In a world increasingly focused on energy efficiency, sustainability, and specialized materials, SRF Ltd. stands out as a diversified industrial leader with strong global linkages. From a refrigerant-focused chemical maker to a multi-business conglomerate, SRF has evolved into a value-driven enterprise spanning chemicals, packaging, textiles, and technical fabrics.

With solid execution, prudent capital allocation, and entry into high-value global chemical segments, SRF is transitioning into a global specialty chemical and materials player, blending cyclical resilience with long-term growth visibility.

But does SRF offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | SRF |

| Industry/Sector | Chemicals |

| CMP | 3,216.40 |

| Market Cap (₹ Cr.) | 95,342 |

| P/E | 75.07 (Vs Industry P/E of 47.59) |

| 52 W High/Low | 3,325.00 / 2,126.85 |

| EPS (TTM) | 42.20 |

| Dividend Yield | 0.22% |

About SRF

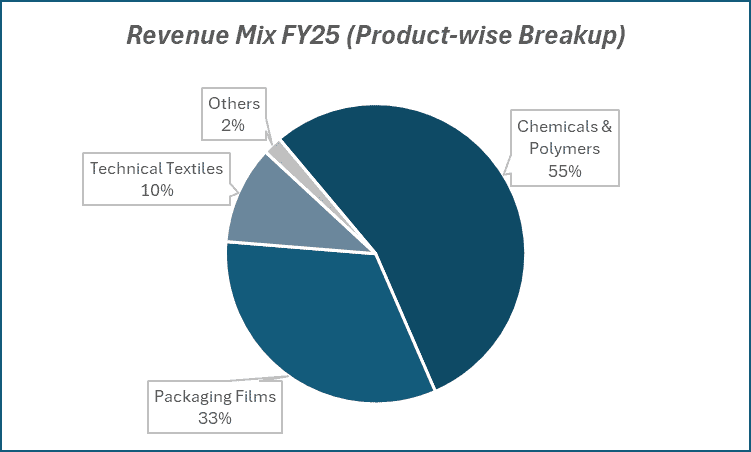

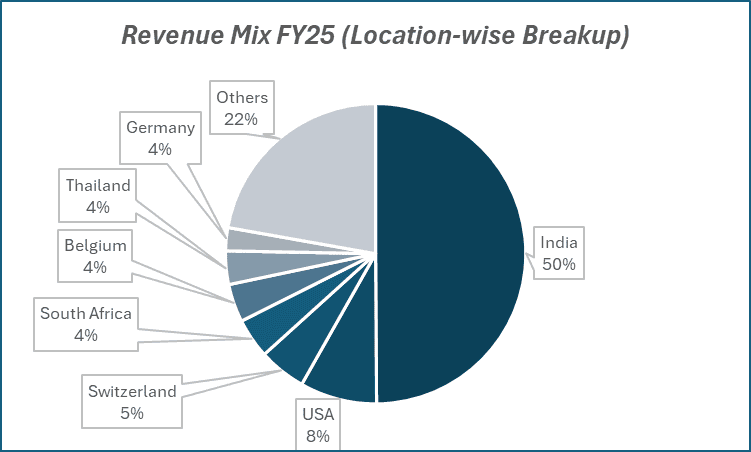

Founded in 1970, SRF Ltd. is a multi-business conglomerate operating in the chemicals, packaging films, technical textiles, and coated & laminated fabrics space. The company has a pan-India manufacturing presence and exports to over 90 countries, with an increasing contribution from high-margin, knowledge-intensive verticals.

SRF is now focused on capitalizing on fluorochemicals, specialty chemicals, and refrigerants, while also retaining its stronghold in packaging films and textiles.

Key business segments

SRF operates primarily in the following key business segments:

- Specialty Chemicals – High-value intermediates and fluorine-based molecules for agrochem, pharma, and industrial use.

- Refrigerants & Fluorochemicals – Domestic and global leader in ozone-friendly refrigerant gases.

- Packaging Films (BOPET/BOPP) – Films used in flexible packaging for FMCG, food, and pharma.

- Technical Textiles – Nylon and polyester-based cords and industrial fabrics for tires, conveyor belts, and protective gear.

Primary growth factors for SRF

SRF key growth drivers:

- Global Shift to Green Chemistry: Increased demand for fluorine-based molecules in pharma and agrochemicals.

- China+1 Tailwind: Rising outsourcing opportunities from global majors seeking reliable partners outside China.

- Domestic Capex & Infrastructure: Growing demand for technical textiles and coated fabrics in auto and construction sectors.

