Finding stocks that can hold value for years is far more demanding than spotting short-term winners. Many funds perform well in the short term but fail to sustain growth over longer periods. Yet, in 2024, more than 40 equity mutual funds delivered more than 15% CAGR across 3, 5, 7 and 10-years, showing that consistent long-term performance is possible.

Recognising this challenge, StockGro introduced Stoxo stock Market AI, a research engine built to simplify analysis for its 35+ million users. In this blog, we will go step-by-step through how to choose stocks for long term selection process and also show how Stoxo comes in at each stage. Let’s go!

How to Choose Stocks for Long Term?

Choosing Long-term Stocks by investing by picking businesses with strong fundamental analysis that grow, earn profits, and create value over decades. According to recent data, Indian equities doubled in value about 80% of the time over a 6- to 7-year holding period and tripled roughly 80% of the time over 10–11 years. Historically, investors who stayed invested for seven years or more had a much higher chance of earning returns above 10% annually, far better than short-term outcomes. The key ways to select such stocks are as follows:

- Start with a Top-Down Approach

The top-down method begins by looking at the overall perspective. Instead of directly picking companies, investors first examine the economy, sectors, and then specific businesses. At the macro scale, this involves analysing GDP growth, inflation patterns, and central bank interest policies. For example, a low-interest-rate environment often benefits real estate and consumer durables, while rising rates can strengthen banking profitability.

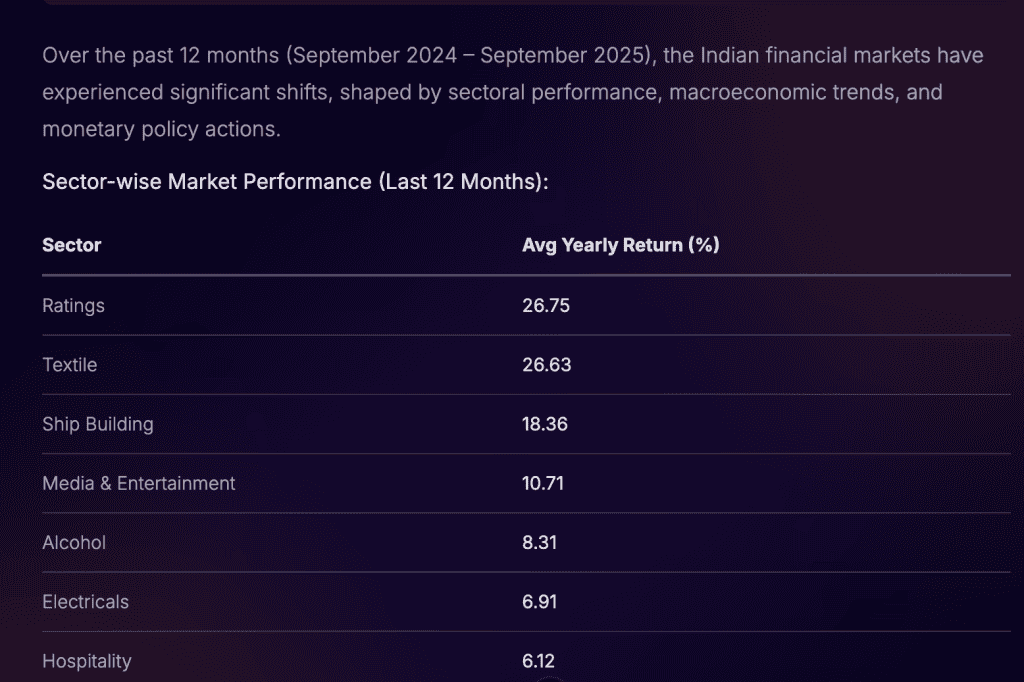

To make this analysis easier, Stoxo market overview tools allow investors to track sectoral trends, macroeconomic indicators, and structural shifts in real time. For example, when given the prompt “Show me sector performance in India over the last 12 months along with GDP growth, inflation trends, and RBI interest rate changes”, Stoxo gave the following response:

The answer showed that sectors like Ratings, Textile, and Ship Building delivered strong double-digit returns, while areas like Agri, IT, and FMCG faced steep declines. At the same time, India’s GDP growth moderated to 6.5%, inflation stayed at historic lows, and RBI maintained the repo rate at 6.5%, shaping investor sentiment.

Once the broad picture is clear, the next step is to identify industries with favourable tailwinds like renewable energy, digital services, or healthcare, and finally narrow down to companies with strong fundamentals.

