Introduction

Have you ever heard financial experts say: “The company’s EBITDA turns positive despite net profit falling”?

In the world of complex financial analysis, multiple acronyms play a significant role in understanding a company’s financials. One such acronym is EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortisation. This metric gives a deeper look into a company’s core performance and its overall ability to make money.

Everyone relies on this metric as a compass to gauge the company’s potential, from investors to stakeholders to analysts. In this blog, we will understand EBITDA in detail, its formula, its significance, its limitations and more.

Decoding EBITDA: The key financial metric

What is EBITDA? EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortisation. It is a financial metric that helps assess a company’s accurate operational performance, independent of its tax rate, capital structure and accounting decision.

This ratio tells us how much money a company makes from its core activities without considering the expenses unrelated to its operations.

EBITDA does not consider the company’s capital structure. So, one can say it is a neutral measurement of profitability. It does not incorporate any aspects related to capital structure, such as debt and taxes.

It also does not factor in non-cash elements like amortisation and depreciation, which have no bearing on the company’s ability to pay dividends.

EBITDA is also not recognised by GAAP, and at times, investors and financial analysts have complained that companies have overstated their metrics, thus showcasing higher profitability. Thus, you must use EBITDA in conjunction with other metrics and financial ratios to analyse a company’s financial health.

You may also like: Why is everyone talking about equity shares: Essential features & benefits!

Breaking down EBITDA: Exploring its components

Let’s break down the various components of EBITDA for a clearer understanding of this metric:

E for earnings:

Earnings, here, refer to the company’s Net Income or Operating Income. Net income signifies earnings after deducting costs and expenses such as taxes and interests. Operating income represents revenue minus operating expenses.

B for before:

In this context, it signifies that the earnings considered are before any expenses or costs.

I for interest:

Interest expenses directly impact operational profit. This factor helps measure profitability without distortion from debt servicing of their capital structure, ensuring a more accurate financial assessment.

T for taxes:

The exclusion of taxes presents an unadulterated view of operational performance, free from the complexities of taxation.

Taxation is also a jurisdictional rule, which in no way states a company’s management and operational performance, and thus is added back to the cash flow. This helps in a better judgement while comparing two businesses.

D for depreciation:

Depreciation is the allocated cost of tangible assets over their useful life. In this, a company’s profitability is calculated before deducting depreciation.

A for amortisation:

Amortisation pertains to the allocated cost of non-physical or intangible assets over their useful life, such as patents and copyrights.

Note: Both D and A are passed for investments and not current expenses. These expenses are calculated assuming an asset’s salvage value, depreciation, and economic life, making it a non-cash expense. Therefore, it is added back to the cash flow.

Also Read: Low price share vs high price share

Crunching the numbers: How to calculate EBITDA effectively

Now that you have an understanding of the meaning of EBITDA, let’s learn how to do EBITDA calculations. In case you cannot find this metric on a company’s financial reports, you can easily calculate it from the financial statements.

Here are two simple formulas to use:

Using operating income or EBIT:

EBITDA = EBIT or Operating income + Depreciation + Amortisation

Using Net Income:

EBITDA = Net income + Interest + Taxes + Depreciation + Amortisation

While calculating it from financial statements, you can find the earnings, taxes, and interest in the income statement. Whereas the depreciation and amortisation in the cash flow statement or the notes to operating profit.

Example of Calculating EBITDA

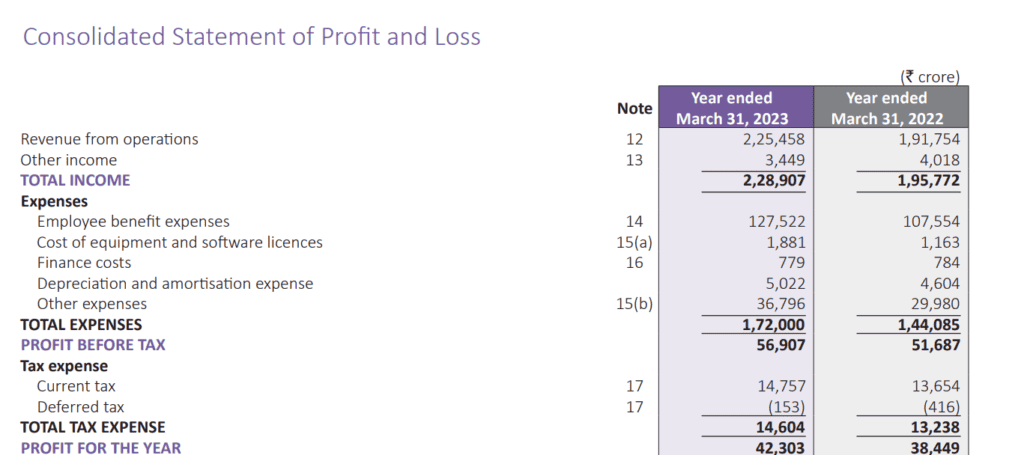

Let’s take the example of TCS.

First, let’s calculate using operating income or EBIT:

EBITDA = EBIT or Operating income + Depreciation + Amortisation

Operating income = Revenue from operations – Cost of goods sold (COGS) – Operating expenses – Depreciation – Amortisation

Operating profit = 228907 – 127522 – 1881 – 5022 – 36796 = Rs. 57,686

EBITDA = 57686 + 5022 = Rs. 62,708

Using Net Income:

EBITDA = Net income + Interest + Taxes + Depreciation + Amortisation

EBITDA = 42303 + 779 + 14604 + 5022 = Rs. 62,708

Significance of EBITDA

Let’s delve into how financial analysts and investors can apply EBITDA in the real world, now that you have a solid grasp of its calculation and definition.

1. Comparing companies:

It is frequently used to compare organisations in the same industry and of roughly equal size. It is a standardised indicator that allows for easy comparison of company performance by analysing profit-generating capability from key operations.

2. Debt assessment:

EBITDA provides information about the company’s operational outcomes, thus enabling a more thorough examination of the company’s debt-servicing capabilities.

In simple words, whether the company is capable of meeting its debt commitments and has sufficient cash flow to do so.

3. Investment decision-making:

EBITDA is one of the essential financial measures that investors consider before making an investment decision.

EBITDA provides an overall picture of the company’s operational success and profitability before including tax obligations and interest payments. This provides for a more accurate assessment of the investment potential.

Limitations of EBITDA

Yes, EBITDA is useful in terms of financial analysis. But it also warrants certain limitations, like:

1. Ignoring capital structure and taxes:

Capital structure and tax responsibilities are two critical variables in establishing a firm’s overall operational and financial health. This overlooks both elements, disguising some of the company’s key concerns.

It also makes the company look less expensive, thus making it difficult for investors to gauge its value in the long term.

2. Exclusion of certain costs:

EBITDA enables straightforward comparison of companies based on operational success and competence in management by excluding costs such as taxes, interest, depreciation, and amortisation.

But, in the long run, it falls short of providing a fuller picture of a company’s financial health.

Also Read: What is LTP in share market & how it is calculated?

3. Misinterpretation:

Another limitation of this metric is that there is a lack of standardised calculation. It leads to variations when it comes to its calculation and applications through various companies and industries. This leads to discrepancies and misinterpretation, causing roadblocks to better comparison and decision-making.

Conclusion

When it comes to financial analysis, EBITDA acts as a significant ally in comparing the company’s profitability and operational strength. It helps compare the company’s financial insights, allowing better decision-making for the investors.

Though EBITDA is a great strategic tool, it does have its share of limitations, which you must consider. Therefore, you need to use this metric along with financial metrics like gross margin, net income, and EBIT to make an informed decision.