The global automotive space is evolving rapidly. The growth of electronic vehicles (EVs) and the rise of automated vehicles are examples of innovation in this sector. For instance, in 2024, the Chinese automobile maker BYD surpassed Tesla in the electric vehicle segment. This development infused greater competitiveness in the Chinese automobile industry.

Therefore, continued innovation is key to sustenance and growth in the automobile sector. Leading companies like Hero MotoCorp and Bajaj Auto are taking giant leaps in this segment to make the best of the prevailing trends.

Understanding the automobile industry in India

India ranks fourth globally in terms of automotive production. It is also a key exporter in this segment. In FY2024- 25, Indian exports increased by 19% to hit more than 53 lakh units.

The automobile space of India is taking fierce steps to incorporate the global trends to maintain its position in the global and domestic market. For instance, January 2025 witnessed a 19.04% month-on-month growth in EV sales that reached 1,69,931 units.

A study conducted by the India Energy Storage Alliance projects that the country’s EV industry would expand at a 36% compound annual growth rate (CAGR) through 2026. Furthermore, it is anticipated that the EV battery market would expand at a 30% CAGR during that exact time frame.

The government of India has also formulated various schemes to support the growth of this segment, namely FAME Phase 1, FAME Phase 2, PM E-Drive, etc.

| Government Scheme | Description |

| Make in India | Promote indigenous automobile brands. |

| Atmanirbhar Bharat | Self-sufficiency in the auto industry. |

| FAME | It stands for Faster Adoption and Manufacturing of Hybrid and Electric Vehicles. |

| PM E-Drive | Accelerate EV adoption and thus reduce pollution. |

Also read: TCS vs. Infosys: A comparative study of the IT

Hero MotoCorp and Bajaj Auto: Company overview

Well-established auto companies like Hero MotoCorp and Bajaj Auto have a competitive edge over new businesses to make the best of the innovative trends. It is primarily due to their capital structure and massive size. A comparative look at Hero Motorsport vs. Bajaj Auto can help investors understand their fiscal health better.

- Hero MotoCorp

Established in January 1984, Hero MotoCorp tops the list of highest sales in a calendar year. The company has manufacturing units, research and development centres and touchpoints spread globally. The company has two world-class centres that helps it maintain the global innovative expertise.

The company has set foot in the innovative EV sector through its VIDA V2 e-scooter. It has an advanced removable battery technology that makes the scooter more affordable and attractive to Indian needs.

Moreover, the company has built strategic partnerships in the EV segment. The company has an equity stake in Ather Technology. The company also jointly develops electric motorcycles with Zero Motorcycles.

The company is also investing heavily in digital infrastructure and other AI-enabled technologies to improve its efficiency and optimise the manufacturing process. The table below shows certain metrics that can better explain the performance and capabilities of the company.

| Number of customers | More than 120 Million |

| Global presence | 48 Countries |

| Experts | 1000+ engineers and experts |

| Patents filed | 750+ |

- Bajaj Auto

Bajaj Auto belongs to the prestigious Bajaj Group. The group was established by Jamnal Bajaj, who actively contributed to the Indian Independence Struggle. Bajaj Auto was established 75 years ago. The company tops the list of motorcycle exporters in India.

The company entered the EV space by primarily focusing on two and three-wheelers. In 2020, they first launched Chetak, an electric scooter. Later, through Bajaj GoGo, the company entered electric three-wheelers. The business has a robust R&D team to stay abreast of contemporary advancements in the field.

The table below shows various parameters that reflect the financial health and scale of the company. The capital structure and size play a key role in determining the capacity of the company to keep up with the global trends.

| Number of customers | More than 89 Million |

| Global presence | 70 Countries |

| Employees | 10,000+ |

| Global Brands | 10+ |

Hero MotoCorp vs. Bajaj Auto: Comparing quarterly reports

For an efficient stock analysis, one must comprehend the financial health of a business. Therefore, the table below compares the quarterly performance of Hero MotoCorp and Bajaj Auto as of Q3FY25.

| Particulars | Hero MotoCorp (Q3) | Bajaj Auto (Q3) |

| Net Profit | ₹ 1203 Crores | ₹2108.7 Crores |

| Revenue from operations | ₹10,211 crore | ₹12,807 crore |

| Interim dividend per equity share | ₹100 | – |

| EBITDA | ₹1,279.58 crore | ₹2,481.06 crore |

There are various key takeaways from the quarterly reports of Hero MotoCorp vs Bajaj Auto. The points below explore the key insights from the reports and various factors that contributed to the fiscal performance exhibited in Q3FY25.

- Sales: Hero MotoCorp’s revenue from operations increased by 5% as opposed to the same quarter prior fiscal year. This rise is complemented by both bottom-line and top-line growth. The company expects a more dominant presence in the premium segment due to the new product launches in Bharat Mobility.

The revenue from the operations of Bajaj Motors witnessed a 6% year-on-year rise due to growing customer preference and the launch of a new variant of its popular electric scooter, Chetak. The company has termed this variant as the ‘best Chetak yet’.

Moreover, Bajaj Auto has recorded ₹2,596 crores more in sales than Hero MotorCorp. The difference of around 25% in sales is attributable to the massive capital structure of Bajaj Auto.

- Profitability: Hero MotoCorp has witnessed a 12% year-on-year rise in standalone profit. The tax relaxation given in the Union Budget has a significant role to play. Moreover, various strategic moves also play a key role. For example, the board has approved a ₹5.15 crore investment in a Solar Power Wheeling project to supply clean, renewable energy to its facilities in Dharuhera and Gurugram.

