Table of contents

“Freed up” describes the period of time following the lock-up period when the limitations on selling shares are removed. Insiders are now able to sell their shares on the public market.

The term freed up is a common phrase in initial public offering (IPO) circles. How does it affect investors and other parties engaged in an IPO, and what does it actually mean? Let’s delve into this topic in our blog to understand its implications in the IPO process.

Freed up meaning

There are several meanings for freed up in finance, each applicable to different aspects of financial markets.

Freed up in IPO

The term “freed up” meaning refers to a specific stage in financial markets, particularly during an IPO or a direct public offering (DPO). Upon deciding to go public, a company usually hires investment banks to oversee the selling and sale of its shares. These banks, or underwriters, are tasked with determining the initial share price and ensuring a certain number of shares are sold.

During the IPO, the underwriters agree to sell their allocated shares at a fixed price. If the market demand for these shares exceeds the initial expectations, the price per share may naturally want to rise. However, these prices cannot be adjusted until the underwriters are freed up from the agreed-upon fixed pricing constraints. This freed up condition allows the price to fluctuate according to market demand.

Freed up shares for insiders

Additionally, the term is used in the context of company insiders who own shares. These insiders frequently have a lock-up period during which they are unable to sell their shares. Once this period expires, their shares are freed up, allowing them to sell in the open market.

This action often results in what is termed freed up cash. This is the freed up funds that insiders gain from selling their shares, which might be motivated by the potential for profit, as the market price can be higher than the initial offer price.

The cash freed up formula is the number of shares sold multiplied by the current market price minus brokerage fees and transaction charges.

Freed up capital from investments

The freed up funds concept also applies when investors close positions in their investments. The resulting available funds can then be redirected or reinvested into other asset classes. This strategic release of funds and shares into the market prevents an oversupply and helps maintain a balanced demand, ensuring the financial health of the company and the interests of its investors.

Key stages in an IPO before shares are freed up

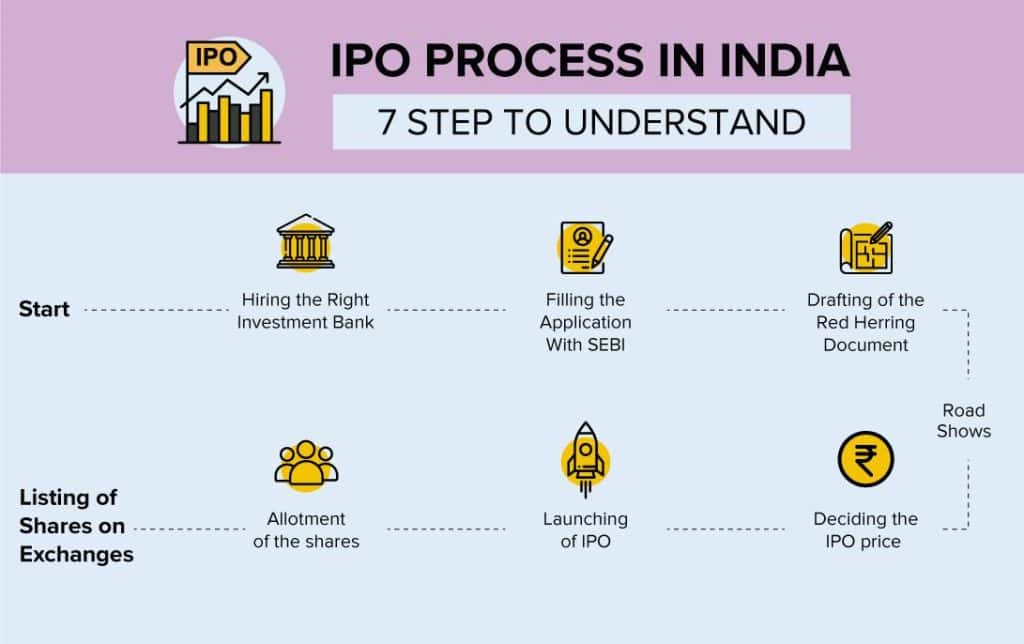

The process leading up to the point where shares in an IPO are freed up for trading involves several key stages:

- Formation of the IPO team: Before launching an IPO, a company organises a team including investment banks, legal experts, accountants, and underwriters. This team is responsible for preparing the IPO, beginning with the drafting of a detailed prospectus which outlines the company’s financial details, business operations, and market risks.

- Registration: The company registers the IPO with regulatory bodies like the Securities and Exchange Board of India (SEBI). This involves submitting detailed documents that disclose the company’s financials and business plans to regulators, ensuring transparency and compliance.

- Roadshow and book building: Prior to the IPO, the company and its underwriters present the investment opportunity to potential investors through roadshows. This helps in assessing the demand and setting the price of the shares, a process known as book building.

- Issuing the final prospectus: Once the share price is determined, a final prospectus is issued. This document provides all necessary information about the IPO to potential investors and is essential for their investment decision-making.

- Quiet period: After the IPO is launched, a regulatory quiet period is enforced. During this time, promotional activities by the company are restricted to prevent influence on the stock price.

- Lock-in period: To stabilise the stock price post-IPO, insiders and major shareholders are often prohibited from selling their shares. For example, 50% of the shares allocated to anchor investors are subject to a 30-day lock-in period, while the remaining 50% are locked in for 90 days. This lock-up period helps mitigate the risk of stock price volatility due to an oversupply of shares.

Once these stages are completed and the lock-up period ends, shares are freed up, allowing insiders to sell their shares on the open market, thus increasing the liquidity of the stock. This phase is crucial as it marks the full transition of the company from private to public, with all the accompanying regulatory and market scrutiny.

Bottomline

The freed up phase in an IPO is a pivotal moment that signifies the transition of a company from private restrictions to public trading freedoms. Understanding this process helps investors and company insiders recognise the critical timings for selling shares and reinvesting capital, ultimately shaping the financial landscape post-IPO.

“Freed up” refers to the phase in financial transactions, especially post-IPO, where previously imposed restrictions on share sales are lifted. During an IPO, company insiders and major investors are often subjected to a lock-up period during which they cannot sell their shares. Once this period ends, the shares are “freed up,” allowing them to be sold on the open market.

In finance, a “lock-up” period refers to a predefined span following an initial public offering (IPO) during which major shareholders, such as company insiders and early investors, are restricted from selling their shares. Typically lasting 90 to 180 days, this period helps stabilise the stock price by preventing the flooding of the market with additional shares. The lock-up is intended to ensure a more controlled and orderly market entry and to maintain investor confidence in the newly public company.

Cash freed up is calculated by multiplying the number of shares sold by the current market price per share and then subtracting any applicable transaction costs, such as brokerage fees and commissions. This calculation provides the net amount of cash that becomes available after selling the shares. The formula is:

Cash Freed Up = (Number of Shares × Market Price per Share) – Transaction Costs

After an IPO is closed, the newly issued shares enter a “lock-up” period during which insiders and early investors are typically prohibited from selling their shares. This period is designed to prevent stock price volatility by controlling the supply of shares available for sale. Once the lock-up period expires, these shares are “freed up,” meaning insiders can then sell their shares on the open market if they choose, potentially increasing the liquidity of the stock.

The lock-up period involves different durations depending on the type of shareholder. Anchor investors have a lock-in period of 90 days for 50% of allotted shares and 30 days for the remaining 50%. For promoters, shares amounting to up to 20% of the post-issue paid-up capital now have a lock-in period of 18 months. Shares exceeding this threshold are locked in for six months. Non-promoters also benefit from reduced restrictions, with their lock-in period now at six months.