Passive mutual funds are building pace with assets under management (AUM) rising to ₹12.2 lakh Cr in 2025 from ₹1.91 lakh crore in 2019, over six-times higher in six years. At the same time, active funds continued to attract inflows, especially in categories such as mid- and small-cap, where fund managers aim to gain higher returns by leveraging market inefficiencies.

Given this pull game, it is essential for investors to know which of these strategies works for them, to plan their investments better, and create wealth in the run.

In this blog, we discuss the key differences between active and passive portfolio management, their pros and cons, and which strategy suits an investor perfectly.

What is Portfolio Management?

Portfolio management is a method of risk management that involves distributing total investment into different asset classes to meet the investment objectives of an investor. It is a group of different investments held by an individual or institution. The primary goal of portfolio management is to manage risks and maximise returns.

Difference Between Active and Passive Portfolio Management

To drive the discussion further, let’s dive into the key differences between active and passive funds

| Key Difference | Active Portfolio Management | Passive Portfolio Management |

| Aims to | Achieve higher returns compared to benchmark | Achieve similar performance to the benchmark |

| Strategy | Investors make buy or sell decisions based on market research and analysis, to leverage market inefficiencies | Investors here are more into buy and hold approach with no extra purchasing or selling |

| Role of investor | Skills, judgment, and active participation of the investors is a bigger deal | While in passive management, ability to replicate the benchmark takes priority |

| Costs involved | Higher management fees and trading cost due to frequent trades | Quite lower costs in comparison to active management |

| Risks associated | Plays with higher risk, arising from lag or deviation between decision making and market | Involves lower risk, as the portfolio performance rides the market wave |

Active Portfolio Management: Definition & Traits

Active portfolio management is all about active participation in buying, holding, and selling financial securities. Its primary focus is to outperform benchmark indices, such as Nifty 50 or S&P 500, by making calculated moves based on market research and analysis. The following are some key features of active investing:

- Hands-on Strategy: Investors or fund managers are continuously strategising based on market research and analysis.

- Beating the Index: The core idea is to get higher returns than the benchmark index by leveraging market inefficiencies.

- Quick Fire Trading: It often features frequent buying and selling of financial securities, which leads to higher transaction costs and management fees.

Passive Portfolio Management: Definition & Traits

Passive portfolio management is calmer and data-driven and aims to replicate its benchmark index by moving along with it rather than competing. It is more about holding a position for the long-term, which often uses index funds or ETFs, to move with the benchmark and avoid market noise. The following are some features and benefits of passive investing:

- Easy on-the-wallet: It usually involves lower expense ratios as there is lower trading activity and no need for active participation.

- Long-Game Mindset: It is more into a buy-and-hold approach with zero to minimal changes, aligning to the belief that the market trend will move upward over the long term.

- Tax-Savvy Mode: With fewer investments with a long-term strategy, there are fewer short-term capital gains, which reduces tax liability for investors.

Pros & Cons of Active Management

Pros of Active Portfolio Management

- Stronger Return Outlook: Investors aim to outperform the market by identifying undervalued assets and market trends, which passive funds might miss.

- Balance of Freedom and Control: Active portfolios are built to quickly adapt to market shifts and manage downside risk effectively.

- Edge in Chaos: Investors or fund managers might leverage mispriced assets, for example, in small-cap stocks or particular sectors, to maximise returns.

Cons of Active Portfolio Management

- Heavier on Costs and Fees: It carries higher management fees and transaction costs due to frequent trading.

- Lag or Deviation in Performance: It could result in human errors, lag, and deviation in market analysis and investment decisions. For instance, 92 active Indian mutual funds failed to beat their respective benchmark, in the financial year 2024-25.

- Less Tax-Friendly: With back-to-back trades, it triggers short-term capital gains, which are subject to a higher rate of tax.

Pros & Cons of Passive Management

Pros of Passive Portfolio Management

- Open-book Approach: It applies understandable and transparent strategies, as the funds holding are a component of the index it tracks.

- Doesn’t put all eggs in one basket: The fund invests in different asset classes. Being involved in a bigger market reduces risks by holding various financial securities.

