As India’s demand for quality healthcare rises sharply, hospital chains are increasingly stepping in to meet this gap with scale, efficiency, and innovation. Among them, Narayana Hrudayalaya Ltd. (NH) stands apart. Known for its mission to deliver affordable healthcare at scale, NH has quietly emerged as a high-margin, capital-efficient hospital chain – not just in India but also globally. Combining world-class cardiac and oncology care with strong execution and disciplined capital allocation, Narayana is now transitioning from a healthcare service provider to a robust compounding business.

But does Narayana Hrudayalaya offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | NH |

| Industry/Sector | Healthcare (Hospital & Healthcare Services) |

| CMP | 1977.60 |

| Market Cap (₹ Cr.) | 40,414 |

| P/E | 49.25 (Vs Industry P/E of 66.75) |

| 52 W High/Low | 1,996.70 / 1,171.00 |

| EPS (TTM) | 38.66 |

| Dividend Yield | 0.23% |

About Narayana Hrudayalaya

Founded in 2000 by renowned cardiac surgeon Dr. Devi Shetty, Narayana Hrudayalaya has built a reputation as a provider of cost-effective, high-quality tertiary and quaternary care. The company operates a network of 40+ healthcare facilities, including hospitals, heart centers, and primary care units, across India and overseas (notably the Cayman Islands).

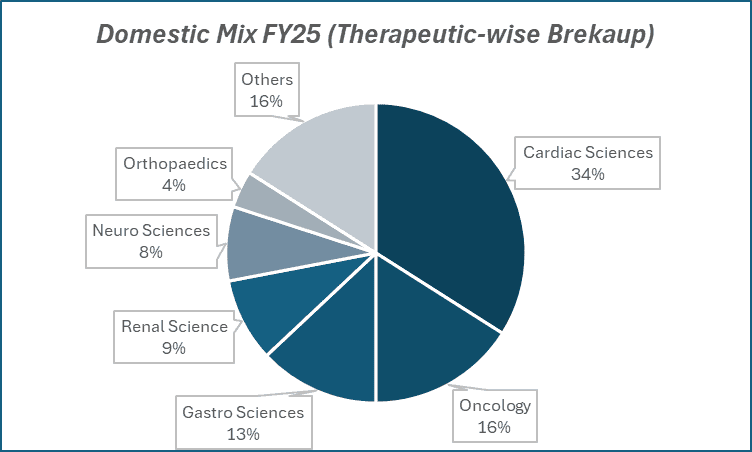

While cardiac sciences remains its flagship vertical, NH has significantly expanded its capabilities in oncology, orthopedics, and renal sciences. Its business model emphasizes asset-light expansion, operational efficiency, and high patient throughput.

Key business segments

Narayana Hrudayalaya operates primarily in the following key business segments:

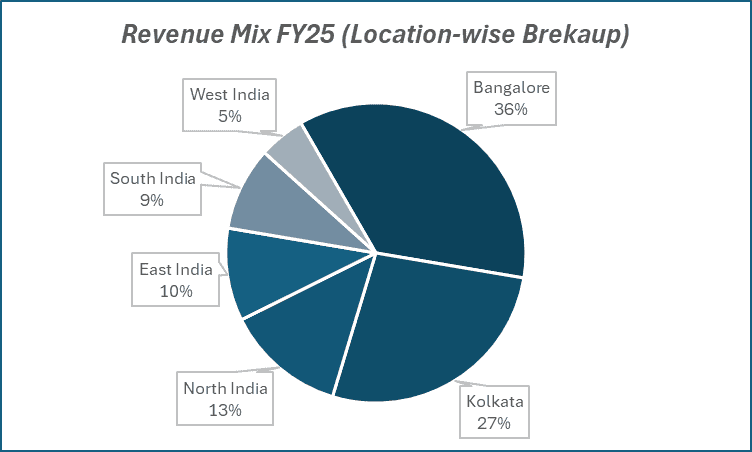

- India Hospitals – Flagship units in Bengaluru, Kolkata, and other Tier 1/2 cities providing multispecialty and super-specialty care.

- International Operations – The Cayman Islands hospital, offering high-end procedures, contributes significantly to profits.

- Digital & Outreach – Includes teleconsultation, remote diagnostics, and low-cost health camps for rural reach.

Primary growth factors for Narayana Hrudayalaya

Narayana Hrudayalaya key growth drivers:

- Tertiary Care Demand: Rising prevalence of cardiac and chronic diseases fuels demand for NH’s specialty services.

