Did you know that India has 12 public sector banks, having total assets worth USD 1.6 trillion i.e., almost equal to the GDP of Canada? The total 22 private sector banks had assets worth USD 925 billion. Huge figures to digest. Clearly, banks form an important segment of financial services sector in India.

And yet, the investment portfolio of financial services firms is never a topic of discussion!

Well, here’s another interesting tit-bit – Indian financial services firms tend to hold stakes in their competition. Not directly but, through their subsidiaries, of course.

This might just be a rendition of the famous saying, keep your friends close; your COMPETITION closer.

So, let’s dwell on how much stake these financial services firms might be holding in each other. And if there are any limitations!

Portfolio of financial services firms

Put simply, institutes in which the majority stake is held by private individuals or institutes are known as private firms. Thus, Axis Group, HDFC Group, and ICICI Group are some of the sought-after and leading private players in India.

Now, let’s view their portfolio –

Axis Group Portfolio

Axis Group owns stakes in 20 institutes from different sectors. However, what’s interesting to note is it holds stakes worth Rs. 11,861 crore in Kotak Mahindra Bank and Rs. 7,247 crore in ICICI Bank. Both banks are private and direct market competitors of the group’s banking subsidiary – Axis Bank.

Of course, Axis Bank does not hold stakes in its competition. But other subsidiaries like Axis Asset Management Company (AMC), Axis Securities or Axis Capital may be holding stakes in the two private banks.