- Evaluate By FundamentalAnalysis

Strong financials alone do not guarantee a stock’s success over decades. When doing fundamental analysis, the durability of a business model, its competitive positioning, and leadership quality are equally important. Using Stoxo fundamental analysis, investors can review a company’s balance sheet strength, profitability trends, and competitive moat in a structured way. This helps filter businesses that not only look good on paper but also have the resilience to sustain growth over the long term.

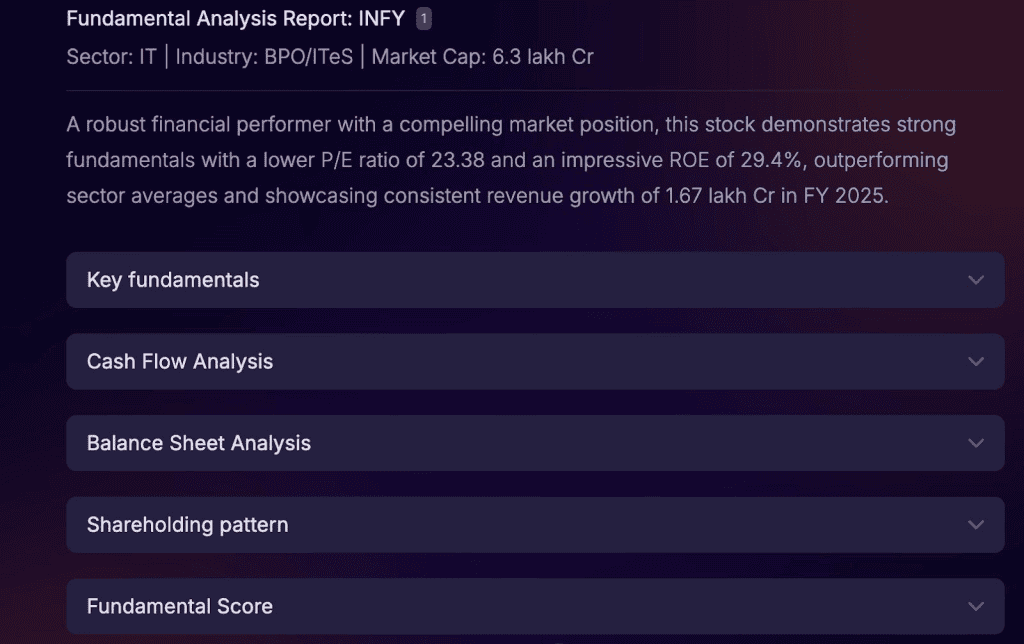

For example, when asked to “Give me a detailed fundamental analysis of Infosys including revenue growth, profit margins, debt levels, and competitive position”, Stoxo provides the following response:

The analysis showed a company with steady revenue growth, healthy returns, and low debt, supported by consistent shareholder rewards like dividends and buybacks. In short, it displays a financially strong and well-managed business with the capacity to sustain performance in the long run.

- Moat & Competitive Advantage

The concept of an “economic moat” popularised by Warren Buffett describes a company’s ability to maintain an edge over rivals. A wide moat allows it to defend market share and profitability.

Is there something sustainable that gives the firm protection vs competitors? This could be:

- Strong brand, licensing, patents, network effects.

- Cost advantage through scale or low input costs.

- High switching costs for customers.

- Regulatory capture or barriers to entry.

- Strong Management

Evaluate leadership through past execution, capital allocation, transparency. Check how management navigated downturns. Do they communicate long-term strategy rather than focus on short-term earnings? Do they invest in R&D, innovation, build reserves, or just spend on share buybacks?

- Key Financial Metrics to Assess

Strong stock selection needs more than qualitative judgment, and requires numbers. The Stoxo financial metrics screener helps investors assess profitability, valuations, debt, and cash flow to identify companies built for long-term growth. Some of the main metrics to assess are as follows:

- Profitability (ROE, Margins)

Return on Equity (ROE) indicates how efficiently shareholder capital is utilised to produce profit. A good ROE varies by industry and stage of growth. Likewise, steady or increasing net profit and operating margins suggest pricing strength and operational efficiency.

- Valuation Ratios (P/E, P/B, PEG)

Valuation ratios help determine whether a stock is attractively priced:

- P/E ratio: The PE Ratio divides a company’s share price by its earnings per share (EPS). It indicates how much investors are willing to pay for each unit of profit, making it useful for comparing stocks within the same industry.

- P/B ratio: The Price to Book ratio divides the share price by the book value per share (assets minus liabilities). It is commonly used for financial and asset-heavy companies to see if the stock is trading above or below its net worth.

