Sometimes the market moves slow-mo, with no big breakouts, no sharp falls, just quietly drifting. That’s when the experienced investors reach out for the strategies built to excel in calm conditions, and one of those tools is the butterfly option strategy.

The butterfly option strategy is a neutral, non-directional option strategy, which combines four option positions at three different strike prices to create a structure with limited risk, limited reward, and a defined profit zone.

Investors use it to target a specific price level while keeping their downside risk contained. Understanding how butterflies work in the stock market helps investors to leverage low-volatility phases, plan entries, and control risk with more confidence.

Learn about the Butter Option Strategy, its types, how it works, its advantages and disadvantages, and more.

What is a Butterfly Option Strategy?

The butterfly option strategy is a neutral, non-directional options strategy which combines four options contracts of three different strike prices to profit from low volatility, with the same expiration date.

In the case of a call option, a trader buys one option at a lower strike, sells two options at a middle strike, and buys another option at a higher strike or vice versa, in the case of put options. It keeps both the risk and the potential gains limited, so the trader always knows their range upfront. The setup works best when the price finishes right at the middle strike on expiry, because that’s where the payoff hits its peak.

It is like building a little price trap that works only if the stock ends up near the middle strike price, and to build that trap, the butterfly uses four options arranged in a funny-but-smart way. As the investors want maximum profit, it is possible only if the stock lands at the middle strike. So, to create that profit mountain, the investor uses two forces to push down from both sides. That’s why traders place two short options at the middle strike, this is what builds the actual payoff shape.

Types of Butterfly Option Strategies

Let’s explore the various butterfly option strategies!

Bullish Butterfly Spread (Long Call / Short Put Butterfly)

A bullish butterfly spread is used when the investors expect a small upward move, and not a rally. The strategy can be constructed using exclusively call or put options, and both create the same payoff. This setup aims to profit when the price drifts towards the middle strike price at expiry, with limited risk and reward.

The investors, here, might want to place the middle strike slightly above the current price so that they can profit if the market drifts upwards to it.

Bearish Butterfly Spread (Long Put / Short Call Butterfly)

A bearish butterfly spread works when the investors expect a little drop, and not a full sell-off. It can be built using only puts or only calls, each giving the same structured payoff. The investors benefit from this strategy if the price settles near the middle strike at expiry, keeping both risk and reward limited while targeting steady, controlled outcomes.

Here, the investors place the middle strike slightly below the current price so that they can profit if the market drifts downward into it.

How Does Butterfly Strategy Work?

- Setup: The strategy uses four options that expire on the same day but have three different strike prices. The trader takes one option at the lower strike, two at the middle strike, and one at the higher strike. This creates the classic butterfly structure around the centre strike.

- Profit Zone: If the underlying asset’s price is exactly at the middle strike price when the options expire, the trader achieves the maximum profit.

- Limited Risk: The net debit paid to enter the trade, plus commissions is the maximum loss a trader is subject to. This happens when the price finishes outside the entire range, either beyond the top strike or below the bottom strike by the time the option expires.

- Market View: The strategy is used when the investors expect the price of the underlying asset to remain stable, or range-bound, and they have a high conviction on a particular price point at expiration.

Payoff Chart & Example (NIFTY Options)

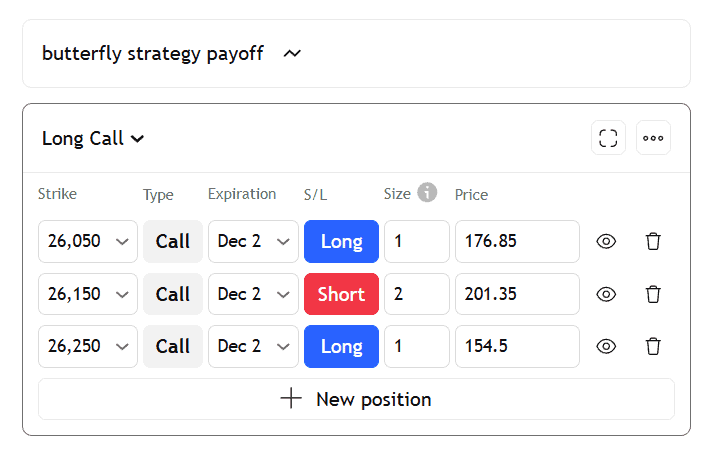

Here’s an example, involving a NIFTY long call butterfly with three strikes: buy 26,050, sell two 26,150 calls, and buy 26,250, all with the same expiry.