- Asset-Light Expansion: Focus on high RoCE models through hospital management agreements and greenfield builds with partners.

- Cayman Islands Growth: Overseas unit continues to see higher ARPOB and occupancy, becoming a profit center.

- Operational Leverage: High patient throughput model keeps costs low and margins high.

- Medical Tourism & NRI Base: Rising demand for quality yet affordable surgical care brings in international patients.

Detailed competition analysis for Narayana Hrudayalaya

Key financial metrics – FY25;

| Company | Revenue(₹ Cr.) | Operational Beds | Hospital Occupancy Rate (%) | Average Length of Stay(Days) | Avg. Daily Revenue / Occupied Bed (₹) | P/E (TTM) |

| Narayana Hrudayalaya | 5482.98 | 5583 | 47% | 4.5 | 46301 | 49.25 |

| Fortis Healthcare | 7782.75 | 4750 | 69% | 4.2 | 69722 | 73.57 |

| Global Health Ltd. | 3692.32 | 2480 | 61% | 3.2 | 63629 | 65.89 |

| Apollo Hospitals | 21794.00 | 8025 | 67% | 3.3 | 63569 | 70.21 |

| Max Healthcare | 7028.46 | 4654 | 75% | 4.0 | 77100 | 109.63 |

Key insights on Narayana Hrudayalaya

- NH has among the highest EBITDA margins in the hospital sector (~21–23%), driven by tight cost control and mix optimization.

- Its RoCE exceeds 20%, a benchmark rarely met in capital-intensive hospital businesses.

- The Cayman Islands unit alone contributes ~30%+ to profits, despite being a single hospital, showcasing strong margin differentiation.

- Continued focus on scalable specialties like oncology and organ transplants is boosting ARPOB and case complexity.

- The management remains conservative in capital allocation, balancing growth with financial prudence.

Recent financial performance of Narayana Hrudayalaya for Q4 FY25

| Metric | Q4 FY24 | Q3 FY25 | Q4 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 1246.25 | 1366.68 | 1475.44 | 7.96% | 18.39% |

| EBITDA (₹ Cr.) | 291.03 | 307.01 | 357.72 | 16.52% | 22.92% |

| EBITDA Margin (%) | 23.35% | 22.46% | 24.25% | 179 bps | 90 bps |

| PAT (₹ Cr.) | 188.05 | 193.05 | 196.24 | 1.65% | 4.36% |

| PAT Margin (%) | 15.09% | 14.13% | 13.30% | -83 bps | -179 bps |

| Adjusted EPS (₹) | 9.33 | 9.44 | 9.65 | 2.22% | 3.43% |

Narayana Hrudayalaya financial update (Q4 FY25)

Financial performance

- Revenue stood at ₹14,754 million, up 18.4% YoY and 10.6% QoQ.

- EBITDA was ₹3,577 million, up 22.9% YoY and 16.4% QoQ; margin expanded to 24.2%, up 80 bps YoY and 120 bps QoQ.

- PAT stood at ₹2,046 million, up 8.8% YoY and 5.7% QoQ.

- FY25 revenue was ₹54,830 million, up 9.3% YoY.

- FY25 EBITDA stood at ₹12,764 million, up 10.8% YoY with margin at 23.3%.

- FY25 PAT came in at ₹7,982 million, up 1.1% YoY.

Business highlights

- India revenue grew 10.7% YoY; ARPOB improved 11% YoY to ₹46,301/day.

- Cayman business posted 50.2% YoY revenue growth to ₹3,797 million.

- Cayman EBITDA was ₹1,663 million, up 39.4% YoY with ~44% margin.

- NHIC and clinic business reported a loss of ₹242 million in Q4; full-year loss at ₹650 million.

- India occupancy hovered between 60–65%.

- Mumbai hospital neared break-even; retail chemotherapy center launched in Gurugram.

Outlook

- Management reiterated bed addition plans of 1,535 beds by FY29 across Bengaluru, Kolkata, and Raipur.

- FY26 capex guidance of ₹7.5 billion, including ₹3 billion for maintenance and ₹4.5 billion for expansions.

- Focus remains on optimizing case mix and enhancing throughput through debottlenecking and infrastructure upgrades.

Recent Updates on Narayana Hrudayalaya

- Dharamshila Narayana Hospital launched a 3D mammography unit and free cancer screening for 5,000 women.

