Many Non-Resident Indians (NRIs) want to invest back in their home country, India, the fastest-growing economy in the world. Having a Demat account is necessary for stock market investments in India. Wondering how to open a demat account for NRIs? You are in the right place. This blog underlines the steps involved in opening a Demat account as an NRI in India.

What is NRI’s Demat Account?

First, let’s establish the meaning of a Demat Account. Demat or Dematerialised Account is a digital account that works like a bank account but for your investments like shares, mutual funds, etc. A demat account is opened through a bank/broker which is indirectly opened with a central depository like the National Securities Depository Ltd. (NSDL) or the Central Depository Services Ltd. (CSDL).

The next section covers a step-by-step guide on how to open a Demat account for NRIs.

How to Open a Demat Account for an NRI(Step-by-Step Process):

Follow these steps to open a Demat Account as an NRI:

- Choose an appropriate broker/depository participant: First, you need to look for a suitable broker or depository participant (DP) that offers NRI demat account services. Prefer SEBI-registered brokers.

- Organise documents: You need to fill out the demat application form and then prepare your KYC documents, such as a passport confirming NRI status, PAN card, etc. The DP takes permission from the RBI for any approvals.

- Link your bank account: Once documents are verified, you need to link your Non-Residential External (NRE) or Non-Residential Ordinary (NRO) bank accounts.

- Validate your account: You can activate your demat account using the provided credentials.

Understanding NRI Investment Routes: Repatriable vs Non-Repatriable Accounts

It is vital to distinguish between Repatriable and Non-repatriable accounts for NRIs. Repatriable accounts allow you to take or send back the invested amount and the returns earned on the investment to your foreign bank account at any time. Most commonly, the NRE or the Non-Residential External account is used. Here, money is held in Indian Rupees but can be moved back to your foreign bank account without restrictions. This is an easier way for NRIs to invest in India, with greater flexibility to transfer funds back smoothly.

On the other hand, Non-repatriable NRI accounts, such as Non-Resident Ordinary accounts, help in managing income earned inside India. The distinction between repatriable and non-repatriable accounts is that money cannot be freely transferred back to your foreign accounts in the latter. You can utilise the funds for transactions within India. However, sending money back to your foreign account is usually restricted to a maximum of 1 million USD per financial year. Technically, the money remains in India.

In short,

| Factor | Repatriable Account | Non-repatriable Account |

| Linked to | Typically linked to an NRE account | Typically linked to an NRO account |

| Movement of funds | Funds can be moved freely to the investor’s foreign bank accounts. | Funds cannot be transferred without restrictions. |

What Is PIS, and Do NRIs Need It?

The Portfolio Investment Scheme (PIS) is mandatory for NRIs who wish to invest through a repatriable account in India. It enables NRIs to invest in equities, bonds, and other securities in the secondary markets. All transactions go through the NRE PIS account.

NRIs can open a PIS account with an authorised and designated bank in India.

Please note that the transactions taking place in PIS are tightly controlled and monitored by RBI, to make sure that all transactions are under the prescribed foreign exchange limits.

List of Documents Required for Opening an NRI Demat Account

Check out this list of the documents required for a demat account of an NRI:

| Document |

| Valid passport |

| International Visa that authorises stay outside India- such as a work visa, student visa, etc |

| Overseas address proof- such as utility bill, rent, etc |

| PAN Card |

| Proof of Indian address – such as Aadhar card, Voter ID, etc |

| Passport-size photographs (Recent) |

| Bank statement |

| Foreign Account Tax Compliance Account (FATCA) declaration form |

Online vs Offline: What’s the Difference?

While some banks strictly require an offline procedure for demat account opening for NRIs, others allow online procedures. Let’s understand how these two processes differ.

| Differentiating Factor | Online | Offline |

| Convenience | Without physical visits, this process is more convenient for NRIs staying abroad. | The offline process becomes inconvenient for NRIs living abroad as it requires physical visits. |

| Speed | The process is much speedier. | Less speedy. |

| Documents required | Self-attested, photocopies, and verified documents. | Original documents that are verified by the authorised banks. |

| Support | Over the phone/digital mode of support is available. | Greater in-person support is given. |

