FY 2025 has been a year of resilient performance for the overall Indian economy. Global crises, wars, geopolitical pressures, supply chain disruptions, mass selling foreign investors, and more, have pained the markets throughout the year. According to market capitalisation, financial services is the largest segment in Indian markets.

Therefore, the banking industry, which is expected to reach US$480 Billion in 2029, plays a crucial role in economic growth. In this, private banking has been growing at a notable pace due to operational efficiency and better credit norms. Up to December 2025, the private banks reported 12% year-on-year growth, which was higher than public sector banks due to better margins. Experts suggest that private bank earnings can grow by 14% CAGR from FY 2025 to FY 2027.

This blog compares two of the leading private banking entities: entities: ICICI Bank vs HDFC Bank. The tight battle between these two private industry stalwarts can provide potential investment opportunities for investors. Let’s explore this in detail!

Understand the banking industry: Retail Banking vs Commercial Banking Key Differences Explained

HDFC Bank: The legacy of 48 years!

The brand is famous for its pioneering position in the housing finance sector and has been leading the private banking space for a significant number of years. HDFC bank financials have consistently grown over the years. As of April 25, 2025, with a market capitalisation of ₹14,57,403.8 crores, it ranks as the third-largest entity in the Indian stock market. In Q4 FY 2025, HDFC Bank reported a 14% growth in deposits and a 5.4% growth in advances on a Y-o-Y basis.

ICICI Bank: Strongest private bank post Q4 FY 2025!

Established in 1994, the company has a strong track record of launching varied banking products. It is one of the fastest-growing private banks. In Q4 FY 2025, the company outperformed the HDFC bank in terms of all bank-specific ratios like net interest margin. The entity has a market capitalisation of ₹10,00,996.93 as of April 25, 2025, which makes it the second-largest private bank.

Must explore: Investment analysis: How to spot market underdogs worth betting on

ICICI Bank vs HDFC Bank: Bank-specific ratios Q4 FY 2025

- Net Interest Margin

The difference between interest charged by banks over loans and the interest paid on deposits is known as net interest income. Its ratio against the average net assets is the net interest margin. It indicates the profitability of an institution.

| Particulars | Q4 FY 2025 | Q4 FY 2024 |

| HDFC Bank Ltd. | 3.50% | 3.40% |

| ICICI Bank Ltd. | 4.41% | 4.40% |

- Capital Adequacy Ratio

The ratio indicates a bank’s overall financial health based on its capital position. CAR is obtained by dividing a bank’s capital by risk-weighted assets. Increasing capital adequacy indicates better financial strength and fewer chances of insolvency for an institution.

| Particulars | Q4 FY 2025 | Q4 FY 2024 |

| HDFC Bank Ltd. | 19.60% | 18.80% |

| ICICI Bank Ltd. | 16.41% | 16.33% |

- CASA Ratio

As the name suggests, the current account savings account ratio indicates the composition of deposits that a bank receives. These are low-cost deposits for the bank. Therefore, a higher CASA ratio indicates lower interest costs for the institution.

| Particulars | Q4 FY 2025 | Q4 FY 2024 |

| HDFC Bank Ltd. | 35% | 38% |

| ICICI Bank Ltd. | 38.4% | 38.9% |

- Net NPA ratio

Non-performing assets (NPA) are loans and advances that have become bad debt for the bank. The net NPA ratio indicates the losses incurred by banks against such NPAs. A high NPA indicates financial instability and risks the bank’s tumbling health.

| Particulars | Q4 FY 2025 | Q4 FY 2024 |

| HDFC Bank Ltd. | 0.40% | 0.30% |

| ICICI Bank Ltd. | 0.39% | 0.42% |

Based on some crucial banking ratios, ICICI Bank has outperformed HDFC Bank in terms of its risk management, margins and interest cost. As an entity, the financials of these banks also become important for holistic analysis.

Financials: ICICI Bank vs HDFC Bank

Both the private banks have performed strongly in FY 2025 compared to the previous year. Apart from gaining operational edge over HDFC Bank through bank-specific ratios, ICICI Bank has outpaced the profit growth of the market leader.

HDFC Bank Ltd.

| Particulars | FY 2025 | FY 2024 | Change (%) |

| Total Income | 3,46,149.32 | 3,07,581.55 | 12.53% |

| Operating profit (in ₹ Crores) | 1,10,416.6 | 1,01,586.8 | 8.6 |

| Net profit (in ₹ Crores) | 70,792.2 | 64,062.0 | 10.5 |

| Net Profit Margin (%) | 20.25% | 20.82% | (0.3) |

| Operating cash flow (in ₹ Crores) | 1,27,241.8 | 19,069.1 | 567.2 |

| Earnings per share (in ₹) | 92.3 | 90.0 | 2.5 |

| Share of retail banking in the revenues (largest segment) | 60.2% | 57.2% | 5.2 |

| Deposits (in ₹ Crores) | 27,14,714.90 | 23,79,786.28 | 14.07% |

ICICI Bank

| Particulars | FY 2025 | FY 2024 | Change (%) |

| Total Income | 1,91,770.48 | 1,64,848.71 | 16.33% |

| Operating profit (in ₹ Crores) | 77,759.3 | 64,146.7 | 21.2 |

| Net profit (in ₹ Crores) | 51,029.2 | 44,256.3 | 15.3 |

| Net Profit Margin (%) | 26.6% | 26.84% | (0.24) |

| Operating cash flow (in ₹ Crores) | 1,22,805.2 | 1,58,284.4 | (22.4) |

| Earnings per share (in ₹) | 71.1 | 61.9 | 14.8 |

| Share of retail banking in the revenues (largest segment) | 53.0% | 57.0% | (7.0) |

| Deposits (in ₹ Crores) | 16,10,348.02 | 14,12,824.95 | 13.98% |

- Total Income: In FY25, HDFC bank earned a total income of ₹3,46,149.32 crores, a 12.53% jump from FY24. ICICI bank earned a total income of ₹1,91,770 crores in FY25, lower than HDFC bank, but saw a rise of 16.33% in total income as compared to the previous year.

