From households to mega infrastructure projects, Pidilite Industries has built a brand empire where “adhesive” is synonymous with Fevicol. Beyond adhesives, the company has successfully expanded into construction chemicals, waterproofing, art materials, and industrial resins, all while maintaining a consumer-first innovation approach. Its combination of brand strength, distribution depth, and consistent innovation makes it one of India’s most defensively strong consumer chemical plays.

But does Pidilite Industries offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | PIDILITIND |

| Industry/Sector | Chemicals (Adhesives) |

| CMP | 3085.40 |

| Market Cap (₹ Cr.) | 1,56,945 |

| P/E | 71.35 (Vs Industry P/E of 44.09) |

| 52 W High/Low | 3,415.00 / 2,622.20 |

| EPS (TTM) | 42.89 |

| Dividend Yield | 0.65% |

About Pidilite Industries

Founded in 1959, Pidilite Industries is a leading manufacturer of adhesives, sealants, waterproofing solutions, and construction chemicals. Its flagship brand Fevicol enjoys iconic status in India, often used as a generic term for adhesives. With a presence in over 80 countries, the company operates both in consumer-facing and industrial segments, benefiting from India’s growing home improvement, infrastructure, and manufacturing trends.

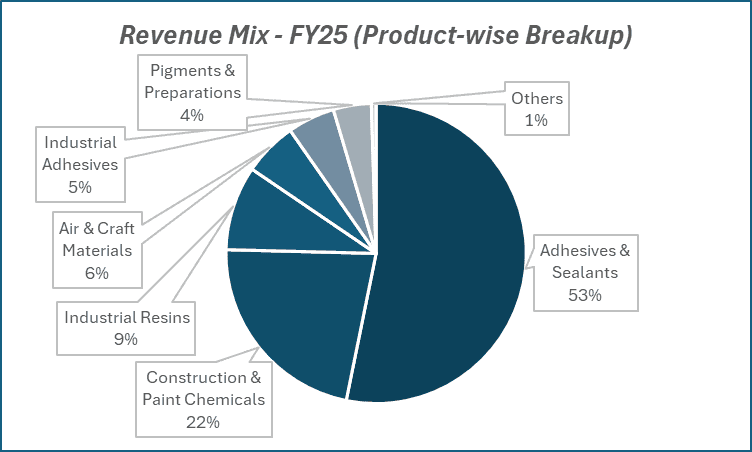

Key business segments

Pidilite Industries operates primarily in the following key business segments:

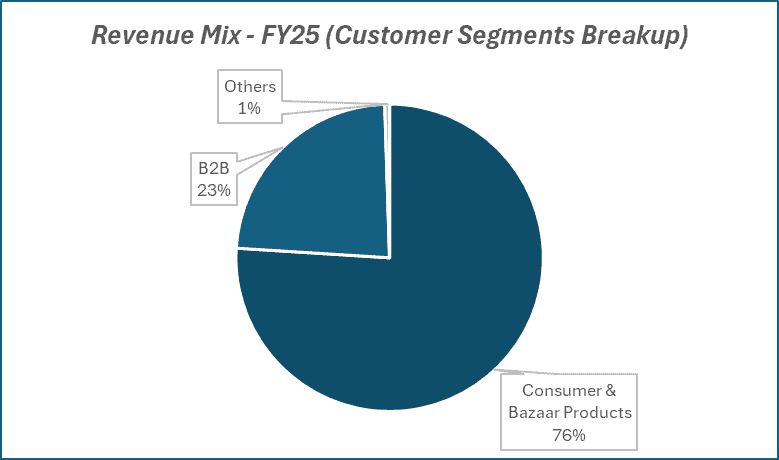

- Consumer & Bazaar (C&B) Segment – Adhesives, sealants, art materials, construction chemicals, and maintenance products for retail customers. This segment contributes the majority of revenues.

- Business-to-Business (B2B) Segment – Industrial resins, adhesives, construction chemicals, and specialty chemicals catering to packaging, automotive, and textile industries.