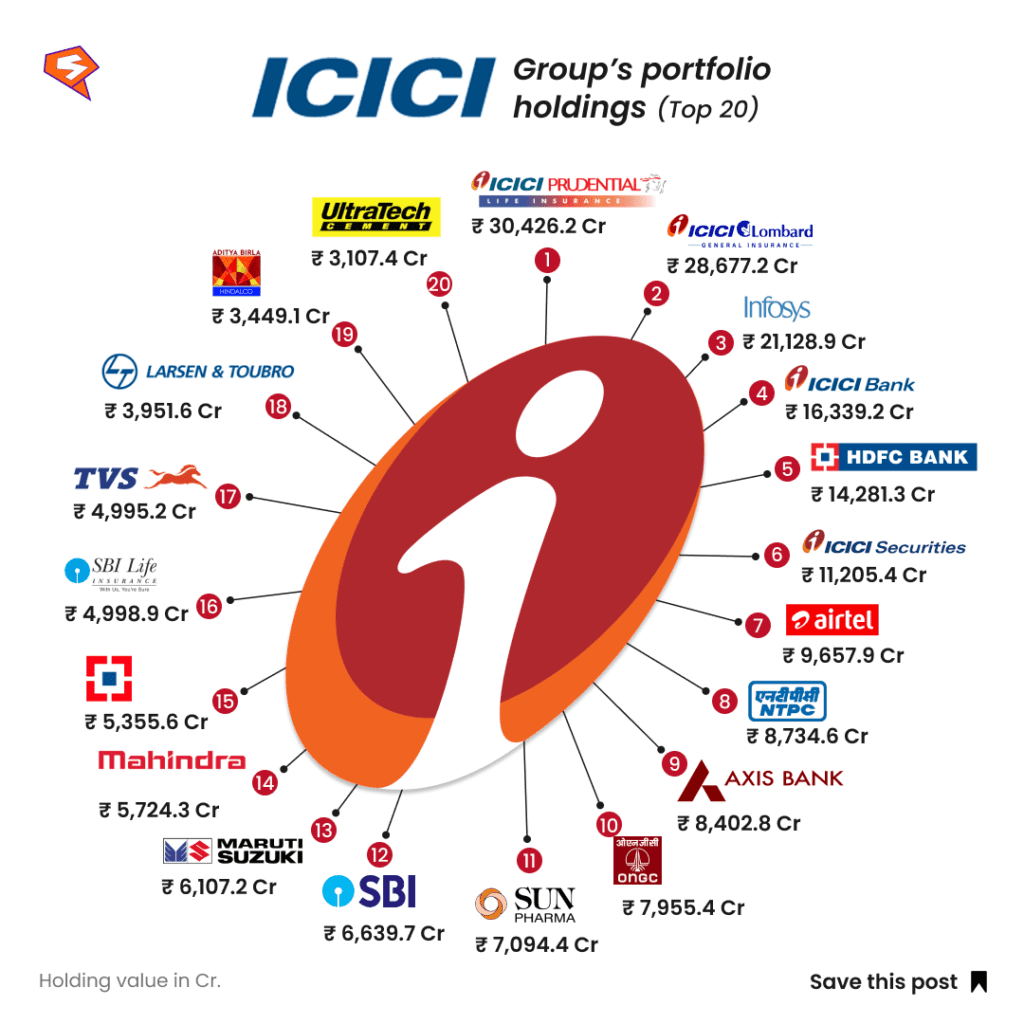

ICICI Group Portfolio

Now, here’s another interesting insight – ICICI Group also holds stakes in Axis Bank worth Rs. 8,402 crore – a coincidence maybe, but it is definitely an interesting observation.

Additionally, it also holds stakes worth Rs. 5,355.6 crore in HDFC Bank – richest private bank and Rs. 6,639 crore in State Bank of India (SBI), the largest public bank in the country.

It may be that ICICI Group’s subsidiary – ICICI Lombard, ICICI Prudential or ICICI Securities – might have invested in Axis Bank, SBI or HDFC Bank.

You may also like: Ever wondered how ChatGPT makes money?

