India’s structural push toward infrastructure development, housing expansion, renewable energy, and electrification is quietly reshaping demand for electrical products. At the heart of this transformation sits Polycab Ltd, a market leader that has steadily evolved from a wires-and-cables manufacturer into a diversified electrical solutions company. With strong brand equity, scale advantages, and improving margin profile, Polycab stands well-positioned to benefit from India’s multi-year capex and consumption cycle.

But does Polycab India Ltd. offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | POLYCAB |

| Industry/Sector | Electricals (Cable) |

| CMP | 7606.00 |

| Market Cap (₹ Cr.) | 1,14,545 |

| P/E | 46.09 (Vs Industry P/E of 42.93) |

| 52 W High/Low | 7903.00 / 4555.00 |

| EPS (TTM) | 165.50 |

| Dividend Yield | 0.46% |

About Polycab India Ltd.

Founded in 1968, Polycab is India’s largest manufacturer of wires and cables and among the fastest-growing players in the electrical consumer durables (ECD) segment. The company operates an integrated manufacturing model with a nationwide distribution network covering over 200,000 retail touchpoints.

Polycab serves a broad customer base across housing, infrastructure, power, industrial, and commercial segments, balancing B2B scale with rising B2C brand-driven growth.

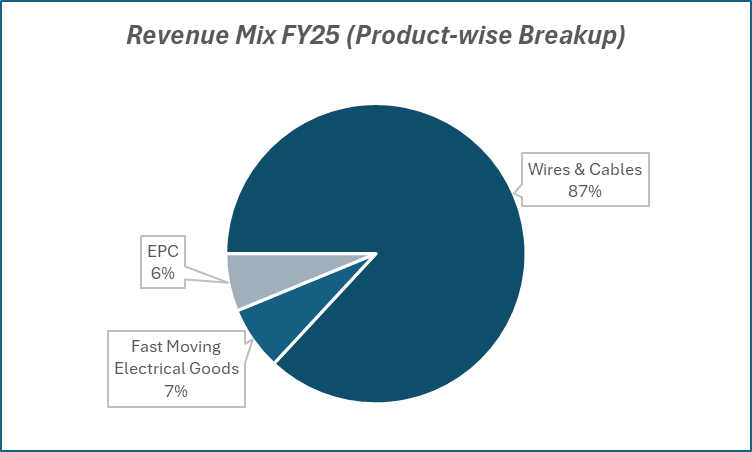

Key business segments

Polycab India Ltd. operates primarily in the following key business segments:

- Wires & Cables (Core Segment): Low-voltage, medium-voltage, and specialty cables catering to housing, infrastructure, power transmission, railways, and industrial applications.

- Fast Moving Electrical Goods (FMEG): Includes fans, lighting, switches, switchgear, solar products, appliances, and smart electrical solutions, focused on premiumization and brand-led growth.

- Engineering, Procurement & Construction (EPC): Turnkey projects in power distribution, substations, and electrification, primarily for utilities and government entities.

Primary growth factors for Polycab India Ltd.

Polycab India Ltd. key growth drivers:

- Strong government-led capex in power, railways, renewables, and infrastructure.

- Housing recovery and real estate upcycle driving demand for wires, cables, and switches.

- Rapid scale-up of the FMEG portfolio with focus on premium and smart products.

- Distribution expansion into Tier 2/3 cities and deeper rural penetration.

- Operating leverage benefits from higher capacity utilization and backward integration.

Detailed competition analysis for Polycab India Ltd.

Key financial metrics – TTM;

| Company | Sales (₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E |

| Polycab India Ltd. | 24595.05 | 3623.65 | 14.73% | 2491.36 | 10.13% | 46.09 |

| KEI Industries Ltd. | 10698.72 | 1069.48 | 10.00% | 790.61 | 7.39% | 53.93 |

| RR Kabel Ltd. | 8222.35 | 622.79 | 7.57% | 400.59 | 4.87% | 40.78 |

| Finolex Cables Ltd. | 5548.00 | 590.07 | 10.64% | 528.95 | 9.53% | 17.26 |

| Sterlite Technologies Ltd. | 4366.00 | 514.00 | 11.77% | -4.00 | -0.09% | -101.62 |

Key insights on Polycab India Ltd.

- Polycab commands leadership in wires & cables with strong pricing power and brand recall.

- FMEG segment margins are steadily improving as scale and premium mix increase.

