In the ever-evolving world of digital transformation and enterprise modernization, Indian IT companies are adapting rapidly to stay relevant. While Tier-1 names dominate headlines, Persistent Systems has carved out a high-quality niche for itself as a specialist in digital engineering, cloud, and data-driven transformation. With a strong growth track record, deep client relationships, and an expanding global footprint, Persistent is one of the most exciting mid-cap tech stories in India.

But does Persistent Systems offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | PERSISTENT |

| Industry/Sector | Information Technology (Softwares) |

| CMP | 6104.00 |

| Market Cap (₹ Cr.) | 94,473 |

| P/E | 68.31 (Vs Industry P/E of 28.58) |

| 52 W High/Low | 6,788.90 / 3765.00 |

| EPS (TTM) | 89.52 |

| Dividend Yield | 0.57% |

About Persistent Systems

Founded in 1990 and headquartered in Pune, Persistent Systems Ltd. is a mid-sized IT services company focused on delivering software engineering and digital transformation solutions to clients globally. Unlike many peers who grew on legacy IT and infrastructure deals, Persistent has always been a product-focused and cloud-native service provider. The company partners with leading technology firms such as Microsoft, AWS, Salesforce, and IBM, and services clients across BFSI, healthcare, and software ISVs.

Today, Persistent is widely recognized for its capabilities in cloud migration, platform engineering, and data & AI, making it a go-to partner for enterprises undergoing digital reinvention.

Key business segments

Persistent Systems operates primarily in the following key business segments:

- Digital Engineering Services – End-to-end product development, platform modernization, and cloud-native solutions.

- Enterprise Modernization – Cloud migration, DevOps, data analytics, and AI-driven solutions for enterprises.

- Alliances & IP Services – Strategic partnerships with technology majors and monetization of proprietary platforms and accelerators.

Primary growth factors for Persistent Systems

Persistent Systems key growth drivers:

- Cloud & Data-Led Transformation: Enterprises across sectors are modernizing IT stacks, a trend Persistent is directly aligned with.

- Strong BFSI & Healthcare Momentum: Growing client spends in these verticals, especially in digital customer experience and automation.

- Strategic Partnerships: Deepened relationships with hyperscalers like AWS, Microsoft, and Google fuel deal wins.

- M&A-Driven Capability Expansion: Acquisitions in UX, cloud consulting, and Artificial Intelligence strengthen Persistent System’s offerings and domain reach.

- Product DNA & IP-Led Services: Persistent System’s roots in software product engineering give it a competitive edge in platform-led engagements.

Detailed competition analysis for Persistent Systems

Key financial metrics – FY25;

| Company | Revenue(₹ Cr.) | EBITDA Margin (%) | PAT Margin (%) | Net Sales by Employee cost – Q4 FY25 (x) | ROCE (%) | P/E (TTM) |

| Persistent Systems | 11938.72 | 17.24% | 11.73% | 1.79x | 31.26% | 68.31 |

| Coforge Ltd. | 12050.70 | 14.05% | 8.00% | 1.71x | 31.28% | 75.48 |

| Mphasis | 14229.99 | 18.60% | 11.96% | 1.76x | 23.01% | 30.11 |

| LTTS | 10670.10 | 17.74% | 11.84% | 1.89x | 31.51% | 36.65 |

| OFSS | 6846.80 | 44.64% | 34.75% | 2.12x | 39.83% | 34.31 |

Key insights on Persistent Systems

- Persistent has delivered 20%+ revenue CAGR over the past 5 years, significantly outpacing industry average growth.

- EBITDA margins have remained resilient (~16–18%), supported by high-value work and a scalable delivery model.

- Client mining has improved – top client contribution has declined, showing broad-based growth and reduced dependency.

- Employee utilization and offshore mix remain high, driving operating leverage without compromising delivery quality.

- The company has consistently improved its deal pipeline and order bookings, indicating sustained revenue visibility.

