With India’s infrastructure cycle gaining momentum and housing demand on the rise, cement companies are witnessing renewed investor interest. Ramco Cements, a southern giant with a legacy of efficiency and innovation, stands out as a focused regional player expanding its footprint and fortifying its position. As the company invests in capacity, logistics, and sustainability, it’s well-poised to benefit from both cyclical tailwinds and long-term structural growth.

But does Ramco Cements offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | RAMCOCEM |

| Industry/Sector | Construction Materials (Cement) |

| CMP | 1186.50 |

| Market Cap (₹ Cr.) | 28,036 |

| P/E | 103.41 (Vs Industry P/E of 46.87) |

| 52 W High/Low | 1,196.00 / 777.80 |

| EPS (TTM) | 11.54 |

| Dividend Yield | 0.17% |

About Ramco Cements

Incorporated in 1961, The Ramco Cements Ltd. is the flagship company of the Chennai-based Ramco Group. With a strong presence in Southern and Eastern India, it’s known for consistent quality, lean operations, and a culture of technological innovation. Headquartered in Chennai, the company operates several integrated cement plants and grinding units, with a current capacity of over 21 million tonnes per annum (MTPA).

Key business segments

Ramco Cements operates primarily in the following key business segments:

- Cement: Core product offering includes OPC, PPC, and Portland Slag Cement (PSC).

- Ready-Mix Concrete (RMC): Growing urban infrastructure and real estate activity support this business vertical.

- Dry Mix Products: Value-added products like tile adhesives and plaster, catering to modern construction needs.

- Wind Power: Ramco also generates renewable energy, partially offsetting its operational power costs.

Primary growth factors for Ramco Cements

Ramco Cements key growth drivers:

- Strong Regional Demand: South and East India continue to see robust demand from housing, road, and irrigation projects.

- Capacity Expansion: Recent additions in Odisha, West Bengal, and Andhra Pradesh aim to de-risk geographic concentration and fuel volume growth.

- Cost Efficiency: Investment in waste heat recovery systems (WHRS), captive power, and logistics optimization helps control input costs.

- Brand Strength: Ramco enjoys high brand recall and pricing power in core markets, especially in Tamil Nadu and Kerala.

- Government Push: Infrastructure focus in the Union Budget and PMAY rural/urban housing schemes to support sustained cement demand.

Detailed competition analysis for Ramco Cements

Key financial metrics – FY25;

| Company | Revenue(₹ Cr.) | Realization / Tonne (₹/MT) | EBITDA / Tonne (₹/MT) | EBITDA Margin (%) | PAT Margin (%) | P/E (TTM) |

| Ramco Cements Ltd. | 8518.40 | 4623 | 607 | 14.47% | 3.15% | 103.41 |

| Ultratech Cement | 75955.13 | 5052 | 1270 | 16.53% | 7.97% | 52.27 |

| JK Cement Ltd. | 11879.15 | 4899 | 1277 | 17.06% | 7.34% | 50.26 |

| Shree Cement | 19282.83 | 5325 | 1403 | 20.40% | 5.83% | 97.77 |

| ACC Ltd. | 21762.31 | 4778 | 480 | 14.07% | 11.03% | 14.20 |

Key insights on Ramco Cements

- Ramco’s EBITDA/tonne is among the best in the southern region, despite higher freight costs due to logistics-heavy markets.

- The company’s strategy of cluster-based manufacturing helps reduce lead time and ensures supply-chain resilience.

- The expansion-led debt uptick is being balanced by operational efficiencies and cash generation.

- Ramco continues to invest in digitization and automation to improve plant productivity and customer service.

Recent financial performance of Ramco Cements for Q4 FY25

| Metric | Q4 FY24 | Q3 FY25 | Q4 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 2678.24 | 1983.45 | 2395.27 | 20.76% | -10.57% |

| EBITDA (₹ Cr.) | 419.01 | 279.06 | 319.23 | 14.39% | -23.81% |

| EBITDA Margin (%) | 15.64% | 14.07% | 13.32% | -75 bps | -232 bps |

| PAT (₹ Cr.) | 130.03 | 183.26 | 24.82 | -86.46% | -80.91% |

| PAT Margin (%) | 4.86% | 9.24% | 1.04% | -820 bps | -382 bps |

| Adjusted EPS (₹) | 5.46 | 7.72 | 1.16 | -84.97% | -78.75% |

Ramco Cements financial update (Q4 FY25)

Financial performance

- Revenue declined 10.5% YoY to ₹2,395 crore in Q4 FY25, impacted by a 4% drop in volumes and 7% lower realisations.