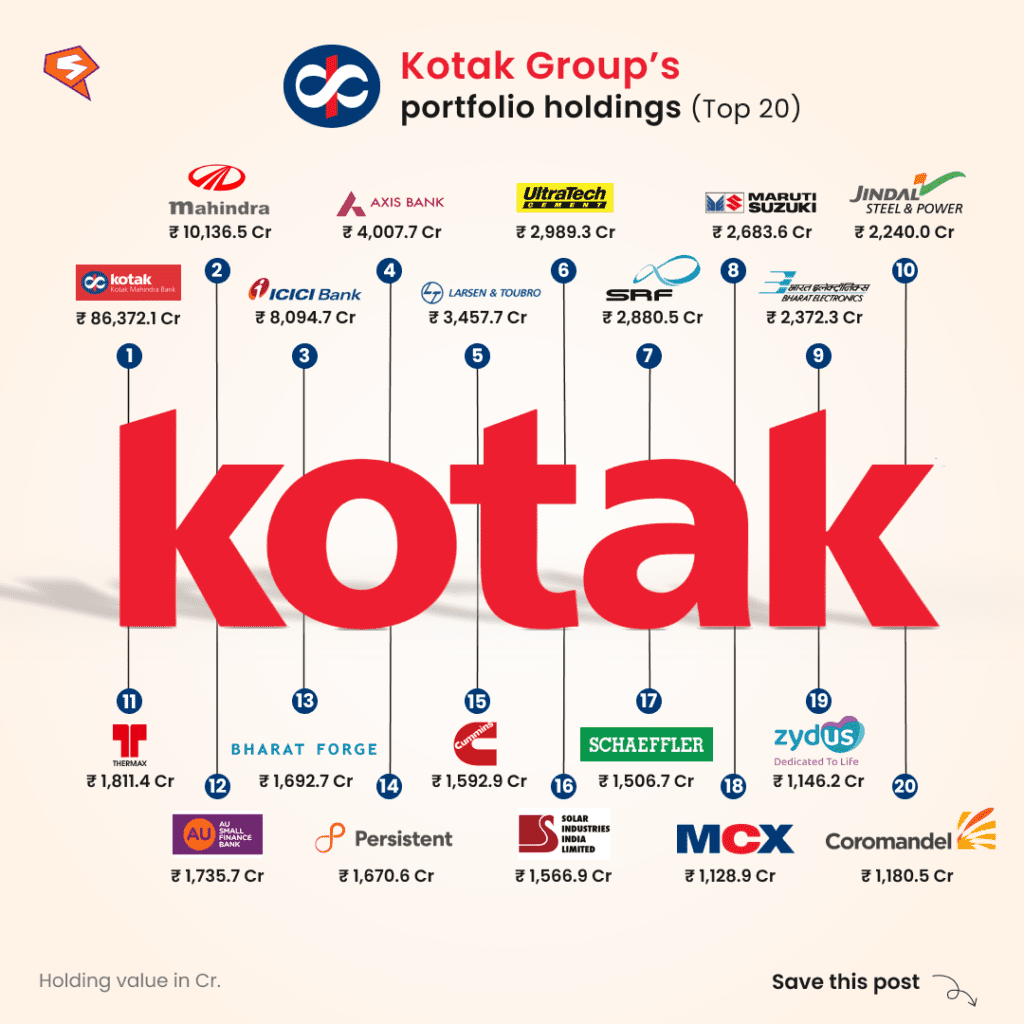

Kotak Group Portfolio

By now, you would have gauged the trends. And so, it may not come as a surprise that Kotak Group owns stakes in both Axis Bank and ICICI Bank. They are worth Rs. 4,007.7 crore and Rs.8,094.7 crore, respectively.

Do you think a similar trend would be evident in public players? Well, it’s time to dive deep into three public banking players.

Public financial services players

In contrast to private players where private entities/individuals hold majority stake, the government holds the highest percentage of stakes in public sector firms. E.g. State Bank of India (SBI), Canara Bank and Bank of Baroda. However, these firms too, have a portfolio of investments.