- Low-expense, High-efficiency: It involves a lower expense ratio on a relative scale. Also, lower numbers of trades and long-term investments lead to long-term capital gains, which are subject to a lower tax rate.

Cons of Passive Portfolio Management

- Market Drop Risks: If the market drops, the fund drops too. Because it is built to replicate the market.

- Tight Play: As it is tied to the benchmark index, the fund can’t adapt to market changes or leverage new opportunities.

- No market competition, with possible tracking errors: The fund is designed to match the market, so there’s no scope to outperform it. Also, even a little failure can lead to increased costs and expenses, indicating it may not be good enough.

Performance Trends: What Do The Data Say?

Active Portfolio Management:

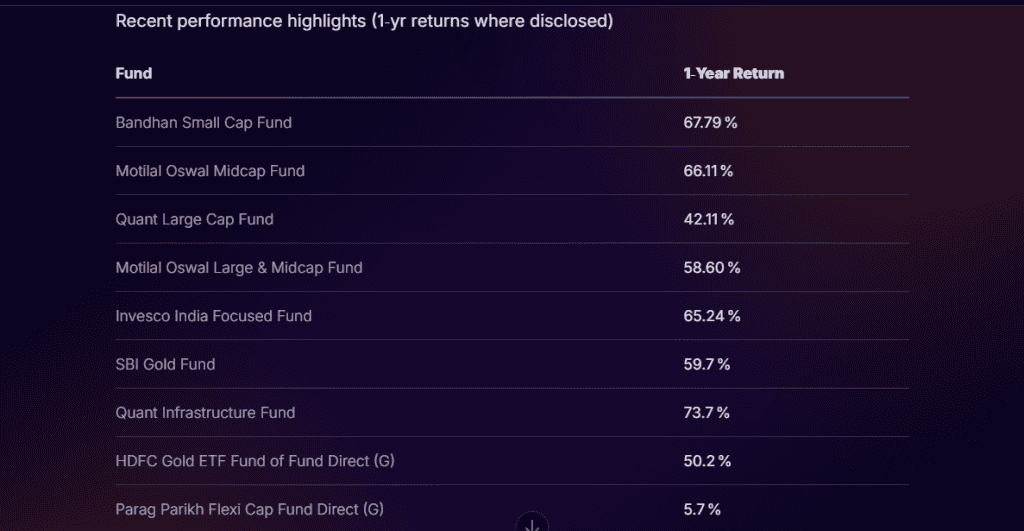

Presented here are the results derived by Stoxo by Stockgro. These are some of the top-performing active funds, highlighting 1-year returns.

Here we can see that:

Small- and mid-cap funds like Bandhan Small Cap and Motilal Oswal Midcap show returns over 65%, reflecting strong performance in high-risk sectors. SBI Gold and HDFC Gold ETF provided consistent gains of around 50-60%, reflecting support due to rising prices.

