Table of contents

One of the main goals of investment analysis is to determine a company’s intrinsic value. It’s about figuring out a company’s actual value, which goes beyond the fluctuations in market prices. This valuation is crucial as it helps investors make informed decisions on whether a stock is overvalued, undervalued, or just right.

Does the company you’re interested in pay dividends consistently? If yes, there’s a straightforward way to assess its value. It’s called the dividend discount model (DDM). The DDM is one of the most traditional and cautious approaches to valuing stocks.

To dive deeper into what is dividend discount model and how it works, keep reading.

Dividend discount model overview

The dividend discount model offers a straightforward approach to stock valuation. It suggests that a stock is truly valued when its current price is less than or equal to the present value of future dividend payments. This method is especially practical for investors focusing on dividend-yielding stocks.

Fundamentally, DDM hinges on the idea that a stock’s intrinsic value is equal to the present value of all anticipated future dividends. It operates under the premise that dividends are the fundamental return on investment for shareholders. By forecasting dividends and adjusting for risk, DDM provides an estimate of a stock’s fair market value.

DDM’s conservative nature is appealing to many as it avoids market noise and speculation. It looks beyond current market prices and conditions, focusing instead on the company’s ability to generate dividend cash flows for its shareholders.

Nevertheless, the dividend discount model assumptions necessitate giving careful thought to several aspects. Investors must make educated guesses about future dividend patterns, growth rates, and the appropriate discount rate to apply, which reflects the risk of investing in the stock.

The model is particularly suited for companies with a steady and predictable dividend issuance history. Comparing a stock’s current price to the estimated value derived from prospective dividends makes it possible to determine if the stock is overvalued or undervalued. If the DDM valuation exceeds the current trading price, it suggests the stock may be undervalued.

Dividend discount model formula

To put it into a formula, we use:

P = D1 / r-g

Here’s what each term represents:

P is the current market price.

D1 stands for the expected dividend in the next year.

r indicates the cost of equity or the return required by investors.

g is the growth rate of dividends, which is assumed to be constant.

By using the dividend discount model formula, investors get a price that reflects the present value of all future dividends, adjusted for growth and risk. This calculation gives a theoretical stock price, offering a benchmark to compare against the current market price.

Types of dividend discount model

The dividend discount model comes in various forms to suit different investment scenarios and dividend growth patterns. Let’s briefly explore these types.

- Zero growth DDM: It is the simplest type. It assumes dividends don’t grow and remain constant over time. Here, the stock price is calculated by dividing the annual dividend by the required rate of return. It’s best for companies with a stable dividend payout.

- Constant growth DDM: It is often known as the Gordon growth model, which assumes dividends will increase at a consistent rate indefinitely. This model is suitable for firms with a stable, predictable growth rate in dividends.

- Two-stage DDM: It caters to companies that may experience rapid growth initially and then settle into a steady growth phase. Hence the two-stage dividend discount model formula involves two parts: an initial period of high growth and a subsequent period of stable growth.

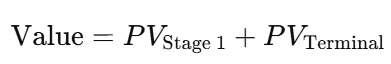

Stage 1: Present value of dividends during high-growth period

Stage 2: Terminal value at the end of high-growth period

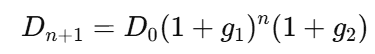

First, calculate the dividend at the start of the stable phase:

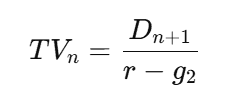

Then calculate terminal value:

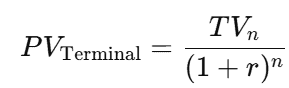

Present value of terminal value:

Intrinsic Value of the Stock

Where:

- D0 = Current dividend

- g1 = High growth rate (Stage 1)

- g2 = Stable growth rate (Stage 2)

- r = Required rate of return

- n = Number of years of high growth

This model is widely used for valuing companies expected to grow rapidly initially and then mature into stable dividend growth.

- Three-stage DDM: It adds another layer to the two-stage model. It is used when a company’s dividend growth rate is expected to slow down over time. Therefore, the three-stage dividend discount model formula becomes even more complex, factoring in three growth stages: It starts with an initial high growth period, then a transitional growth phase, and finally, a lower perpetual growth rate.

Other Dividend Discount Models

While the two-stage DDM works well for companies transitioning from high growth to stability, it is not the only way to value dividend-paying stocks. Depending on a company’s dividend pattern and maturity, investors often use simpler or more specialised versions of the Dividend Discount Model.

Adjusted Dividend Discount Model

he adjusted dividend discount model is used when a company’s dividends are irregular, volatile, or temporarily distorted. Instead of relying purely on reported dividends, this model adjusts dividends to reflect a more sustainable or “normalised” payout level.