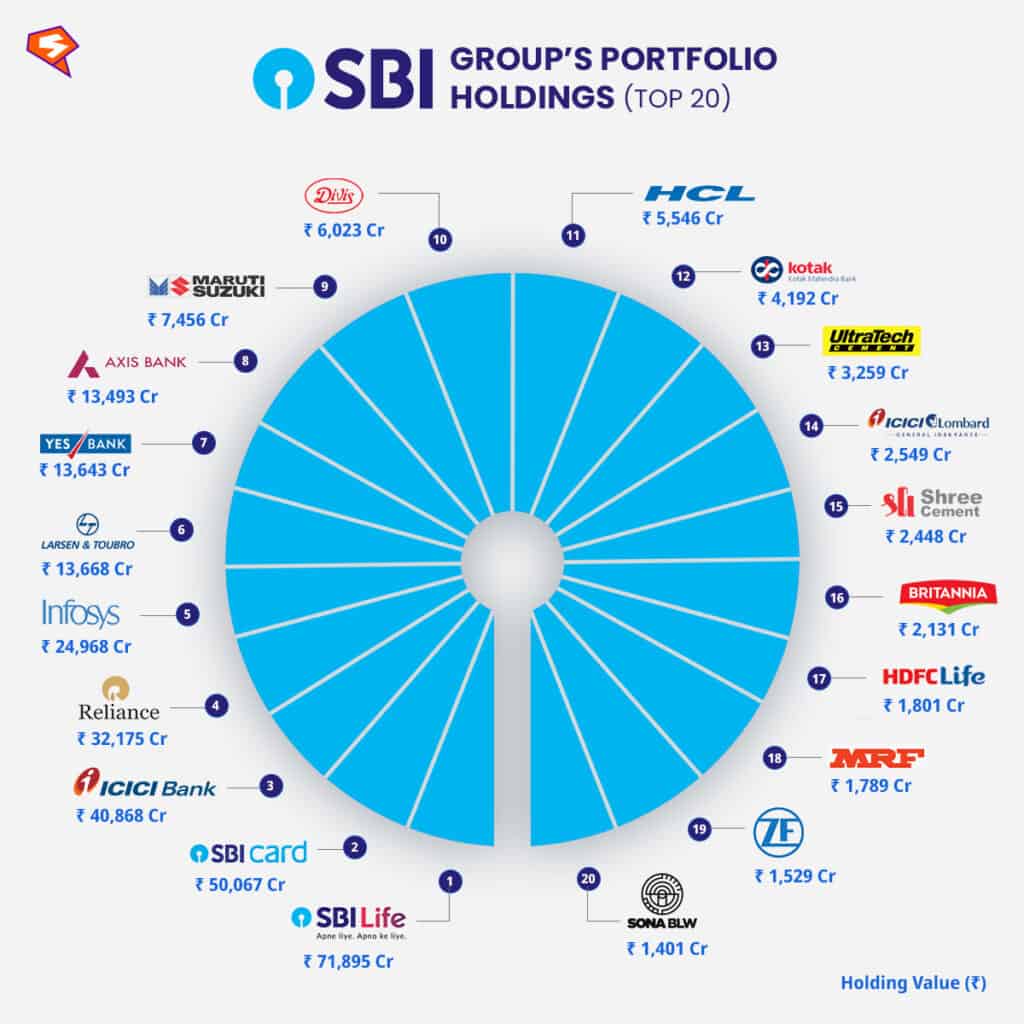

State Bank of India (SBI) Group

The largest public sector bank in India, accounts for 23 percent share in the total market capitalisation. It is owned by SBI Group.

And interestingly, if you observe its portfolio, SBI Group holds stakes in four private players – Kotak Mahindra Bank (Rs. 4,192 crore), Axis Bank (Rs. 13,493 crore), Yes Bank (Rs. 13,643 crore) and ICICI Bank (Rs. 40,868 crore).

SBI Group, however, holds no stakes in public lenders for obvious reasons – i.e., max stakes in public players are owned by the government.

Interestingly, group owners of other public banks like the Bank of Baroda, Canara Bank, and Indian Bank do not have other bank holdings in their portfolios.

A possible reason for this is the lack of liquidity to invest. Let’s again reiterate – the government holds approximately 70 percent stake in public banks.

Note: Banks do not directly hold stakes in their competition owing to “conflict of interest”. But as observed above, their owners can invest in other banks via subsidiaries. Thus, evaporating the conflict entirely.

Read also: How much is the Rupee worth across the globe?

Why do financial services firms invest in each other?

Let’s break this question into two parts –

- A. Why do financial services firms invest in other firms?

- B. Why are these firms investing in direct competitors of their subsidiary?

Let’s answer the first question in the context of banks. When discussing banks putting money in other firms, the term ‘investment banks’ comes to mind. Of course, these banks specialise in funding and raising capital. But conventional, commercial banks also actively invest in other companies.

In fact, the interest amount that comes from these investments is a major source of revenue for commercial banks. Apart from the usual loan amounts, account charges, investing services, etc.

And so banks also have a diverse investment portfolio, as mentioned above. Something that you – a trader or investor – need.

Interestingly, commercial banks are seen as the “new venture capitalists,” i.e., those who invest in potential companies in return for stakes.

This is precisely what a recent article by Forbes implied. It seems that banks are actively investing in fintech – especially those that can improve their services.

No surprise there. After all, you would only invest in a venture that has high growth potential, can improve your services, or offers a product/service that offers high utility in the near future.

Thus, the first question is answered.

Now, coming to the second part. The only obvious reason to invest is the interest income. For instance, if Axis Bank shares increase, shareholders like SBI Group, ICICI Group, and Kotak Group would also benefit. Larger the stake, more the interest!

RBI’s investment and trading rules for banks

Speaking of banks investing in other financial services firms, Like always, here’s a catch – the Reserve Bank of India (RBI) has imposed certain limits on banks investing in other firms. Let’s take a look at some key restrictions imposed by the apex bank –

- Banks are allowed up to 10 percent stake in non-banking financial institutions (NBFCs) – except if the NBFC works in housing finance or money is regulated through derivatives.

- Need to maintain a capital adequacy of 9 percent i.e., capital available with them after investing.

- A capital conservation buffer of 2.5 percent i.e., capital stored during normal times, which can be used during periods of loss. Thus, the overall capital adequacy needs must be at least 11.5 percent.

These are just a handful of all the important rules imposed on banks. Moreover, the rules get more stringent for public banks.

What’s interesting to know is that while the group owning the bank can benefit from stakes in its subsidiary’s competition, this “advantage” is limited to 10 percent. Fair rules, don’t you think?

As a retail investor, however, you have no restriction on investing in banking stocks, especially via public stock exchanges like the National Stock Exchange (NSE) or the Bombay Stock Exchange (BSE).

If you haven’t invested in stocks yet, why not take this as a sign and give it a go?

1 Comment