Table of contents

Have you ever been in a situation where you believe the market or a particular stock is poised for a significant price change but are uncertain about whether it will increase or decrease? The short call butterfly strategy can be useful for options traders facing such uncertainty.

In the world of options trading, there are various techniques developed to benefit from changing market situations. One such approach is the short call butterfly strategy.

What is the short call butterfly strategy?

Looking for a profit opportunity in a volatile market without predicting the direction? The short call butterfly strategy, also called the short call spread, might be an advanced options strategy for you.

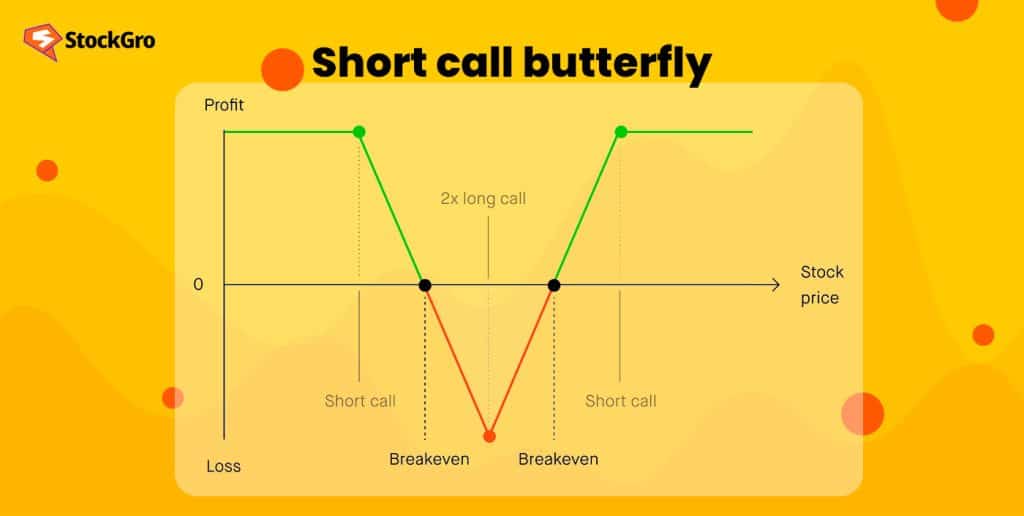

The short call butterfly is a three-part strategy that involves:

- Selling one call option slightly below the current price (in-the-money)

- Buying two call options at the current price (at-the-money)

- Selling one call option slightly above the current price (out-of-the-money).

Please note that all options have the same expiration date and underlying asset.

When to use the short call butterfly strategy?

The short butterfly spread strategy provides traders with flexibility when they expect a stock’s price may undergo significant change but are uncertain about which way it will move.

This approach can be tailored to suit a trader’s views on how strongly the price may fluctuate and the gains they hope to realise. Whether anticipating a modest or sizable shift in price, the butterfly spread can be implemented.

Implementing this strategy relies on anticipating significant fluctuations in the underlying asset’s price. It does not require market direction speculation but rather a bet on the volatility. This strategy can yield returns if the price of the underlying asset experiences moderate fluctuations in any direction provided the volatility is high.

How to construct this strategy?

A short call butterfly is a three-leg options trading strategy which involves four call options at three distinct strike prices. The procedure to set up this strategy can be summarised in these steps:

Step 1: Sell an in-the-money (ITM) call option with a strike price ‘A’.

Step 2: Purchase two at-the-money (ATM) call options with a strike price ‘B’.

Step 3: Sell an out-of-the-money (OTM) call option with a strike price ‘C’.

| Strategy | Long 2 ATM call options (Leg 1) + Short ITM call option (Leg 2) + Short OTM call option (Leg 3) |

| Maximum profit | Limited to net premium received (Premium of ITM call option + Premium of OTM call option – Premium of ATM call options |

| Maximum risk | Difference between lower and middle strike prices – Net premium received |

| Breakeven | Upper breakeven point: Higher strike price of short call + Net premium receivedLower breakeven point: Lower strike price of short call + Net premium received |

But what is the difference between short put butterfly vs short call butterfly?

Both strategies are neutral options strategies, but the short put butterfly involves selling and buying puts, short call butterfly involves selling and buying calls.

Example – Short call butterfly option strategy

Let’s understand how this strategy works.

Suppose the shares of XYZ company are trading at ₹300, and you anticipate high volatility but are unsure about the direction. Thus, you employ a short call butterfly strategy as follows:

Step 1: Sell a call option with a strike price of ₹280 at a premium of ₹15

Step 2: Buy two call options with a strike price of ₹300 at a premium of ₹8 each

Step 3: Sell a call option with a strike price of ₹320 at a premium of ₹5

Let’s assume a lot size of 500 shares.

Here, your initial net premium and maximum profit would be:

Net Premium = (15×500)+(5×500)−(8×2×500)= ₹2000

If the price of XYZ shares closes above ₹320 or below ₹280 at expiry, you will retain the profit of ₹2000. However, if the share price remains at ₹300, you will incur a loss.