This approach is especially useful for:

- Companies with inconsistent dividend histories

- Firms that recently cut or resumed dividends

- Businesses where dividends do not fully reflect earning power

By adjusting dividends to a realistic long-term level, the model aims to produce a valuation that better reflects the company’s underlying fundamentals rather than short-term fluctuations.

Gordon Dividend Discount Model

The Gordon dividend discount model is the simplest and most widely known version of DDM. It assumes that dividends will grow at a constant rate forever.

This model works best for:

- Mature, stable companies

- Businesses with predictable cash flows

- Firms with a long history of steady dividend growth

Because of its simplicity, the Gordon model is easy to apply and interpret. However, it is highly sensitive to assumptions about growth and return rates, making it less suitable for high-growth or cyclical companies.

Perpetuity Dividend Discount Model

The perpetuity dividend discount model assumes that a company pays a fixed dividend forever with no growth. It values the stock as a perpetuity.

This model is most appropriate when:

- Dividends are stable and unlikely to grow

- The company operates in a mature or regulated industry

- Growth prospects are minimal or uncertain

Although rarely used for growth companies, this model provides a conservative baseline valuation and is helpful for understanding minimum value scenarios.

Limitations of dividend discount model

While the DDM is a useful tool, it has notable limitations.

- One significant issue is its reliance on a constant dividend growth rate. This doesn’t work well for firms with variable dividend policies or those that don’t pay dividends at all.

- The accuracy of DDM is highly sensitive to the input values used, such as the growth rate and the discount rate. A small change in these inputs can lead to a big change in the calculated stock price.

- Moreover, the model falls short when it comes to companies whose return rates are lower than their dividend growth rates. In such cases, DDM may not provide a reliable stock value.

What are the key assumptions in the Dividend Discount Model?

- The Dividend Discount Model (DDM) is built on a few core assumptions that must hold true for the valuation to be meaningful.

- Dividends are the primary source of value for shareholders. In other words, the model works best for companies that regularly pay dividends and are expected to continue doing so.

- DDM assumes that future dividends can be estimated with reasonable accuracy. This means the company has a predictable dividend policy and stable earnings over time.

- The model assumes a constant and appropriate required rate of return. The discount rate reflects the risk of the stock and is assumed to remain stable over the valuation period.

- In models like the Gordon or two-stage DDM, it is assumed that dividend growth follows a defined pattern, either constant or transitioning from high growth to stable growth. If dividend behaviour is erratic, the model’s reliability reduces significantly.

When to use the Dividend Discount Model

The Dividend Discount Model is most useful when valuing mature, stable companies that pay regular dividends.

It works particularly well for:

- Large, established firms with a consistent dividend history

- Companies operating in regulated or defensive sectors such as utilities, banking, or consumer staples

- Businesses with predictable cash flows and long-term growth visibility

DDM is also helpful when the goal is to estimate intrinsic value for long-term investing, rather than short-term price movements. It is less suited for high-growth companies that reinvest most of their earnings and do not pay dividends.

Limitations of the Dividend Discount Model

Despite its usefulness, the Dividend Discount Model has clear limitations.

- The biggest drawback is that it cannot be applied to non-dividend-paying companies. Many growth companies create value through reinvestment rather than dividends, making DDM unsuitable.

- The model is also highly sensitive to assumptions. Small changes in growth rates or the required rate of return can lead to large changes in valuation, which can reduce confidence in the output.

- DDM assumes dividends accurately reflect a company’s financial health. In reality, dividend decisions can be influenced by management preferences, tax policies, or short-term considerations.

- The model struggles with companies that have irregular or unpredictable dividend patterns, where forecasting future payouts becomes unreliable. In such cases, alternative valuation methods may offer more practical insights.

Bottomline

The dividend discount model offers a practical method for valuing dividend-paying stocks by focusing on future dividend payments. While it’s useful for companies with steady dividend payments, it’s vital to recognize its limitations.

Such as, the effectiveness can vary based on dividend discount model assumptions about dividend growth and discount rates. Despite its limitations, DDM remains a valuable tool for investors aiming to estimate a stock’s intrinsic value based on its dividend prospects.

FAQs

The dividend discount model values a stock by calculating the present value of its expected future dividends, offering a method to estimate the stock’s intrinsic worth based on dividend payouts.

The two-stage dividend discount model values a stock by considering an initial phase of high dividend growth and then a lower, stable growth phase into perpetuity.

The discounted cash flow model values a company based on the present value of all future cash flows, while the dividend discount model values a stock based on the present value of expected future dividends.

No, CAPM (Capital Asset Pricing Model) is not a dividend discount model. It’s a formula used to determine the expected return on investment, factoring in risk compared to the overall market.

Gordon’s dividend discount model values a stock by assuming that dividends grow at a constant rate indefinitely. It calculates the stock’s value based on expected future dividends, adjusted by the constant growth rate and required rate of return.