising participation of banks and fintechs in gold loans may pressure yields.

- Regulatory Risks – Tighter RBI norms on lending practices could affect growth or margins.

- Concentration Risk – Heavy reliance on gold loans as the primary revenue stream.

- Operational Risks – Branch expansion and digital platforms require constant vigilance against fraud and defaults.

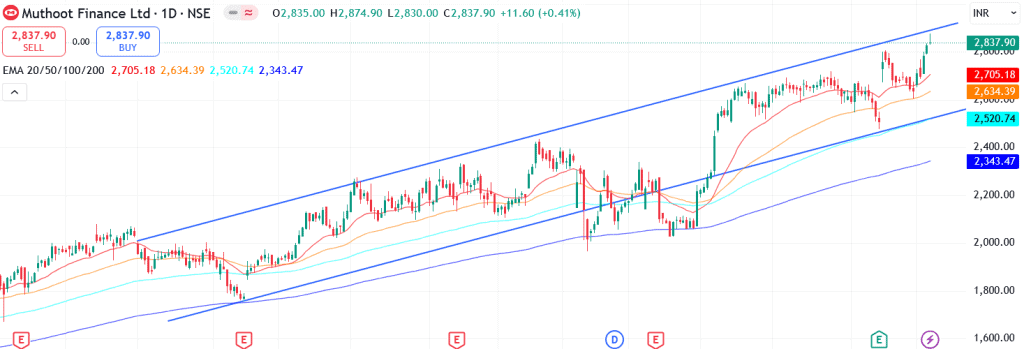

Technical analysis of Muthoot Finance share

Following its sustained move within a well-established ascending channel, Muthoot Finance continues to respect its upward trajectory, reaffirming the ongoing uptrend. The stock is trading above its 50-day, 100-day, and 200-day EMAs, reflecting strong bullish momentum and a constructive medium- to long-term outlook.

The MACD stands positive at 33.19, with the MACD line already above the signal line, confirming bullish momentum. RSI at 66.21 highlights strong buying interest, while relative RSI values of 0.06 (21-day) and 0.07 (55-day) point to steady outperformance versus the broader market. The ADX at 16.26 suggests that trend strength is gradually building up.

A breakout above the key resistance at ₹3,200 could open upside potential toward ₹3,400, aligning with its 12-month fundamental target. On the downside, ₹2,550 remains a critical support; sustaining above this level will be vital to preserving the bullish structure.

- RSI: 66.21 (Strong Buying Interest)

- ADX: 16.26 (Trend Strength Building)

- MACD: 33.19 (Positive Momentum)

- Resistance: ₹3,200

- Support: ₹2,550

Muthoot Finance stock recommendation

Current Stance: Buy, with a 3-month target of ₹3,200 (~12% upside) and a 12-month target of ₹3,400 (~20% upside).

Why buy now?

Record Q1 FY26 profit (₹1,974 cr), aided by 40% YoY gold loan growth and NIM expansion.

Strong AUM visibility at ₹1.33 lakh cr, with steady traction in high-ticket gold loans.

Improving asset quality with Stage-III loans down to 2.6% vs 3.4% QoQ.

Lower borrowing costs expected in coming quarters, supporting spreads.

Diversification into housing, vehicle finance, and microfinance subsidiaries strengthens growth levers.

Portfolio fit

Muthoot Finance is India’s largest gold loan NBFC with unmatched brand equity, robust distribution, and industry-leading return ratios. Its resilient business model, high collateral coverage, and steady growth outlook make it a compelling play on financial inclusion and rising household credit demand.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebMuthoot Finance: Budget 2025-26 opportunities

- Gold Loan Growth Catalyst: Higher gold import duty rationalization or policies favoring monetization of idle household gold could drive stronger demand for gold loans.

- Rural & SME Credit Push: Increased government focus on rural credit, MSME financing, and priority sector lending to boost loan disbursements in semi-urban and rural areas, Muthoot’s key markets.

- Lower Borrowing Costs: Budget measures to improve NBFC funding access and reduce cost of borrowings can enhance spreads and profitability.

- Digital & Financial Inclusion: Incentives for digital lending, financial inclusion, and wider adoption of fintech models to support Muthoot’s tech-led branch expansion and customer acquisition.

- Regulatory & Tax Benefits: Any relaxation in NBFC regulations or tax incentives for borrowers could enhance affordability and demand for Muthoot’s loan products.

Final thoughts

Muthoot Finance represents a trusted, resilient play on India’s gold-backed credit ecosystem. Its extensive reach, brand strength, and efficient business model provide consistent earnings visibility even in volatile economic environments. While risks from competition and regulatory oversight remain, its deep-rooted presence and structural demand for collateralized retail credit ensure long-term sustainability. For investors, Muthoot Finance is not just a gold loan company – it is a play on India’s credit inclusion, financial resilience, and household gold monetization story.