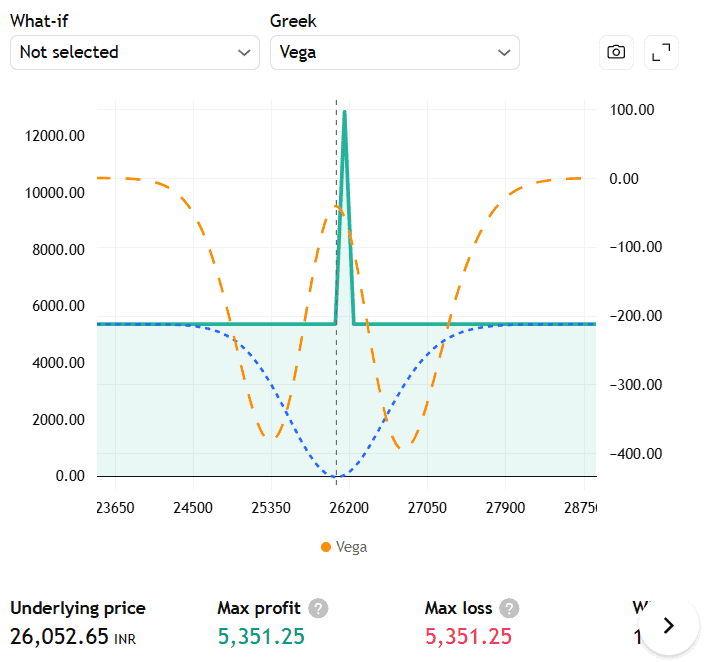

This creates the classic butterfly shape on the payoff chart, with low risk on both sides and a sharp profit peak at the middle strike. Here, the max profit and max loss are equal at ₹5,351.25, which reflects the tightly balanced structure of the butterfly.

In the chart below, the Green line represents expiry payoff, the blue line represents current profit-loss before expiry, and the orange line represents the implied volatility or Vega, which is the strategy’s sensitivity to volatility changes.

Since the trader here sells two calls at 26,150, the most expensive strike, the net cost of the strategy stays low. The position makes its maximum profit if NIFTY expires exactly at 26,150, where the short calls decay perfectly and the wings balance out. If NIFTY expires far above or below the wings, beyond 26,050 or 26,250, the trade only loses the debit paid upfront.

When to Use the Butterfly Option Strategy

- Low volatility: This strategy works best when the market is calm and price movement is limited. It performs well when the asset is expected to trade within a steady, predictable range without big swings.

- Neutral or range-bound market: The investors might use it when they believe the market will stay within a specific, narrow price range and won’t make a major move.

- Minimal price movement: If the investors anticipate little to no significant price movement in the underlying asset, the strategy might provide a defined profit.

- High implied volatility expected to decline: The investors might profit from the decline in volatility if implied volatility is currently high and expected to fall before expiration.

When NOT to Use Butterfly Strategy

- High volatility is expected: The investors usually avoid this strategy when they expect large and sudden price movements, as it could lead to significant losses.

- Directional market: If the investors have a strong conviction that the market will move significantly higher or lower, they might believe a directional strategy would be more appropriate.

- Before major events: The investor should not use this strategy for a major event, such as an earnings report or an economic announcement, as it might cause a large price gap.

- Underlying price is expected to move beyond the outer strikes: A large move beyond the outer strike prices will result in maximum loss for a long butterfly.

