In options trading, bull spreads are option strategies to capitalise on their bullish outlook for a particular asset. These strategies offer traders the potential to profit from price increases while minimising risk.

This article explains bull spreads, for both call and put variations, while exploring their mechanics, market conditions ideal for their application, and essential tips for successful implementation.

Meaning of bull spread

The bull spread is an options strategy employed by traders anticipating a modest or moderate increase in the underlying asset’s price. It involves the simultaneous purchase and sale of securities or assets with the same expiry duration but different strike prices.

There are two types of bull spread strategies:

the Bull Call and the Bull Put.

In a bull call spread, the trader pays the premium upfront and can earn profits at expiration. In a bull put spread, the trader receives the premium upfront and aims to retain as much of it as possible until expiry.

Both strategies allow traders to earn premiums from selling their options, requiring a lower initial investment than simply buying the options. Traders realise maximum profits when the underlying asset closes at or above the higher strike price they set.

Also read: Option chain for smarter online trading

What is bull call spread?

A bull call spread strategy involves using call options to benefit from an anticipated price increase in the underlying asset.

The primary goal of a bull call spread is to limit potential losses and decrease the cost of the trade, allowing the investor to enjoy gains if the asset’s price rises but caps the maximum profit, as the short call offsets some of the profit potential.

It’s a strategy suitable for scenarios where the investor expects a moderate price increase in the asset but wants to reduce risk and financial commitment compared to merely buying a call option.

Bull spread option strategy

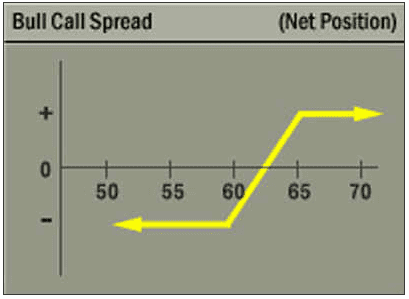

The bull spread is an options trading strategy designed to profit from a moderately bullish market outlook while minimising risk. It involves using two call options on the same asset and the same expiry date.

In a bull call spread, an investor engages in a dual call option transaction. They purchase a call option with a lower strike price (known as the long call) and also sell a call option that has a strike price that is higher (known as the short call). This approach capitalises on an expected asset price rise.

With the long call, the investor secures the right to buy the underlying asset at the lower strike price, while the short call commits them to sell the asset at the higher strike price. Selling the short call serves to lower the overall trade expenses.

A bull call spread provides limited risk and a capped profit potential, making it an ideal strategy when expecting a moderate price increase in the underlying asset while controlling costs and potential losses.

Also read: How to trade in options and maximise your profit?

Bull call spread example

Let us understand bull call spread with its formula:

Bull Call spread = Long Call (purchase a call option at a lower strike price) + Short Call (sell a call option at a higher strike price)

Typically, a bullish call spread involves using in-the-money long calls and out-of-the-money short calls. Here, in-the-money is an option having intrinsic value and can lead to a profit if exercised, whereas out-of-the-money does not have intrinsic value and cannot generate profit if exercised.

However, adjustments can be made based on the trading spread and time until expiration to optimise gains and limit potential losses.

Source: Economic times

Take a hypothetical example where the trader is Aman-

Aman is confident that the stock of Company X, currently trading at ₹ 100 per share, will increase in value. He initiates a bull call spread strategy.

- He buys a call option with a strike price of ₹ 100 and pays a premium of ₹ 5.

- He sells another call option that has a strike price that is higher i.e. ₹ 110 and receives a premium of ₹ 3.

- Aman’s total net premium outlay is ₹ 2 (₹ 5 – ₹ 3).

Benefits of Aman trading through this strategy:

- By combining buying and selling call options, he limited potential losses.

- The net premium outlay was only ₹2, reducing upfront investment.

- Aman can profit if the stock surpasses ₹110, thanks to the lower strike call option’s gains exceeding the premium paid. This strategy allows profit with risk management and cost control.

Also Read: Bullish engulfing candlestick pattern: Learn how to spot trend reversals

Bull call spread vs Bull put spread

| Bull call spread | Bull put spread |

| Differences | |

| This spread is required when you expect a movement that uptrend in the asset’s price. | This spread is required when it is a mild upward or neutral movement in the underlying asset. |

| Requires buying and selling of call options at a strike price that is higher. | Requires buying an option of put and selling another option of put with strike price that is lower. |

| The sum of the lower strike price and the net premium paid. | The lower strike price subtracted by the premium. |

| Utilises call options only. | Utilises put options exclusively. |

| It is required to pay a premium as a debit spread. | It is a credit spread, as you receive a premium to establish the spread. |

| This spread is profitable if the asset’s price is more than the strike price. | This spread is profitable when the asset is more than the strike price. |

| Suits a more bullish market outlook. | Fits a moderately bullish to neutral market view. |

| Similarities | |

| Showcases balanced profit and lesser risk. | Showcases balanced profit and lesser risk. |

| Occurs when the asset price rises significantly more than the strike price. | Realised when the asset underlying is more than the strike price at expiry. |

| Limits the initial cost of setting up the spread. | Also capped at the initial spread cost. |

Bottomline

In summary, bull spreads offer strategic options for capitalising on bullish market trends. These strategies provide structured approaches that help by studying the price movements from the uptrend and reducing losses.

It is for conducting research and considering the market environment before applying bull spreads effectively.