From humble beginnings to becoming one of India’s fastest-growing luggage brands, Safari Industries India has transformed itself into a consumer favorite. As travel rebounds strongly post-pandemic and aspirations shift toward branded, durable luggage, Safari is positioning itself as a direct challenger to the market leader, with design innovation, competitive pricing, and aggressive distribution expansion.

But does Safari Industries offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | SAFARI |

| Industry/Sector | FMCG (Household & Personal Products) |

| CMP | 2047.40 |

| Market Cap (₹ Cr.) | 10,022 |

| P/E | 67.46 (Vs Industry P/E of 48.65) |

| 52 W High/Low | 2,744.70 / 1670.15 |

| EPS (TTM) | 30.45 |

| Dividend Yield | 0.15% |

About Safari Industries

Founded in 1974 and headquartered in Mumbai, Safari Industries is engaged in the manufacturing, marketing, and trading of luggage and travel accessories. The company offers a wide range of hard and soft luggage, backpacks, and business bags, catering to both budget-conscious and premium-seeking travelers. Over the last decade, Safari has shifted from being a low-profile player to a brand-savvy, design-led company.

Key business segments

Safari Industries operates primarily in the following key business segments:

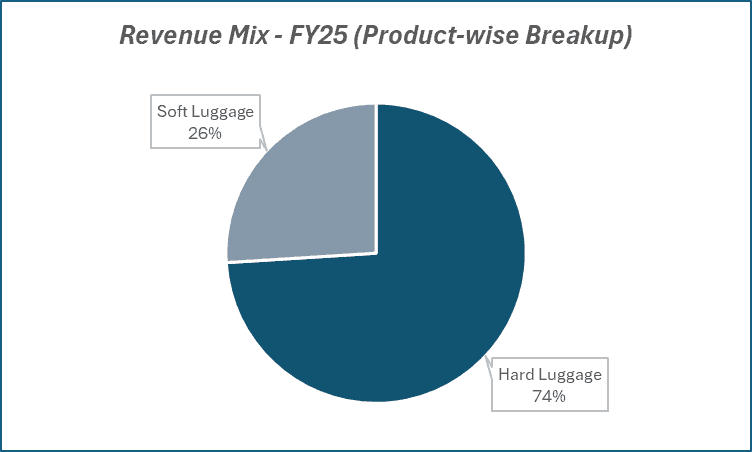

- Hard Luggage – Polycarbonate and polypropylene suitcases, a fast-growing segment driven by durability and premium looks.

- Soft Luggage – Polyester and fabric-based trolleys, duffel bags, and cabin luggage catering to mid and economy segments.

- Backpacks & Accessories – School bags, laptop bags, and travel accessories expanding the brand’s footprint beyond luggage.

- Contract Manufacturing – Producing for its own brand and third-party requirements, leveraging low-cost manufacturing capabilities.

Primary growth factors for Safari Industries

Safari Industries key growth drivers:

- Travel Revival: Surge in domestic and international tourism, corporate travel, and wedding-related travel.

- Brand Premiumisation: Shift from unbranded to branded luggage, with Safari gaining share from both the unorganised sector and premium brands.

- Retail Network Expansion: Increasing exclusive brand outlets, large-format store tie-ups, and online marketplace presence.

- Product Innovation: Focus on lightweight, scratch-resistant hard luggage and trendy backpack designs.

- Operational Integration: In-house manufacturing capabilities to reduce reliance on imports and improve margins.

Detailed competition analysis for Safari Industries

Key financial metrics – TTM;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Safari Industries Ltd. | 1849.39 | 238.41 | 12.89% | 148.88 | 8.05% | 67.46 |

| VIP Industries Ltd. | 2100.97 | 57.58 | 2.74% | -85.93 | -4.09% | -74.40 |

| Bajaj Consumer Care | 964.83 | 127.43 | 13.21% | 124.79 | 12.93% | 25.62 |

| Emami Ltd. | 3807.21 | 1022.82 | 26.87% | 828.22 | 21.75% | 31.06 |

| Gillette India Ltd. | 2941.56 | 809.21 | 27.51% | 563.35 | 19.15% | 61.60 |

Key insights on Safari Industries

- Safari has consistently outpaced industry growth, gaining market share from the unorganised segment.