- PEG ratio: The Price/Earnings to Growth ratio divides the P/E ratio by the expected earnings growth rate. The PEG adjusts valuation for growth prospects, where a value below 1 often suggests the stock may be undervalued.

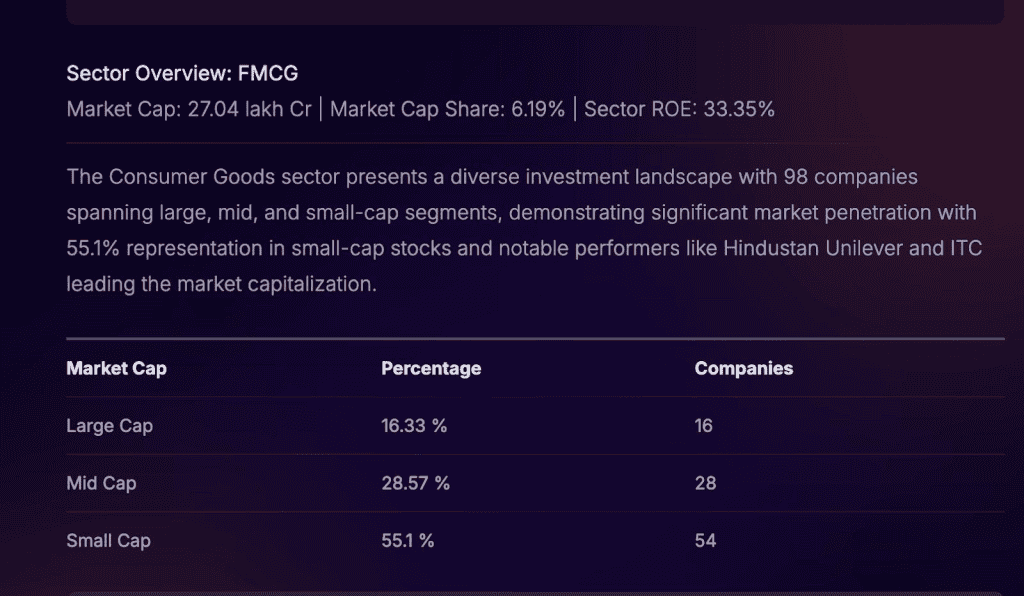

Stoxo brings these filters together smoothly. In the FMCG sector, a prompt given to screen for companies with ROE above 15%, Debt-to-Equity below 1, P/E ratio under the industry average, and positive free cash flow provided the following response:

The response listed companies such as ITC, VST Industries, and BCL Industries, showing how valuation, profitability, and leverage metrics combine to identify fundamentally strong businesses.

- Debt Levels & Financial Stability

The D/E or Debt-to-Equity ratio compares a company’s total debt to its shareholder equity. It measures financial leverage and shows how much of the business is funded through borrowed money versus owned capital. Companies with lower D/E are generally more stable during downturns and flexible in pursuing new opportunities. While a D/E ratio below 1 is often seen as safe, the acceptable level can vary across sectors.

- Free Cash Flow & Dividend Stability

Free cash flow shows the cash left after maintaining or expanding assets. Companies with positive, growing FCF can distribute dividends, cut liabilities, or reinvest in expansion. For long-term investors, a history of consistent dividends is a sign of financial strength and shareholder commitment.

- Growth Potential & Market Position

Even a strong business needs to be in the right place to grow over many years.

- Industry Tailwinds

India is now part of many global growth themes renewables, digital infrastructure, clean energy, fintech. According to a report, India has recently surpassed China in its weighting in the MSCI Emerging Market Investable Market Index due to strong earnings growth and improved corporate behavior.

- Market Share & Leadership

Leaders in their industries whether by innovation, scale, or brand recognition often sustain growth better than smaller rivals. Dominant companies enjoy pricing power, distribution reach, and customer loyalty, making them more reliable for long-term investing.

- Diversification & Portfolio Protection

Even strong stocks carry risks. Managing those risks is a central part of long-term investing.

- Diversifying across sectors & geographies

Spreading capital across sectors (technology, banking, healthcare, consumer goods) and regions (domestic and international markets) reduces the effect of losses in any one area. Research shows that based on modern portfolio theory holding around 20 to 30 well-chosen stocks across different industries can eliminate up to 90% of unsystematic risk, protecting overall returns from individual company failures.

- Avoiding Value Traps

Not all seemingly cheap stocks are solid investments. Companies with low valuations due to obsolete products or structural decline are called value traps. A thorough analysis of fundamentals is necessary to differentiate undervalued opportunities from businesses in long-term trouble.