Recent financial performance of Persistent Systems for Q4 FY25

| Metric | Q4 FY24 | Q3 FY25 | Q4 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 2590.53 | 3062.28 | 3242.11 | 5.87% | 25.15% |

| EBITDA (₹ Cr.) | 454.36 | 537.84 | 584.41 | 8.66% | 28.62% |

| EBITDA Margin (%) | 17.54% | 17.56% | 18.03% | 47 bps | 49 bps |

| PAT (₹ Cr.) | 315.32 | 372.99 | 395.76 | 6.10% | 25.51% |

| PAT Margin (%) | 12.17% | 12.18% | 12.21% | 3 bps | 4 bps |

| Adjusted EPS (₹) | 20.47 | 23.93 | 25.39 | 6.10% | 24.04% |

Persistent Systems financial update (Q4 FY25)

Financial performance

- Revenue: US$ 375.2 mn in Q4 FY25, up 20.7% YoY and 4.2% QoQ; in rupee terms, ₹ 3,242.1 cr, up 25.2% YoY and 5.9% QoQ.

- EBIT margin: 15.6%, up 113 bps YoY and 70 bps QoQ.

- PAT: ₹ 395.8 cr, up 25.5% YoY and 6.1% QoQ.

- FY25 aggregates: Revenues US$ 1,409.1 mn (+18.8% YoY); EBIT margin 14.7% (+30 bps YoY); PAT ₹ 1,400.1 cr (+28% YoY).

Business highlights

- BFSI grew 6.1% QoQ (32.3% mix), TMT rose 5.2% QoQ (40.9% mix) and Healthcare increased 0.4% QoQ (26.8% mix).

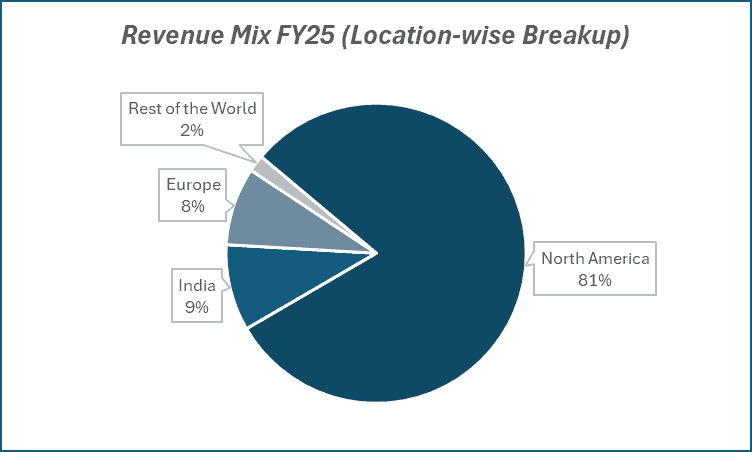

- North America revenues climbed 4.2% QoQ (80.5% mix), Europe grew 6.7% (8.4%), India was up 3.1% (9.3%) and ROW declined 1.3% (1.8%).

- Q4 TCV reached US$ 517.5 mn (–12.9% QoQ; +15.6% YoY) and ACV was US$ 350.2 mn (including US$ 198.1 mn new bookings), with FY25 TCV/ACV at US$ 2.1 bn/US$ 1.5 bn.

- The SASVA GenAI platform filed 15 new patents (total 35) and partnered with NVIDIA for agent-based AI.

- Employee strength stood at 24,594 with attrition at 12.9%.

- A final dividend of ₹ 15/share was declared.

Outlook

- Revenue targets: Management reconfirmed US$ 2 bn by FY27 (12.4% CAGR over FY 25 – 27) and US$ 3 bn by FY 31 (20% CAGR over FY 25 – 31).

- Margin expansion: On track to deliver 200–300 bps medium-term improvement; modelling EBIT margins of ~15.5% in FY26E and ~16.5% in FY27E.

- Deal pipeline: Strong ACV flow provides healthy revenue visibility for FY26 and beyond.

Recent Updates on Persistent Systems

- Final dividend: Persistent Systems declared a final dividend of ₹15 per share for FY25, underscoring its strong cash-flow generation.

- NSA approval: On June 9, 2025, Persistent System’s Wave Relay mobile-networking solution received NSA clearance for secure classified information transfers, expanding its defense-sector credentials.

- GenAI platform: The SASVA AI/GenAI platform secured 15 new patents (taking the total to 35) and inked a partnership with NVIDIA Inference Microservices to enhance agent-based AI capabilities.

- Industry recognition: Ranked as a “Most Honored Company” in Extel’s 2025 Asia Executive Team survey, marking the second consecutive year of top-tier industry acknowledgment.

Company valuation insights – Persistent Systems

Persistent Systems is currently trading at a TTM P/E of 68.31× versus the industry average of 28.58×, backed by a 1-year return of ~54.7% versus the Nifty 50’s ~6.7%. While valuations appear elevated, they reflect the company’s resilient, broad-based growth across BFSI, TMT and Healthcare verticals; disciplined margin expansion; and strong free-cash-flow generation.

