Aluminium is often called the “metal of the future,” thanks to its versatile use in transport, power, construction, packaging, and renewable energy sectors. In India, National Aluminium Company Ltd (NALCO) stands as one of the largest integrated aluminium producers and a key PSU player in the metals space. With its integrated operations spanning bauxite mining, alumina refining, and aluminium smelting, NALCO remains strategically positioned to benefit from India’s infrastructure buildout and the global energy transition. But as with all commodity businesses, cyclicality and volatility are part of the story.

But does National Aluminium Company offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | NATIONALUM |

| Industry/Sector | Metals (Aluminium & Aluminium Products) |

| CMP | 217.90 |

| Market Cap (₹ Cr.) | 40,020 |

| P/E | 6.87 (Vs Industry P/E of 12.69) |

| 52 W High/Low | 262.99 / 137.75 |

| EPS (TTM) | 31.19 |

About National Aluminium Company Ltd

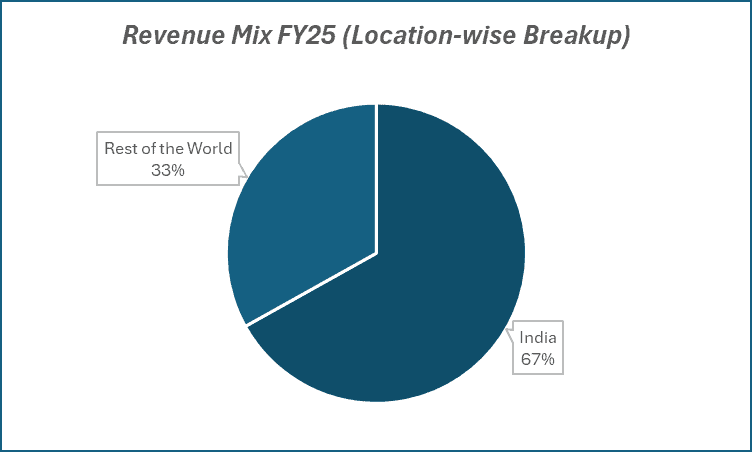

Founded in 1981 and headquartered in Bhubaneswar, NALCO is a Navratna PSU under the Ministry of Mines. It has operations across the entire aluminium value chain, ranging from bauxite mining to alumina refining to aluminium smelting and power generation. The company is also a significant player in exports, especially in alumina, with a strong presence in Asian and European markets.

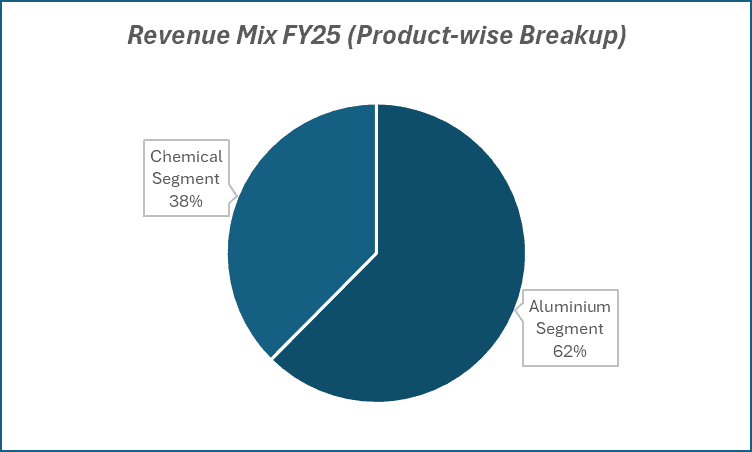

Key business segments

National Aluminium Company Ltd. operates primarily in the following key business segments:

- Bauxite Mining – Access to rich reserves in Odisha, ensuring long-term raw material security.

- Alumina Refining – One of the largest alumina refineries in India, with a major portion exported to global buyers.

- Aluminium Smelting & Casting – Production of primary aluminium products including ingots, billets, and wire rods.

- Captive Power Generation – Ensures cost competitiveness and energy security in operations.

Primary growth factors for National Aluminium Company Ltd

National Aluminium Company key growth drivers:

- Infrastructure & Construction Boom – Rising aluminium demand from housing, smart cities, and industrial expansion.

- EV & Renewable Energy Push – Aluminium is critical in lightweight vehicles, solar panels, and transmission lines.

- Export Opportunities – Strong positioning in alumina exports helps capture global demand.

- Government Support – As a PSU, NALCO benefits from strategic policy initiatives in mining and metals.

- Backward Integration – Self-sufficiency in raw material and energy secures margins even in volatile markets.

