From laying the foundations of India’s industrial revolution to becoming a global steel powerhouse, Tata Steel’s journey is one of scale, resilience, and strategic vision. Operating in a cyclical industry prone to commodity price swings, the company has demonstrated an ability to weather downturns and capitalize on growth cycles through timely expansions, technological upgrades, and value-added product innovation. As the world transitions toward greener steel and infrastructure spending accelerates, Tata Steel stands well-positioned to ride both domestic and global demand waves.

But does TATA Steel offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | TATASTEEL |

| Industry/Sector | Iron & Steel |

| CMP | 158.25 |

| Market Cap (₹ Cr.) | 1,97,552 |

| P/E | 43.87 (Vs Industry P/E of 32.11) |

| 52 W High/Low | 170.18 / 122.62 |

| EPS (TTM) | 3.64 |

| Dividend Yield | 2.28% |

About TATA Steel

Founded in 1907, Tata Steel is one of the world’s largest steel producers, with a crude steel capacity exceeding 35 million tonnes per annum (MTPA) across India, Europe, and Southeast Asia. The company has an integrated value chain, from mining iron ore and coking coal to manufacturing finished steel, ensuring cost efficiency and supply security. Tata Steel is part of the Tata Group, known for its governance, operational excellence, and long-term strategic approach.

Key business segments

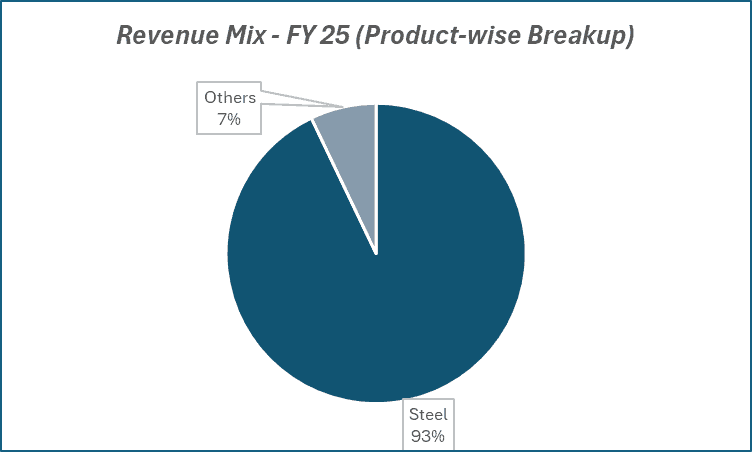

TATA Steel operates primarily in the following key business segments:

- Indian Operations – Core profit driver with high-margin integrated steel production, backed by captive iron ore and coal mines.

- European Operations – Flat steel products for automotive, construction, and packaging sectors in the UK and Netherlands.

- South-East Asia Operations – Presence in Singapore, Thailand, and Vietnam, focusing on long steel products for infrastructure and construction.

- Value-Added Products & Solutions – Includes branded steel, advanced automotive steel grades, and downstream processing for high-margin growth.

Primary growth factors for TATA Steel

TATA Steel key growth drivers:

- Domestic Infrastructure Push – Government spending on roads, railways, and urban development boosts long steel demand.

- Automotive & Consumer Durables – Growing penetration of high-strength steel in EVs and appliances.

- Capacity Expansion – Ongoing Kalinganagar Phase II expansion to increase capacity and product mix.

- Value-Added Portfolio – Shift toward premium steel grades to improve margins and reduce cyclicality.

- Sustainability Initiatives – Investments in hydrogen-based steelmaking and decarbonisation to align with global ESG mandates.

Detailed competition analysis for TATA Steel

Key financial metrics – TTM;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| TATA Steel Ltd. | 216949.24 | 26031.52 | 12.00% | 4084.55 | 1.88% | 43.87 |

| JSW Steel Ltd. | 169028.00 | 24970.00 | 14.77% | 5232.00 | 3.10% | 53.89 |

| Jindal Stainless Ltd. | 40089.59 | 4764.71 | 11.89% | 2624.24 | 6.55% | 23.28 |

| SAIL | 104403.01 | 11194.90 | 10.72% | 2581.37 | 2.47% | 16.77 |

| APL Apollo Tubes | 20885.01 | 1269.33 | 6.08% | 801.06 | 3.84% | 55.25 |

Key insights on TATA Steel

- Integrated Indian operations provide a strong cost advantage over global peers, reducing raw material price volatility impact.

- The European segment faces structural challenges, but restructuring, asset sales, and focus on high-margin grades aim to improve profitability.

- Steady shift toward value-added products and branded retail (Tata Tiscon, Tata Steelium) reduces dependence on commodity-grade steel.

- Debt reduction remains a priority, with free cash flow allocated to deleveraging while supporting capex for expansion and green steel projects.