In Q4 FY25, Persistent delivered revenues of US$ 375.2 mn (+20.7% YoY; +4.2% QoQ) with an EBIT margin of 15.6% (+113 bps YoY; +70 bps QoQ). Management is targeting 200–300 bps of medium-term margin uplift, driven by operating leverage, investments in digital/GenAI (SASVA platform) and a robust deal pipeline (FY25 TCV/ACV of US$ 2.1 bn/US$ 1.5 bn).

At 50× our FY27E EPS of ₹145, we arrive at a 12-month target price of ₹7,250 (implying ~19% upside) and a 3-month target of ₹6,500 (~6% upside), offering an attractive risk-reward profile given Persistent System’s growth visibility and cash-flow strength.

Major risk factors affecting Persistent Systems

- Valuation Sensitivity: Any slowdown in growth or margin compression could trigger a de-rating.

- Client Concentration: A few large clients still contribute significantly to revenue – any pullback may impact growth.

- Attrition & Talent Costs: Being a digital-heavy business, rising wage costs or attrition can affect delivery and margins.

- Macro Uncertainty: Global slowdown or delayed IT spending cycles can hurt new deal conversions.

Technical analysis of Persistent Systems share

Persistent Systems is showing a strong bullish setup, having recently broken out of an inverse head and shoulders pattern. The breakout, supported by strong Q4 results, has propelled the stock comfortably above its 50-day, 100-day, and 200-day EMAs, indicating a well-established uptrend.

The MACD is highly positive at 139.29, with the MACD line above the signal line, confirming sustained bullish momentum. RSI stands strong at 65.05, indicating robust buying interest, while Relative RSI values of 0.07 (21-day) and 0.04 (55-day) point to notable outperformance versus the broader market. The ADX at 20.37 suggests a developing trend, strengthening the case for continued upside.

A sustained move above the key resistance level of ₹6,500 could open the way to ₹7,250, while ₹5,450 remains an important support level to watch for trend validation.

- RSI: 65.05 (Strong Buying Interest)

- ADX: 20.37 (Developing Trend)

- MACD: 139.29 (Positive)

- Resistance: ₹6,500

- Support: ₹5,450

Persistent Systems stock recommendation

Current Stance: Buy, with a 3-month target of ₹6,500 (~6% upside) and a 12-month target of ₹7,250 (~19% upside) based on 50× our FY27E EPS estimate of ₹145.

Why buy now?

Robust margin expansion: Q4 FY25 EBIT margins came in at 15.6%, up ~70 bps QoQ and ~110 bps YoY, and management is targeting a further 200 - 300 bps medium-term uplift.

Strong deal pipeline: FY25 TCV/ACV of US $2.1 bn/US $1.5 bn provides high-visibility revenue for FY26, with no deal cancellations in Q4.

Broad-based growth: All verticals - BFSI, TMT and Healthcare grew sequentially, underscoring resilient demand across its end markets.

Portfolio fit

Persistent Systems offers a high-growth, technology-led complement to traditional IT allocations. Its secular exposure to digital transformation, strong return ratios and robust free-cash-flow generation make it an attractive core holding for portfolios seeking durable earnings growth and innovation-driven upside.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebPersistent Systems: Budget 2025-26 opportunities

- Digital Infrastructure: ₹220B DPI boost to accelerate demand for cloud and enterprise tech services.

- AI & Deep Tech: Government funding to drive GenAI adoption and platform-led growth.

- Startup Collaboration: Incentives and funds to spur innovation and co-development partnerships.

- Tier 2/3 Expansion: Tax benefits for GCCs to support delivery hub growth beyond metros.

- Cybersecurity & Compliance: Stronger data laws and funding to lift secure IT and governance solutions.

Final thoughts

Persistent Systems isn’t chasing scale – it’s chasing specialization. In a world where enterprises demand agility, deep tech expertise, and fast innovation cycles, Persistent offers a rare blend of product mindset, enterprise-grade delivery, and strong digital capabilities.

For investors, it’s a way to participate in the cloud-data-AI trifecta without the drag of legacy businesses. If you’re betting on the future of digital engineering, Persistent Systems may be the quiet outperformer that keeps compounding – quarter after quarter.