If the market looks slightly bullish, two popular option strategies to consider are the Bull Call Spread and Bull Put Spread. Both are designed to limit risk while aiming for steady gains, but they work in different ways. In this blog, we’ll break down Bull Call Spread vs Bull Put Spread, how each strategy works, and when you might use them.

What is a Bull Call Spread?

A Bull Call Spread is an options trade set up to benefit from a small, gradual increase in an asset’s price. It involves taking a long call with a lower exercise value and an offsetting short call with a higher exercise value, both maturing on the same date.

With this strategy, the trader limits his potential winnings and losses at the same time, thus giving an equalised way of profiting from a rise in prices up to a certain extent while keeping risk under control.

What is a Bull Put Spread?

A Bull Put Spread is a derivative strategy that a trader anticipating a moderate rise or stability in the undervalued asset’s price would employ. The setup is created by shorting a put at a higher exercise level while buying another put at a lower level, with both expiring on the same date.

As a result, the position has a net credit, and the trader is at risk of limited losses but also has limited potential profit. Essentially, this method is to earn with partly guarded risk if the asset’s price is above the higher strike price.

How a Bull Call Spread Works

A Bull Call Spread is an options trick that is used when the price of an asset is predicted to go up, but only moderately. Here, the trader takes a long position in a call with a smaller exercise value and offsets it with a short call at a larger exercise value, both ending on the same expiry. With this, the money you have paid upfront is reduced by a considerable amount when compared with the sole buying of a call.

The trader will be in profit if the asset price increases beyond the lower strike, but the profit will be limited to the higher strike. The maximum loss is kept to the net premium paid, which makes it a fight with balanced trade for a moderately bullish trend.

How a Bull Put Spread Works

A Bull Put Spread is an options strategy used when expecting the asset’s price to remain stable or rise moderately. This plan involves selling a put at a greater exercise value and acquiring another at a smaller exercise value, with both options ending together.

The result is a net credit position, which limits the user’s potential profit and loss to certain amounts. The idea is to collect the net premium in case the underlying price is higher than the higher strike price at expiration, thus giving a safer risk-reward ratio in a slightly bullish market.

Bull Call Spread vs Bull Put Spread: Key Differences

The Bull Call Spread and Bull Put Spread are multi‑leg options strategies employed when a trader expects the market to trend upward in a moderate manner. These sets of strategies possess comparable risk-reward figures; however, they are distinct in terms of their structural setup, cash flow, and suggested application.

| Feature | Bull Call Spread | Bull Put Spread |

| Strategy Type | It is a debit strategy, meaning the trader pays an upfront cost to enter the position. | It is a credit strategy, meaning the trader receives a premium upfront when initiating the trade. |

| Options Used | Going long a call at a lower exercise value and short another at a higher exercise value, with each option sharing the same maturity date. | Selling a put at a higher exercise value while at the same time buying a put at a lower value, both expiring on the same date. |

| Maximum Profit | Found by taking the distance between strikes and deducting the net premium outlay. | Limited to the amount of premium received when the position was opened. |

| Maximum Loss | The loss cannot exceed the premium paid for entering the position. | Determined by taking the gap between the strike prices and subtracting the net premium earned. |

| Impact of Time Decay | Works against the position as the bought call loses value over time. | Works in favour as the sold put loses value as expiry nears. |

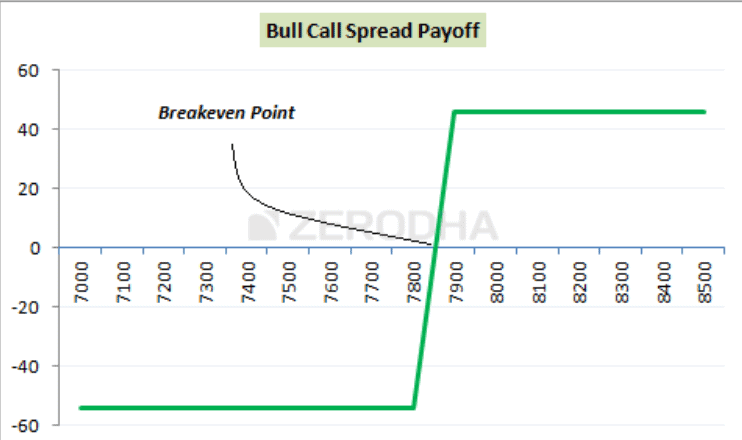

Payoff Diagrams: Bull Call vs Bull Put

First of all, to understand how these popular option strategies work and what their goals are, let’s examine the Bull Call Spread and Bull Put Spread one by one.

