In the rapidly evolving world of specialty chemicals, few Indian companies have managed to carve a niche as deep and defensible as Navin Fluorine International Ltd (NFIL). With a legacy of over five decades in fluorine chemistry, Navin Fluorine has transitioned from being a basic refrigerant gas manufacturer to a high-value global player in specialty chemicals, fluorochemicals, and contract research & manufacturing (CRAMS). Its strategic evolution, strong client partnerships, and focus on high-margin segments have positioned it as a key beneficiary of the global supply chain shift toward India.

But does Navin Fluorine International offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | NAVINFLUOR |

| Industry/Sector | Chemicals |

| CMP | 5687.40 |

| Market Cap (₹ Cr.) | 28,829 |

| P/E | 65.73 (Vs Industry P/E of 42.69) |

| 52 W High/Low | 5839.00 / 3180.00 |

| EPS (TTM) | 86.67 |

| Dividend Yield | 0.12% |

About Navin Fluorine International Ltd.

Founded in 1967 and headquartered in Mumbai, Navin Fluorine International Ltd is part of the Padmanabh Mafatlal Group. The company operates across the fluorochemicals value chain, from bulk inorganic fluorides to complex specialty molecules and high-end contract manufacturing. It caters to industries such as pharmaceuticals, agrochemicals, electronics, and refrigerants, with operations spread across its Dahej, Surat, Dewas, and Noida facilities.

NFIL’s strategic emphasis on R&D, global partnerships, and expansion into fluorine derivatives and specialty chemistries has allowed it to deliver consistent growth and margin expansion over the past decade.

Key business segments

Navin Fluorine International Ltd. operates primarily in the following key business segments:

- Specialty Chemicals: Focused on high-value fluorine-based intermediates for pharma, agrochemicals, and new-age applications like EV batteries and semiconductors. This is the largest and fastest-growing segment.

- Contract Research and Manufacturing Services (CRAMS): Offers end-to-end development and manufacturing solutions to global innovators, leveraging strong fluorine chemistry expertise.

- Refrigerants & Inorganics: Core legacy segment including products like hydrofluorocarbons (HFCs) and hydrofluoro-olefins (HFOs) used in air-conditioning and refrigeration systems.

- Hydrofluoric Acid & Derivatives: Supplies key building blocks for specialty chemical intermediates and industrial applications.

Primary growth factors for Navin Fluorine International Ltd.

Navin Fluorine International Ltd. key growth drivers:

- Capacity Expansion: Ongoing projects at Dahej and Dewas to expand high-performance product capacities in specialty and CRAMS segments.

- Global Supply Chain Diversification: Rising preference for Indian fluorochemical suppliers amid China+1 sentiment benefits NFIL’s export-led business.

- R&D-Led Differentiation: Heavy investments in R&D and process innovation drive higher-value product introductions and longer client stickiness.

- Emerging Applications: Growing demand from EV batteries, green refrigerants, and semiconductor industries open new avenues for fluorine derivatives.

- Strategic Partnerships: Collaboration with global innovators in pharma and chemicals enhances recurring revenue visibility in the CRAMS segment.

Detailed competition analysis for Navin Fluorine International Ltd.

Key financial metrics – TTM;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Navin Fluorine | 2790.96 | 778.98 | 27.91% | 444.12 | 15.91% | 65.73 |

| Deepak Nitrite Ltd. | 8004.97 | 972.13 | 12.14% | 607.08 | 7.58% | 38.84 |

| TATA Chemicals Ltd. | 14695.00 | 1947.00 | 13.25% | 229.00 | 1.56% | 44.23 |

| BASF India Ltd. | 15167.64 | 634.97 | 4.19% | 395.89 | 2.61% | 48.25 |

| Godrej Industries Ltd. | 19869.28 | 2161.66 | 10.88% | 1536.33 | 7.73% | 19.15 |

Key insights on Navin Fluorine International Ltd.

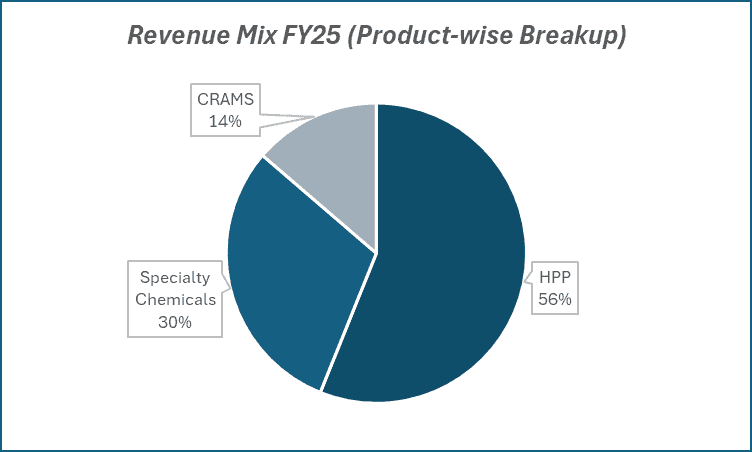

- Specialty and CRAMS segments now contribute over 60% of revenue, driving structural margin improvement.