- Narayana Health infused $1 million into its Cayman Islands arm to strengthen overseas operations.

Company valuation insights – Narayana Hrudayalaya

Narayana Hrudayalaya is currently trading at a TTM P/E of 49.25×, below the industry average of 66.75×, despite delivering a stellar 1-year return of ~66.6%, significantly outperforming the Nifty 50’s ~6.1%. This valuation, while appearing modest relative to peers, factors in the company’s disciplined capital allocation, strong free cash flows, and sustained margin improvement across both domestic and Cayman operations. Backed by continued growth in key specialties, expanding hospital network, and improved case mix and occupancy rates, NH remains well-positioned for scalable, asset-light expansion.

At 40× our FY27E EPS of ₹60, we arrive at a 12-month target price of ₹2,400 (implying ~21% upside) and a 3-month target of ₹2,100 (offering ~6% upside), presenting a compelling investment case given its visibility in earnings growth and operating leverage.

Major risk factors affecting Narayana Hrudayalaya

- Geographic Concentration: A large portion of profits still depends on a few flagship units, especially Cayman.

- Regulatory Risks: Price caps on procedures or devices in India may impact ARPOB and margins.

- Execution Risks: New hospital ramp-ups and doctor onboarding can affect profitability in the short term.

- Forex Sensitivity: Overseas earnings may be impacted by currency volatility and changing medical tourism dynamics.

Technical analysis of Narayana Hrudayalaya share

Narayana Hrudayalaya is exhibiting a strong bullish setup, trading within a long-term ascending channel since its Q3 FY25 results, with the rally further accelerated post the Q4 results. The stock is comfortably positioned above its 50-day, 100-day, and 200-day EMAs, reinforcing a well-established uptrend.

The MACD stands positive at 48.05, with the MACD line above the signal line—confirming sustained bullish momentum. The RSI is elevated at 72.05, reflecting strong buying interest, while Relative RSI values of 0.15 (21-day) and 0.10 (55-day) highlight continued outperformance versus the broader market. An ADX reading of 35.83 indicates a very strong trend, strengthening the conviction for further upside.

A decisive move above the ₹2,100 resistance could set the stage for a rally toward ₹2,400, while ₹1,750 remains a critical support level for trend validation.

- RSI: 72.05 (Strong Buying Interest)

- ADX: 35.83 (Very Strong Trend)

- MACD: 48.05 (Positive)

- Resistance: ₹2,100

- Support: ₹1,750

Narayana Hrudayalaya stock recommendation

Current Stance: Buy, with a 3-month target of ₹2,100 (~6% upside) and a 12-month target of ₹2,400 (~21% upside) based on 40× our FY27E EPS estimate of ₹60.

Why buy now?

Margin strength: Q4 FY25 margins improved on better occupancy and case mix; management continues to target scalable, asset-light growth.

Growth visibility: Expansions in India and Cayman, along with improving realizations, ensure a strong earnings outlook.

Sector tailwinds: Rising insurance penetration and demand for affordable tertiary care support long-term growth.

Portfolio fit

Narayana Hrudayalaya offers a high-quality, structural healthcare play with scalable earnings potential. Its differentiated operating model, growing global footprint, and improving return ratios make it an ideal core portfolio candidate for investors seeking exposure to defensive growth and healthcare formalization themes.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebNarayana Hrudayalaya: Budget 2025-26 opportunities

- Healthcare Infrastructure Push: ₹100B allocation to expand tertiary care and medical infra to benefit hospital chains with pan-India networks.

- Insurance Penetration: Higher outlay for Ayushman Bharat and expanded ECLGS for healthcare to drive patient volumes and realizations.

- Digital Health Mission: Continued investments in NDHM to support tech-led patient engagement and operational efficiency.

- PPP Model Incentives: Policy focus on public-private partnerships to enable faster expansion in underserved Tier 2/3 cities.

- Medical Workforce Development: Budgetary support for training and skilling to ease staffing constraints in specialty care delivery.

Final thoughts

Narayana Hrudayalaya is more than just a hospital chain – it’s a mission-led, systems-driven organization redefining the economics of healthcare delivery. While many players in the space chase topline growth with heavy capex, NH has mastered the art of doing more with less, delivering outcomes, affordability, and shareholder value in equal measure.

For investors, it offers exposure to India’s healthcare build-out with a global profit engine, high return metrics, and scalable execution. In a market where defensive growth is prized, Narayana Hrudayalaya could be the heartbeat of a long-term portfolio.