The global agrochemical industry is navigating one of its most challenging cycles in recent years, marked by inventory corrections, pricing pressure, and volatile farm economics. Amid this reset, UPL Ltd stands out as a diversified agri-solutions player attempting a strategic pivot from scale-driven growth to value-led profitability. The key question for investors is whether this transition can translate into durable earnings recovery and balance sheet improvement.

But does UPL Ltd. offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | UPL |

| Industry/Sector | Chemicals |

| CMP | 770.00 |

| Market Cap (₹ Cr.) | 65,800 |

| P/E | 27.81 (Vs Industry P/E of 28.76) |

| 52 W High/Low | 786.30 / 493.00 |

| EPS (TTM) | 28.08 |

| Dividend Yield | 0.72% |

About UPL Ltd.

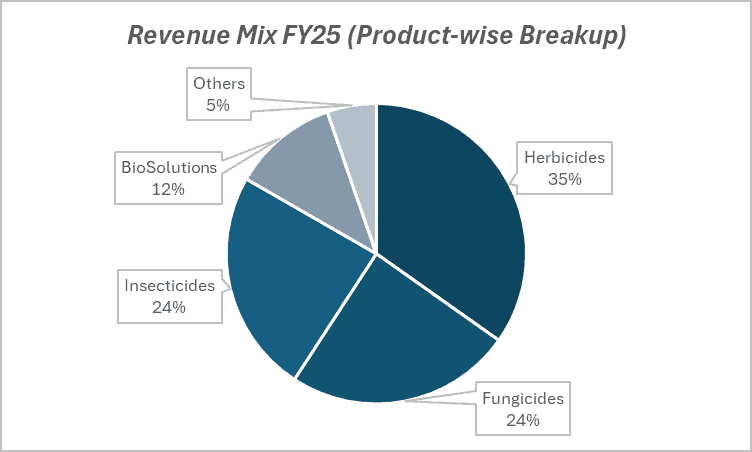

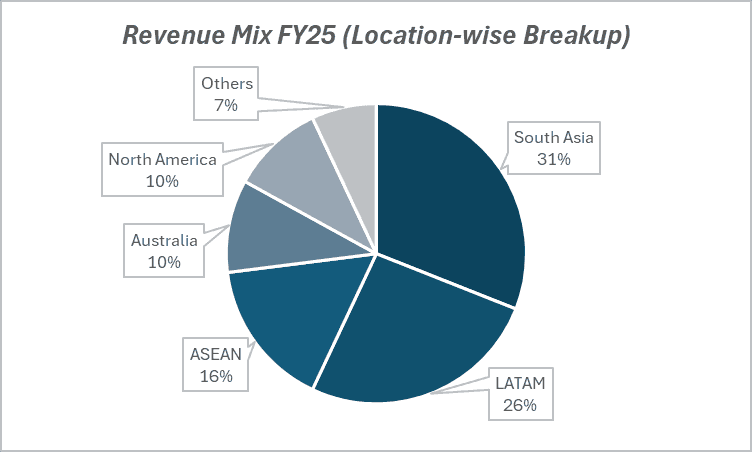

UPL Ltd is one of the world’s largest agrochemical companies, offering crop protection products, seeds, and post-harvest solutions across more than 130 countries. Unlike traditional agrochemical peers focused primarily on active ingredients, UPL operates a broad portfolio spanning herbicides, insecticides, fungicides, specialty chemicals, and biologicals.

Over the past decade, UPL expanded aggressively through acquisitions and global reach. The current phase marks a shift toward simplification, cash-flow discipline, and improving return ratios.

Key business segments

UPL Ltd. operates primarily in the following key business segments:

- Crop Protection Chemicals: The core business comprising generic and specialty formulations across major crops such as cereals, oilseeds, fruits, and vegetables, with strong exposure to Latin America, Europe, and India.

- Seeds & Traits: Includes field crops and vegetable seeds, aimed at offering integrated solutions to farmers and improving cross-selling opportunities.

- Biologicals & Sustainable Solutions: A growing focus area covering bio-stimulants, bio-pesticides, and residue-free products, aligned with global sustainability trends.

- Post-Harvest & Grain Storage Solutions: Specialty offerings that support food security and reduce post-harvest losses, adding diversification beyond crop protection.

Primary growth factors for UPL Ltd.

UPL Ltd. key growth drivers:

- Demand recovery trigger: Volume growth depends on normalization in global agrochemical demand as channel destocking eases, led by Latin America and India.

- Margin improvement lever: Greater focus on differentiated formulations, biologicals, and integrated solutions should lift margins and reduce generic exposure.

- Portfolio discipline: Rationalization and exit from low-return products are aimed at improving earnings quality and returns.

- Cash flow focus: Strong working-capital discipline remains key to sustaining the next phase of growth.

Detailed competition analysis for UPL Ltd.

