The Indian real estate sector has been witnessing a strong upcycle, driven by rising urbanization, premium housing demand, and a wave of consolidation favoring organized developers. In this landscape, Sobha Ltd has carved a distinct niche for itself as a trusted luxury real estate brand, known for quality, execution, and customer-centricity. With a growing footprint across key cities, strong brand equity, and improving financial metrics, Sobha is positioning itself for the next leg of growth in India’s premium housing and commercial real estate market.

But does Sobha offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | SOBHA |

| Industry/Sector | Realty (Construction – Real Estate) |

| CMP | 1430.00 |

| Market Cap (₹ Cr.) | 15,279 |

| P/E | 149.53 (Vs Industry P/E of 40.47) |

| 52 W High/Low | 2,070.00 / 1,075.30 |

| EPS (TTM) | 9.56 |

About Sobha Ltd

Founded in 1995 and headquartered in Bengaluru, Sobha Ltd is one of India’s leading real estate developers, with a reputation for luxury residential and commercial projects. The company has executed several landmark developments and has expanded into contractual projects and international markets. With integrated in-house capabilities spanning architecture, engineering, and design, Sobha stands out for its execution discipline and premium product offerings.

Key business segments

Sobha Ltd. operates primarily in the following key business segments:

- Residential Real Estate – Core business segment, with a focus on mid-income to luxury housing across metros and tier-1 cities.

- Contractual & Commercial Projects – Execution of corporate offices, IT parks, and interiors for marquee clients.

- International Operations – Presence in the Middle East, contributing through high-end contracting and project management.

- Manufacturing Verticals – Backward integration with divisions in concrete products, interiors, and glazing, aiding efficiency and margins.

Primary growth factors for Sobha

Sobha key growth drivers:

- Luxury & Premium Housing Demand: Rising disposable incomes, aspirational buying, and consolidation in favor of branded developers.

- Urbanization & Infrastructure Push: Government support for housing, metros, and smart cities expands Sobha’s opportunity set.

- Brand Equity: Premium positioning and strong delivery track record create pricing power in competitive markets.

- Backward Integration: In-house capabilities in interiors, furniture, and engineering ensure cost control and quality consistency.

- Contracting Opportunities: Expansion into IT/Commercial projects offers diversification beyond residential housing.

Detailed competition analysis for Sobha

Key financial metrics – TTM;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Sobha Ltd. | 4250.23 | 262.23 | 6.17% | 102.25 | 2.41% | 149.53 |

| DLF Ltd | 9348.01 | 2244.18 | 24.01% | 2737.35 | 29.28% | 40.79 |

| Lodha Developers | 14424.70 | 4215.60 | 29.22% | 2967.00 | 20.57% | 40.19 |

| Prestige Estates | 7794.60 | 2656.30 | 34.08% | 668.10 | 8.57% | 127.44 |

| Oberoi Realty | 4868.66 | 2808.33 | 57.68% | 2050.11 | 42.11% | 28.38 |

Key insights on Sobha

- Sobha has maintained strong pre-sales growth, supported by premium launches in Bengaluru, NCR, and Kerala.

- Pricing discipline and efficient execution help the company generate robust operating cash flows, supporting deleveraging.

- Backward integration continues to provide a cost advantage versus peers, sustaining higher margins in an inflationary environment.

- A healthy project pipeline and land bank provide multi-year visibility on launches and sales.

Recent financial performance of Sobha for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 640.39 | 1240.62 | 851.93 | -31.33% | 33.03% |

| EBITDA (₹ Cr.) | 55.91 | 94.06 | 23.82 | -74.68% | -57.40% |

| EBITDA Margin (%) | 8.73% | 7.58% | 2.80% | -478 bps | -593 bps |

| PAT (₹ Cr.) | 6.06 | 40.86 | 13.62 | -66.67% | 124.75% |

| PAT Margin (%) | 0.95% | 3.29% | 1.60% | -169 bps | 65 bps |

| Adjusted EPS (₹) | 0.64 | 3.82 | 1.27 | -66.75% | 98.44% |

Sobha financial update (Q1 FY26)

Financial performance

- Revenue from operations stood at ₹852 crore (up 33% YoY), supported by strong real estate sales and steady contributions from contracts and manufacturing.

- PAT surged to ₹14 crore (up 124.8% YoY), though margins remain modest.

- EBITDA came in at ₹24 crore, translating to a 2.8% margin, while PAT margin stood at 1.6%.

- Collections rose 15% YoY to ₹1,778 crore, with real estate collections hitting a record ₹1,599 crore.

- Net operational cash flow was ₹395 crore; post-financing and capex, net cash flow stood at ₹56.8 crore.

- Gross debt declined to ₹1,019 crore, with a healthy cash balance of ₹1,706 crore; average interest cost eased to 8.86%.

Business highlights

- Achieved a milestone with record real estate pre sales of ₹2,079 crore in Q1 FY26, led by the blockbuster launch of Sobha Aurum in Greater Noida (~₹833 crore sales value, ~80% sold by quarter-end).

