In a market where retail investors are increasingly drawn to the thrill of derivatives trading, SEBI Chief Tuhin Kanta Pandey recently reminded everyone that derivatives aren’t tools for quick profits, but for hedging and risk management.

This highlights why understanding hedging matters. However, when in certain cases regular hedging options or identical derivatives aren’t available, that’s when cross hedging walks in. It helps investors to offset risk by using correlated assets to protect their portfolios against market fluctuations.

In this blog, learn what cross hedging is, how it is different from regular hedging, its purpose and benefits, and much more.

What is cross hedging?

Let’s start with understanding what hedging is. Simply stating, hedging is purchasing an asset to minimise the risk of another asset that is already in possession. It is a strategy used to manage risk in derivative trading.

Now, cross hedging is a method used when a direct hedge for an asset is not available. Instead, an opposite position in another asset is held, whose price trend tends to move in a similar direction.

Cross hedging involves hedging an asset by taking an opposite position in another but correlated asset, such as futures or forwards contracts, if a direct hedge is not available.

Let’s understand with an example: Air India wants to hedge against jet fuel prices going up, and since there is no future contract for jet fuel, they use crude oil futures, as their prices are correlated.

However, as the two assets tend to move in a similar direction but aren’t exactly related, the hedge might not guarantee full offset of losses. The difference between the price moves that take place is known as the basis.

How cross hedging differs from regular hedging

| Key Difference | Cross Hedging | Regular Hedging |

| Aim | To offset losses using correlated assets, when an exact hedge is not available. | To offset losses using related assets. |

| Derivative | Uses a different but correlated derivative to the existing asset. | Uses a same or highly similar derivative to the existing asset. |

| Effect | Can not fully eliminate risks but reduce it with profits from the hedging asset. | Its goal is to completely eliminate risks, creating a perfect hedge. |

Purpose and benefits of cross hedging

Purpose of cross hedging:

- Financial risk management: It reduces risk by holding an opposite position in a correlated asset of the existing asset, when an exact match is unavailable.

- Handle unique assets: It helps to manage risk for assets or commodities that do not have direct hedging options.

- Find alternatives: When related futures contracts are not available or are expensive, cross hedging provides a substitute to achieve similar risk management.

Benefits of cross hedging:

- More flexibility: Cross hedging helps investors to make risk management strategies that fit their needs and adapt to changing market conditions. With this, investors can choose derivatives with better liquidity or stronger correlation.

- Lower costs: Direct or regular hedging options could be expensive or illiquid. Therefore, using a correlated asset can reduce risk more efficiently, at a lower cost.

- Stable profits: Investors can generate consistent cash flow and profits by reducing risks of price moves through low-cost correlated assets.

Instruments used (futures, options, ETFs)

There are different instruments that can be used for cross-hedging, depending on the type of asset, risk level, and market availability.

- Futures: Futures are commonly used in cross-hedging in assets, equities, or currencies. For example, hedging crude oil futures with jet fuel or index futures manages risk associated with a particular sector.

- Options: Options are useful in complex hedging as they provide greater flexibility than futures. It can also be combined with futures, used for delta-cross-hedging to balance mismatched assets, or used as portfolio insurance through put options on correlated assets. For example, buying put options for an S&P 500 ETF to insure a stock portfolio from market declines.

- ETFs: ETFs are widely accessible, diversified, and cover multiple markets. It helps investors to hedge against market risks, inflation, currency shifts, or sector-specific risks through inverse, commodity, international, or sector-based ETFs. For example, buying a gold ETF to protect against inflation.

Calculating cross-hedge ratio

The hedge ratio measures the portion of the spot price or the existing asset’s value protected through a hedge, compared to its total value. It is calculated as,

Hedge Ratio = Hedged Value/Total Value

The standard hedge ratio is 1, and a lower hedge ratio signifies more contracts are required to completely offset the losses.

For example, an investor holds $200,000 in crude oil assets and hedges $150,000 through a Brent crude futures contract. Here, the hedge ratio is 0.75 ($150,000 / $200,000), which means 75% (0.75 x 100) of the spot price is hedged.

Risk considerations and limitations

- Basis risk: The most significant risk of cross hedging is basis risk. It is the difference between the price movements of the hedged asset and the hedging asset. It occurs when the two correlated assets do not move together in the same direction, making the hedge imperfect, leading to significant losses.