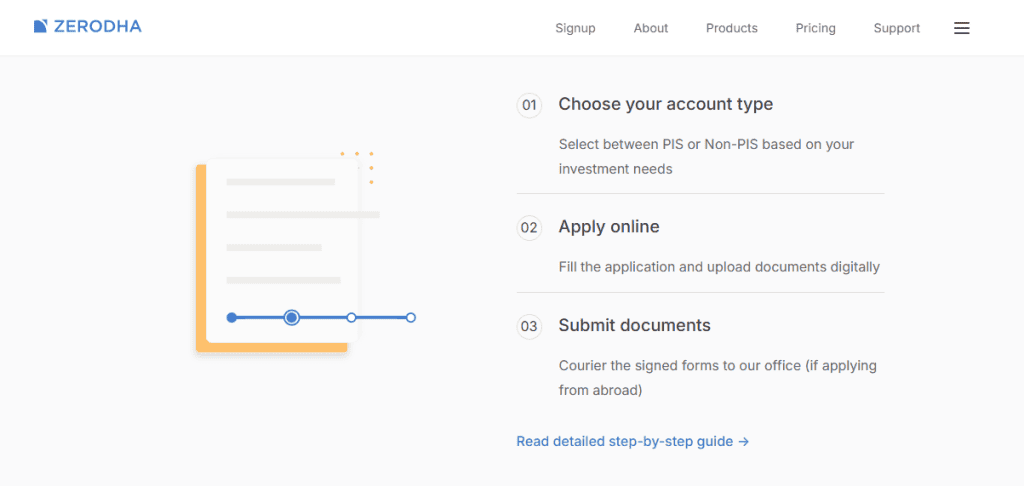

Broker-Specific Procedures & Highlights (e.g., Zerodha, ICICI, Angel One)

Let’s consider a few brokers and their demat account opening procedures for NRIs.

- Zerodha: Zerodha charges a ₹500 fee for demat account opening for NRIs. The brokerage charges are as follows:

For equity delivery trades:- 0.5% of the transaction value or ₹50 (lower value), in case of Non-PIS accounts.

- 0.5% of the transaction value of ₹200 (lower value), in case of PIS accounts.

- ICICI: ICICI offers an integrated platform that combines savings, demat, and trading accounts for NRIs. Investors can access equities, ETFs, IPOs, and mutual funds seamlessly.

- Angel One: Angel One provides both PIS and non-PIS account options for NRIs. Angel One charges an account opening and annual maintenance fee. It charges a brokerage fee of 0.5% on transaction value or ₹0.05 per unit for equity delivery, whichever is lower.

Similarly, multiple other brokers provide a Demat Account opening facility for NRIs. Do your research before finalising a broker.

Charges, Timelines & Onboarding Ease Across Brokers

Let’s take a look at a few brokers and their charges, timelines, and onboarding ease of process.

| Bank/Broker name | Charges | Timelines | Onboarding ease |

| The South Indian Bank | Account Opening: Free Account Maintenance: ₹200 plus GST for accounts other than corporate accounts. ₹1000 plus GST for corporate accounts. Transactions (Debit): ₹25 plus GST | Not confirmed | Both online and offline processes are available. |

| Zerodha | Account Opening: ₹500 Account Maintenance Charge: ₹500 plus GST | Account is validated within 48 hours of completed verification process. | Entirely online process. |

| SBI Bank | Account Opening: ₹1000+ GST Account Maintenance Charge: 1st year free, 2nd year onwards: ₹600 + GST | Not confirmed | Both online and offline processes are available. |

Real NRI Experiences: Challenges & Tips

In reality, NRIs often face some challenges while opening a Demat Account in India. Here’s how:

- Choosing the wrong account type: Often, NRIs are confused between repatriable and non-repatriable accounts and end up losing money on taxation and formalities for an account that does not match their investment goals.

- Breaching regulations: The RBI has strict rules for NRI investments. Failure to follow them may incur penalties.

- Selecting the wrong broker: Always compare across different brokers and banks before selecting the right broker for your needs.

- Tax regulations: NRIs face different taxation rules than citizens of India. You must be well-informed about any taxation rules before investing.

Conclusion

In summary, opening a demat account for NRIs in India is a straightforward process. This is available both online and offline. However, the key is to ensure that you choose the right broker and account type (repatriable or non-repatriable) based on your needs.

FAQs

A Non-Resident External (NRE) account is an account used to manage earnings from foreign sources that are deposited in India. A Non-Resident Ordinary account is an account used to manage earnings of an NRI earned from within India. The interest earned on NRE accounts is tax-free, while interest earned on NRO accounts is taxable.

A Portfolio Investment Scheme (PIS) is not mandatory for opening an NRI demat account. However, if you want to invest in a repatriable manner, you need to have a PIS account.

Yes, NRIs can open demat accounts online from abroad. This facility is provided by many brokers and banks in India.

To open an NRI demat account, you need a valid passport, a visa status, a recent passport-size photograph, address proof (both in India and abroad), a FATCA certificate, a PAN card, a bank statement, and others. These can differ across different brokers or banks.

Typically, a Demat Account opening for an NRI can take up to 3 working days. However, each broker/bank has a different standard timeline.