As India moves steadily toward becoming a consumption-driven economy, the penetration of credit – especially unsecured credit – is rising rapidly. Within this evolving landscape, SBI Cards stands out as one of the strongest plays on India’s transition from cash to cards. With the backing of the State Bank of India (SBI), a growing base of digitally-savvy consumers, and increasing credit appetite among India’s middle class, SBI Cards is well-positioned to capitalize on the structural shift toward digital and credit-based spending.

But does SBI Cards offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | SBICARD |

| Industry/Sector | Financial Services (NBFC) |

| CMP | 939.00 |

| Market Cap (₹ Cr.) | 89,344 |

| P/E | 48.28 (Vs Industry P/E of 27.01) |

| 52 W High/Low | 1,027.25 / 659.80 |

| EPS (TTM) | 20.14 |

| Dividend Yield | 0.27% |

About SBI Cards

SBI Cards and Payment Services Ltd. is a pure-play credit card issuer and the second-largest credit card company in India after HDFC Bank. Originally launched as a joint venture between SBI and GE Capital, SBI now holds a majority stake in the company. With over 1.8 crore cards in force and a strong pan-India distribution network, SBI Cards is the only listed credit card pure-play in the country, giving investors direct exposure to India’s evolving consumer credit story.

Key business segments

SBI Cards operates primarily in the following key business segments:

- Revolver & EMI-Based Lending – Interest income from cardholders who revolve credit balances or convert purchases to EMIs.

- Fee-Based Income – Interchange income, annual fees, processing charges, and late fees.

- Co-Branded & Corporate Cards – Partnerships with brands and corporates to offer tailored credit solutions.

Primary growth factors for SBI Cards

SBI Cards key growth drivers:

- Low Credit Card Penetration: With under 5% penetration, India offers massive headroom for new customer acquisition.

- Rising Digital Payments: Increasing card acceptance across merchants and e-commerce boosts transaction volumes.

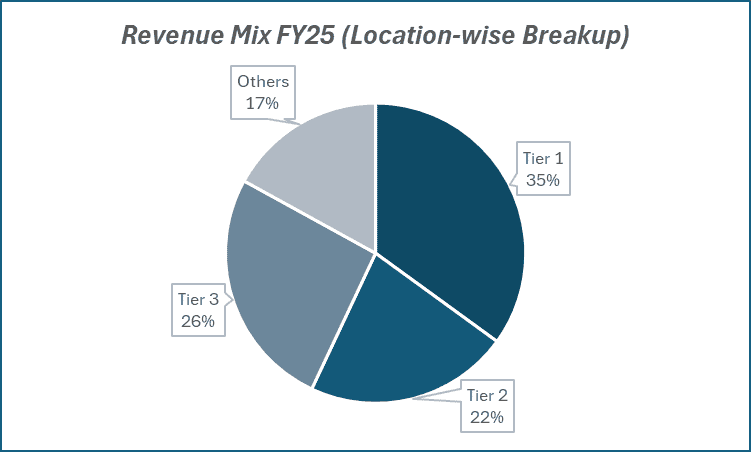

- SBI Parentage: Leverages SBI’s 45,000+ branches and brand trust for customer acquisition in Tier 2/3 cities.

- EMI & Pay-Later Culture: Growing acceptance of small-ticket EMIs and credit-led purchases supports fee and interest income.

- Youth Demographic & Aspiration Spend: Young consumers adopting credit for travel, electronics, and lifestyle purchases.

Detailed competition analysis for SBI Cards

Key financial metrics – Q4 FY25;

| Company | Revenue(₹ Cr.) | Net Interest Margin (%) | Cost of Borrowing (%) | CRAR Ratio(%) | PAT Margin (%) | P/E (TTM) |

| SBI Cards | 4673.95 | 11.20% | 7.20% | 22.90% | 11.43% | 48.28 |

| Aditya Birla Capital | 12214.04 | 6.07% | 7.70% | 18.22% | 5.66% | 20.01 |

| Shriram Finance | 11454.23 | 8.25% | 8.80% | 20.66% | 18.68% | 12.81 |

| Muthoot Finance | 5621.75 | 11.27% | 8.70% | 23.71% | 25.68% | 19.84 |

| L&T Finance | 4022.92 | 8.15% | 7.84% | 22.27% | 15.81% | 17.71 |

Key insights on SBI Cards

- Strong Growth: Median sales growth of 28% and profit CAGR of 22% over the last 10 years.

- High Margins: Fee income forms ~50% of revenue, ensuring profitability.

- Efficient Returns: RoA consistently above 4%, highlighting strong capital efficiency.

