The real idea behind issuing shares was that a company could sell its stake to an investor to obtain money for expansion or day-to-day operations. Investors would get a share in a company’s profitability as dividends. But later, these shares started changing hands and investors started chasing price appreciation compared to dividends.

In this article, we will understand what are dividends, what are the types of dividends and how these work.

What are dividends and how do they work?

A dividend is a part of a company’s profits distributed to its shareholders. The board of directors of a company can choose to pay dividends quarterly, half-yearly, or annually. Paying dividends is not compulsory for a company. Some companies choose to hold cash for future expansion instead of giving dividends.

Also read: Dividend Stocks

The following four terms need to be understood before learning about the different types of dividends –

Announcement date – The date a company announces its decision to pay dividends, the date it intends to pay, and the amount.

Record date– The date before which shares must be available in a demat account for an investor to be eligible for dividends.

Ex-date – It is generally 2 days before the record date investors who want to be eligible for dividends must purchase shares before Ex-date so that they can receive the delivery of stocks before the record date.

Payment date – It is the date on which the dividend is credited to the bank accounts of the shareholders.

Types of dividends

Here are the various types of dividends issued by a company:

Cash dividend – This is the direct payment transferred to the bank accounts of the shareholders on the basis of the number of shares they hold. Paying cash dividends attracts investors but, on the other hand, leaves less cash with the company for future growth.

For example, if a company x made a net profit of ₹100 crores, it has 10 crore shares outstanding, and it decides to distribute ₹20 crore as dividends, each shareholder will get a dividend of ₹2 multiplied by the number of shares they hold.

Stock dividend – In order to save money and give shareholders a return, a company can choose to give a stock dividend. The company issues additional shares to the existing shareholders depending upon the number of shares they already hold.

For example, if an investor holds 1000 shares of company ABC and the company gives a 15% stock dividend. The investor would get 150 additional shares, therefore bringing his total shareholding to 1150 shares.

A stock dividend is different from a stock split because, in a stock split, a company breaks or divides its shares into little pieces.

Scrip dividend – Sometimes, a company might be running short of cash and still want to reward their shareholders, so they distribute a scrip dividend. A scrip dividend gives the shareholders an option to get cash at a future date or receive additional shares now.

A company creates new shares when distributing scrip dividends, unlike stock dividends, where the company already has extra shares of ownership that it can give to the shareholders.

Property dividend – Companies have the option to reward their shareholders with assets. These can be intangible assets like patents, shares in subsidiary companies, etc., or tangible assets like land, inventory, etc.

Companies choose this method when running low on cash or looking forward to monetising their assets.

For example, a company has ten shareholders, each holding 10% of the company. It chooses to reward them with dividends and at the same time there is a 10 acres of excess or unused land that belongs to the company that the company wants to sell which has a similar value to the amount of dividends that the company desires to distribute.

In this case, the company can distribute the land as a dividend instead of giving cash.

Liquidating dividend – This dividend is paid when the company is shutting down its operations. Once all the debt and other liability obligations are paid, a company can choose to distribute whatever remains to the shareholders in the form of liquidating dividends.

For example, after shutting down operations, selling all the assets, and paying off all the liabilities, the company is left with ₹5 million cash. Then, it can distribute that among shareholders as a liquidating dividend.

Also read: The final countdown: What you must know about company liquidation

Impact of paying dividends

A company that regularly pays dividends gives a message to the shareholders and investors that the company is financially sound and has good future growth prospects. Hence, investors are attracted to such companies, potentially driving their prices up in the long term.

However, a downside to dividend distribution is that the company may not have prospective future projects to finance. Therefore, investors need to analyse holistically regarding the same.

Moreover, if dividends are fluctuating, investors should check the reason behind it as it can be a sign of caution.

Also read: Dividend Rate vs. Dividend Yield

How different types of dividends work

Dividends are a way for companies to share profits with their shareholders. Depending on the company’s performance and policies, dividends can come in various forms. Let’s take a look at the most common types:

1. Cash Dividends: The most common type of dividend. Cash dividends are paid directly to shareholders in the form of cash, usually on a per-share basis. These are paid on a regular schedule, such as quarterly or annually.

- Example: If a company declares a cash dividend of ₹5 per share, and you own 100 shares, you will receive ₹500.