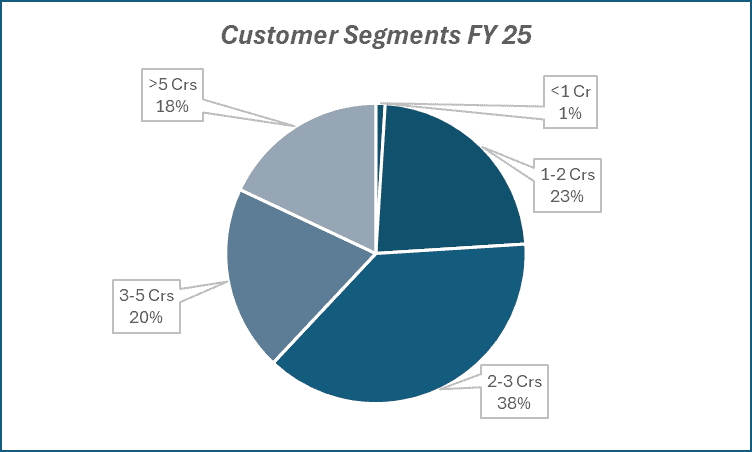

- Total sales stood at 1.44 million sq. ft. with an average realization of ₹14,395 per sq. ft.

- Delivered 1.07 million sq. ft. (594 homes) during the quarter; on track to complete 4–4.5 million sq. ft. over FY26.

- Inventory stood at 11.55 million sq. ft. with potential sales value of ₹17,000 crore.

- Delays in obtaining occupancy certificates (OCs) for five Bengaluru projects deferred over ₹650 crore in revenue and ~₹150 crore in PBT recognition, impacting margins in the quarter.

- Balanced revenue to be recognized from sold units stood at a strong ₹17,245 crore.

Outlook

- Management expects margin improvement in subsequent quarters as Bengaluru projects with OCs come into recognition.

- Clear visibility of ₹24,752 crore in cash inflows from ongoing and completed projects over 4–5 years, with an estimated project surplus of ₹11,091 crore.

- Additional ₹7,000 crore surplus expected over 5–6 years from planned launches of 18.38 million sq. ft.

- Guided for ~30% increase in pre-sales over FY25, targeting ₹10,000 crore sales in coming years.

- Robust pipeline of 17.67 million sq. ft. residential and 0.7 million sq. ft. commercial projects across 9 cities; another 23.53 million sq. ft. in planning.

- Upcoming launches across Bengaluru, Gurugram, Greater Noida, Pune, Chennai, and Kerala (Trivandrum, Calicut) to drive growth momentum in FY26.

Recent Updates on Sobha

- Expansion of luxury housing launches in Bengaluru and Pune to capture premium demand.

- Ongoing investments in land acquisition for future pipeline growth in Mumbai and NCR.

- Strengthened brand visibility through high-profile project launches under the Sobha City and Sobha Dream Series.

- Increasing focus on customer experience through digital booking platforms and CRM enhancements.

Company valuation insights – Sobha

Sobha is currently trading at a TTM P/E of 149.5, significantly above the industry average of 40.5, with a 1-year return of -17.8% versus Nifty 50’s -3.4%.

The company remains a key beneficiary of rising housing demand in premium and mid-income segments, supported by strong brand recall, a healthy launch pipeline across major metros, and robust sales traction. With visibility of over ₹24,000 crore in future cash inflows from ongoing projects, a strong pipeline of 17.7 million sq. ft. residential and 0.7 million sq. ft. commercial projects, and improving collections, Sobha is well-positioned to deliver sustained growth. Delayed revenue recognition due to occupancy certificates is temporary, and margins are expected to improve meaningfully as these projects come into the books. The company’s disciplined capital allocation, reducing debt, and healthy cash balance further strengthen the investment case.

We value Sobha at 35x FY27E EPS of ₹50 to arrive at a 12-month target price of ₹1,750, implying a 22% upside from current levels. A short-term target of ₹1,550 suggests an 8% upside over 3 months, supported by strong pre-sales momentum, timely project launches, and improving cash flows.

Major risk factors affecting Sobha

- Demand Slowdown: Sensitivity to interest rate cycles and consumer sentiment in housing.

- Execution Risks: Delays in approvals or project delivery can impact cash flows.

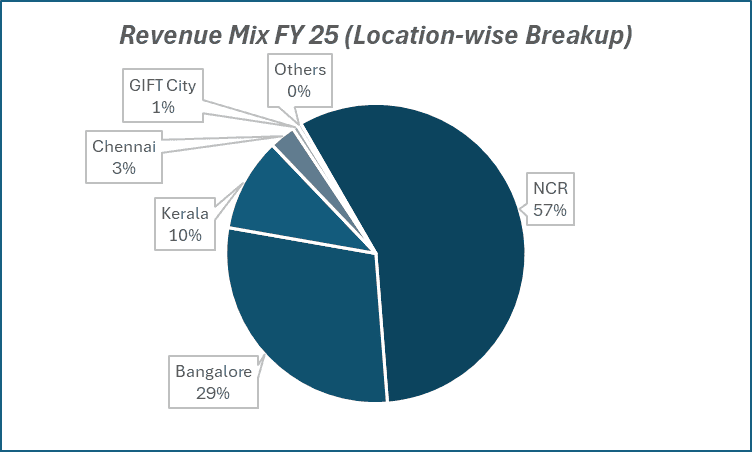

- Geographical Concentration: High dependence on Bengaluru market, though diversification efforts are ongoing.