Recent financial performance of TATA Steel for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 54771.39 | 56218.11 | 53178.12 | -5.41% | -2.91% |

| EBITDA (₹ Cr.) | 6694.47 | 6559.22 | 7427.54 | 13.24% | 10.95% |

| EBITDA Margin (%) | 12.22% | 11.67% | 13.97% | 230 bps | 175 bps |

| PAT (₹ Cr.) | 826.06 | 1124.08 | 1927.64 | 71.49% | 133.35% |

| PAT Margin (%) | 1.51% | 2.00% | 3.62% | 162 bps | 211 bps |

| Adjusted EPS (₹) | 0.77 | 1.04 | 1.67 | 60.58% | 116.88% |

TATA Steel financial update (Q1 FY26)

Financial performance

- Revenue from operations: ₹53,178 crore (down 2.9% YoY).

- PAT:: ₹1,928 crore (up 133.3% YoY).

- Consolidated EBITDA: ₹7,428 crore (up 13% QoQ), margin up ~230 bps QoQ.

- EBITDA/ton improved by ~₹2,400 QoQ.

- NINL EBITDA: ₹224 crore, margin at 24% (vs 23% in Q4 FY25).

- Cost & efficiency programs delivered ₹2,900 crore improvement in Q1.

- Capex: ₹3,829 crore (primarily in India).

- Net debt: ₹84,835 crore; cash & cash equivalents: ₹14,118 crore.

Business highlights

- India: Revenue ₹31,014 crore; production at 5.24 MT (down QoQ due to G blast furnace shutdown at Jamshedpur); deliveries at 4.75 MT.

- EBITDA in India: ₹7,263 crore; margin up 276 bps QoQ to 23.4% on lower costs.

- Kalinganagar 5 MTPA blast furnace ramping up; Ludhiana EAF construction underway; tinplate expansion on track.

- Europe: UK deliveries 0.60 MT (subdued demand), revenue £536 mn, EBITDA loss £41 mn. Netherlands production 1.70 MT, deliveries 1.50 MT; capacity utilisation ~60–65%.

Outlook

- Sales volume guidance: +1.5–1.6 MT in FY26.

- Kalinganagar crude steel production target: 6.7–6.8 MT in FY26.

- Cost & efficiency savings target: ₹11,500 crore over 12–18 months.

Recent Updates on TATA Steel

- Tata Steel’s Kalinganagar plant started dispatching galvanised coils from its new Continuous Galvanising Line for auto and appliance sectors.

- Tata Steel signed an MoU to bring modular bridge construction technology from Australia’s InQuik Group to India.

- Maintenance shutdowns, including a blast furnace reline, lowered production in Q1 FY26, but operations have resumed with good crude steel output.

Company valuation insights – TATA Steel

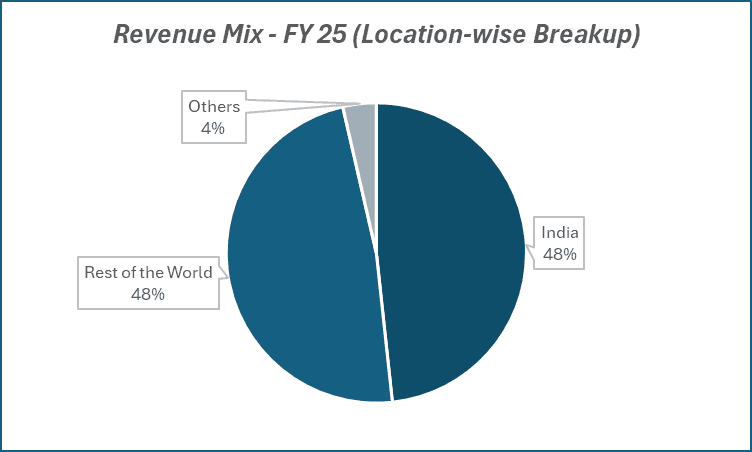

Tata Steel is currently trading at an EV/EBITDA of 11x, delivering a modest 1-year return of 4.24% versus Nifty 50’s -0.02%. The company’s steady performance is underpinned by resilient margins (FY25 EBITDA margin at 11.6%, expected to rise to 14.8% by FY27E) and ongoing operational efficiencies across geographies.

In India, improved realizations and cost discipline have offset temporary volume pressures from maintenance shutdowns, while European operations are showing a tangible turnaround, UK losses have nearly halved and the Netherlands business has posted strong EBITDA gains. The Global Cost Transformation Program has delivered ₹2.9 billion in savings since H2FY25, and management remains committed to deleveraging despite growth capex in Kalinganagar and tinplate capacity expansion. With UK operations expected to break even by FY26 and incremental volumes from new facilities like the Ludhiana EAF plant, Tata Steel is well-positioned to enhance profitability and cash flows in the medium term.

We value Tata Steel at 9x FY27E EBITDA to arrive at a 12-month target price of ₹190, implying a 20% upside from current levels. A short-term target of ₹175 implies a 10% upside over 3 months, supported by sustained cost efficiencies, improving European profitability, and a favorable steel price environment.