- Food & Pharma Packaging Boom: Steady growth in flexible packaging demand across emerging markets.

- Capacity Expansion: Large ongoing capex (~₹3,000+ crore) toward specialty and fluorochemicals to support multi-year growth.

Detailed competition analysis for SRF

Key financial metrics – FY25;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| SRF Ltd. | 14693.07 | 2718.44 | 18.50% | 1250.78 | 8.51% | 75.07 |

| Solar Industries Ltd. | 7540.26 | 1960.36 | 26.00% | 1282.38 | 17.01% | 113.80 |

| Gujarat Fluorochem | 4737.00 | 1099.00 | 23.20% | 546.00 | 11.53% | 68.67 |

| Deepak Nitrite Ltd. | 8281.93 | 1091.76 | 13.18% | 697.37 | 8.42% | 38.43 |

| Navin Fluorine | 2349.38 | 533.72 | 22.72% | 288.60 | 12.28% | 85.60 |

Key insights on SRF

- Specialty chemicals and refrigerants now contribute a major share of profits, enabling a shift from commoditized to value-added portfolio.

- High export revenue (~40–45%), particularly from developed markets, reflects global acceptance and pricing power.

- Margins in packaging films have moderated due to overcapacity, but the chemical segment continues to deliver strong RoCE and EBITDA growth.

- SRF maintains a strong balance sheet with healthy cash flows, allowing it to reinvest in innovation and scale.

- Backward integration, in-house R&D, and strong client relationships drive entry barriers in its key segments.

Recent financial performance of SRF for Q4 FY25

| Metric | Q4 FY24 | Q3 FY25 | Q4 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 3569.74 | 3491.31 | 4313.34 | 23.55% | 20.83% |

| EBITDA (₹ Cr.) | 695.82 | 619.57 | 957.41 | 54.53% | 37.59% |

| EBITDA Margin (%) | 19.49% | 17.75% | 22.20% | 445 bps | 271 bps |

| PAT (₹ Cr.) | 422.21 | 271.08 | 526.06 | 94.06% | 24.60% |

| PAT Margin (%) | 11.83% | 7.76% | 12.20% | 444 bps | 37 bps |

| Adjusted EPS (₹) | 14.24 | 9.15 | 17.75 | 93.99% | 24.65% |

SRF financial update (Q4 FY25)

Financial performance

- Revenue stood at ₹4,313 crore, up 20.8% YoY, driven by strong performance across the chemicals and packaging segments.

- FY25 revenue rose 11.2% YoY to ₹14,358 crore, supported by higher exports, improved product mix, and volume growth.

- PAT increased 24.6% YoY to ₹526 crore in Q4; FY25 PAT declined 6.4% YoY to ₹1,251 crore due to margin pressure in H1.

- EBIT grew 6% YoY to ₹2,336 crore in FY25, despite volatile input costs and a weaker first half.

- Capex for FY25 stood at ₹1,230 crore, with investments mainly in debottlenecking and capacity expansion projects.

Business highlights

- The chemicals segment delivered strong growth, with Q4 revenue up 30% YoY and EBIT up 50% YoY, driven by specialty chemicals and robust domestic refrigerant demand.

- Packaging films & foil business saw Q4 EBIT surge 216% YoY, supported by better margins in BOPET/BOPP films and improved overseas performance.

- Technical textiles faced margin pressure due to low-cost imports, though overall FY25 revenue rose 6.9% YoY with capacity expansion completed.

Outlook

- Management guides for ~20% growth in the chemical segment, aiming for ₹11,000–₹12,000 crore revenue by FY28.

- EBIT margins in chemicals are expected to sustain at 25–26%, driven by better product mix and scale benefits.

- FY26 capex is planned at ₹2,200–₹2,300 crore (65–70% in chemicals; 30–35% in packaging and textiles).

- HFC capacity utilization is expected to rise to 85–90% in FY26.

- Growth drivers include scaling of fluoropolymers, expansion of refrigerant capacity, and recovery in global agrochemical demand.

Recent Updates on SRF

- Acquired CPP film unit from Kanpur Plastipack for ₹49.25 crore enhancing SRF’s packaging portfolio by adding high-barrier films, enabling a full-spectrum offering (BOPP, BOPET, CPP) and improving competitive positioning.

- Chairman & MD reappointed till March 2030 which Ensures leadership continuity and strategic consistency during an aggressive growth phase, especially in chemicals and packaging.

