Introduction

“Best stocks with high ROE to add to your portfolio” – do you often hear this phrase and wonder what it means? ROE is one of the key ratios that gauge a firm’s profitability in relation to the equity owned by its shareholders.

Just like how a doctor uses various health indicators like blood pressure, heart rate, and cholesterol levels to assess a patient’s health, financial ratios are tools investors and analysts use to measure a company’s financial health.

Financial ratios offer insights into a company’s operations, including liquidity, financial stability, profitability, etc. ROE is one of the key financial ratios used.

Let’s delve deeper into what ROE is, how it is calculated and the significance of ROE in this article!

What is ROE in stock market?

Return on Equity (ROE) is a metric that evaluates a company’s financial performance. It measures a company’s profitability and the effectiveness with which it produces those profits.

In simple terms, ROE is a gauge for evaluating how proficient a company is at generating earnings from the capital invested in it.

Here is how it works: Let’s suppose you invested some capital in a company’s shares. . The capital you’ve invested is your ‘equity’. The company then utilises this capital to operate its business and generate profit. Understand what is trading on equity?

Your Return on Equity (ROE) is how much profit the company made with the capital you invested in it. Therefore, if a company has a high ROE, it indicates that it is highly efficient at using the invested capital to generate profits and vice versa.

You may also like: Understanding stock valuations using PEG ratio analysis

What is the significance of ROE?

Return on Equity (ROE) is a crucial financial indicator due to the following reasons:

1. Financial stability: ROE can reflect a company’s financial well-being. Firms with an ROE higher than their competitors may yield superior returns for their investors.

2. Efficiency: This metric assesses the effectiveness of a company in utilising its equity funding to generate income. An increased ROE implies that a firm is enhancing its profit-making ability without requiring substantial capital. Understanding the function of Trading on Equity will help you analyse the company’s profits.

3. Management efficacy: ROE can also demonstrate how efficiently a company’s management is utilising shareholder funds. An upward trend in ROE indicates effective decision-making by management, while a downward trend may suggest less efficient use of equity capital.

4. Profitability: ROE gauges a firm’s efficiency with which it generates profits. So, if the ratio is higher, it means the firm is effective at converting its equity funding into profits.

5. Performance monitoring: A company’s ROE can be compared over various periods to monitor the performance of the company’s management.

6. Investment choices: Identifying companies with consistent and increasing ROE over the past five to seven years can aid in spotting potentially profitable stocks.

How to calculate return on equity?

ROE formula = (Net Income / Shareholders’ Equity) x 100

Here,

Net income is the total profit a company has made in a specific period after deducting all expenses. These expenses include operational costs, interest payments on any loans, taxes, and depreciation. This figure can be found at the end of a company’s income statement (profit and loss statement).

Shareholders’ equity is essentially the remaining interest in the company’s assets after all liabilities have been subtracted. Put simply, it is the sum that would be allocated to shareholders if every asset of the company were to be sold off or liquidated and all its debts settled.

Also read: What is CAGR and how to calculate? [ Explained]

Shareholders’ equity = Total Assets – Total Liabilities

Here is the return on equity example for better understanding.

