India’s liquor industry is undergoing a subtle but strong transformation—where the rising affluence of consumers, increasing urbanization, and evolving tastes are shifting preferences from mass-market liquor to premium and craft brands. Among the few Indian companies successfully riding this premiumization wave is Radico Khaitan – a legacy player that’s modernized its portfolio while maintaining a strong distribution grip. Let’s explore what makes Radico an interesting mix of legacy, innovation, and long-term growth potential.

But does Radico Khaitan offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | RADICO |

| Industry/Sector | Alcohol (Breweries & Distilleries) |

| Market Cap (₹ Cr.) | 35,423 |

| P/E | 101.86 (Vs Industry P/E of 69.14) |

| 52 W High/Low | 2,786.90 / 1,628.00 |

| EPS (TTM) | 25.83 |

| Dividend Yield | 0.15% |

About Radico Khaitan

Founded in 1943, Radico Khaitan is one of India’s oldest and most respected liquor companies. It was the first in India to launch branded liquor in the country’s liquor space. Known initially for its iconic 8PM whisky, the company has since transitioned into a broad-based alcohol company with offerings across the price spectrum – from economy to luxury.

Radico’s strength lies in its ability to adapt: launching new-age, premium products while continuing to dominate in semi-urban and rural segments with trusted value brands.

Key business segments

Radico Khaitan operates primarily in the following key business segments:

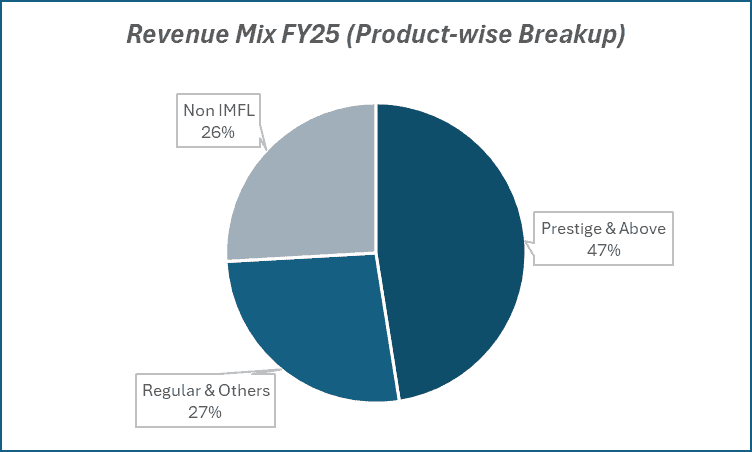

- Prestige & Above Category (Premium Brands): Includes products like Magic Moments Vodka, Rampur Indian Single Malt, Jaisalmer Craft Gin, Morpheus Brandy, and Royal Ranthambore.

- Regular & Economy Brands: Includes value-driven products like 8PM Whisky and Contessa Rum, catering to the large volume market.

- Bulk Alcohol & Contract Manufacturing: Supplies bulk spirits and undertakes bottling for other companies, utilizing its capacity efficiently.

Primary growth factors for Radico Khaitan

Radico Khaitan key growth drivers:

- Premiumization Wave: Consumers are upgrading from regular to premium spirits, boosting margins and brand equity.

- Product Innovation: Launch of niche products (craft gin, single malt) targeting millennials and export markets.

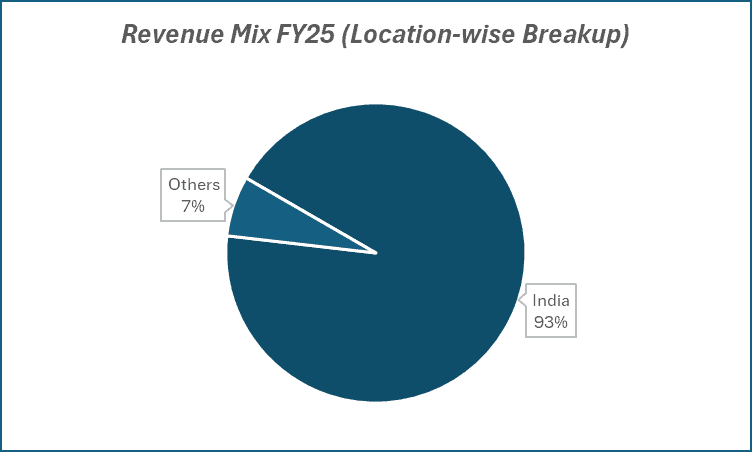

- Distribution Network: Strong presence in over 75,000 retail outlets across India ensures deep market access.