- A higher share of hard luggage sales is improving gross margins, supported by economies of scale.

- The company is leveraging e-commerce as a key sales driver, making its products accessible across India.

- Working capital is well-managed, with healthy inventory turnover despite rapid expansion.

- The management is targeting deeper penetration in tier-2/3 cities, where brand awareness and aspirational buying are rising sharply.

Recent financial performance of Safari Industries for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 450.02 | 421.06 | 527.83 | 25.36% | 17.29% |

| EBITDA (₹ Cr.) | 65.87 | 60.85 | 79.28 | 30.29% | 20.36% |

| EBITDA Margin (%) | 14.64% | 14.45% | 15.02% | 57 bps | 38 bps |

| PAT (₹ Cr.) | 57.51 | 49.43 | 65.44 | 32.39% | 13.79% |

| PAT Margin (%) | 9.87% | 8.93% | 9.57% | 64 bps | -30 bps |

| Adjusted EPS (₹) | 9.11 | 7.69 | 10.33 | 34.33% | 13.39% |

Safari Industries financial update (Q1 FY26)

Financial performance

- Revenue up 17.3% YoY to ₹5,27.8 crore, driven by 17% volume growth; realizations flat YoY.

- EBITDA up 20.4% YoY to ₹79.3 crore; margin at 15.0% (+38 bps YoY) despite higher A&P spends (7% vs 5.5%).

- PAT up 13.8% YoY to ₹65.4 crore; QoQ growth of 32.4%.

- Gross margin at 45.8% (+128 bps YoY, -344 bps QoQ).

- Strong net cash position; net debt-to-equity at -0.2x.

Business highlights

- Growth led by higher-margin GT & MT channels; e-commerce muted.

- Premium segment (‘Urban Jungle’, ‘Safari Select’) at ~5% of sales; target 6% by FY26.

- Jaipur plant at 50% utilization; ₹25 crore capex for in-house trolleys & wheels (H2 FY26 commissioning).

- Price competition to persist, limiting near-term realization gains.

Outlook

- Margins seen improving by ~200 bps in FY26 via efficiencies & scale.

- Volume growth to be supported by capacity expansion & premiumisation.

- Strong domestic demand to drive long-term growth.

Recent Updates on Safari Industries

- Capacity Expansion: Jaipur facility at ~50% utilisation; ₹25 crore capex planned for in-house trolleys & wheels by H2 FY26.

- Premium Portfolio Growth: ‘Urban Jungle’ & ‘Safari Select’ contribute ~5% of sales; target 6% by FY26.

- Channel Shift: Higher-margin General Trade & Modern Trade driving growth; e-commerce remains muted.

Company valuation insights – Safari Industries

Safari Industries is currently trading at a TTM P/E of 67.5x, at a premium to the industry average of 48.7x, despite delivering a muted 1-year return of -7.8% vs Nifty 50’s 1.0%.

The stock’s long-term appeal lies in its strong brand presence, expanding capacity, and premiumisation strategy. Growth is being supported by healthy volume momentum in higher-margin General Trade and Modern Trade channels, increasing contribution from premium offerings like ‘Urban Jungle’ and ‘Safari Select,’ and operational efficiencies from the Jaipur plant.

The planned ₹25 crore capex for in-house production of trolleys and wheels, coupled with scale benefits, is expected to drive margin expansion over the medium term. With a diversified channel mix, improving product portfolio, and capacity ramp-up, Safari remains well-positioned to capture India’s growing travel and luggage demand.