- EBITDA fell 24% YoY to ₹320 crore with EBITDA/tonne at ₹607, hurt by elevated operating costs.

- PAT dropped sharply by 81% YoY to ₹25 crore, reflecting weak margins and lower income.

- For FY25, revenue stood at ₹8,495 crore (down 9.1% YoY), and PAT (adjusted) at ₹92 crore (down 76.6% YoY).

- Free cash flow improved to ₹378 crore vs. negative ₹35 crore last year; net debt stood at ₹4,480 crore as of March 2025.

Business highlights

- Sales volume declined ~4% YoY in Q4 to 5.29 MT; full-year volumes up ~1% to 18.5 MT.

- Realisation/tonne fell 7% YoY to ₹4,522.

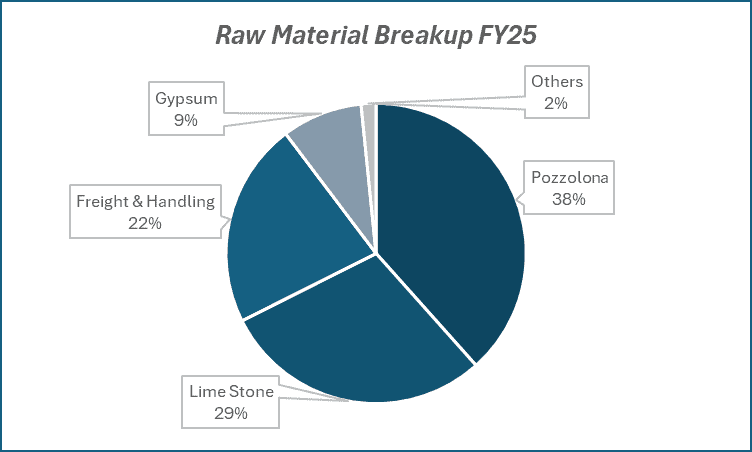

- Operating cost/tonne declined ~5% YoY, aided by lower fuel and freight costs.

- Premium products contributed ~27% of South India sales and ~23% in the East.

- Green energy share in power mix at 31% for FY25.

- Net petcoke usage rose to 63% in FY25 (vs 52% in FY24).

- Commissioned railway siding at Kolimigundla and completed 54% land acquisition for Karnataka greenfield project.

- Monetized ₹460 crore from non-core assets in FY25; remainder to be completed by Q1 FY26.

Outlook

- Capacity to reach 30 MTPA by March 2026 (from 24 MTPA currently), driven by new lines and debottlenecking.

- FY26 capex guidance at ₹1,200 crore.

- Plans to commission additional 25 MW WHRS in FY26.

- Focus remains on improving operating leverage, deleveraging the balance sheet, and expanding market share in South and East India.

Recent Updates on Ramco Cements

- Asset Monetization: Ramco sold non-core assets worth ₹24 crore in July 2025, part of its ₹1,000 crore target; stock hit a fresh high of ₹1,169 recently.

- Institutional Interest: SBI Group acquired a 1.7% stake in Q1 FY26, reflecting growing investor confidence.

- Sector Tailwinds: Cement prices rose 3-4% QoQ in Q1 FY26; however, Ramco may face margin pressure due to new limestone tax in Tamil Nadu.

Company valuation insights – Ramco Cements

Ramco Cements is currently trading at an EV/EBITDA of 21x, slightly above its long-term average, supported by recent outperformance, delivering a 1-year return of 44.9% vs the Nifty 50’s -0.4%. This rally reflects improved investor sentiment driven by visible deleveraging, cost optimization, and ongoing capacity expansion.

While near-term earnings were impacted by weak volumes and lower realizations, the company is poised for a recovery with its focused strategy on increasing capacity to 30 MTPA by FY26 through efficient brownfield expansion and de-bottlenecking. Ramco is also sharpening its product mix by increasing the share of premium products, improving its fuel efficiency (blended coal cost down to $121/t), and scaling up the use of green energy (36% in FY25). These initiatives are expected to enhance cost competitiveness and improve margins structurally.

With strong operating leverage, a stable demand outlook in South and East India, and focused capital allocation, Ramco is well-positioned to deliver sustained profitability and margin expansion. Its ongoing monetization of non-core assets and prudent capex management are additional positives.