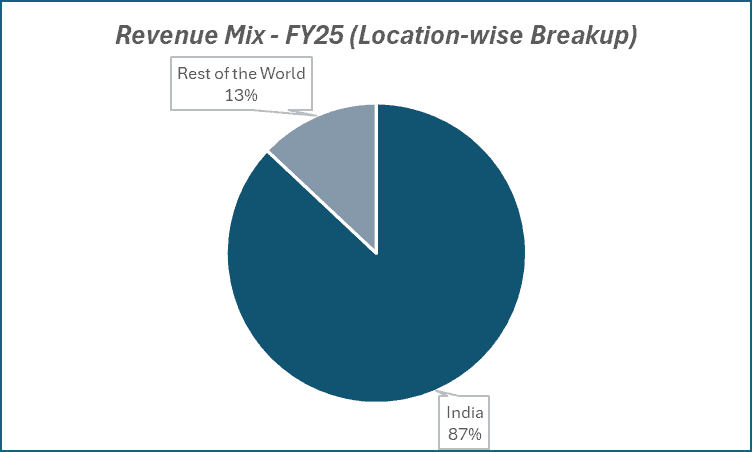

- International Business – Operations across emerging and developed markets, leveraging India-led brands and localized manufacturing.

Primary growth factors for Pidilite Industries

Pidilite Industries key growth drivers:

- Strong Brand Equity – Market dominance in adhesives and waterproofing products ensures pricing power and customer loyalty.

- Urbanisation & Real Estate Growth – Rising demand for construction and home improvement products.

- Distribution Strength – A vast network of dealers and retailers ensures deep penetration in urban and rural markets.

- Premiumisation Trend – Increasing share of high-value waterproofing and specialty products boosts margins.

- International Expansion – Growing market presence in Asia, Africa, and Latin America to diversify revenue streams.

Detailed competition analysis for Pidilite Industries

Key financial metrics – TTM;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Pidilite Industries Ltd. | 13498.06 | 3140.75 | 23.27% | 2205.27 | 16.34% | 71.35 |

| SRF Ltd. | 15047.57 | 2936.17 | 19.51% | 1430.88 | 9.51% | 59.09 |

| Solar Industries Ltd. | 8009.91 | 2045.83 | 25.54% | 1336.47 | 16.69% | 107.85 |

| Godrej Industries Ltd. | 19869.28 | 2161.66 | 10.88% | 1536.33 | 7.73% | 39.27 |

| Deepak Nitrite | 8004.97 | 972.13 | 12.14% | 607.08 | 7.58% | 36.63 |

Key insights on Pidilite Industries

- Pidilite commands over 70% market share in India’s branded adhesives space, with Fevicol as an unchallenged leader.

- The C&B segment remains the key profit driver, with resilient demand across market cycles.

- Rural market penetration initiatives are aiding long-term growth, even in slower consumption cycles.

- Focus on eco-friendly and sustainable product innovation aligns with global consumer trends.

- Robust cash flows and low leverage support capacity expansion and acquisitions.

Recent financial performance of Pidilite Industries for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 3395.35 | 3141.14 | 3753.10 | 19.48% | 10.54% |

| EBITDA (₹ Cr.) | 812.74 | 632.58 | 940.98 | 48.75% | 15.78% |

| EBITDA Margin (%) | 23.94% | 20.14% | 25.07% | 493 bps | 113 bps |

| PAT (₹ Cr.) | 572.08 | 428.32 | 677.90 | 58.27% | 18.50% |

| PAT Margin (%) | 16.85% | 13.64% | 18.06% | 442 bps | 121 bps |

| Adjusted EPS (₹) | 11.15 | 8.30 | 13.22 | 59.28% | 18.57% |

Pidilite Industries financial update (Q1 FY26)

Financial performance

- Revenue from operations at ₹3,753 crore (up 10.5% YoY); net profit at ₹678 crore (up 18.5% YoY).