Meaning that although ICICI bank has lower total income than HDFC bank but it is growing at a faster rate (in terms of total income).

- Profitability: In FY25, HDFC bank earned a net profit of ₹70,792 crores and ICICI bank earned a net profit of ₹51,029 crores. HDFC bank’s net profit is higher than ICICI bank due to its higher revenue base.

In terms of net profit margin, ICICI bank has a net profit margin of 26.6% as compared to HDFC bank with a margin of 20.25%. This shows ICICI bank’s better capability of converting revenues into net profit.

- Operating Cash Flows: ICICI Bank’s operating cash flow fell by 22.4% from ₹1,58,284.4 Cr in FY24 to ₹1,22,805.2 Cr in FY25, indicating weaker cash generation.

In contrast, HDFC Bank reported a sharp 567.2% rise, from ₹19,069.1 Cr to ₹1,27,241.8 Cr, reflecting significantly improved operational performance.

- Deposits: HDFC bank has total deposits of ₹27.14 lakh crores in FY25, a jump of 14.7% from the previous year. ICICI bank stands at a much lower total deposits of ₹16.10 lakh crores in FY25, a jump of 13.89%.

Despite a higher deposit base, HDFC bank saw a better deposit growth from FY24 to FY25.

Share price comparison: HDFC vs ICICI

In the race of ICICI bank vs HDFC bank, the latter has generated slightly higher returns in a year’s tenure as of April 25, 2025.

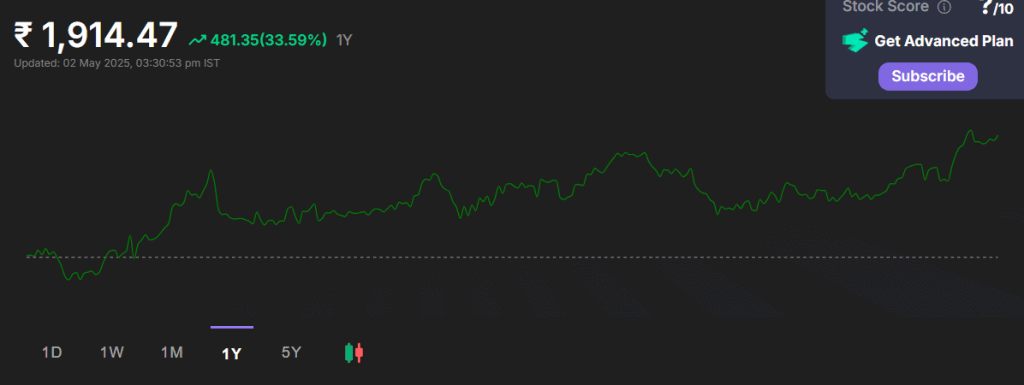

HDFC Bank Ltd.

Being the 3rd largest entity based on the market capitalisation, HDFC Bank has consistently performed despite the overall pressure in the markets since September 2024.

Its share price has surged 33.59% in a year as of May 3, 2025. The stock made a 52-week high of ₹1,944 and a 52-week low of ₹1,327

ICICI Bank Ltd.

The pacing financial growth of ICICI Bank is also reflected in the share price growth. The bank has also earned significantly in terms of EPS in FY 2025.

Despite the global pressure, the share price has gained by 28.25% in a year’s timeframe as of May 3, 2025.

Comparative SWOT analysis

| Particulars | HDFC Bank Ltd. | ICICI Bank Ltd. |

| Strength | Strong retail presence with 9455 branches and a customer base of nearly 97 Million people. | Increasing operating efficiency. The count of total branches of ICICI has surged by 7% in FY 2025. |

| Weakness | The NPA management requires attention as it can create financial instability. | The company’s stock is trading at 3.21 times higher than its book value as of April 25, 2025, which may indicate over valuation. |

| Opportunity | The rural market has been stable at 17% of the total number of branches, which can generate significant business. | Rural advances account for only 5% of the total portfolio. The bank can earn significantly by designing specific credit products for the rural area. |

| Threat | Due to lagging bank-specific ratios, the bank may lose its leading position to competitors like ICICI Bank. | Recent claims of ICICI data breach have concerned customers and the company may need to take the required measures for the same. |

HDFC or ICICI, which is better?

The Indian banking industry has been transforming in the digital era, and banks like HDFC and ICICI are some of its key players. Both these private banks have been in a tight race to lead this space. Based on the Q4 FY 2025 results, ICICI has outperformed HDFC in terms of operational efficiency and growth. However, HDFC still leads the private banking sector in terms of market capitalisation, revenue, profits, etc. Therefore, investors should analyse their investment objectives and risk profile to select the most suitable among them.

Check this out! Investing in Bank Stocks: Are They Right for Your Portfolio?