Setup Steps – Entry, Strike Selection & Expiry

- Step-1 Choose the Underlying Asset: The investors are first required to pick a stock or index they expect to stay stable or within a narrow range.

- Step-2 Select the Option Type: Next, they have to decide whether to use calls or puts. Both of these create the same payoff shape, so the investors choose whichever is cheaper or fits their slight market bias.

- Step-3 Execute the Trades: Then, they build the butterfly by buying one lower-strike option, selling two at the middle strike, and buying one higher-strike option, which must share the same expiration date.

Risk, Reward & Breakeven Explained

- Risk: The maximum possible loss is limited to the initial net debit or cost paid to open the position, plus the commissions. This happens when the asset finishes outside the entire strike range at expiry, either below the lowest strike or above the highest one.

- Reward: The strategy offers limited profit, and traders get the maximum only when the expiry price lands exactly on the middle strike. The profit comes from the gap between the strikes, minus whatever premium went into building the position.

- Breakeven: There are two breakeven levels in this setup. The trader find the lower one by adding the net premium paid to the lower strike. The upper breakeven comes from subtracting that same net premium from the higher strike.

Impact of Volatility & Greeks

Implied volatility (Vega): A long butterfly has a negative Vega, so it benefits the investors when the implied volatility drops, which makes it ideal when IV is high and is expected to fall. While a short butterfly has positive Vega, it gains from rising volatility and larger price swings beyond the strike range.

Option Greeks: In the case of a butterfly options strategy, the Delta starts close to neutral, but it shifts as the price moves towards either of the wings. The Gamma is negative, due to which sharp moves hurt the position. The Theta helps when the price stays near the middle strike, as time decay favours the butterfly.

Advantages & Disadvantages of Butterfly Option

Advantages of the butterfly option strategy:

- Limited Risk: The maximum loss that could occur is known upfront and is limited to the initial net cost or debit of establishing the position, which makes it a defined-risk strategy.

- Ideal for Range-Bound Markets: The setup works best when the market barely moves. Its ideal outcome comes when the underlying finishes the expiry session close to the middle strike, since that’s where the payoff sits at its strongest.

- Predictable Payoff: In this strategy, both the potential profit and loss are clearly defined at the outset, which allows better risk management and planning.

Disadvantages of the butterfly option strategy:

- Limited Profit Potential: The profit potential stays limited, even if the underlying makes a sizable move but still remains inside the outer strike range.

- Requires Precision: This strategy demands accuracy, and the trader gets the full profit only when the underlying finishes right at the middle strike on expiry day, something that doesn’t happen often, which makes the perfect outcome tough to capture consistently.

- Complexity and Costs: The construction of a butterfly spread involves executing four options contracts or four legs simultaneously, which can be complex and result in higher commission and transaction costs.

Summary

A butterfly option strategy is built to profit when the market is expected to stay calm and the price drifts towards a defined strike level. It uses four options to shape a limited-risk, limited-reward setup that peaks near the centre strike. This makes it useful for range-bound phases, which provides the investors with a controlled way to trade in low-volatility markets with a clear payoff structure.

FAQ‘s

A butterfly option strategy is a neutral, non-directional options strategy which combines four contracts with the same expiration date but three different strike prices to profit from low volatility.

In the butterfly option strategy, the investors buy one lower-strike option, sell two at the middle strike, and buy one higher-strike option, with the same expiry date. The payoff peaks if the price closes at the middle strike.

The butterfly option strategy is suited for low-volatility phases, when the market is expected to stay quiet and trade within a narrow range.

In the butterfly spread strategy, the risk is limited to the net debit paid. And the reward is limited as well and is earned only if the price settles exactly at the middle strike on expiry.

The regular butterfly uses either all calls or all puts. While the iron butterfly mixes calls and puts to form a similar payoff, but with margin requirements instead of a net debit.

Yes, in case of butterfly spread, if the price finishes outside the outer strikes, the spread loses the net debit paid at entry.

The investors usually roll the middle strike closer to the market price, widen the wings, or convert the position into a wide-wing spread if the price drifts away from the target zone.