Key financial metrics – TTM;

| Company | Sales (₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E |

| UPL Ltd. | 47715.00 | 8544.00 | 17.91% | 2709.00 | 5.68% | 27.81 |

| PIIND Ltd. | 7460.70 | 2028.00 | 27.18% | 1506.10 | 20.19% | 32.50 |

| Sumitomo India Ltd. | 3307.93 | 662.90 | 20.04% | 543.07 | 16.42% | 42.30 |

| Bayer Cropscience Ltd. | 5571.30 | 744.20 | 13.36% | 608.90 | 10.93% | 32.89 |

| Sharda Cropchem Ltd. | 4671.78 | 682.36 | 14.61% | 451.90 | 9.67% | 17.82 |

Key insights on UPL Ltd.

- Strategic shift: UPL is moving from expansion-led growth to a profitability- and cash flow–focused operating model.

- Balance sheet focus: Management is prioritising deleveraging, tighter working capital control, and improved free cash flow conversion.

- Long-term optionality: The biologicals and sustainable agriculture portfolio provides structural growth potential, though its current contribution remains modest.

- Cyclical sensitivities: Near-term performance will continue to be shaped by global agri cycles, pricing trends, and currency movements.

Recent financial performance of UPL Ltd. for Q2 FY26

| Metric | Q2 FY25 | Q1 FY26 | Q2 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Sales (₹ Cr.) | 11090.00 | 9216.00 | 12019.00 | 30.41% | 8.38% |

| EBITDA (₹ Cr.) | 1352.00 | 1396.00 | 2001.00 | 43.34% | 48.00% |

| EBITDA Margin (%) | 12.19% | 15.15% | 16.65% | 150 bps | 446 bps |

| PAT (₹ Cr.) | -450.00 | -194.00 | 666.00 | 443.30% | 248.00% |

| PAT Margin (%) | -4.06% | -2.11% | 5.54% | 765 bps | 960 bps |

| Adjusted EPS (₹) | -5.67 | -1.11 | 6.54 | 689.19% | 215.34% |

UPL Ltd. financial update (Q2 FY26)

Financial performance

- Strong H1 execution: Q2 revenue rose 8% YoY to ₹12,019 crore, driven by 7% volume growth and favorable forex, offset partly by pricing pressure.

- Sharp margin expansion: Contribution margin improved 420 bps to 42%, aided by better mix, higher capacity utilization, and lower input costs.

- Earnings recovery: EBITDA surged 48% YoY to ₹2,001 crore with margins up 446 bps to 16.7%; PATMI improved by ~₹1,000 crore YoY, signaling a strong turnaround.

- Balance sheet strengthening: Net debt reduced by $605 million YoY, with net debt-to-EBITDA improving to 2.7x, reinforcing financial resilience.

Business highlights

- Global crop protection momentum: UPL Corp revenue grew 12% YoY, led by strong recovery in North America (+79%) and Latin America (+13%), supported by herbicides and fungicides.

- India & seeds recovery: India business grew 6%, led by seeds and specialty chemicals; Advanta delivered robust 26% growth with strong volume traction.

- Specialty chemicals gaining scale: Super Specialty Chemicals grew 18%, with non-agchem share rising to 25%, supported by contract manufacturing and platform-led growth.

- Post-patent strength: Accelerating demand for cost-effective post-patent products amid farmer margin pressures, with new product momentum exceeding targets.

Outlook

- Upgraded profitability guidance: FY26 EBITDA growth guidance raised to 12–16%, reflecting confidence in execution and margin trajectory.

- H2 volume-led growth: Management expects H2 growth to be driven largely by volumes, with pricing broadly stable and Brazil order book up ~20%.

- Deleveraging on track: Continued working capital release and strong cash generation position UPL to further reduce leverage toward targeted levels.

- Sustainable value creation: Increasing mix of differentiated, biological, and specialty offerings supports a structurally stronger, more resilient earnings profile over the medium term.

Recent Updates on UPL Ltd.

- Organizational simplification: Streamlining structure and reducing geographic complexity to improve execution and accountability.

- Supply chain strengthening: Enhancing end-to-end visibility to improve efficiency, cost control, and responsiveness.

- Sustainability-led focus: Scaling sustainable and differentiated solutions while optimizing the overall product portfolio.

- Capital allocation discipline: Prioritising deleveraging and return enhancement through a sharper, more disciplined capital allocation framework.

Company valuation insights – UPL Ltd.

UPL is currently trading at a TTM P/E of 27.8x, broadly in line with the agrochemicals industry average of 28.8x. The stock has delivered a strong 54.2% return over the last one year, significantly outperforming the NIFTY 50’s 9.5%, reflecting improving fundamentals, balance sheet repair, and recovery in global agri demand.

While near-term earnings remain sensitive to agri cycles, valuations appear reasonable given the sharp earnings rebound underway, margin expansion driven by better mix and lower input costs, and improving cash flow visibility.

The investment case rests on normalisation of channel inventories, volume-led recovery across North America, Latin America, and India, and a strategic shift toward higher-value post-patent products, differentiated formulations, and specialty chemicals.

Strong execution in H1 FY26, upgraded EBITDA guidance, disciplined working capital management, and continued deleveraging strengthened confidence in earnings durability. Additionally, Advanta seeds and Super Specialty Chemicals provide diversification and structural growth optionality, while management’s sharpened capital allocation framework supports ROCE improvement over the medium term.