Major risk factors affecting TATA Steel

- Cyclical Price Swings – Steel prices are sensitive to global demand-supply dynamics.

- European Margin Pressure – High energy costs and structural inefficiencies could weigh on earnings

- Raw Material Volatility – Despite captive resources, imported coal prices can impact margins.

- Regulatory & ESG Compliance – Stringent decarbonisation rules in Europe may require heavy investments.

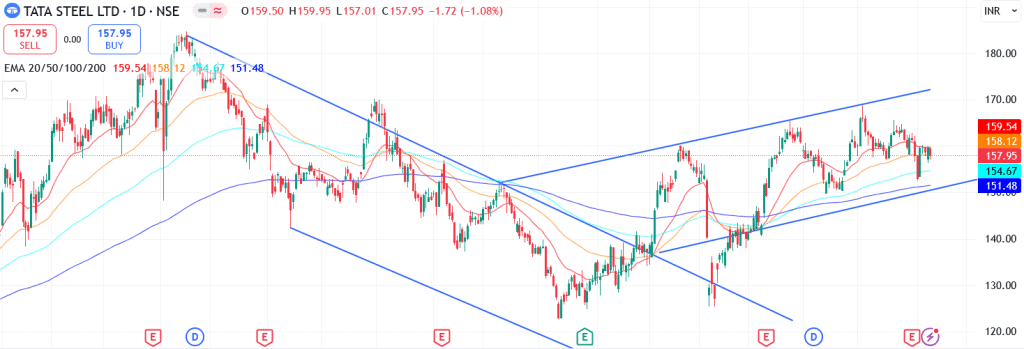

Technical analysis of TATA Steel share

TATA Steel has recently broken out of a descending channel in early March with an impressive ~8% move, marking the start of a trend reversal. Since then, the stock has been forming higher highs, signalling a sustained uptrend.

It trades comfortably above its 50-day and 100-day EMAs, and is currently near its 200-day EMA. A decisive close above the 200-day EMA would further reinforce medium-term strength and bolster investor confidence.

Momentum signals are improving. The MACD is slightly negative at -0.22, with the MACD line just below the signal line, a potential bullish crossover could confirm a fresh upward push. The RSI stands at 46.85, showing decent buying interest, while relative RSI scores of 0.02 (21-day) and 0.01 (55-day) indicate mild but consistent outperformance versus the broader market.

The ADX at 19.17 suggests a moderate trend that could gather pace if the price breaks above key resistance.

A breakout above ₹175 could open the path toward ₹190, aligning with the 12-month fundamental target. On the downside, ₹150 remains a crucial support, sustaining above it is essential to preserve the bullish structure.

- RSI: 46.85 (Decent Buying Interest)

- ADX: 19.17 (Moderate Trend)

- MACD: -0.22 (Slightly Negative, Watch for Crossover)

- Resistance: ₹175

- Support: ₹150

TATA Steel stock recommendation

Current Stance: Buy, with a 3-month target of ₹175 (~10% upside) and a 12-month target of ₹190 (~20% upside).

Why buy now?

Strong domestic demand: Benefiting from robust infrastructure spending and urban development driving steady steel consumption.

Green transition advantage: Early investments in low-carbon steel and sustainability initiatives position Tata Steel ahead of regulatory changes.

Improved cost efficiency: Enhanced raw material security and operational improvements support healthy margins despite inflationary pressures.

Global growth: Expanding presence in value-added and specialty steel segments across emerging and developed markets enhances revenue diversity.

Portfolio fit

Tata Steel is a leading integrated steel producer with a strong domestic and international footprint. It combines steady cash flow generation with strategic investments in green steel and technology, making it an attractive choice for investors seeking exposure to cyclical growth with sustainability focus and improving return ratios.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebTATA Steel: Budget 2025-26 opportunities

- Infrastructure Development: Increased government spending on roads, housing, and urban projects supports robust domestic steel demand.

- Green Steel Transition: Policy incentives and subsidies encourage Tata Steel’s shift toward low-carbon, sustainable steel production.

- Raw Material Security: Focus on boosting domestic iron ore mining reduces reliance on imports, improving cost efficiency and supply stability.

- Export Growth: Simplified export norms and trade agreements help Tata Steel expand in global markets, especially for value-added steel products.

- Innovation Support: Enhanced R&D funding enables development of advanced steel technologies and digital manufacturing processes.

Final thoughts

Tata Steel is more than just a steel producer, it’s an industrial bellwether that mirrors India’s infrastructure ambitions and the global manufacturing cycle. The company’s strategy is clear: strengthen the core Indian business, transition to high-value products, expand sustainably, and turn around global operations. For investors, Tata Steel offers a blend of cyclical opportunity and structural transformation, making it a stock to watch as the world builds its next phase of growth, literally on steel foundations.