- Integrated manufacturing provides cost efficiency and supply chain resilience.

- Working capital discipline and cash generation remain structurally strong.

- Shift toward B2C and branded products is reducing cyclicality over time.

Recent financial performance of Polycab India Ltd. for Q2 FY26

| Metric | Q2 FY25 | Q1 FY26 | Q2 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Sales (₹ Cr.) | 5498.42 | 5905.98 | 6477.21 | 9.67% | 17.80% |

| EBITDA (₹ Cr.) | 631.55 | 857.60 | 1020.75 | 19.02% | 61.63% |

| EBITDA Margin (%) | 11.49% | 14.52% | 15.76% | 124 bps | 427 bps |

| PAT (₹ Cr.) | 445.21 | 599.70 | 692.96 | 15.55% | 55.65% |

| PAT Margin (%) | 8.10% | 10.15% | 10.70% | 55 bps | 260 bps |

| Adjusted EPS (₹) | 29.24 | 39.34 | 45.54 | 15.76% | 55.75% |

Polycab India Ltd. financial update (Q2 FY26)

Financial performance

- Consolidated revenue grew 17.8% YoY to ₹6,477 crore in Q2FY26, driven by strong core segment performance.

- EBITDA surged 61.6% YoY to ₹1,021 crore, with margins expanding 430 bps YoY to 15.8%.

- Operating leverage and favourable product mix were key margin drivers.

- PBT rose 56% YoY, reflecting sharp improvement in operating profitability.

- PAT increased 55.6% YoY to ₹693 crore, despite lower other income.

Business highlights

- Wires & Cables revenue grew 19.3% YoY, supported by high-teens volume growth and premium products.

- Segment EBIT margins improved sharply on scale benefits and mix improvement.

- FMEG revenue rose 13.8% YoY, led by lighting, switches and solar; fans remained soft.

- FMEG delivered its third consecutive profitable quarter, aided by premiumisation.

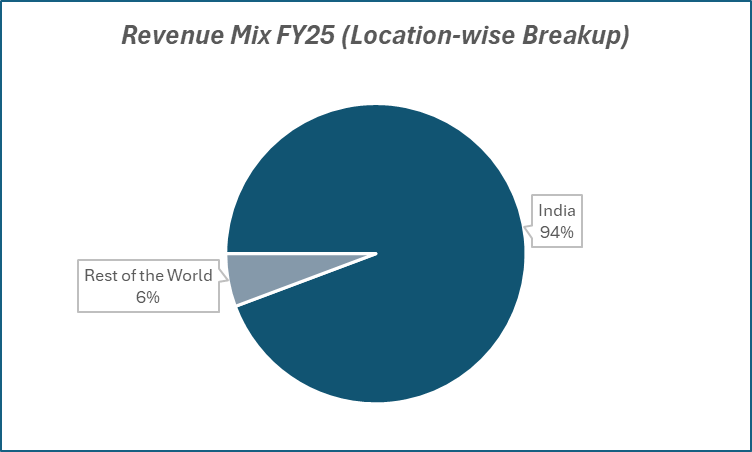

- International business grew 25% YoY, contributing 6.5% to overall revenues.

Outlook

- Core W&C business expected to outperform industry growth, supported by infrastructure and housing demand.

- Project Spring to drive premiumisation, operating leverage and market share gains.

- FMEG margins guided to improve steadily, targeting 8–10% EBITDA margin by FY30.

- Strong order book under RDSS and BharatNet provides medium-term visibility.

- Planned ₹12,000–16,000 crore capex and near-zero net debt support long-term scalable growth.

Recent Updates on Polycab India Ltd.

- Capacity expansion & automation: Ongoing investments across manufacturing facilities to support long-term volume growth and efficiency.

- FMEG portfolio expansion: Aggressive scale-up in fans, lighting and switches to deepen presence beyond core wires & cables.

- Brand strengthening: Higher marketing spends to improve brand recall and accelerate premiumisation in consumer categories.

- ESG focus: Emphasis on energy-efficient products and sustainable manufacturing practices.

- Investor appeal: Strong ESG alignment enhances long-term positioning with institutional investors.

Company valuation insights – Polycab India Ltd.

Polycab is currently trading at a TTM P/E of 46.1x, marginally above the industry average of 42.9x, while delivering a muted 1-year return of 3.6%, significantly underperforming the NIFTY 50’s 10.1%.