Passive Portfolio Management

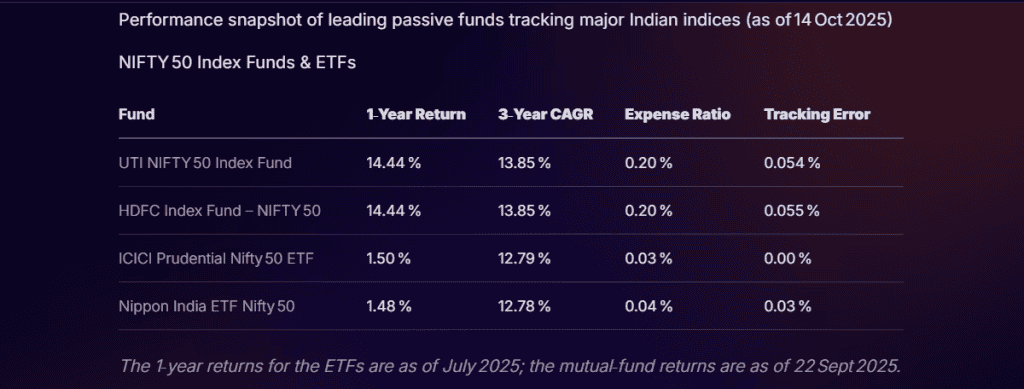

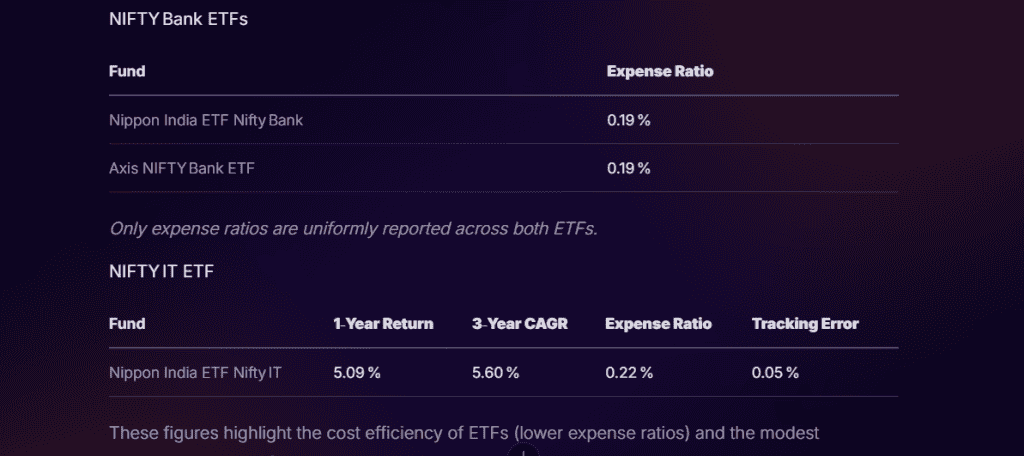

Here are some top passive funds’ performance under different index funds. It reflects returns over 1-year and a 3-year CAGR.

From this data, it can be said that,

Nifty 50 funds stayed consistent, giving around 14% returns with lower costs and tracking errors. Bank ETFs were more towards cost-efficiency, both Nippon and Axis charging only 0.19%. IT ETF returns showed slow growth compared to wider market indices.

Which Strategy Fits Your Style?

When the question is which strategy fits your style, it always depends on certain factors of the investor, such as expectations, investment goals, capital, and risk tolerance.

| Factors | Active Portfolio Management | Passive Portfolio Management |

| Knowledge | It requires knowledge of valuation and technical tools and is suitable for advanced investors | It is doesn’t demand much technical know-how, so beginners can opt for it |

| Time Availability | Investors interested in devoting time to their investments, can opt for active funds. | However, if the investor is low on time, passive funds would be a good choice |

| Risk Tolerance | It is suitable for investors who are comfortable with high risks and aims for higher return | It is suitable for investors who prefer stability and accepts low to medium risk |

| Cost Sensitivity | If the investors doesn’t care much about higher fees and costs, they can go for active funds | If the investors is little on the cost sensitive side, they can go for passive funds |

| Goals | It is suitable if the investor has short-term goals | It is suitable for investors to prefer long-term wealth creation and growth |

Conclusion

Active and passive portfolio management differ mainly in approach, costs, and the investor’s or fund manager’s involvement. While active management aims to outperform benchmarks through market research and frequent trades, passive management focuses on moving together with the benchmarks, with long-term benefits and lower costs.

The right choice depends on an investor’s goals, time, and risk balance. Whether they prefer control or consistency, both strategies can build wealth when aligned with investment objectives.

FAQs

Active portfolio management aims to outperform benchmark indices through market research, analysis, and frequent trades. While passive portfolio management replicates the benchmark’s performance by following a buy-and-hold strategy with lower trading activity.

Active management carries higher management fees and trading costs due to frequent buying and selling. Passive management involves lower expense ratios, as it follows a stable, long-term approach with average portfolio changes.

No, active funds don’t outperform passive funds. While some active funds can outperform benchmarks during market fluctuations, most fail to do that consistently and even end up incurring higher costs.

Yes, passive investing can be better for long-term goals as it follows a buy-and-hold approach, offers stability, lower costs, and reduced tax liability through long-term capital gains.

Yes, a balanced mix of both will allow investors to benefit from the flexibility of active management and stability of passive management for long-term holdings, offering diversification and risk control.

Passive funds are more suitable for beginners as they don’t demand much technical knowledge, involve lower costs, and are easier to manage.