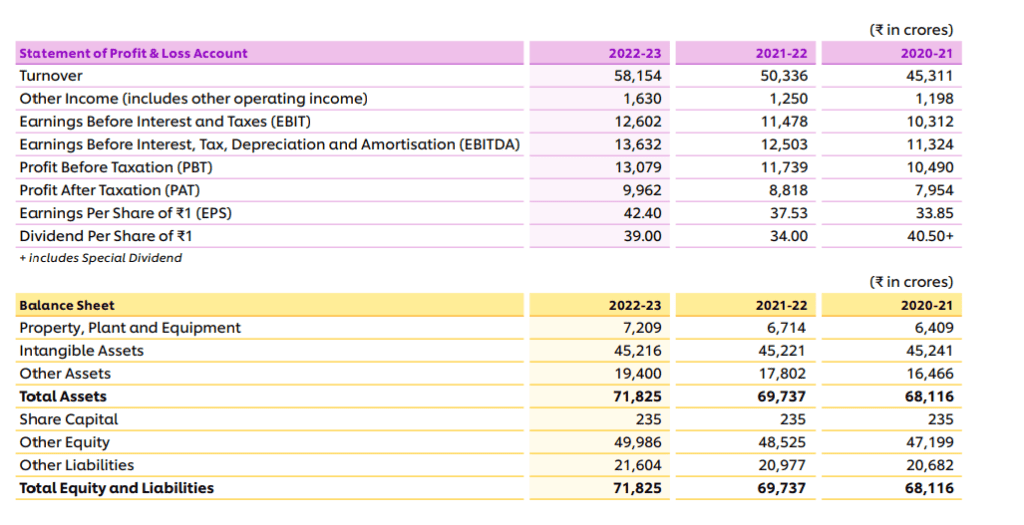

Below is the balance sheet and profit and loss statement of HUL (Hindustan Unilever Ltd)

Here, the net income for FY 2022-23 is ₹9,962.

Shareholder’s equity is = Total Assets – Total Liabilities

= ₹71,825 – ₹21,604 = ₹50,221

ROE ratio formula = (Net Income / Shareholders’ Equity) x 100

= (9,962/50,221)*100 = 19.83%.

How to use ROE?

ROE can be used in several ways to analyse a company’s performance and make investment decisions:

1. Compare companies: You can use ROE to compare the profitability of different firms in the same industry. A firm which has a higher ratio is generally considered more financially efficient than its peers.

2. Tracking performance over time: By comparing a company’s ROE from one period to the next, you can track changes in its financial efficiency and profitability. This can assist you in determining whether the company’s performance is on an upward trajectory or experiencing a decline over time. Learning how to use return on equity to evaluate stocks will help you in picking the best stocks.

Limitations of return on equity

Here are some potential drawbacks of the ROE metric:

Here are some potential drawbacks of the ROE metric:

1. Overlooking debt levels: The return on stockholders equity metric primarily concentrates on equity and net income, neglecting the impact of debt. A substantial debt load can amplify return on equity while subjecting the company to financial hazards.

2. Impact of accounting policies:The ROE calculation can be affected by the different accounting policies that companies adopt. Comparing the ROE ratio among companies employing diverse accounting methods may not offer a fair basis for comparison.

3. High ROE due to low equity: When a company has low equity but generates high net income, its return on equity might appear inflated, signaling strong performance. However, this could be a sign of financial instability or undercapitalisation. It could lead to risky conditions for long-term sustainability.

4. Ignores asset depreciation: Companies with older, depreciated assets may report lower net income, which decreases return on equity. This can cause bias in the metric, particularly when you are comparing companies with different levels of asset depreciation.

5. Distorted by share buybacks: When a company buys back its own shares, it reduces the equity base. Doing so artificially boosts return on equity, even though there has been no real improvement in performance or profitability. Investors must be cautious about high ROE figures due to stock repurchases rather than actual operational success.

6. Industry differences: Return on equity varies significantly across industries. This makes it difficult to compare companies operating in different sectors. A high ROE in one industry might be considered average or even low in another. These differences limit its usefulness as a cross-industry benchmark.

These limitations highlight the importance of using return on equity alongside other financial metrics to get a more accurate and real view of a company’s financial health.

Also read: EBITDA explained: Definition, calculation, significance, and more

Bottomline

To sum up, Return on Equity (ROE) is a multifaceted metric that delivers crucial insights into a company’s financial health. When used judiciously in conjunction with other financial indicators, it can guide investors and businesses in making enlightened decisions about investments, strategic planning, and expansion.

A higher return on equity generally signifies effective management and a strong business model. On the other hand, a lower ROE may indicate inefficiencies or challenges in generating returns. However, while ROE can provide a quick snapshot of a company’s performance, it’s important not to rely solely on this metric.

Return on equity can be misleading if it’s driven by high levels of debt or short-term financial engineering. For instance, companies with excessive leverage may report an inflated ROE, masking underlying risks. Additionally, ROE doesn’t account for industry variations, as different sectors naturally operate with varying levels of capital intensity. Therefore, it’s essential to compare ROE within the same industry for a more accurate analysis.

In conclusion, ROE should be used in combination with other financial metrics, such as return on assets (ROA) and debt-to-equity ratios. This will help you get a more comprehensive view of a company’s financial health. When interpreted correctly, return on equity can guide you to make smarter investment decisions, but it’s crucial to avoid overemphasising it without considering the broader financial picture.

Enjoyed reading this? Share it with your friends.