- Investing Discipline & Strategy

A financial plan backed by discipline is what sustains long-term investing.

- Margin of Safety & Patience

The ‘margin of safety,’ a principle from Benjamin Graham, focuses on purchasing a stock at a significant discount to its intrinsic worth. Buying with a margin of safety means you don’t pay full price for future expectations. Perhaps the business looks worth ₹100, but you buy at ₹70 or even lower if possible. Then you wait out volatility. Companies with strong financial discipline can recover from temporary setbacks if their fundamentals are intact.

- Dollar-Cost Averaging & SIP

Timing the market is notoriously difficult. Dollar-Cost Averaging (DCA) is a strategy that removes the need for it. It involves putting in a fixed sum regularly (e.g., monthly) regardless of share price. When the price is high, you buy fewer shares, and when it’s low, you buy more. This helps average your acquisition cost over time. In India, this is most popularly done through a Systematic Investment Plan (SIP).

- Portfolio Rebalancing

Over time, the returns of different holdings will shift your portfolio’s original distribution. For example, a bull run in stocks might increase their weight from your target of 60% to 75%. Portfolio rebalancing entails periodically selling some outperforming assets and buying underperformers to restore the initial allocation. This enforces a ‘buy low, sell high’ approach, reduces risk, and keeps the portfolio aligned with long-term objectives and risk appetite.

- ESG & Quality Investing Considerations

Modern investors increasingly combine financial analysis with ESG (Environmental, Social, and Governance) factors.

- Quality Investing Frameworks

Quality investing focuses on companies with sustainable earnings, strong returns on invested capital, and low leverage. Applying ESG filters helps spot companies less vulnerable to legal, reputational, or environmental risks. In fact, recent academic evidence shows that Indian ESG portfolios (2011–2023) delivered lower market risk and greater resilience during downturns, with positive, though statistically insignificant excess returns compared to conventional indices. This suggests how governance and sustainable practices support long-term growth and stability.

- Sample Workflow: Picking Long-Term Stocks with Stoxo

To see how to understand how to choose stocks for the long term, we can use Stoxo AI by StockGro. When asked for potential long-term picks, the tool generates a structured stock list with fundamentals, returns, and sector exposure.

The output not only lists stocks but also highlights why they may be suited for the long term:

- HDFC Bank & ICICI Bank: Consistent financial strength and large-cap stability.

- BSE Ltd: Strong momentum backed by solid ROE and over 130% one-year return.

- Welspun Corp & LT Foods: Diversification benefits with competitive positioning in steel and FMCG.

This shows how the Stoxo stock selection process brings clarity by combining fundamentals, sector strength, and past performance into an actionable framework for long-term investors.

Conclusion

Successful investing isn’t about timing the market but about holding strong businesses that thrive across decades. With tools like Stoxo simplifying research, investors can focus on fundamentals, diversification, and consistency. Understanding how to choose stocks for long term requires patience, discipline, and clarity on what drives sustainable growth. A well-chosen portfolio becomes not just an investment but a strategy for financial independence and wealth creation over time.

FAQs

Key metrics include Return on Equity (ROE), profit and operating margins, P/E, PEG, Debt-to-Equity, dividend consistency, and free cash flow. Look for stable, growing earnings, sound financial health, low debt, and reasonable valuations for quality long-term candidates.

Identify moats by finding sustainable competitive advantages like brand strength, patents, network effects, cost leadership, or high switching costs. Companies with long industry leadership, protected market share, and resilience against competitors generally possess strong moats.

A value trap is a stock that looks attractively priced but is cheap for valid reasons, such as weak business models or declining industry prospects. Avoid by analysing fundamentals, growth drivers, management quality, and verifying that low valuation is temporary, not structural.

Hold 10–20 stocks spread across various sectors and geographies. Diversification helps protect against downturns in any single industry while smoothing returns; review sector exposure regularly to ensure balanced risk.

SIP (Systematic Investment Plan) and Dollar-Cost Averaging (DCA) reduce market timing risk, even out purchase costs, and build discipline. Investing fixed amounts regularly helps ride out volatility and compounds wealth steadily over years.

ESG (Environmental, Social, Governance) filters add another layer of risk management, focusing on companies with sustainable practices and lower exposure to regulatory, reputational, or environmental risks, which tend to deliver stronger long-term returns.

Review and rebalance at least once a year or after significant market moves. Rebalancing realigns your portfolio with target allocations, prevents overexposure to outperforming assets, and enforces a disciplined “buy low, sell high” approach.

Leave a Comment