Bull Call Spread

This strategy represents a trading view where the investor anticipates a mild upward movement in the asset’s price. In this method, a call option is bought at a more affordable strike level, while another is sold at a higher strike, and both are set to mature on the same expiry date.

Using this method, a part of your money will be used to pay for the net premium (debit), and you will be able to see a certain part of both the potential profit and loss in return.

The top gain is the distance between strike levels minus the net cost, reached if the price closes at or above the upper strike on expiry. If it ends below the lower strike, the worst loss is the initial premium outlay.

Bull Put Spread

The Bull Put Spread also expresses a moderately bullish expectation of the market, but differs from the previous in its assembly and cash flow. This method entails writing a put option at a greater exercise price while simultaneously purchasing a put option at a smaller exercise price, with both contracts maturing on the same expiration date.

This obviously results in a net credit upfront. Profit is limited to the credit received, achieved if the asset finishes at or above the higher strike at expiry. The maximum loss is the strike gap less the credit, realised if it ends below the lower strike.

Advantages and Risks

Bull Call Spreads and Bull Put Spreads can be effective in certain market scenarios, but come with their own benefits and drawbacks:

Bull Call Spread

Advantages

- Defined Risk and Reward – Risk is limited in this plan since it has a maximum profit and maximum loss, thus making the risk management easier.

- Lower Cost Entry – It is much less expensive than buying a single call option directly. The reason is that the money you get from selling the call with the higher strike price offsets the premium you paid.

- Suited for Moderate Gains – The method is effective if the rise is expected to be moderate and not a pronounced upward rally.

Risks

- Capped Profit Potential – Profit potential is limited to the spread between the two strikes, after subtracting the cost of the net premium.

- Loss If Price Stays Low – If it closes below the lower strike at expiry, the whole initial premium is lost.

- Time Decay Impact – The position may lose money if the anticipated move occurs slowly because of the natural decay of the call option time value.

Bull Put Spreads

Advantages

- Upfront Income Generation – It is the source of immediate premium income at the trade’s entry point.

- Risk is Limited – The put with the lower strike that is bought limits the potential loss.

- Profitable Without Large Price Moves – It is possible to profit from the asset if it stays above the higher strike regardless of a large movement.

Risks

- Potential for Larger Loss Than Premium Received – The losses can be higher than the initial premium if the price drops significantly below the lower strike.

- Margin Requirement – Needs margin because of the short put position.

- Vulnerability to Volatility – Unexpected market falls and volatility spikes can lead to an increase in potential losses in a very short time.

When to Use Each Strategy

Both the Bull Call Spread and Bull Put Spread options trading strategies are consistent with a slightly bullish market sentiment. Nevertheless, which one is the best option depends on several aspects such as the state of the market, the trader’s attitude towards risk, and their trading goals.

- Bull Call Spread:

This strategy is typically applied when anticipating a modest rise in the asset’s price rather than a substantial increase. It is better in markets with minor upward trends and when you want to control the risk and limit both the potential loss and gain.

As it is necessary to make an initial premium payment, this strategy performs better when the price of the call option is relatively low and you want a defined-risk position with limited profit.

- Bull Put Spread:

The Bull Put Spread is the right choice when the asset’s price is expected to remain unchanged or slightly increase, and the trader’s aim is to make money from the premium collected. It is effective in stable markets and can become appealing when the put premiums are high as a result of a drop or volatility.

The strategy gives an immediate credit at the beginning, with the risk being limited if the asset falls below the lower strike unexpectedly. It is a wise option for making money and risk management when a bullish trend is not certain.

Example Trade Setups

To better understand how these strategies work in practice, it is useful to look at clear, illustrative examples.