Detailed competition analysis for National Aluminium Company Ltd

Key financial metrics – TTM;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| National Aluminium | 17738.47 | 8122.58 | 45.79% | 5787.31 | 32.63% | 6.87 |

| Hindalco Industries | 245715.00 | 32208.00 | 13.11% | 16929.00 | 6.89% | 9.85 |

| Vedanta Ltd. | 155028.00 | 42316.00 | 27.30% | 19896.00 | 12.83% | 11.75 |

| Hindustan Zinc Ltd. | 33724.00 | 17301.00 | 51.30% | 10242.00 | 30.37% | 18.41 |

| Hindustan Copper | 2093.73 | 738.08 | 35.25% | 488.30 | 23.32% | 49.41 |

Key insights on National Aluminium Company Ltd

- NALCO’s integrated model provides a cost advantage over peers, making it resilient in down-cycles.

- Profitability is closely linked to LME aluminium prices and foreign exchange movements.

- The company has maintained a strong dividend payout track record, making it attractive for income-focused investors.

- Expansion plans in mining and refining capacity aim to improve long-term volume growth.

Recent financial performance of National Aluminium Company Ltd. for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 2856.10 | 5267.83 | 3806.94 | -27.73% | 33.29% |

| EBITDA (₹ Cr.) | 934.20 | 2753.88 | 1492.14 | -45.82% | 59.72% |

| EBITDA Margin (%) | 32.71% | 52.28% | 39.20% | -1308 bps | 649 bps |

| PAT (₹ Cr.) | 601.22 | 2078.37 | 1063.86 | -48.81% | 76.95% |

| PAT Margin (%) | 21.05% | 39.45% | 27.95% | -1150 bps | 690 bps |

| Adjusted EPS (₹) | 3.20 | 11.26 | 5.71 | -49.29% | 78.44% |

National Aluminium Company Ltd. financial update (Q1 FY26)

Financial performance

- Revenue up 33% YoY, driven by higher alumina and aluminium sales.

- PAT grew 77% YoY, supported by strong topline growth and operational efficiencies.

- Final dividend of ₹2.50 per share recommended.

- Production rose with bauxite up 6.6%, alumina hydrate up 35%, aluminium up 3%, and power up 6% YoY.

Business highlights

- Alumina Refinery Expansion (5th Stream): Mechanical completion targeted by March 2026, commissioning by June 2026; FY27 output expected at ~50% capacity (5–6 lakh tons).

- Bauxite Mine Expansion (Pottangi): Lease deed signed; operations expected by end of CY25 / Q1 FY27, adding 3.5 MTPA capacity.

- Aluminium Smelter Expansion: Brownfield expansion DPR under preparation, land acquisition nearly complete; project likely online by FY2030.

- Captive Coal Mine: Operating at rated 4 MTPA capacity; cost advantage of ~₹400/ton vs purchased coal.

Outlook

- Alumina: ₹20,000–₹21,000 per ton (60% variable).

- Aluminium: ₹1,55,000–₹1,60,000 per ton.

- Caustic Soda (landed cost): ₹44,301 per ton.

- RPO obligation: ₹75 crore incurred; strategy to reduce dependence via captive renewable capacity.

Recent Updates on National Aluminium Company Ltd.

- Announced new bauxite mining lease acquisitions to strengthen raw material security.

- Plans underway for capacity expansion in alumina refining to cater to growing domestic and export demand.

- Renewed focus on renewable energy projects, aligning with India’s net-zero commitments.

- Entered into long-term supply agreements with power and infrastructure companies to ensure offtake visibility.

Company valuation insights – National Aluminium Company Ltd.

National Aluminium is currently trading at an EV/EBITDA of 3.6x, and has delivered a strong 21.4% return over the past year versus the Nifty 50’s -1.1%.

The stock’s outperformance reflects its integrated operations, raw material security, and strong balance sheet with zero debt. With robust Q1 FY26 results (Revenue ↑33% YoY, PAT ↑77% YoY), increasing alumina and aluminium sales, and capacity expansions underway, NALCO is well-positioned to benefit from rising domestic aluminium consumption (~9% growth projected) and supportive global demand trends.

Strategic projects like the 5th stream alumina refinery (commissioning by June 2026), Pottangi bauxite mines (expected by FY27), and value-added product expansion (wire rods, foils, rolled products) are expected to drive volume growth and margin resilience over the medium term. Cost advantages from captive coal, low-cost alumina production, and expansion into renewable energy further strengthen long-term competitiveness.

Applying a 6x multiple to FY27E EBITDA, we derive a 12-month target price of ₹260, implying a 20% upside from current levels. A near-term target of ₹235 suggests an 8% upside over the next three months, supported by strong earnings momentum, volume growth visibility, and integrated cost leadership.

Major risk factors affecting National Aluminium Company Ltd.

- Commodity Cyclicality – Sharp swings in LME aluminium prices directly impact profitability.

- Global Slowdown – Weak demand from export markets can drag revenues.

- Cost Pressures – Rising energy or raw material costs may compress margins.

- Policy Risks – Changes in mining or export regulations could alter growth trajectory.