- Tier 2/3 Expansion: Leveraging SBI’s network for low-cost growth in underpenetrated markets.

- Digital Focus: Digital onboarding, risk analytics, and co-branded cards driving scale and quality.

- Stable Asset Quality: GNPA maintained around 2–3% despite unsecured lending exposure.

Recent financial performance of SBI Cards for Q4 FY25

| Metric | Q4 FY24 | Q3 FY25 | Q4 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 4347.72 | 4618.69 | 4673.95 | 1.20% | 7.50% |

| EBITDA (₹ Cr.) | 1536.76 | 1247.16 | 1354.31 | 8.59% | -11.87% |

| EBITDA Margin (%) | 35.35% | 27.00% | 28.98% | 198 bps | -637 bps |

| PAT (₹ Cr.) | 662.37 | 383.23 | 534.18 | 39.39% | -19.35% |

| PAT Margin (%) | 15.23% | 8.30% | 11.43% | 313 bps | -380 bps |

| Adjusted EPS (₹) | 6.97 | 4.03 | 5.61 | 39.21% | -19.51% |

SBI Cards financial update (Q4 FY25)

Financial performance

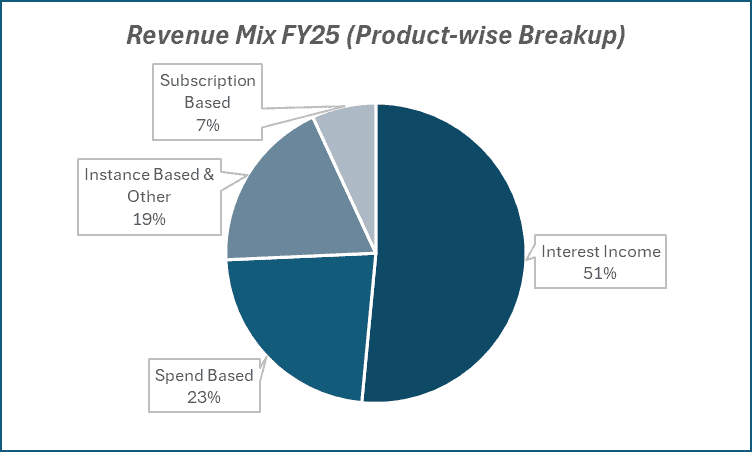

- Revenue from operations: ₹ 4,674 cr, up 7.5% YoY, driven by a 13% YoY rise in interest income and 2% YoY growth in fee & other income.

- Net profit: ₹ 534 cr, down 19.4% YoY, primarily due to higher credit costs despite improved operating metrics.

- Net interest margin (NIM): 11.2% (+29 bps YoY; +54 bps QoQ) on better yields and lower funding costs.

- Cost-to‑income ratio: 51.4% (+21 bps YoY) reflecting ongoing investments in digital and risk infrastructure.

- Return on Assets (annualized): 3.4%; CRAR: 22.9%; GNPA / NNPA: 3.08% / 1.46%.

Business highlights

- Cards in force: 2.08 cr (+10% YoY; +3% QoQ); new accounts: 11.09 lakh (+8% YoY; +6% QoQ)

- Spends: ₹ 88,365 cr (+11% YoY); receivables: ₹ 55,840 cr (+10% YoY; +2% QoQ).

- Market share: 15.6% of total card spends; online spends: 58.9% of mix.

- Segment trends: Retail spends +15% YoY; corporate spends –17% YoY but +63% QoQ.

- Asset mix: Transactors at 41% (+100 bps QoQ); revolvers stable at 24%; EMIs 35% of receivables.

- Recoveries: ₹ 154 cr (+22% YoY; +6% QoQ).

- Co‑branding: 40 lakh SBI‑BPCL fuel cards live; interim dividend ₹2.5/share declared.

Outlook

- Cost of funds expected to decline gradually in FY26.

- NIMs to remain steady; credit cost to moderate.

- Card additions: Target ~11 lakh new cards per quarter.

- Cost‑income ratio: Guided at 55–56%.

- Receivables growth: Projected at 12–14% in FY26.

Recent Updates on SBI Cards

- Interim Dividend: SBI Cards declared an interim dividend of ₹2.5 per share for FY25, reflecting strong capital generation and shareholder returns.

- BPCL Co‑Brand Milestone: The company has crossed 40 lakh SBI‑BPCL fuel cards in force, making it one of India’s largest and fastest‑growing fuel co‑branded partnerships.

- Digital & UPI Traction: Integration of SBI Card SPRINT has significantly enhanced digital onboarding, while UPI spends on RuPay cards grew 4× YoY in Q4 FY 25 – 75% of active UPI users and spends now come from tier‑2+ cities.

