As a stock investor, if you expect the stock price to surge, you have two options. Either you go forward to buy the stock and hold it back to your demat account, or you buy the futures. But what if there is a negative view of your invested stock? In this case, you can sell those futures or buy a put option. If no stock is available on the F&O, the best option is short selling.

Short selling in the stock market is quite common among traders. However, many new investors lack the knowledge of what exactly it is and how it works.

What is short selling?

As a part of the investment strategy of shorting stocks, the short seller bets about the stock that will decline. In short selling, an investor strategically borrows stock shares they expect to lose value, sells them at market value, and then buys them back at a discount.

The investor then returns the shares to its original lender to complete the short sale, pocketing the difference in value between the buy and sell prices. In other words, shorting a stock is a trading strategy.

Investors can make significant profits if the stock’s price declines, but they risk enduring limitless losses if the price rises. However, one should know that short selling is possible in stocks not falling in the “Z” group or Trade to Trade segment (a category of stocks where delivery of shares is compulsory for every trade, and no speculative trading is allowed.)

You may also like: Dividend Rate vs. Dividend Yield

Some facts you must know about short-selling shares-

- In short selling, the seller borrows shares from another owner to sell, as they do not own the shares.

- Only institutional and retail investors are allowed for short selling.

- Short selling is based on speculation.

- When engaging in short selling, the seller speculates on a price decline and may suffer losses if prices increase.

- Upon settlement, traders have an obligation to return the borrowed shares to the owner.

- Investors must disclose their intention to conduct a short sale as part of the transaction.

What is the purpose of engaging in short-selling stocks?

Short-selling stocks happen for two reasons-

- Speculating: To profit from a stock’s decline, stock market investors or speculators short-sell by finding what they perceive to be an expensive stock. It is considered a risky investment tactic.

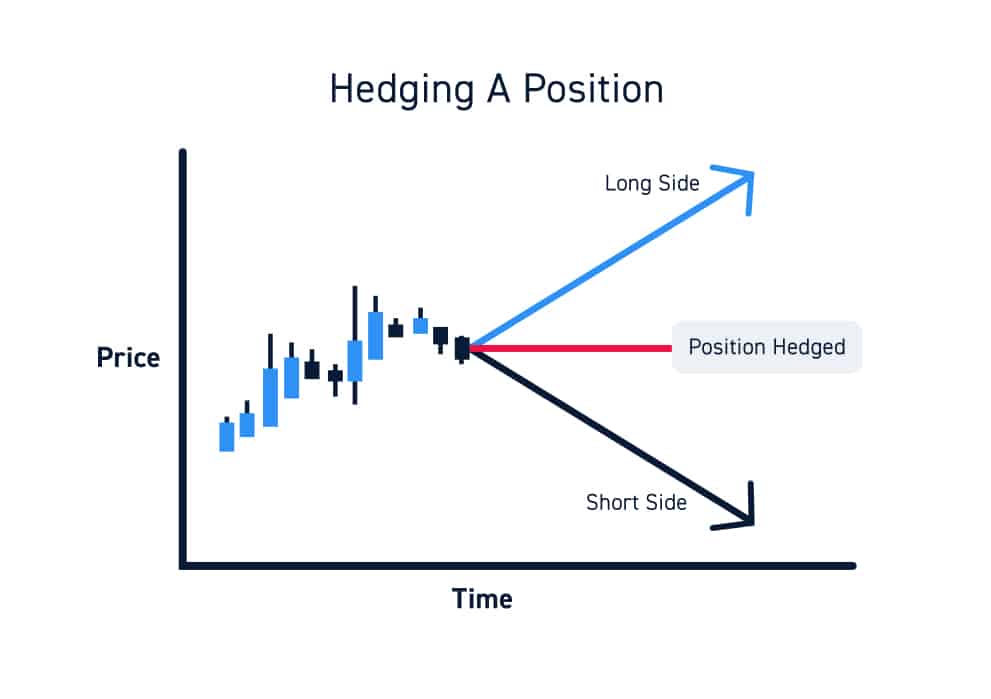

- Hedging: Most of the short sellers are hedgers. Hedgers sell stock to reduce the risk associated with their other long positions in the market. Hedgers prefer to protect gains on other long-position investments in their stock portfolio by making money from a short sell. For many hedge funds, hedging is a typical investment technique.