- Backward Integration: Own distilleries and bottling plants drive cost control and product consistency.

- Export Opportunity: Growing international recognition of Indian craft spirits is opening new doors abroad.

Detailed competition analysis for Radico Khaitan

Key financial metrics – FY25

| Company | Revenue(₹ Cr.) | EBITDA Margin (%) | PAT Margin (%) | ROE(%) | ROCE(%) | P/E (TTM) |

| Radico Khaitan | 17098.54 | 3.94% | 2.02% | 11.31% | 13.42% | 101.86 |

| United Spirits | 27276.00 | 8.22% | 5.83% | 21.46% | 29.40% | 73.26 |

| Allied Blenders | 8073.16 | 5.33% | 2.41% | 0.45% | 15.42% | 61.41 |

| Tilaknagar Industries | 3174.62 | 8.03% | 7.24% | 24.78% | 21.83% | 29.66 |

Key insights on Radico Khaitan

- 10-year revenue CAGR of 13% reflects consistent growth driven by a strategic shift toward premiumization.

- 10-year PAT CAGR of 17% underscores steady bottom-line expansion with improving product mix.

- Premium segment (Prestige & Above) now contributes ~30% to volumes but over 50% of revenues, enabling margin expansion and profitability.

- Flagship brands like Magic Moments and Morpheus enjoy strong brand recall, reinforcing consumer loyalty in a competitive market.

- Premium Indian-origin labels Rampur and Jaisalmer are gaining global traction, bolstering the company’s international positioning.

- The new Sitapur plant, designed for high-end product lines, is expected to unlock the next leg of premium volume-led growth.

Recent financial performance of Radico Khaitan for Q4 FY25

| Metric | Mar-24 | Dec-24 | Mar-25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 3894.64 | 4440.90 | 4485.43 | 1.00% | 15.17% |

| EBITDA (₹ Cr.) | 122.54 | 183.93 | 177.53 | -3.48% | 44.88% |

| EBITDA Margin (%) | 3.15% | 4.14% | 3.96% | -18 bps | 81 bps |

| PAT (₹ Cr.) | 56.81 | 95.96 | 90.63 | -5.55% | 59.53% |

| PAT Margin (%) | 1.46% | 2.16% | 2.02% | -14 bps | 56 bps |

| Adjusted EPS (₹) | 4.03 | 7.14 | 6.88 | -3.64% | 70.72% |

Radico Khaitan financial update (Q4 FY25)

Financial performance

- Revenue for Q4 FY25 grew by 15% YoY, while net profit surged 71% YoY, reflecting strong operational performance.

- Standalone EBITDA stood at ₹175 crore in Q4 FY25, up 39% YoY; for FY25, EBITDA rose 32% YoY to ₹668 crore.

- Standalone EBITDA margin in Q4 FY25 improved 180 bps YoY, though declined 80 bps QoQ; FY25 margin was 13.8% vs 12.3% last year.

Business highlights

- Q4 FY25 IMFL volumes stood at ~9.2 million cases, up 28% YoY; FY25 volumes rose 9% YoY to 31.4 million cases.

- Prestige & Above segment volumes grew 17% YoY in Q4 to 3.4 million cases.

- Regular category volumes surged 79% YoY, aided by a low base and normalization in key markets.

- A&SP spends were at 7.6% of IMFL sales, marginally up from 7.4% in Q4 FY24, due to celebrity endorsements and brand building.

Outlook

- Targeting double-digit growth in P&A category with improved profitability.

- Regular category is expected to grow at 12–13%.

Company valuation insights – Radico Khaitan

Radico is trading at a TTM P/E of 101.86, significantly above the industry average of 69.14. It has delivered a stellar 1-year return of +54.69%, outperforming the Nifty 50’s +7.93%.