2. Stock Dividends: A stock dividend is paid out in the form of additional shares rather than cash. This type of dividend increases the number of shares you own but does not change the value of your investment.

- Example: A 10% stock dividend means if you own 100 shares, you will receive 10 additional shares.

3. Special (One-Time) Dividends: These are one-time dividends that are paid in addition to the regular dividends. Companies may declare a special dividend when they have excess profits or a surplus of cash.

- Example: A company may declare a special dividend of ₹50 per share in addition to the regular quarterly dividend.

4. Property Dividends: Instead of cash or stock, property dividends are paid in the form of company assets, such as real estate or physical goods. This is rare but can happen in some special circumstances.

- Example: A company may distribute property like machinery or land to its shareholders.

5. Scrip Dividends: Scrip dividends allow shareholders to choose between receiving their dividend in the form of additional shares or cash. This gives investors flexibility based on their needs.

- Example: If the company offers a 5% scrip dividend, you can choose to receive either the dividend in shares or in cash.

6. Dividend Reinvestment Plans (DRIPs): While not technically a type of dividend itself, DRIPs allow shareholders to automatically reinvest their dividends to purchase more shares of the same company, often at a discount.

- Example: If your dividend is ₹100, it will automatically be used to purchase more shares of the company, growing your position in the company.

How to calculate dividends on your investments

Calculating dividends is straightforward, but it requires knowing a few key details about the company and your holdings. Here’s how you can calculate your dividends:

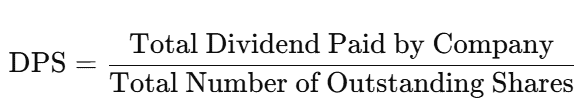

1. Dividend Per Share (DPS)

First, you need to know the dividend per share (DPS). This is the amount of money paid to each shareholder for each share they own.

Formula:

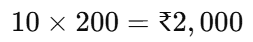

2. Total Dividend Income

Once you know the DPS, multiply it by the number of shares you own to calculate your total dividend income.

Formula:

Example: If a company pays ₹10 per share as a dividend and you own 200 shares, your total dividend income would be:

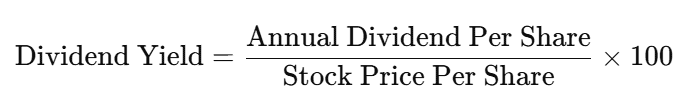

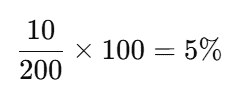

3. Dividend Yield

Dividend yield is a ratio that shows how much income you can expect from your investment in the form of dividends relative to the stock price.

Formula:

Example: If a stock is priced at ₹200 and pays ₹10 in annual dividends, the dividend yield would be:

4. Gross Dividend vs. Net Dividend

- Gross Dividend: This is the total dividend you receive before any deductions (such as taxes).

- Net Dividend: This is the amount you actually receive after taxes have been deducted. The tax rate depends on the jurisdiction and tax laws.

Bottomline

Dividends might be a good indicator of a financially strong company. It should not be the sole basis for choosing stocks for investment. A thorough research about the company must be conducted before investing.

FAQs

1 – What is a dividend?

A type of reward that a company gives to its shareholders is known as a dividend. A shareholder can get dividends if they hold shares in their demat account before the record date. Depending on how many shares they own, they receive dividends.

2 – What are the different types of dividend ?

A company is not required to pay dividends in cash only, despite being the most attractive to investors. A company can reward the shareholders by giving cash, stock, scrip, or property dividends. It can pay liquidating dividends when winding up.

3 – Difference between scrip dividend and stock dividend ?

At first, these kinds of dividends might look the same but they are not. A company pays a stock dividend in the form of shares it already owns and when giving a scrip dividend, a company creates new shares.

4 – When does a company pay dividends ?

A company has flexibility as to when it can pay dividends. A company can do so quarterly, semi-annual, or annually or the company might choose to not pay dividends at all. However, companies usually announce dividends with their quarterly or annual results.

5 – What is dividend yield ?

The percentage returns that an investor earns from dividends in a year is called dividend yield. The formula is annual dividend per share divided by market value per share.

The metric is used when comparing the financials of various companies.