- Underlying volume growth (UVG) at 9.9% YoY across categories and geographies.

- EBITDA margin improved 113 bps YoY to 25.1%; gross margin stable YoY.

Business highlights

- Consumer & Bazaar business UVG at 9.3% YoY; B2B segment UVG at 12.6% YoY.

- Rural market growth outpaced urban; domestic subsidiaries posted 11.5% sales growth and 31.7% EBITDA growth.

- International subsidiaries (ex-USA & Brazil) grew sales 6.4% YoY; strong performance in Roff, Dr. Fixit, Araldite, and Fevicol.

- Expanded rural and small-town coverage through Pidilite Ki Duniya outlets and Dr. Fixit centres.

- Announced 1:1 bonus issue and special interim dividend of ₹10/share.

Outlook

- Targets double-digit UVG driven by premiumization, innovation, and robust B2B performance.

- Maintains EBITDA margin guidance of 20–24%, with FY26 likely at the higher end.

- Rural markets expected to continue outpacing urban; core categories to grow 1–2x GDP, growth categories 2–3x GDP.

Recent Updates on Pidilite Industries

- Partnered with global chemical companies for technology sharing in sustainable and specialty products.

- Expanded waterproofing portfolio under the Dr. Fixit brand with advanced leak-proofing solutions.

- Launched training programs for carpenters and contractors, strengthening on-ground brand advocacy.

- Continued to invest in rural outreach programs to deepen penetration beyond tier-3 towns.

Company valuation insights – Pidilite Industries

Pidilite Industries is currently trading at a TTM P/E of 71.35, above the industry average of 44.09, with a 1-year return of 1.8% versus Nifty 50’s 2.0%. The company’s medium-term growth visibility is supported by sustained double-digit underlying volume growth in both Consumer & Bazaar (C&B) and B2B segments, aided by rural demand outpacing urban, steady expansion in premium and innovative product offerings, and margin stability driven by benign raw material prices.

Strong execution in core categories like Fevicol, Dr. Fixit, and Roff, coupled with distribution expansion into rural and smaller towns, reinforces its market leadership in adhesives and sealants. EBITDA margins remain elevated (FY25 at 22.9%, FY27E at 23.3%) with limited volatility in key input costs, allowing for consistent brand investments without significant margin trade-offs. The company’s diversified growth levers, including international expansion, premiumization, and targeted acquisitions in home improvement position it to deliver strong earnings.

We value Pidilite Industries at 62x FY27E EPS of ₹60 to arrive at a 12-month target price of ₹3,720, implying a 20% upside from current levels. A short-term target of ₹3,350 implies a 9% upside over 3 months, supported by steady demand, healthy rural traction, and premium category growth momentum.

Major risk factors affecting Pidilite Industries

- Raw Material Price Volatility – Fluctuations in crude-linked inputs like VAM (vinyl acetate monomer) can impact margins.

- High Valuation Risk – Premium multiples leave little room for earnings disappointment.

- Competitive Pressures – Rising presence of regional players in adhesives and waterproofing in rural markets.

- Demand Slowdown – Extended weakness in real estate or infrastructure activity can moderate growth.