Impact of options Greeks

Options Greeks play a critical role in the performance and risk profile of a short call butterfly option strategy. Here’s how key Greeks influence it:

- Delta: This measures the strategy’s sensitivity to changes in the underlying’s price. A short call butterfly is usually delta-neutral around the middle strike at inception, meaning small moves in the stock price have limited impact. However, as price moves away, the delta can shift, affecting potential profit or loss.

- Gamma: Gamma indicates how quickly delta changes. In a butterfly, gamma is highest near the middle strike, which means the strategy benefits from price consolidation around that strike. If the stock moves sharply away, gamma exposure can reduce profitability.

- Theta: Time decay works in favour of a short call butterfly. Since you sell more premium than you buy, theta is positive, meaning the position gains value as time passes — especially when the underlying price stays near the middle strike.

- Vega: Vega measures sensitivity to volatility changes. A short call butterfly benefits from falling implied volatility, since lower volatility reduces option prices. If volatility spikes, it can increase the value of the wings you sold, hurting profitability.

Understanding Greeks helps traders predict how the strategy will behave with price moves, time decay, and volatility shifts — essential for effective risk management and optimizing entry/exit points.

How is butterfly option settlement calculated

Settlement for a short call butterfly at expiration is based on the intrinsic value of each leg (the calls you’ve sold and bought), using the underlying’s closing price on expiry day.

- Identify strikes: A typical butterfly has three strikes — lower (K1), middle (K2), and upper (K3) — usually equidistant (e.g., K1 = 100, K2 = 110, K3 = 120).

- Determine underlying price at expiration (S): This is the final price used to calculate value.

- Compute intrinsic values:

- For calls below their strike: intrinsic value is zero.

- For calls in the money: intrinsic value = max(0, S − strike).

- Net payoff formula at expiration: Payoff=[max(0,S−K1)]−2[max(0,S−K2)]+[max(0,S−K3)]\text{Payoff} = \left[\max(0, S – K1)\right] – 2\left[\max(0, S – K2)\right] + \left[\max(0, S – K3)\right]Payoff=[max(0,S−K1)]−2[max(0,S−K2)]+[max(0,S−K3)]

- If S = K2 (middle strike), payoff is highest (maximum gain).

- If S ≤ K1 or S ≥ K3, payoff is zero — you keep the premium as profit, and the strategy expires worthless.

- Profit/Loss: Profit/Loss=Net credit received−Payoff at expiration\text{Profit/Loss} = \text{Net credit received} – \text{Payoff at expiration}Profit/Loss=Net credit received−Payoff at expiration In a short butterfly, you receive a net credit at trade entry. If the payoff at expiration is less than this credit, you keep the difference as profit; if greater (rare in butterflies), it results in a loss.

Example:

If you receive a ₹5 credit entering a short call butterfly and at expiration the net payoff (calculated above) is ₹2, your profit is ₹3 per unit. If payoff is ₹0, you keep the full credit of ₹5.

Settlement is automatic at expiry based on the final underlying price and does not require manual action, making butterflies efficient tools for defined-risk strategies.

Bottomline

The short call butterfly option strategy is a multifaceted trading technique that demands careful consideration yet allows for flexibility and profit potential regardless of which way the underlying asset’s price moves.

However, like all trading strategies, traders must carefully analyse their risk profiles and must be cautious when employing this strategy.

FAQs

A short call butterfly option strategy is a three-leg options trading strategy, which involves four call options at three distinct strike prices. The purpose of the strategy is to take a bet on the volatility rather than on the market direction.

In a short call butterfly option strategy, the maximum loss is the difference between lower and middle strike prices minus the net premium received. Here, the net premium received is the premium of the ITM call option + the premium of the OTM call option – a premium of ATM call options.

Short put butterfly and short call butterfly strategies are neutral options strategies, but short put butterfly involves selling and buying puts, and short call butterfly involves selling and buying calls.

There are many easy option trading strategies, one of them being purchasing a call option. It is an excellent strategy for those who have a positive outlook on the price of a specific stock or index. This approach enables investors to profit from increasing stock prices, provided they sell their options before expiration.

The short call butterfly is a three-part strategy that involves selling one call option slightly below the current price (in-the-money), buying two call options at the current price (at-the-money) and selling one call option slightly above the current price (out-of-the-money).

The maximum loss occurs if the underlying stock price moves far away from the middle strike price (K2), particularly towards either lower (K1) or higher (K3) strike. The loss is limited to the net premium received at the start of the trade.

The maximum profit is achieved when the stock price settles at the middle strike price (K2) at expiration. Profit is the net premium received for entering the position.

A short put butterfly is a strategy where you sell a put spread using three strike prices, betting that the stock price will remain close to the middle strike at expiration. It’s similar to a short call butterfly but involves puts instead.

Butterfly strategies benefit from low volatility. They are effective when you expect little price movement in the underlying asset, as the strategy profits from time decay and stable prices.

A butterfly call option is a strategy where you use three call options with the same expiration date but different strike prices. It aims to profit when the stock price stays near the middle strike price at expiration.