- Bull Call Spread

To illustrate a Bull Call Spread, let us use the latest price for Tata Motors. As of 12 August 2025, the price is about ₹654.

- Buy a Tata Motors ₹650 Call Option (near-the-money), and pay a premium of ₹15.4 per share.

- Write a call with a strike price of ₹660 on Tata Motors (out-of-the-money) and collect the premium of ₹13.3 per share.

These are standard European options with an expiration date of 28 August 2025.

Net Premium Paid: ₹2.1 per share (₹15.4 paid minus ₹13.3 received).

Maximum profit: ₹7.9 per share (the difference between the strikes: ₹660 − ₹650 = ₹10, less the net premium paid of ₹2.1). It is achieved when the expiry time of Tata Motors is at or above ₹660.

Maximum loss: The loss is limited to the net premium paid of ₹2.1 per share, i.e. ₹2.1 should the shares remain at or below ₹650 at the expiry of the options.

Breakeven price: ₹652.1 (lower strike of ₹650 plus net premium paid of ₹2.1)

- Bull Put Spread

To illustrate a Bull Put Spread, let us use the latest price for Reliance Industries. As on 12 August 2025, the price is about ₹1,380.

- To initiate the trade, sell a Reliance ₹1,380 Put Option (at-the-money) and in return, get a premium of ₹24.0 per share.

- Buy a Reliance ₹1,330 Put Option (out-of-the-money), and for that, give a premium of ₹11.9 per share.

The expiry date for both options is the same: 28 August 2025.

Net Credit Received: ₹12.1 per share (₹24.0 received − ₹11.9 paid).

Maximum profit equals the net premium received and is earned if Reliance closes at or above ₹1,380 at expiry.

Maximum loss occurs if Reliance falls to or below ₹1,330 at expiry, calculated as the difference between the strikes (₹50) minus the net credit (₹12.1).

Breakeven price is the higher strike (₹1,380) minus the net premium received (₹12.1), giving ₹1,367.9.

Final Thoughts

The Bull Call Spread and Bull Put Spread are distinct but related options strategies, both designed for market conditions with a mildly bullish outlook. These two differ in their working principles, yet both set out the possible profit and loss beforehand. By understanding these strategies in terms of their building, payoff profiles, and restrictions, traders can better analyse how these techniques operate under various market and trading conditions.

FAQs

There isn’t a better Bull Call Spread or Bull Put Spread, each being more appropriate for different views of the market, different risk tolerances and trading goals. The question of their effectiveness turns out to be a matter of individual situations and likes instead of an easy answer for all cases.

A Bull Call Spread is a bullish options strategy used when expecting a moderate rise in an asset’s price. The idea is to purchase a call option at a strike price that is lower and sell another at a strike price that is higher, with the goal of gaining from the upward trend but having the risk limited and the profit being bounded.

A Bull Put Spread is best used when expecting the underlying asset to rise moderately or remain stable above a certain level. It suits scenarios with a neutral to slightly bullish outlook, aiming to generate income with limited risk and defined potential losses. This strategy is often chosen to profit from time decay and rising prices without requiring significant upward movement.

The highest gain from a Bull Call Spread is the gap between the two strike prices, less the net premium paid to open the position. This profit will be made if the price of the underlying asset is either equal to or greater than the higher strike at the expiry date, limiting the possible increment.

The Bull Call Spread is a transaction where a net premium is paid in advance, thereby limiting the maximum loss to this amount, but the profit is capped. With the Bull Put Spread, a net credit is created initially, and the maximum loss is limited to the difference between the strikes minus the resulting credit. Both of them have limited risk; however, the Bull Put Spread entails the risk of being an issuer of obligation until the time of expiration, as opposed to the Bull Call Spread, which is a debit paid strategy.

Both the Bull Call Spread and Bull Put Spread have defined risks and rewards, making them relatively safer compared to naked options. The Bull Call Spread limits loss to the upfront premium paid, while the Bull Put Spread carries the risk of assignment and higher margin requirements despite offering a net credit. Safety depends on the trader’s preference for upfront cost versus potential obligation risk until expiry.