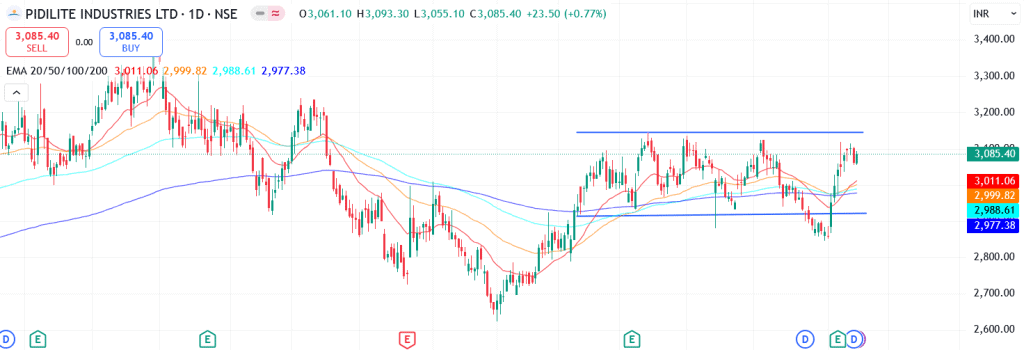

Technical analysis of Pidilite Industries share

Pidilite Industries has been trading within a rangebound channel since April. Following its recent results, the stock has moved higher and is now approaching the upper trendline of the channel. A decisive breakout from this level could open up a fresh entry opportunity for investors.

The stock trades comfortably above its 50-day, 100-day, and 200-day EMAs, highlighting a well-established upward trend.

Momentum indicators support the bullish setup. The MACD is firmly positive at 25.65, with the MACD line above the signal line, indicating sustained bullish momentum. The RSI stands at 62.57, signalling strong buying interest, while relative RSI scores of 0.06 (21-day) and 0.03 (55-day) reflect consistent outperformance versus the broader market.

The ADX at 30.20 indicates a strong trend, which could gather further strength if the price breaks past key resistance.

A breakout above ₹3,350 could set the stage for a rally toward ₹3,720, aligning with the 12-month fundamental target. On the downside, ₹2,920 serves as a crucial support level, and holding above it will be essential to maintain the bullish structure.

- RSI: 62.57 (Strong Buying Interest)

- ADX: 30.20 (Strong Trend)

- MACD: 25.65 (Firmly Positive)

- Resistance: ₹3,350

- Support: ₹2,920

Pidilite Industries stock recommendation

Current Stance: Buy, with a 3-month target of ₹3,350 (~9% upside) and a 12-month target of ₹3,720 (~20% upside).

Why buy now?

Sustained double-digit growth: Strong underlying volume growth in both Consumer & Bazaar (C&B) and B2B segments, supported by broad-based demand across regions, categories, and products.

Rural market momentum: Rural growth continues to outpace urban, aided by expanding direct coverage via Pidilite Ki Duniya outlets and Dr. Fixit centres.

Premiumisation & innovation: Ongoing success in premium categories such as Roff and Dr. Fixit, along with new product launches and project-focused solutions, driving value-led growth.

Margin stability: Elevated EBITDA margins (~23%) backed by benign raw material prices and pricing discipline, allowing continued investments in brand building and distribution.

International growth: Steady expansion in overseas markets with consistent growth from subsidiaries, diversifying revenue streams.

Portfolio fit

Pidilite Industries is India’s market leader in adhesives and sealants, with an unmatched brand portfolio, extensive distribution reach, and strong pricing power. Its growth is driven by a combination of rural penetration, premiumisation, innovative solutions, and disciplined cost management, making it a compelling pick for investors seeking a defensive compounder with steady earnings visibility and high return ratios.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebPidilite Industries: Budget 2025-26 opportunities

- Housing & Infra Boost: Higher PMAY and infra spending to lift demand for adhesives, waterproofing, and construction chemicals.

- Rural Demand: Increased rural housing and sanitation projects to drive uptake in entry-tier products.

- Cost Advantage: Incentives for domestic specialty chemicals to lower raw material costs and improve margins.

- Export Push: Trade agreements and simplified procedures to expand international sales.

- R&D & Sustainability: Government grants for green manufacturing and product innovation to strengthen premium positioning.

Final thoughts

From school craft projects to high-rise towers, Pidilite’s products have been part of India’s growth story for decades. It isn’t just selling adhesives; it’s selling trust, reliability, and innovation in every drop. For investors, the company offers a rare mix, a consumption play tied to industrial growth, backed by a brand moat that’s nearly impossible to replicate. As India builds and renovates, Pidilite is well-positioned to stick to its growth trajectory.