Fluctuating or stagnant stocks can make short-term gains unpredictable for traders. Swing trading provides an approach where trades are held for a few days to a few weeks, allowing investors to capture clear price movements without the need for constant intraday monitoring. It combines the patience of position trading with the activity of short-term strategies, making it appealing to those who want flexibility. In this blog, we’ll look at how to choose the stocks for swing trading and the factors that make certain stocks more suitable than others.

How to Choose Stocks for Swing Trading?

Picking the right stocks is the backbone of swing trading, with traits such as:

- Liquidity & Volume

Liquidity shows how easily a stock can be bought or sold. Stocks with high trading volumes allow smooth entry and exit without affecting price. For example, a stock like Reliance Industries trades millions of shares daily, enabling quick positions without slippage. Illiquid stocks may trap traders or cause losses when trying to exit positions quickly.

- Volatility

Volatility measures how much a stock’s price moves in a given period. Moderate to high volatility is essential for swing trading because it creates price swings necessary to capture profits. Low-volatility stocks may remain stagnant, limiting opportunities, while extremely volatile stocks can be risky if proper risk management is not applied.

- Momentum & Patterns

Momentum indicates the speed of price changes, while chart patterns show trends or reversals. Swing traders use momentum indicators and pattern signals to enter at early stages of uptrends or downtrends, increasing the chances of capturing short-term gains efficiently

Technical Tools & Indicators

Swing traders analyse price trends using tools such as:

- Moving Averages & Crossovers

A moving average smooths out price fluctuations over time. Crossovers, like a 10-day moving average crossing above a 50-day average, signal a potential trend reversal or continuation. For example, a trader might buy a stock showing a bullish crossover to ride the early trend for several days.

- RSI & Momentum Oscillators

The Relative Strength Index (RSI) indicates whether a stock is overbought or oversold. Swing traders use it to spot potential short-term reversals. Say an RSI below 30 may indicate oversold conditions, providing a buying opportunity if other signals confirm.

Screening Process & Tools in Swing Trading

Successful swing trading requires a thorough grasp of screening methods that combine fundamentals, sector performance, market updates, and price action into one clear picture. Traditionally, traders juggle multiple platforms for these tasks, which often leads to scattered information and missed insights.

This is where Stoxo, StockGro’s AI-powered research engine, fits in. It brings all key elements together, from financial filters and sector mapping to corporate events and charting into a single platform. For retail investors, this means less noise, structured insights, and faster decision-making.

- Fundamental filters: Track earnings growth, debt ratios, and return on equity to measure financial stability.

- Sector mapping: Compare how industries are performing against the broader market using visual heatmaps.

- Event tracking: Keep up with results, board meetings, and announcements that may affect stock prices.

- Charting tools: Study support-resistance levels and candlestick formations to understand price behavior.

Strategy Examples & Approaches in Swing Trading

Swing trading also makes use of specialized approaches designed around price behavior and market events:

- Episodic pivot strategy: This method focuses on sudden catalysts such as earnings reports, regulatory updates, or industry news that spark sharp price moves. Traders look for early entry points when such events create strong market attention, aiming to capture the resulting swings.

- Darvas box theory: Introduced by Nicolas Darvas, this strategy defines a “box” where price moves within a set high and low. A breakout above the box signals strength, while a drop below indicates weakness. It offers a structured way to identify entry and exit levels.

Risk Management & Trade Planning

Effective risk control is essential in swing trading and includes practices such as:

- Stop-loss strategy & trigger discipline: Always define a price point to exit automatically. During the Adani Group stock rout in early 2023, many investors without stop-loss levels faced double-digit losses after Hindenburg’s fraud report triggered panic selling.

- Trade size & capital exposure: Control how much capital goes into a single position. In general, risking 2–5% of portfolio value per trade may prevent a single loss from wiping out weeks of gains. Over-sized positions magnify volatility..

- Clear exit plan with profit targets: Define profit objectives before entering trades (e.g., exit at 10–12% upside). Without pre-set exits, traders often hold too long and see gains vanish. In 2021, many retail traders in Zomato exited too late after its post-IPO rally cooled, missing the chance to lock in profits before prices corrected.

- Risk-reward ratio & loss scenarios: Target trades where potential profit is at least twice the potential loss (2:1 ratio). Also prepare for tail risks like policy changes or global events. The Silicon Valley Bank collapse in March 2023 dragged banking and tech shares lower overnight, hurting traders who hadn’t sized risk properly.