- Backward integration into key raw materials such as hydrofluoric acid strengthens cost competitiveness.

- Transitioning portfolio mix away from refrigerants toward higher-margin products enhances long-term stability.

- A healthy balance sheet with low leverage enables sustained capex and global expansion.

- Management’s long-term focus remains on scaling the CRAMS and specialty chemical segments to form 70–75% of total revenue mix over the next few years.

Recent financial performance of Navin Fluorine International Ltd. for Q2 FY26

| Metric | Q2 FY25 | Q1 FY26 | Q2 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 518.56 | 725.40 | 758.42 | 4.55% | 46.26% |

| EBITDA (₹ Cr.) | 107.35 | 206.79 | 246.17 | 19.04% | 129.32% |

| EBITDA Margin (%) | 20.70% | 28.51% | 32.46% | 395 bps | 1176 bps |

| PAT (₹ Cr.) | 58.82 | 117.17 | 148.37 | 26.63% | 152.24% |

| PAT Margin (%) | 11.34% | 16.15% | 19.56% | 341 bps | 822 bps |

| Adjusted EPS (₹) | 11.86 | 23.62 | 28.95 | 22.57% | 144.10% |

Navin Fluorine International Ltd. financial update (Q2 FY26)

Financial performance

- Revenue: Consolidated revenue at ₹758.4 crore (+46% YoY, +5% QoQ).

- EBITDA: Operating EBITDA of ₹246.2 crore, margin expanded sharply to 32.5% (vs 20.7% in Q2 FY25).

- PAT: Reported PAT of ₹148.4 crore (up 152% YoY), with EPS at ₹28.9.

- Profitability drivers: Margin expansion driven by better product mix, higher volumes in specialty segments, and operating leverage.

Business highlights

- Segmental momentum: Strong growth across High-performance Refrigerants (HPP), Specialty Chemicals, and CDMO, specialty and CRAMS continue to show robust order visibility and utilisation.

- Capacity & commercialisation: Additional R32 capacity commissioned and ramped up; cGMP4 CDMO capex (₹288 crore) progressing, with Phase-1 expected to be operational by Q3 FY26.

- Geography & customers: Improving export mix and new long-term supply contracts for specialty molecules; European CDMO traction improving.

Outlook

- Management remains confident on near-term revenue visibility backed by a healthy order book and ongoing capacity additions; expects continued momentum in specialty demand and CDMO ramp-up through FY26.

- Margins may stay under review but consecutive quarter expansion gives room for upside.

Recent Updates on Navin Fluorine International Ltd.

- Commissioned a new R&D center focused on fluoropolymer and high-performance materials.

- Announced progress on multi-phase expansion projects at Dahej SEZ for specialty chemical intermediates.

- Secured long-term contracts from global agrochemical majors under the CRAMS division.

- Strengthened ESG initiatives, including transitioning to green power and waste minimization.

Company valuation insights – Navin Fluorine International Ltd.

Navin Fluorine International Ltd (NFIL) currently trades at a TTM P/E of 65.7x, above the industry average of 42.7x, with a 1-year return of 69.7% versus the Nifty 50’s 7.2%.

The investment case for Navin Fluorine is anchored in its leadership in fluorochemicals, growing contribution from specialty and CDMO segments, and margin recovery following operational realignment. The company’s pivot toward high-value molecules, strong visibility from long-term contracts in High-Performance Products (HPP), and traction in the contract development and manufacturing (CDMO) business underpin multi-year earnings growth. With new capacity additions at Dahej and the ongoing CGMP-4 CDMO project, NFIL is well-positioned to capture rising global demand for complex fluorine-based intermediates across pharmaceuticals, agrochemicals, and EV battery chemistries.

Key growth drivers include capacity ramp-up in Specialty Chemicals, export expansion to regulated markets, and higher contribution from value-added products. The company’s capital efficiency, robust R&D pipeline, and prudent capital allocation strategy continue to support strong profitability and return ratios.

We value Navin Fluorine at 52x FY27E EPS of ₹135, arriving at a 12-month target price of ₹7,020 (24% upside from current levels). For the short term, we assign a 3-month target of ₹6,000 (6% upside). Upside triggers include faster CDMO scale-up, improved utilization at the new Dahej unit, and incremental contract wins in specialty segments.

Major risk factors affecting Navin Fluorine International Ltd.

- Execution Delays: Any delays in capacity commissioning or project ramp-up could defer revenue recognition.

- Regulatory Risks: Environmental and safety regulations around fluorine chemistry may affect operating flexibility.

- Input Cost Volatility: Dependence on imported raw materials like fluorspar and energy prices can impact margins.

- Client Concentration: A few large customers contribute significantly to CRAMS revenue.