Applying a 21x multiple to FY27E EPS of ₹45, we derive a 12-month target price of ₹945, implying 22% upside from current levels. A shorter-term 3-month target of ₹820 suggests ~6% upside, supported by continued volume recovery, stable pricing, and incremental margin gains as operational normalisation plays out through H2 FY26.

Major risk factors affecting UPL Ltd.

- Demand risk: Prolonged weakness in global agrochemical demand or delayed channel restocking could pressure volume recovery.

- EM exposure: High exposure to emerging markets increases sensitivity to currency volatility and geopolitical risks.

- Regulatory overhang: Changes in chemical usage regulations and environmental norms may impact approvals, timelines, and cost structures.

- Leverage monitorable: Elevated leverage, despite improvement, remains a key risk to track.

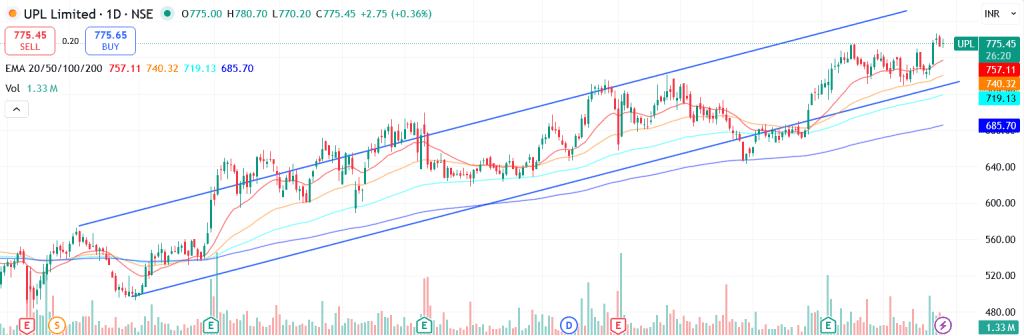

Technical analysis of UPL Ltd. share

UPL is trading within a well-established upward channel, reflecting steady accumulation and positive price structure. The stock remains comfortably above its 50-, 100-, and 200-day EMAs, reinforcing a strong long-term uptrend and sustained buying support across timeframes.

Momentum indicators continue to back the bullish setup. MACD at 8.66 is firmly positive, with the MACD line holding above the signal line, pointing to continued underlying strength.

RSI at 60.34 indicates healthy buying momentum while still leaving room for further upside. Relative RSI readings (0.02 / 0.09 over 21- and 55-day periods) signal ongoing outperformance versus the broader market. ADX at 18.19 suggests the stock is currently in a range-bound phase; however, a breakout above resistance could trigger a strong directional move.

A decisive move above ₹820 could open the path toward ₹945 (12-month target). On the downside, ₹720 remains the key support; holding above this level keeps the bullish structure intact.

- RSI: 60.34 (Strong Buying Momentum)

- ADX: 18.19 (Range-bound, breakout watch)

- MACD: 8.66 (Positive)

- Resistance: ₹820

- Support: ₹720

UPL Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹820 (6% upside) and a 12-month target of ₹945 (22% upside), based on 21x FY27E EPS of ₹45.

Why buy now?

Earnings recovery underway: Sharp turnaround in profitability driven by volume recovery, better product mix, and lower input costs post channel destocking.

Margin expansion visibility: Improving contribution margins from post-patent strength, higher capacity utilisation, and disciplined cost control support the EBITDA upcycle.

Balance sheet repair: Sustained deleveraging, improving free cash flow conversion, and tighter working capital management reduce financial risk.

Platform-led growth: Advanta seeds and Super Specialty Chemicals add diversification and structural growth optionality beyond core crop protection.

H2 tailwinds: Normalised inventories, strong Brazil order book, and volume-led growth outlook underpin near-term momentum.

Portfolio fit

UPL Ltd offers cyclical recovery exposure with improving quality, combining global scale, strengthening margins, and balance sheet repair. With valuations in line with the sector, rising earnings visibility, and a clear shift toward profitability and cash discipline, the stock presents an attractive risk–reward for portfolios seeking recovery-led upside with medium-term compounding potential.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebUPL Ltd.: Budget 2025-26 opportunities

- Rural income support: Higher agri and rural spending can lift farm incomes, supporting demand for crop protection and seeds.

- Food security focus: Push toward higher yields and productivity benefits agrochemicals and integrated crop solutions.

- Manufacturing & exports: Incentives for domestic manufacturing and exports improve cost competitiveness and supply resilience.

- Ease of doing business: Faster approvals and simpler compliance aid quicker product launches and execution.

- Sustainability push: Policy support for sustainable farming aligns with UPL’s biologicals and ESG-led growth strategy.

Final thoughts

UPL Ltd is no longer a pure expansion story, it is a turnaround-in-progress built on discipline, portfolio refinement, and cash flow focus. For investors willing to look beyond near-term cyclicality, UPL offers exposure to global agriculture with optionality from sustainable solutions and biologicals. The next leg of value creation will depend less on scale and more on execution, margins, and balance sheet repair.