Bajaj Auto showed a 3.3% year-on-year growth in profit. It was the slowest profit growth of the company because it focused more on sustenance than expansion in this quarter. The exports of the company are maintaining a sustained growth. The green energy portfolio contributed around 45% of revenue.

Subsequently, Bajaj Auto has delivered ₹905.7 crores, i.e. around 75% more profit than Hero MotorCorp. Hero MotorCorp has claimed to focus on expansion, which might have contributed to the disparity.

- Dividend: Unlike Hero MotoCorp, Bajaj Auto did not declare any dividends. Although there might be various factors behind this decision, a key reason might be the expansion strategy of Hero MotoCorp vs Bajaj Auto. While Hero MotoCorp recorded a robust growth in its EV segment and massive expansion in Bangladesh and Colombia, Bajaj Auto focused on sustaining its existing market and EBITDA. This difference in objective between Hero MotoCorp vs Bajaj Auto might have played an important role in their dividend decision.

Also read: JSW Energy Q4 FY25 result highlights

Hero MotoCorp vs. Bajaj Auto stock market performance

Against the backdrop of the quarterly reports, the table below shows how Hero MotoCorp and Bajaj Auto fared in the stock market. The details below highlight the stock performance as of 20 May 2025.

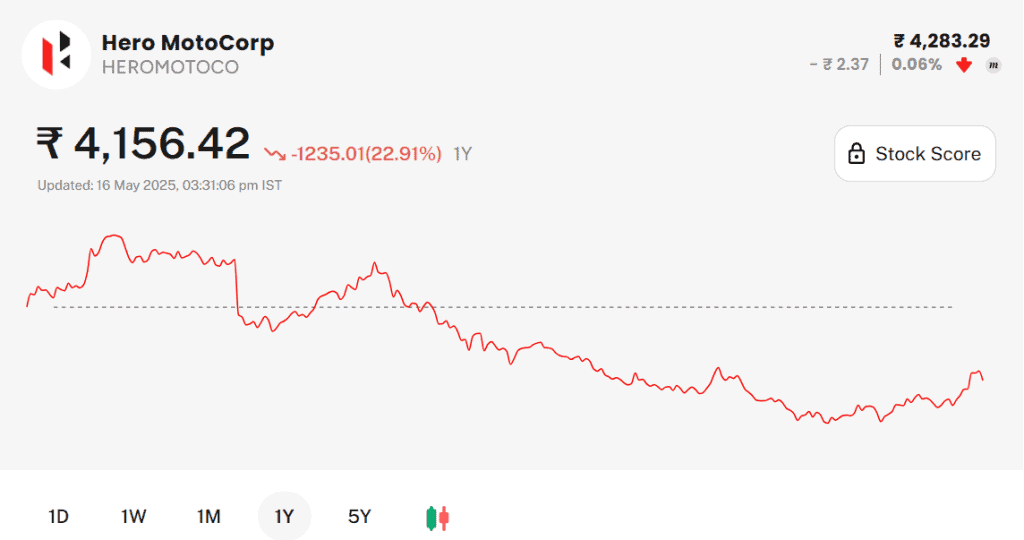

- Hero MotoCorp

Hero MotoCorp Ltd. is one of the major automobile stocks in India listed under the Nifty 50. Its market position is evident through its 8.42 Lakhs trading volume valued at ₹ 361.13 Crore.

At 14.48 IST on 20 May 2025, the company stock was trading at ₹4,256.05. The company has a market capitalisation of ₹84,986.67 Crores. As per the latest statements, the stock has recorded an EPS of ₹58.06. Over the past year, the stock has returned -14.1%.

The stock has a PE ratio of 19.4, whereas Nifty Auto’s PE ratio is 25.2. Hero MotoCorp stock experiences a daily volatility of 1.67. A stock volatility of around 1% is typical of Indian markets. However, it might change with the changing market dynamics.

- Bajaj Auto

Bajaj Auto Ltd. is one of the major automobile stocks in India listed under the Nifty 50. Its market position is evident through its 4.50 Lakhs trading volume valued at ₹ 390.84 Crore.

At 14.48 IST on 20 May 2025, the company stock was trading at ₹8,577.50. The company has a market capitalisation of ₹2,40,161.54 Crores. As per the latest statements, the stock has recorded an EPS of ₹78.62. Over one year, the stock returned 0.42%.

The stock has a PE ratio of 31.8, whereas Nifty Auto’s PE ratio is 25.2. Bajaj Auto stock experiences a daily volatility of 1.78. A stock volatility of around 1% is typical of Indian markets. However, it might change with the changing market dynamics.

Also read: Delhivery jumps 10% after Q4 results

Bottomline

Hero MotoCorp and Bajaj Auto are one of the leading automobile companies operating in the two and three-wheeler segments. A comparative analysis of the quarterly reports of Hero MotoCorp vs. Bajaj Auto can provide necessary fiscal takeaways that can aid investor decisions.

Both firms have demonstrated a significant commitment to the changing market sector dominated by EVs and modern computing methods like AI. Continuous innovation is required to meet the shifting needs of the contemporary globe.

Moreover, Bajaj Auto have shown a greater capital structure compared to Hero MotoCorp. However, their goals are distinct. While Bajaj focused on sustenance, Hero MotoCorp focused on expansion.