Company valuation insights – SBI Cards

SBI Cards is currently trading at a TTM P/E of 48.3x, well above the industry average of 27.0x, supported by a strong 1‑year return of 28.1% (vs. Sensex’s 5.95%). While valuations appear rich, they are underpinned by steadily improving fundamentals.

SBI Cards’ net interest margin expanded to 11.2% in Q4 FY 25 (+29 bps YoY, +54 bps QoQ) on the back of improved yields and lower funding costs; gross credit cost eased to 9.0% (–40 bps QoQ) with further declines guided; return on equity is set to rise from 14.8% in FY25 to 17.3% by FY27E through operating leverage and disciplined cost management; and growth is underpinned by digital onboarding, AI‑driven risk analytics, deepening co‑brand partnerships (4 mn+ BPCL cards live) and focused expansion in Tier 2/3 markets.

At 28× FY27E EPS of ₹ 40, we arrive at a 12‑month target price of ₹ 1,120, implying ~20% upside. A 3‑month target of ₹ 1,030 offers ~9% near‑term upside.

Major risk factors affecting SBI Cards

- Regulatory Risks: RBI’s evolving stance on unsecured credit, interchange fees, and consumer data usage may impact earnings.

- Rising Competition: Fintechs and digital-first lenders are entering the pay-later/credit space aggressively.

- Asset Quality: Being unsecured, the business is highly sensitive to macro slowdowns and rising delinquencies.

- Dependence on Revolver Income: A decline in revolver behavior (e.g., prompt repayments) can pressure interest income.

Technical analysis of SBI Cards share

SBI Cards is trading in a well‑defined ascending channel, reflecting its ongoing uptrend. The stock rallied sharply post Q4 results and sits comfortably above its 50‑day and 100‑day EMAs, though it remains just below the 200‑day EMA – suggesting a minor short‑term weakness but a crossover above the 200‑day line could decisively resolve in favor of fresh gains.

The MACD is positive at 21.50, confirming sustained bullish momentum; the RSI at 47.32 signals decent buying interest, while Relative RSI readings of 0.04 (21‑day) and 0.03 (55‑day) underline recent outperformance versus the market. The ADX at 23.44 indicates a developing trend, strengthening the case for further upside.

A sustained move above ₹1,030 could open the path to ₹1,120, while ₹890 remains a crucial support level to watch.

- RSI: 47.32 (Decent Buying Interest)

- ADX: 23.44 (Developing Trend)

- MACD: 21.50 (Positive)

- Resistance: ₹1,030

- Support: ₹ 890

SBI Cards stock recommendation

Current Stance: Buy with a 3‑month target of ₹1,030 and a 12‑month target of ₹1,120, implying ~9% and ~20% upside, respectively.

Why buy now?

Strong Margins: NIM at 11.2% in Q4 FY25 demonstrates pricing power and falling funding costs.

Credit‑Cost Tailwinds: Gross credit cost down to 9.0% with further moderation expected.

High‑Visibility Growth: Digital onboarding, Tier 2/3 expansion, and 40 lakh in SBI‑BPCL cards driving sustainable spend growth.

Portfolio fit

SBI Cards adds a defensive growth angle to financial-services allocations, combining high‑margin fee income with secular card‑spend growth and digital adoption. Its strong capital efficiency, resilient asset quality, and diversified revenue streams align well with portfolios seeking steady earnings compounding, yield, and exposure to India’s consumer-finance premium cycle.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebSBI Cards: Budget 2025-26 opportunities

- DPI & UPI Boost: Enhancements in Digital Public Infrastructure and UPI drive tokenization and card‑on‑file adoption.

- Rural Credit Access: Jan Dhan and rural credit schemes unlock Tier 2/3 and semi‑urban lending growth.

- Fintech Incentives: Tax breaks and the Fintech Innovation Fund spur analytics partnerships and customer acquisition.

- Rural Capex: Increased hinterland infrastructure spend lifts discretionary card usage.

- Digital Finance PPPs: Bharat BillPay and Bharat QR collaborations expand acceptance and co‑brand opportunities.

Final thoughts

SBI Cards isn’t just a credit card issuer – it’s a mirror to India’s rising middle class, aspirational spending, and the rapid digitization of commerce. Whether it’s a smartphone purchase in Patna or an online ticket in Bengaluru, SBI Cards are often the bridge between desire and transaction.

For investors, this company offers pure-play exposure to India’s growing consumer credit cycle, backed by one of the most trusted banking brands in the country. It’s not just about numbers – it’s about betting on the shift from savings to spending, and from debit to credit.