- Partial risk elimination: Cross hedging cannot fully offset risks due to basis risk. The lack of similarities between the commodities indicates the hedge can not cover the intended risk reduction.

- Analytical Complications: Cross hedging requires a thorough understanding of the relationship between different asset classes and derivatives, compared to regular hedging. Investors need to carefully analyse and monitor correlated instruments to make cross-hedging effective.

AI-powered cross-hedging analysis via Stoxo

An AI could enhance cross hedging by detecting correlations, calculate hedge ratios for optimal hedge, and adjusting strategies in accordance to the market. Tools like Stoxo (not a full-blown auto-hedging platform), can provide real-time price trend analysis, identify correlating stocks, and track market sentiment.

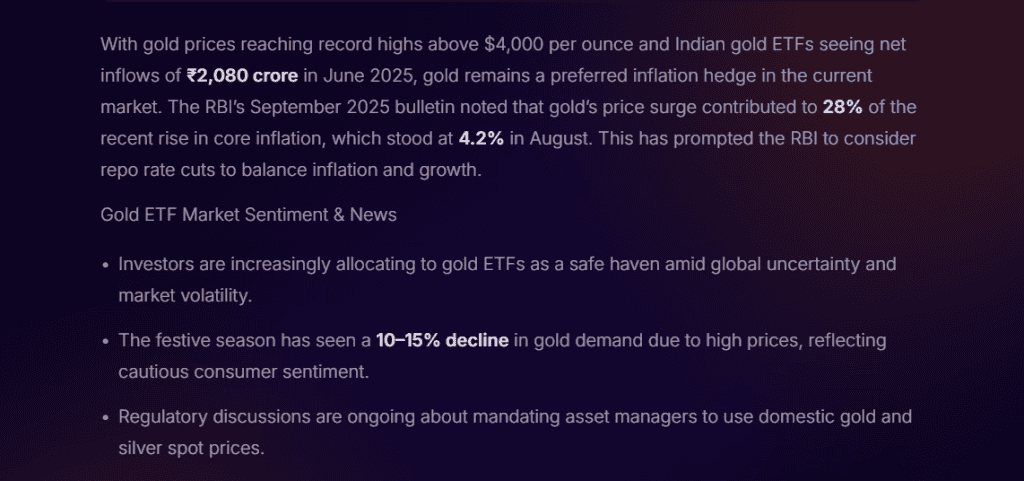

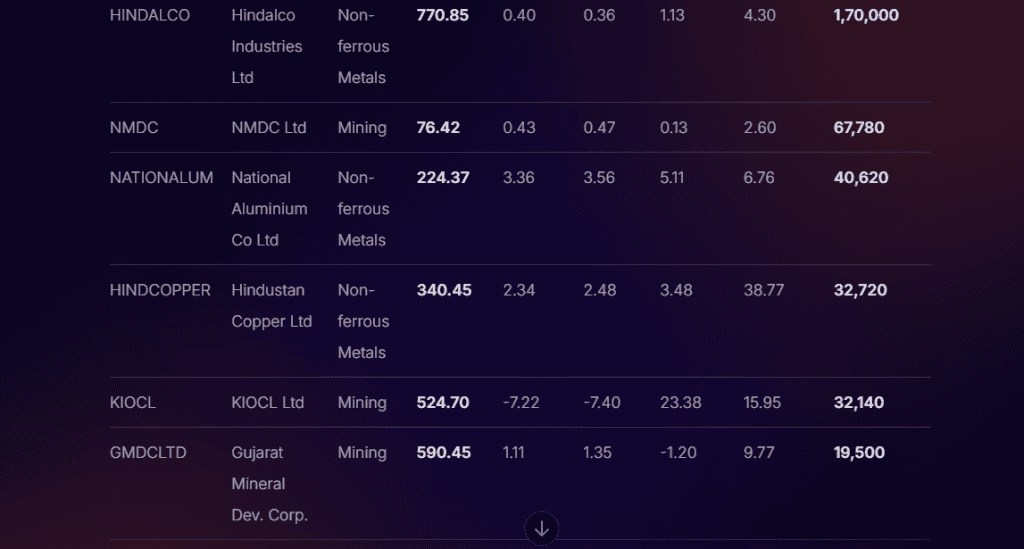

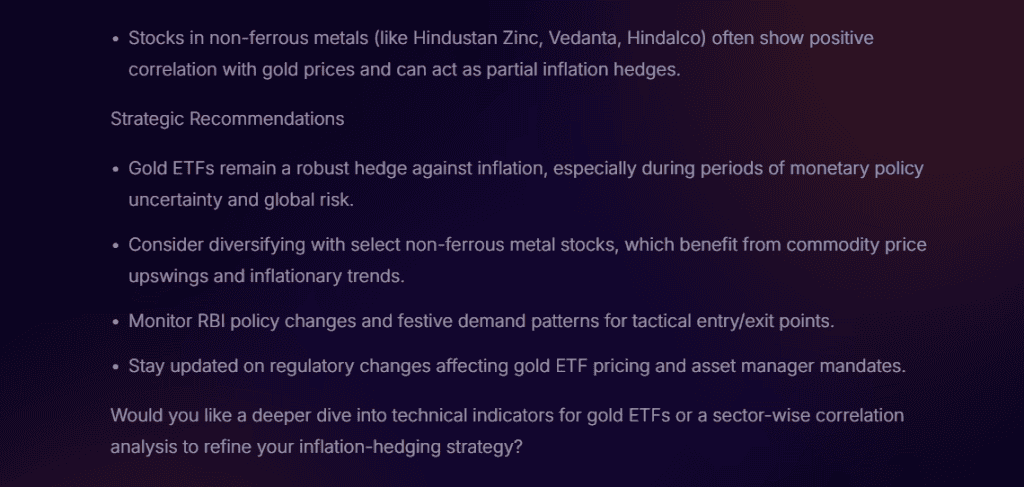

The following results were presented by Stoxo, after running a simple prompt as “I’m looking to cross hedge inflation with gold ETFs, can you help me with it by providing real-time price trend analysis, identifying correlating stocks, and tracking market sentiment and other important strategies”.

A representation of rising demand for gold ETFs amidst inflation, by Stoxo, helping investors identify correlated stocks for effective cross-hedging.

Real-world examples and case studies

Let’s dive into some real-world examples of potential cross-hedging strategies:

Tata Steel Limited, Derivative and hedging strategies: Tata Steel uses derivatives to hedge against steel price volatility. Since direct steel futures are limited, it might cross-hedge using iron ore or coal futures, which often move similarly to steel prices.

From this chart, representing Tata Steel’s price moves, cross-hedging insight can be derived based on how such companies usually manage risk.