- Valuation Sensitivity: Elevated multiples leave limited room for short-term disappointment.

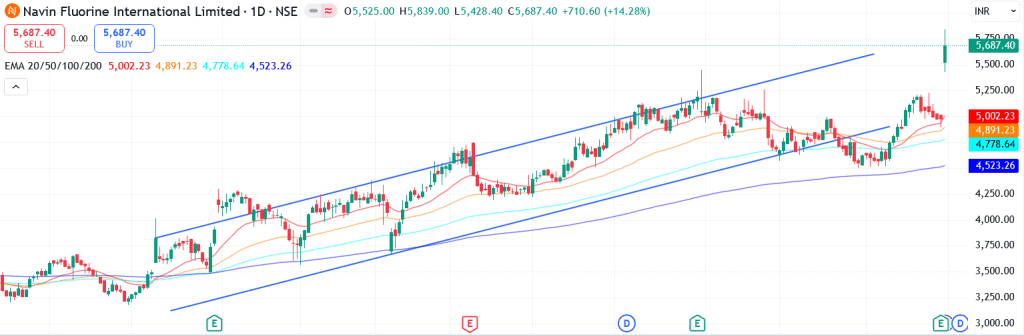

Technical analysis of Navin Fluorine International Ltd. share

Navin Fluorine continues to trade in a well-established uptrend, signaling the potential for a sustained upward move following its Q2 results. The stock’s price action reflects strong momentum and consistent higher highs, indicating robust investor confidence in its long-term growth outlook.

The stock is comfortably positioned above its 50-day, 100-day, and 200-day EMAs, reaffirming the strength of its bullish structure. Sustaining above these key moving averages would further solidify the medium- to long-term positive trend.

Momentum indicators remain supportive of the ongoing uptrend. The MACD at 126.06 stays positive, with the line well above the signal line, a classic sign of strengthening bullish momentum. The RSI at 77.83 reflects strong buying interest, while relative RSI scores of 0.18 (21-day) and 0.13 (55-day) highlight consistent outperformance versus the broader market. The ADX at 25.01 reinforces that the trend is gaining traction, confirming a healthy directional strength.

A decisive move above ₹6,000 could open the path toward ₹7,020 (12-month fundamental target). On the downside, ₹5,200 acts as a key support; maintaining above this level will be crucial to preserving the stock’s bullish setup.

- RSI: 77.83 (Strong Buying Interest)

- ADX: 25.01 (Strong Trend)

- MACD: 126.06 (Positive)

- Resistance: ₹6,000

- Support: ₹5,200

Navin Fluorine International Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹6,000 (~6% upside) and a 12-month target of ₹7,020 (~24% upside) based on 52x FY27E EPS of ₹135.

Why buy now?

Specialty & CDMO-Led Growth: Specialty chemicals and CDMO segments are expected to drive 20%+ revenue CAGR over FY25–27, backed by long-term contracts and new molecule launches.

Capacity Expansion: Dahej HPP and CGMP-4 facilities ramping up production, enhancing contribution from high-margin segments and strengthening export competitiveness.

Margin Recovery: EBITDA margins expected to expand to ~25% (FY27E) as utilization improves and specialty product mix rises.

R&D & Innovation: Ongoing investment in fluorination technologies and partnerships with global innovators underpin long-term scalability.

Financial Resilience: Strong balance sheet, low leverage (D/E <0.3×), and consistent FCF generation provide funding headroom for growth projects.

Portfolio fit

Navin Fluorine represents high-quality specialty chemicals and CDMO plays with leadership in fluorine chemistry, strong operating leverage, and expanding global relevance. For investors seeking exposure to India’s chemical value migration toward high-value intermediates, Navin offers a blend of growth visibility, innovation-led scalability, and margin strength, making it a compelling mid-cap compounder in the specialty chemicals space.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebNavin Fluorine International Ltd.: Budget 2025-26 opportunities

- R&D Push: Higher allocation for chemical innovation under PLI and Atmanirbhar Bharat to boost specialty and high-value fluorochemicals.

- Export Incentives: Policy support for chemical exports to strengthen Navin Fluorine’s global specialty and CDMO footprint.

- Green Chemistry: Incentives for low-emission, sustainable manufacturing align with Navin’s eco-efficient operations.

- Semiconductor Demand: Rising need for electronic-grade gases and refrigerants opens new growth avenues.

- Skill & Infra Support: Focus on technical education and logistics to enhance manufacturing scale and efficiency.

Final thoughts

Navin Fluorine exemplifies India’s transition from a commodity chemicals producer to a global specialty player built on innovation, sustainability, and deep domain expertise. With strong leadership in fluorine chemistry, accelerating global partnerships, and expanding applications across green energy, healthcare, and electronics, NFIL stands at the intersection of chemistry and innovation.

For long-term investors, Navin Fluorine offers a compelling opportunity to participate in India’s specialty chemicals growth story, one that’s cleaner, sharper, and built for the next decade of global transformation.