- Currency Volatility – Export earnings remain sensitive to INR-USD fluctuations.

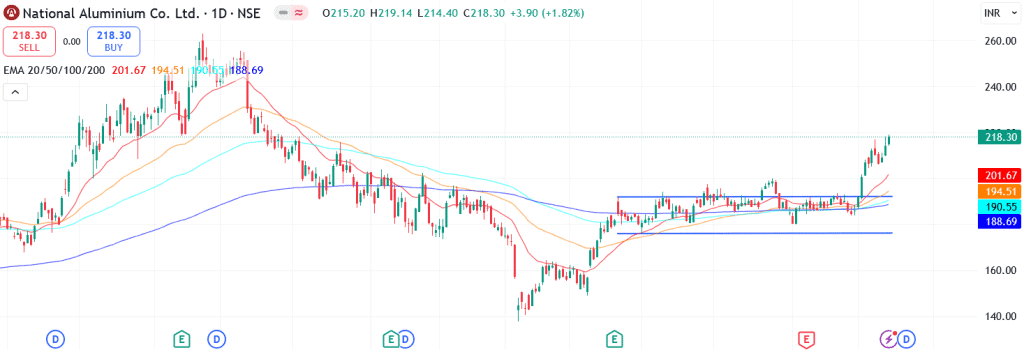

Technical analysis of National Aluminium Company Ltd. share

Following a sideways consolidation, NALCO has recently broken out above the upper trendline, delivering a strong ~13% cumulative up-move, signaling a shift toward building upward momentum. The breakout is backed by strong price action, suggesting the potential for trend continuation.

The stock is currently trading comfortably above its 50-day, 100-day, and 200-day EMAs, indicating sustained bullish momentum and reinforcing the medium-term positive outlook.

The MACD is positive at 6.6, with the line placed above the signal line, confirming strong short-to-medium term momentum. The RSI at 72.8 highlights very strong buying interest, nearing overbought territory but still suggesting room for continuation. Relative RSI values also reflect consistent outperformance versus the broader market. The ADX at 28.10 indicates a strengthening trend, adding conviction to the breakout setup.

A decisive move above the ₹235 resistance could unlock further upside toward ₹260, aligning with its 12-month fundamental target. On the downside, ₹190 serves as a key support level; holding above this zone will be crucial for sustaining the bullish structure.

- RSI: 72.8 (Strong Buying Interest)

- ADX: 28.10 (Strong Trend)

- MACD: 6.6 (Positive Momentum)

- Resistance: ₹235

- Support: ₹190

National Aluminium Company Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹235 (~8% upside) and a 12-month target of ₹260 (~20% upside).

Why buy now?

Strong Q1 FY26 performance with revenue up 33% YoY and PAT up 77% YoY.

Highest-ever Q1 domestic sales in both alumina and aluminium.

Integrated operations with raw material security through captive bauxite and coal mines, ensuring cost leadership.

Capacity expansion is underway with the 5th stream alumina refinery (commissioning by June 2026) and Pottangi bauxite mines (expected by FY27).

Growth focuses on value-added products including wire rods, foils, and rolled products, supporting margin expansion.

Zero-debt balance sheet and low-cost structure provide resilience against commodity cycles.

Portfolio fit

NALCO is a leading integrated aluminium producer with a strong domestic franchise and a cost-efficient, resource-secured business model. Rising domestic aluminium consumption (~9% CAGR expected), coupled with global supply-side constraints, positions the company to capture both volume and margin growth. With upcoming expansions, investments in renewables, and increasing share of value-added products, NALCO offers a compelling opportunity to participate in India’s aluminium growth story while maintaining downside protection through its integrated cost structure.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebNational Aluminium Company Ltd.: Budget 2025-26 opportunities

- Green Transition Push: Higher allocation toward renewable energy and green hydrogen to benefit NALCO’s smelting operations and sustainability roadmap.

- Infra Expansion: Increased spending on power, construction, and railways to boost aluminum demand across end-use industries.

- Import Substitution: Policies encouraging domestic manufacturing under “Make in India” to reduce reliance on imported aluminum and support capacity utilization.

- Export Incentives: Trade facilitation measures and FTAs could strengthen NALCO’s export competitiveness in alumina and value-added aluminum products.

- Mining & Mineral Support: Government focus on mining reforms and bauxite exploration to ensure long-term raw material security.

Final thoughts

Picture a city skyline dotted with aluminium-based infrastructure, EVs zooming past with lightweight frames, and solar panels capturing energy, all powered by aluminium. This vision highlights NALCO’s role in India’s growth story. For investors, NALCO is not just a metals stock; it’s a cyclical opportunity tied to infrastructure expansion and energy transition. While volatility comes with the territory, patient investors with an appetite for commodities may find value in riding the aluminium cycle with NALCO.