Reliance Industries, Derivatives and Options Trading: Reliance Industries uses derivatives and options trading to manage risks arising from crude oil and petrochemical price fluctuations. The company might use Brent crude oil futures and energy index options for hedging, costs, and product prices.

The chart represents the stock movement of Reliance Industries, for which they use derivatives and options trading strategies for risk management against market fluctuation.

Conclusion

Cross hedging is an effective strategy for offsetting financial risk when direct hedging options are unavailable. By the use of correlated assets such as futures, options, or ETFs, investors can reduce risks and protect asset value.

While it doesn’t fully offset risks due to basis difference, data-based analysis and AI assistants like Stoxo could make it more accurate and efficient.

FAQ‘s

Cross hedging involves hedging an asset by taking an opposite position in another but correlated asset, such as futures or forwards contracts, if a direct hedge is not available.

Normal hedging uses the same or highly related assets to entirely offset risks, while cross hedging uses correlated assets, which may not completely offset risk.

Cross-hedge ratio is calculated as:

Hedge Ratio = Hedged Value / Total Value.

It helps to calculate the value of the spot price or existing asset that shall be covered through a hedge.

Cross hedging offers more flexibility, lower cost, and risk for assets without direct hedging instruments, and helps to stabilise profits and cash flow.

The common instruments used in hedging include futures, options, and ETFs, depending on the type of asset and market availability.

The most significant risk involved in cross hedging is basis, where the hedged asset and hedging assets don’t move together similarly, leading to partial risk coverage.

Yes, AI tools like Stoxo can analyse correlated stocks, identify hedge instruments, calculate hedge ratios, and provide real-time insights for proper decision-making.