This underperformance, despite strong fundamentals, reflects valuation consolidation after a strong multi-year run rather than any deterioration in business momentum.

The investment case for Polycab is anchored in its dominant position in Wires & Cables, which continues to grow at 1.5–2.0x the industry rate, improving profitability driven by premiumisation, operating leverage, and automation-led efficiency gains. Additionally, the FMEG segment has turned consistently profitable, international business is scaling rapidly, and Project Spring is structurally enhancing margins, exports, and market share. A debt-free balance sheet, strong cash flows, and sustained capex for capacity expansion further strengthen long-term earnings visibility.

From a valuation standpoint, applying a 45x multiple to FY27E EPS of ₹210, we arrive at a 12-month target price of ₹9,450, implying an upside of ~24% from current levels. On a shorter-term basis, we assign a 3-month target of ₹8,060, offering ~6% upside, supported by continued earnings momentum, margin expansion, and improving visibility in both domestic and export markets.

Major risk factors affecting Polycab India Ltd.

- Raw material volatility: Fluctuations in copper and aluminium prices can pressure margins if pass-through to customers is delayed.

- Demand cyclicality: Any slowdown in real estate or infrastructure spending could impact volume growth in wires and cables.

- Competitive intensity in FMEG: Rising competition from established and new-age players may compress margins if brand differentiation weakens.

Technical analysis of Polycab India Ltd. share

Polycab is trading within a well-established upward channel, indicating steady accumulation and a continuation of its medium- to long-term uptrend. Price action remains constructive, suggesting a sustained bullish bias.

The stock is comfortably placed above its 50-, 100-, and 200-day EMAs, reinforcing strong long-term trend strength and consistent buying support across timeframes.

Momentum indicators remain supportive of the bullish setup. MACD at 66.44 is firmly positive, with the MACD line holding above the signal line, signalling strengthening underlying momentum.

RSI at 59.36 reflects healthy buying momentum without entering overbought territory, while Relative RSI (0.04 over 21 days) indicates continued outperformance versus the broader market. ADX at 18.49 suggests the trend is gradually strengthening, with improving directional conviction.

A decisive move above ₹8,060 could open the path toward ₹9,450 (12-month target). On the downside, ₹7,100 remains the key support; holding above this level keeps the bullish structure intact.

- RSI: 59.36 (Healthy Buying Momentum)

- ADX: 18.49 (Trend Gaining Strength)

- MACD: 66.44 (Positive)

- Resistance: ₹8,060

- Support: ₹7,100

Polycab India Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹8,060 (6% upside) and a 12-month target of ₹9,450 (24% upside), based on 45x FY27E EPS of ₹210.

Why buy now?

Industry-beating growth: Wires & Cables growing 1.5–2.0x industry, ensuring steady earnings momentum.

Margin upcycle underway: Premiumisation, automation and operating leverage driving structural margin expansion.

FMEG turning accretive: Consistent profitability in FMEG adds incremental earnings optionality.

Balance sheet strength: Near-zero net debt and strong cash flows support growth without financial risk.

Export & capex tailwinds: Scaling international business and planned capex underpin long-term compounding.

Portfolio fit

Polycab provides high-quality exposure to India’s electrification and infrastructure growth, combining strong execution, premium positioning, and balance-sheet strength, well suited for portfolios seeking durable earnings compounding with limited downside risk.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebPolycab India Ltd.: Budget 2025-26 opportunities

- Infra & housing capex push: Sustained government spending on power, renewables, housing, and urban infrastructure drives demand for wires, cables, and electrical solutions.

- Power & energy transition tailwinds: Grid expansion, renewable integration, EV charging, and rooftop solar schemes boost structural demand for cables and electrical products.

- Make in India & PLI support: Domestic manufacturing incentives and import substitution favour organised players like Polycab, aiding market share gains and capacity utilisation.

- Electrification & urbanisation: Rising electrification in rural areas and rapid urban development support long-term volume growth across W&C and FMEG categories.

Final thoughts

Polycab represents a rare blend of industrial scale and consumer-brand economics. As India’s electrification, housing, and infrastructure story unfolds, Polycab is positioned to compound earnings through market leadership in wires & cables and margin-led growth in FMEG. For investors seeking steady compounding with exposure to India’s structural capex and consumption themes, Polycab offers a high-quality, long-term opportunity.