Market Conditions & Catalysts for Swing Trading

Swing traders often benefit when certain market-wide triggers are active, such as:

- Interest rate policy shifts: When central banks cut rates, borrowing gets cheaper and rate-sensitive sectors rally. For example, on June 6, 2025, RBI cut the repo rate by 50 bps to 5.50% plus lowered CRR, triggering strong gains in realty, banking, auto stocks.

- Sector rotation trends: Investors moving money into sectors showing strength create opportunities. In late 2024, Realty, Pharma, Auto and PSU Bank sectors outperformed broadly, providing clearer swing setups for those aligned.

- News & corporate events: Earnings surprises, buybacks or regulatory changes tend to move stocks more sharply. Infosys recently surged on announcement of a buyback, giving short-term traders a quick gain opportunity.

- Government /regulatory catalysts: Actions like proposed import taxes or trade rules can sharply affect particular sectors. E.g. in March 2025, steel companies gained after India proposed a temporary import tax on certain steel products, triggering upside in JSW, Tata Steel, and SAIL.

Swing Trading in Indian Markets (if targeting India)

The major rules shaping swing trading in India in 2025 are as follows:

- Margin rule

Effective February 1, 2025, option buyers must pay the entire premium upfront at order entry. This eliminated short-term leverage and reduced speculative high-volume trades.

- No expiry-day spread benefits

SEBI removed expiry-day calendar spread benefits for F&O contracts in February 2025, making margin rules stricter for positions held till expiry.

- Intraday position monitoring

From April 1, 2025, NSE and BSE began monitoring open positions in equity derivatives at least four times daily, ensuring real-time oversight for swing traders.

- Pre-open session for F&O

Proposed to be introduced in December 2025, a pre-open session for derivatives improves price discovery and reduces shocks when entering or exiting large swing positions..

- Insider trading restrictions

Updated SEBI rules in 2025 extended trading window closures to swing trades, barring insiders from participating ahead of results or major announcements.

Step-by-Step Analysis Using Stoxo AI

To see how AI powered stock analysis works in real life, let’s look at Reliance Industries Ltd. (RELIANCE) through Stoxo AI by StockGro.

To perform this analysis, you simply:

- Open Stoxo by visiting StockGro: Navigate to the AI-powered research engine.

- Ask your question: Type in a simple query, such as “Swing trading analysis for Reliance Industries.”

- Review the insights: It will generate a comprehensive report as follows:

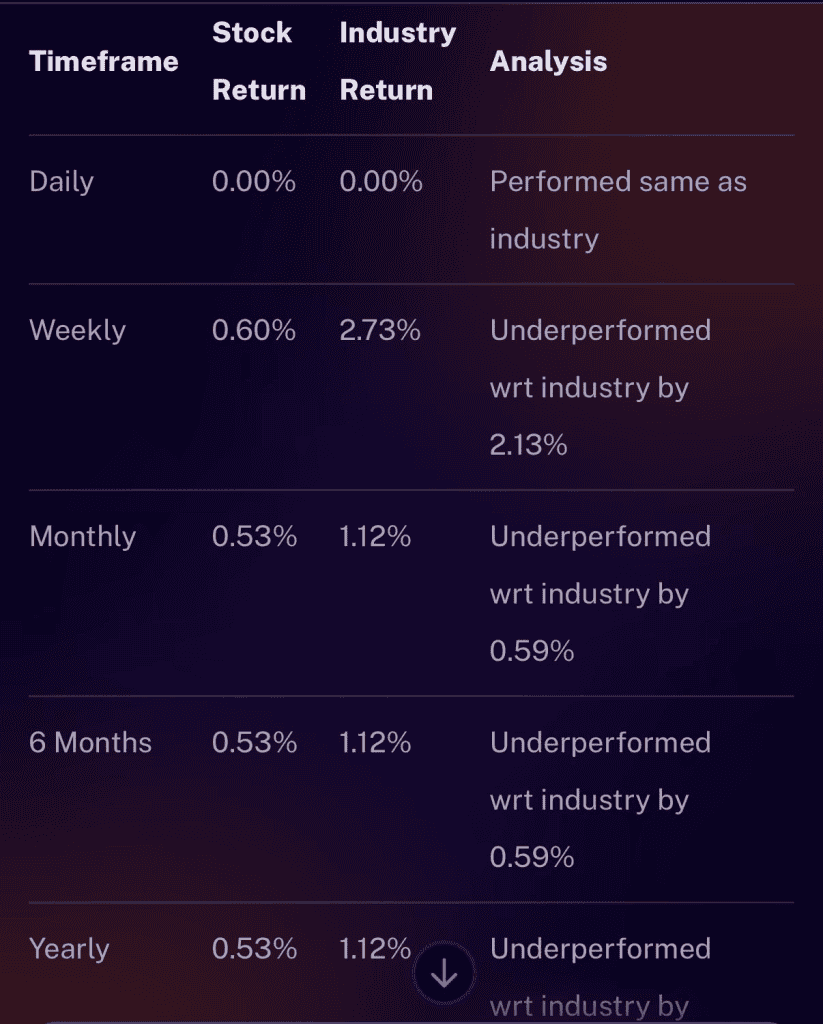

The tool first delivers a broad snapshot covering both technical and fundamentals. Reliance’s last close was ₹1,395.00, with the stock currently trading near ₹1,377.00. The overall technical score stands at 9/10, though the stock has slightly underperformed its industry benchmark across different timeframes. Here’s how the stock compares to its sector:

This data suggests that while the stock has strong underlying technicals, its momentum is lagging. It further breaks down the technicals:

- Trend direction: Sideways, with the 20-day Moving Average at ₹1,385.03.

- RSI (14): 52.13, pointing to a neutral zone (neither overbought nor oversold).

- Volume trend: Declining, suggesting caution before fresh entries.

- Overall outlook: Positive, driven by a 10/10 Risk Assessment score, but weighed down by a weaker 4/10 Momentum Score.

The stock is consolidating between ₹1,340 and ₹1,396. A breakout above ₹1,396.30 with strong volume could hint at a bullish swing, while a bounce near ₹1,340.60 might present a buying opportunity.

This is what predicting market direction is all about: using a multi-faceted approach to see the full picture. Instead of relying on a single indicator, Stoxo AI brings together performance benchmarks, technical scores, and key price levels to build a clear decision-making framework.

Why the Right Stock Selection Matters

In order to learn how to choose stocks for swing trading, there are certain tips you can follow, such as:

- Target high-momentum stocks: Stocks showing strong price moves or breaking key levels provide better opportunities for short-term profits and help traders enter trends early.

- Avoid weak or erratic stocks: Stocks with inconsistent patterns, low liquidity, or weak fundamentals can lead to unpredictable price swings, increasing the risk of losses or stagnation.

- Ensure smooth trade execution: Stocks with high daily trading volumes allow traders to enter and exit positions efficiently without significant slippage, ensuring trades execute close to intended prices.

- Follow reliable trend signals: Stocks that exhibit consistent chart patterns and momentum provide clear cues for timing entries, setting stop-losses, and identifying profit targets, enabling disciplined decision-making.

Conclusion

Swing trading is less about predicting the distant future and more about reading the market’s immediate rhythm. It blends patience with quick execution, allowing traders to capture meaningful moves without long waits. By treating each price swing as a short chapter in a bigger story, it turns volatility into opportunity. For anyone on the path to figure out how to choose stocks for swing trading, it starts with rhythm, clarity, and smart analysis of every move.

FAQ

A good swing trading stock shows high liquidity, clear price patterns, moderate volatility, and strong sector momentum. Large-cap and mid-cap stocks with robust volume and technical setups are typically chosen for reliable price swings.

Volatility can be spotted using Bollinger Bands, Average True Range (ATR), and observing wide price swings or sudden volume spikes. Stocks with regular 2–5% moves and periods of consolidation/breakout.

Some swing trading indicators that are good to use include Moving Averages (SMA/EMA), Relative Strength Index (RSI), MACD, Bollinger Bands, volume analysis, and candlestick patterns. These tools help spot entry/exit points, confirm trends, and measure momentum or reversals.

Online screeners like Screener.in, Chartink, or Tickertape help filter stocks based on liquidity, price patterns, fundamental ratios (PEG, ROE, debt/equity), and technical signals (breakouts, moving average crossovers), simplifying the search for swing trade candidates.

Use stop-loss orders, define risk per trade (usually 1–2% of capital), set clear entry/exit rules, diversify trades, and apply position sizing. Discipline in following pre-set rules prevents emotional decisions and limits losses in volatile swings.

Yes, Stoxo AI by StockGro is a powerful AI platform that combines technical scores, fundamentals, volume, and trend analysis to deliver clear, data-driven insights. It predicts market direction and suggests entry/exit points, helping swing traders make confident, informed decisions with real-time, holistic analysis.

Best swing trading stocks include large-cap and mid-cap sectors like FMCG, IT, pharmaceuticals, infrastructure, and banking. Avoid naming specific stocks; instead, focus on sectors with good liquidity, volume, and trending price action suitable for short-term trades.

Leave a Comment