We value Safari Industries at 40x FY27E EPS of ₹62 to arrive at a 12-month target price of ₹2,480, implying a 21% upside from current levels. A short-term target of ₹2,200 implies an 8% upside over 3 months, supported by continued channel strength, capacity utilisation gains, and premium segment growth.

Major risk factors affecting Safari Industries

- Raw Material Volatility: Polycarbonate and polyester price fluctuations can impact margins.

- Intensifying Competition: Aggressive strategies from market leaders and new entrants may limit pricing power.

- Currency Risks: Import dependence for certain raw materials exposes Safari to forex fluctuations.

- Demand Cyclicality: Travel slowdowns due to economic or geopolitical shocks could impact sales growth.

Technical analysis of Safari Industries share

Safari Industries, after posting its Q1 FY26 results, has seen a slight dip amid market-wide selling, though its fundamentals remain robust. The stock is currently trading just below its 50-day, 100-day, and 200-day EMAs, and a sustained breakout above these levels could set the stage for a strong medium- to long-term uptrend.

Momentum indicators reflect short-term weakness but also hint at a potential turnaround. The MACD remains negative at -31.89, with the MACD line slightly below the signal line; a bullish crossover could mark the start of upward momentum. The RSI at 36.09 signals weak buying interest and is near oversold territory, which could present an attractive entry point. Relative RSI scores of -0.04 (21-day) and -0.08 (55-day) indicate slight underperformance versus the broader market.

The ADX at 17.87 suggests a moderate trend, with room for strengthening if the price breaks out above its immediate resistance.

A breakout above ₹2,200 could open the door for a rally toward ₹2,480, aligning with the 12-month fundamental target. On the downside, ₹1,980 serves as a key support level; holding above it will be crucial for a reversal in weakness.

- RSI: 36.09 (Weak Buying Interest)

- ADX: 17.87 (Moderate Trend)

- MACD: -31.89 (Negative)

- Resistance: ₹2,200

- Support: ₹1,980

Safari Industries stock recommendation

Current Stance: Buy, with a 3-month target of ₹2,200 (~8% upside) and a 12-month target of ₹2,480 (~21% upside).

Why buy now?

Channel-led growth: Strong volume momentum from higher-margin General Trade & Modern Trade channels, with premium portfolio (‘Urban Jungle’, ‘Safari Select’) gaining share.

Capacity expansion: Jaipur facility at ~50% utilisation; ₹25 crore capex for in-house trolley & wheel production to support margins and scalability.

Premiumisation strategy: Premium segment currently ~5% of sales, targeted to reach 6% by FY26, aiding margin improvement.

Portfolio fit

Safari Industries is a leading branded luggage player, positioned to benefit from India’s growing travel demand, premiumisation trends, and organised sector consolidation. With a scalable manufacturing base, a well-diversified channel mix, and a clear focus on operational efficiency, it offers investors a consumer discretionary play on long-term urban consumption growth with improving profitability and market share gains.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebSafari Industries: Budget 2025-26 opportunities

- Travel & Tourism Boost: Higher budget allocation for tourism infrastructure and UDAN scheme expansion to 120+ destinations to spur luggage demand.

- Export Incentives: Revamped duty remission schemes and ₹20,000 crore Export Promotion Mission to support global market expansion.

- MSME Support: Policy push for MSME manufacturing units aids cost competitiveness and supply chain efficiency.

- Urban Consumption Push: Increased infrastructure and connectivity spend to boost discretionary spends, including premium luggage.

- Trade Facilitation: Simplified customs processes and faster clearances to ease exports of luggage and accessories.

Final thoughts

Safari’s journey is a story of brand reinvention, operational discipline, and market share grab. With the Indian luggage market poised to grow on the back of rising disposable incomes, evolving lifestyles, and travel aspirations, Safari is well-placed to ride this wave. For investors seeking a play on India’s consumer premiumisation trend with a strong travel consumption angle, Safari Industries offers a compelling growth story, one where the baggage you carry could carry your portfolio higher.