How does the short selling work?

Selling a stock short involves purchasing it back just before the trading day ends. You get an overall time of 5 to 6 hours. Short selling is used when you anticipate that the stock price will decline during the day. Short selling consists of three steps-

- You must choose the MIS (Margin intraday square-up) option to inform the system about the short-selling order when creating the sell order.

- An intraday order requires margin payment. However, you can lower the margin by using the Cover Order (CO) step. You can add a stop loss to a CO and a stop loss and profit goal to a BO.

- Orders for intraday short sales must be closed out on the same day by law. Around 3:15 pm, brokers perform an RMS (Risk Management System) check and automatically shut out open orders.

Scenarios after short-selling shares

When you sell the stock, the value decreases. Here’s an example: If you sold 500 shares of RIL at Rs. 1,100 and the price decreases to Rs. 1,080, you can close out and book profits of Rs. 10,000.

When you engage in short selling, and the stock price goes up, setting a stop loss will automatically close your position. To minimise losses, you may choose to stop out early.

After placing a short sell order, there will be no activity in your stock for the first four hours. To avoid the volatility in the last hour, you may opt for a closeout. However, do keep in mind that you may incur some losses after accounting for brokerage expenses.

Also Read: Difference between Nifty and Sensex

What are the risks involved in short selling?

- Timing error

The successful execution of short selling hinges on the timing of share purchases and sales. Although stock prices might not drop immediately, a trader is still responsible for paying interest and margin while he waits to profit from the stock price.

- Borrowing money

Margin trading, often known as short selling, is when a trader borrows a collateralised asset from a brokerage. All traders are required to keep a specific percentage in their accounts by the broker.

- Returning Security

The seller must prioritise returning the security amount to the owner within the allotted time frame; otherwise, they will come under inspection by the market regulator.

- Regulations

Even though market regulators allow short selling, they are subject to a prohibition in a particular industry at any moment to protect investors and prevent panic, which can drive up prices.

Benefits of short selling

- Gives investors market liquidity, which could lead to lower stock prices, better bid-ask spreads, and help with price discovery.

- Ability to lower total market exposure and hedge existing portfolio’s long-only exposure.

- The manager can use capital gains from short sales to overweight the long-only portion of the portfolio.

- Exposure to long and short positions can reduce the overall volatility of a portfolio and increase the potential for significant risk-adjusted returns.

What are the short selling examples?

Short selling is a trading strategy where an investor makes money when a stock price falls. It involves selling a stock first and buying it back later at a lower price.

Simple example:

- You believe a stock trading at ₹500 is overvalued.

- You borrow the stock and sell it at ₹500.

- A few days later, the stock falls to ₹420.

- You buy it back at ₹420 and return it to the lender.

- Profit = ₹80 per share (before costs and charges).

Another example in real markets:

Suppose a company reports weak earnings or faces regulatory trouble. Traders may expect the stock to fall and short-sell it ahead of the news. If the price drops as expected, they exit the position at a lower level.

However, if the stock rises instead of falling, losses can increase quickly. For example, if the stock moves from ₹500 to ₹650, the short seller faces a ₹150 loss per share, and losses can theoretically be unlimited.

Short selling vs long selling

Short selling and long selling are opposite strategies, based on different market expectations.

Long selling (buy first, sell later):

- You buy a stock because you expect its price to rise

- Profit is made when you sell at a higher price

- Maximum loss is limited to the amount invested

- Used by long-term investors and growth-focused traders

Short selling (sell first, buy later):

- You sell a stock because you expect its price to fall

- Profit is made when you buy it back at a lower price

- Losses can be unlimited if the stock keeps rising

- Commonly used by traders, hedge funds, and for hedging risk

Key difference in mindset:

- Long selling benefits from growth and optimism

- Short selling benefits from declines, corrections, or weak fundamentals

Conclusion

Short selling in the stock market isn’t for fresh investors or traders. This is because there are many speculations and potential losses if done wrongly. It is important to learn what is shorting and then get into the basics of it before heading over to the process.

Once you turn into an experienced trader, you can try on this technique.

FAQ’s

A short position is when an investor sells a stock they do not own, expecting its price to fall. The stock is bought back later at a lower price to make a profit.

If the price rises instead, the investor incurs a loss, which can be unlimited.