- Regulatory Risks: Changes in RERA, taxation, or housing policy could affect margins.

- Input Costs: Rising construction material costs may pressure profitability.

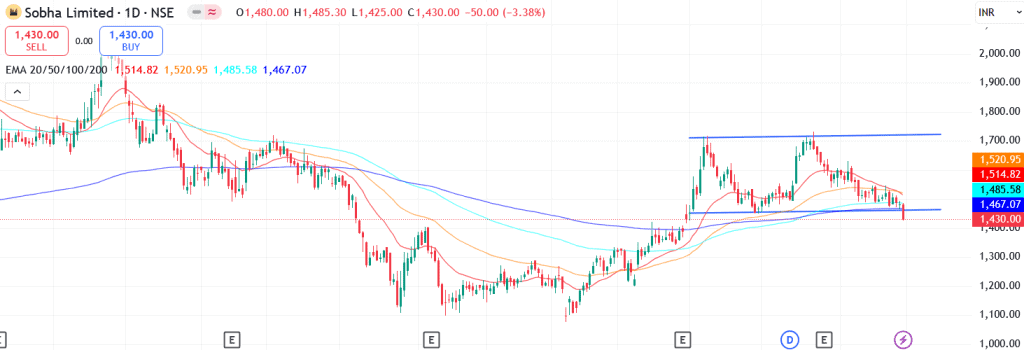

Technical analysis of Sobha share

Sobha was in a strong uptrend post Q3 and Q4 FY25 but has since entered a consolidation phase. The stock is currently trading near the lower end of its sideways channel, making this an important support zone and a potential entry opportunity if it rebounds.

The stock trades below its 50-day, 100-day, and 200-day EMAs, underscoring weak short-term momentum. However, it is hovering near the 20-day EMA, which could provide immediate support. A sustained rebound from this level may trigger a recovery.

Momentum indicators also reflect short-term weakness. The MACD is negative at -26.65, with the MACD line below the signal line, though a bullish crossover here could mark a shift in momentum. The RSI at 33.34 is close to oversold territory, suggesting selling pressure may be nearing exhaustion. Relative RSI scores of -0.07 (21-day) and -0.09 (55-day) indicate underperformance versus the broader market.

The ADX at 16.82 indicates a weak downward trend, which could fade if the stock consolidates at current levels and attempts a reversal.

A breakout above ₹1,550 could set the stage for a rally toward ₹1,750, in line with the 12-month fundamental target. On the downside, ₹1,330 remains a key support; holding above it will be vital to preventing further weakness.

- RSI: 33.34 (Near Oversold Range)

- ADX: 16.82 (Weak Downward Trend)

- MACD: -26.65 (Negative)

- Resistance: ₹1,550

- Support: ₹1,330

Sobha stock recommendation

Current Stance: Buy, with a 3-month target of ₹1,550 (~8% upside) and a 12-month target of ₹1,750 (~22% upside).

Why buy now?

Record pre-sales in Q1 FY26, led by Sobha Aurum.

Strong pipeline of 7-8 mn sq. ft. launches across key metros.

Robust cash flows with ₹17,245 crore revenue visibility.

Net cash position with lower interest costs.

Margin expansion expected as Bengaluru projects with OCs get recognized.

Portfolio fit

Sobha is a leading premium developer with strong brand equity, diversified presence, and a robust launch pipeline. Healthy cash flows, margin visibility, and structural housing demand make it a compelling play on India’s real estate growth cycle.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebSobha: Budget 2025-26 opportunities

- Housing Demand Push: Higher allocation toward affordable and mid-income housing, along with tax incentives for homebuyers, to boost residential sales.

- Urban Infrastructure Development: Increased spending on metro, smart cities, and urban renewal programs to drive demand for housing in key metros.

- Real Estate Financing Support: Measures to ease credit availability for developers and lower borrowing costs could strengthen Sobha’s balance sheet.

- MSME & Job Creation Boost: Employment-linked policies and MSME growth to support housing affordability and demand in Tier-1 and Tier-2 cities.

- Sustainability & Green Housing: Incentives for green buildings, energy-efficient housing, and sustainable construction practices to enhance Sobha’s positioning.

Final thoughts

Sobha Ltd represents a premium real estate play riding on structural housing demand, aspirational lifestyle shifts, and brand-led consolidation. For investors, it offers a combination of luxury positioning, backward integration-led margin strength, and long-term visibility through a robust project pipeline. While near-term demand may ebb and flow with macro cycles, Sobha’s strong execution, brand value, and strategic expansion make it a compelling pick in India’s real estate growth story.