We value Ramco at 17x FY27E EV/EBITDA to arrive at a 12-month target price of ₹1,440, implying a 21% upside. A short-term target of ₹1,270 implies a 7% upside, backed by improving pricing trends, operational efficiencies, and potential re-rating.

Major risk factors affecting Ramco Cements

- Input Cost Pressures: High pet coke, coal, and diesel prices could impact margins if not offset by price hikes.

- Regional Overcapacity: Intensifying competition in southern markets could weigh on realizations.

- Capex Execution: Delays or cost overruns in capacity addition may impact volume/margin growth.

- Demand Volatility: Monsoon-led disruptions or election-related delays in public project execution can affect dispatches.

Technical analysis of Ramco Cements share

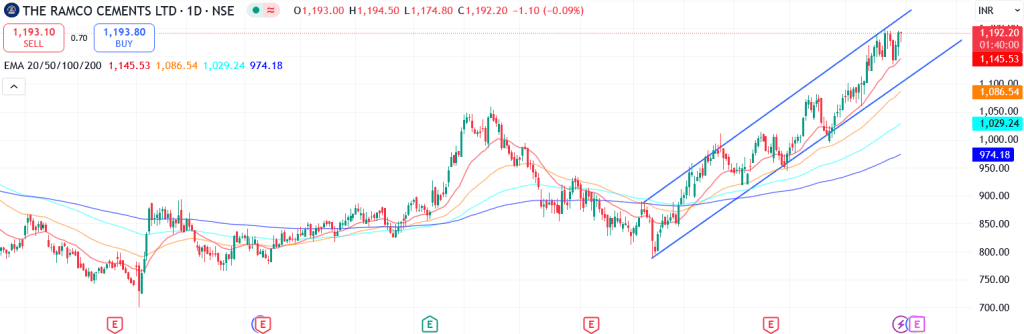

Ramco Cements is currently trading within a well-established uptrend, signaling continued bullish momentum. The stock is comfortably positioned above its 50-day, 100-day, and 200-day EMAs, reinforcing a strong medium-term outlook and investor confidence.

The MACD remains firmly positive at 33.65, with the MACD line placed above the signal line, indicating sustained upward momentum. The RSI at 66.40 reflects strong buying interest, while Relative RSI values of 0.14 (21-day) and 0.21 (55-day) underscore consistent outperformance against the broader market. The ADX, at a robust 42.79, confirms the presence of a powerful and strengthening trend.

A breakout above ₹1,270 could pave the way for a rally toward ₹1,440, in line with the stock’s 12-month fundamental target. On the downside, ₹1,070 serves as a crucial support level; sustaining above it will be key to preserving the bullish structure.

- RSI: 66.40 (Strong Buying Interest)

- ADX: 42.79 (Strong Trend)

- MACD: 33.65 (Positive Momentum)

- Resistance: ₹1,270

- Support: ₹1,070

Ramco Cements stock recommendation

Current Stance: Buy, with a 3-month target of ₹1,270 (~7% upside) and a 12-month target of ₹1,440 (~21% upside).

Why buy now?

Capacity-led growth: Set to expand to 30 MTPA by FY26 via cost-efficient brownfield projects and debottlenecking.

Margin recovery: Fuel cost savings, rising premium product mix, and cost controls support margin expansion to 20%+ by FY27.

Balance sheet strength: Steady deleveraging and lower capex enhance free cash flow visibility and return ratios.

Portfolio fit

Ramco offers a focused play on South and East India’s cement demand with improving profitability and cash flows. Its disciplined capital allocation, rising share of green energy, and margin recovery potential make it suitable for investors seeking mid-cap industrial plays with cyclical upside and structural improvement triggers.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebRamco Cements: Budget 2025-26 opportunities

- Infra & housing boost: Higher allocations to southern infra and rural housing to support demand in core markets.

- Green energy push: WHRS and solar incentives align with Ramco’s 36% green energy mix.

- Logistics & mining: Railway and mining reforms to ease clinker transport and limestone sourcing.

- Make in India: Supports regional capacity expansion in Andhra Pradesh and Karnataka.

Final thoughts

Ramco Cements is no longer just a regional cement brand, it’s evolving into a more geographically balanced, sustainability-conscious growth player. Backed by operational excellence, smart capital allocation, and strong brand recall, it offers a durable play on India’s cement cycle. For investors seeking exposure to India’s building story with a tilt towards quality, Ramco Cements brings a solid mix of legacy strength and future readiness.