Company valuation insights – SRF

SRF Ltd is currently trading at a TTM P/E of 75.1x, significantly above the industry average of 47.6x, reflecting investor optimism on its specialty chemicals-led growth trajectory and high capital efficiency. The stock has delivered a strong 1-year return of 34.3%, outperforming the Nifty 50’s modest 2.5% gain, driven by recovery in chemical exports, margin improvement in packaging films, and continued leadership in fluorochemicals.

The company’s growth engine is expected to be fueled by strong momentum in specialty and fluorochemicals, supported by robust capex, R&D-led innovation, and the ramp-up of new products and capacities. SRF’s strategic focus on expanding its value-added product portfolio and leveraging export opportunities underlines its long-term compounding potential, despite near-term cost headwinds in technical textiles.

Applying a SoTP-based approach, we arrive at a 12-month target price of ₹3,900, implying ~21% upside from current levels, led by high-margin growth in chemicals and packaging films. A shorter-term target of ₹3,600 offers a 12% upside over three months, supported by improving utilization across segments and commissioning of new high-impact product lines.

Major risk factors affecting SRF

- Packaging Films Margin Volatility: Global overcapacity and raw material price swings may impact near-term profitability.

- Execution Risk in Capex: Any delay in project commissioning could defer earnings ramp-up.

- Environmental & Regulatory: Chemical operations carry inherent regulatory and environmental risks, especially in fluorochemicals.

- Global Demand Slowdown: Weakness in pharma/agro or export markets may lead to volume/margin pressure.

Technical analysis of SRF share

After forming a well-defined ascending trend channel, SRF is currently trading near the lower trendline, indicating a potential rebound within the ongoing bullish structure. The stock is also trading well above its 50-day, 100-day, and 200-day EMAs, highlighting strong underlying momentum and reinforcing the medium-term bullish setup.

The MACD remains positive at 49.59, though the MACD line is currently placed slightly below the signal line. A bullish crossover in the coming sessions could act as a key trigger for further upside momentum. The RSI at 58.22 reflects strong buying interest, while Relative RSI readings of 0.03 (21-day) and 0.02 (55-day) indicate steady outperformance relative to the broader market. Additionally, the ADX at 25.14 confirms the presence of a strong trend, lending further conviction to the upside move.

A breakout above ₹3,400 could open the door to a rally toward ₹3,900, aligning with the stock’s SoTP-based fundamental target. On the downside, ₹2,950 remains a key support level, and holding above it will be crucial for trend validation.

- RSI: 58.22 (Strong Buying Interest)

- ADX: 25.14 (Strong Trend)

- MACD: 49.59 (Positive)

- Resistance: ₹3,400

- Support: ₹2,950

SRF stock recommendation

Current Stance: Buy, with a 3-month target of ₹3,600 (~12% upside) and a 12-month target of ₹3,900 (~21% upside), based on our SoTP-based valuation approach.

Why buy now?

Chemicals-led growth: SRF’s specialty and fluorochemicals segments are set to drive strong earnings momentum, backed by capacity ramp-up and robust export demand.

Capex & innovation edge: Ongoing investments in R&D, new molecule development, and backward integration position SRF as a long-term compounder.

Packaging tailwinds: Temporary supply constraints (e.g., closure of a peer’s plant) and rising demand for high-impact films provide near-term margin support.

Portfolio fit

SRF offers a rare blend of high-growth specialty chemicals, stable cash flows from packaging, and resilient return ratios. It fits well in core portfolios targeting manufacturing, specialty chemicals, and Make-in-India themes, especially for investors seeking a quality compounder with strong RoCE and scalable growth visibility.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebSRF: Budget 2025-26 opportunities

- PLI Scheme for Chemicals: Boosts specialty and fluorochemicals expansion with better export incentives.

- Pharma R&D Incentives: Supports SRF’s innovation in pharma intermediates and new molecule development.

- Make in India Push: Import duty hikes and manufacturing focus aid SRF’s domestic substitution strategy.

- EV & Cooling Sector Growth: Drives demand for SRF’s refrigerants and fluoropolymers like PTFE.

- Capex-Friendly Policies: Tax benefits and financing support align with SRF’s ongoing capex plans.

Final thoughts

SRF Ltd. is no longer just a refrigerant and film maker – it’s becoming a formidable global player in specialty fluorochemicals and niche industrial solutions. Its multi-decade execution track record, strategic diversification, and bold capital deployment make it a compelling case for investors looking to ride India’s rise in high-value manufacturing and global contract development.

With scalable assets, sticky client relationships, and a balanced portfolio, SRF offers a rare blend of innovation, margin durability, and global relevance – a stock that quietly compounds beneath the radar, quarter after quarter.