Radico’s focused premiumization strategy is delivering results – the Prestige & Above (P&A) segment now contributes 41% of IMFL volumes (up from 28% in FY19), driven by successful brand launches and aggressive scaling. Its retail reach has expanded to 100,000+ outlets, with declining CSD dependency and deeper penetration across key consumption states.

With strong traction in premium offerings and continued innovation, Radico is positioned to sustain double-digit volume growth, led by 15% CAGR in P&A. EBITDA margins are expected to expand to 16.2% by FY28E, up from 13.9% in FY25.

At 65x FY27E EPS of ₹49, we assign a 12-month target price of ₹3,200, implying a 21% upside. The 3-month target stands at ₹2,985, indicating a 12% upside from current levels.

Major risk factors affecting Radico Khaitan

- Regulatory Risks: State-wise policy changes can disrupt pricing and distribution.

- Raw Material Volatility: Fluctuating input costs may affect margins.

- Execution Hurdles: Delays in capacity ramp-up or new brand traction may impact growth.

Technical Analysis of Radico Khaitan share

Radico Khaitan has been trading within a rising trendline over the past year, confirming a well-established bullish momentum.

The stock is currently positioned above its 50-day, 100-day, and 200-day EMAs – strengthening the case for a sustained uptrend.

MACD is highly positive at 53.19, with the MACD line above the signal line, reinforcing bullish sentiment.

RSI at 60.59 indicates strong buying interest, while the Relative RSI (21-day and 55-day) at 0.03 and 0.07 respectively confirm continued outperformance versus peers.

ADX at 30.97 points to a strong ongoing trend, with bullish continuation likely if the stock breaks above the ₹2,980 resistance zone.

A sustained move above this level could lead to further upside towards ₹3,200, while ₹2,530 remains a key support.

- RSI: 60.59 (Strong Buying Interest)

- ADX: 30.97 (Strong Trend)

- MACD: 53.19 (Positive)

- Resistance: ₹2,980

- Support: ₹2,530

Radico Khaitan stock recommendation

Current Stance: Buy with a target price of ₹2,980 over a 3-month horizon and ₹3,200 over a 12-month horizon. Radico Khaitan is a high-conviction consumption play on India's premiumization trend in the alcoholic beverages space, backed by strong brand equity, margin-accretive product mix, and global expansion potential.

Why buy now?

Premiumization Trend: Prestige & Above segment drives higher margins with over 50% revenue contribution.

Brand Strength: Strong consumer recall with flagship brands like Magic Moments and Morpheus.

Global Expansion: Rampur and Jaisalmer gaining traction in premium international markets.

Capacity Expansion: New Sitapur plant to unlock next phase of volume-led growth.

Steady Financials: 10Y revenue CAGR of 13% and PAT CAGR of 17% reflect consistent performance.

Portfolio fit

Radico Khaitan is a compelling consumer stock for investors looking to ride India's premiumization wave in discretionary spending. Its evolving brand mix, export potential, and strategic capacity expansion make it suitable for portfolios seeking a blend of steady growth, defensive traits, and long-term margin accretion.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebRadico Khaitan: Budget 2025-26 opportunities

- Premiumization Push – Continued tax stability and rising disposable incomes to accelerate shift toward premium spirits.

- Rural Consumption Uplift – Higher rural spending and agri-infra allocation to boost demand in mass and mid-premium segments.

- Manufacturing Incentives – PLI schemes and Make in India initiatives to support domestic production and exports of premium liquor.

- Export Facilitation – Enhanced export incentives and trade agreements to aid global expansion of brands like Rampur and Jaisalmer.

- Alcohol Regulation Clarity – Potential policy reforms and ease of doing business to improve long-term industry dynamics.

Final thoughts

Radico Khaitan is no longer just a legacy liquor player – it’s emerging as India’s own premium spirits house, blending decades of expertise with modern brand building. With a growing focus on exports, rising premium share, and bold innovation bets, it’s scripting a new chapter in India’s alco-bev landscape.

If you’re looking for a consumer-facing business with a resilient moat, expanding margins, and export optionality – Radico Khaitan may be one to toast to.