Options trading is full of numbers and signals, but one indicator that traders keep a close eye on is open interest (OI) in the option chain. In other words, it reflects the number of open option contracts left in the market, an indicator useful in estimating liquidity, market activity, and the direction in which the price may move.

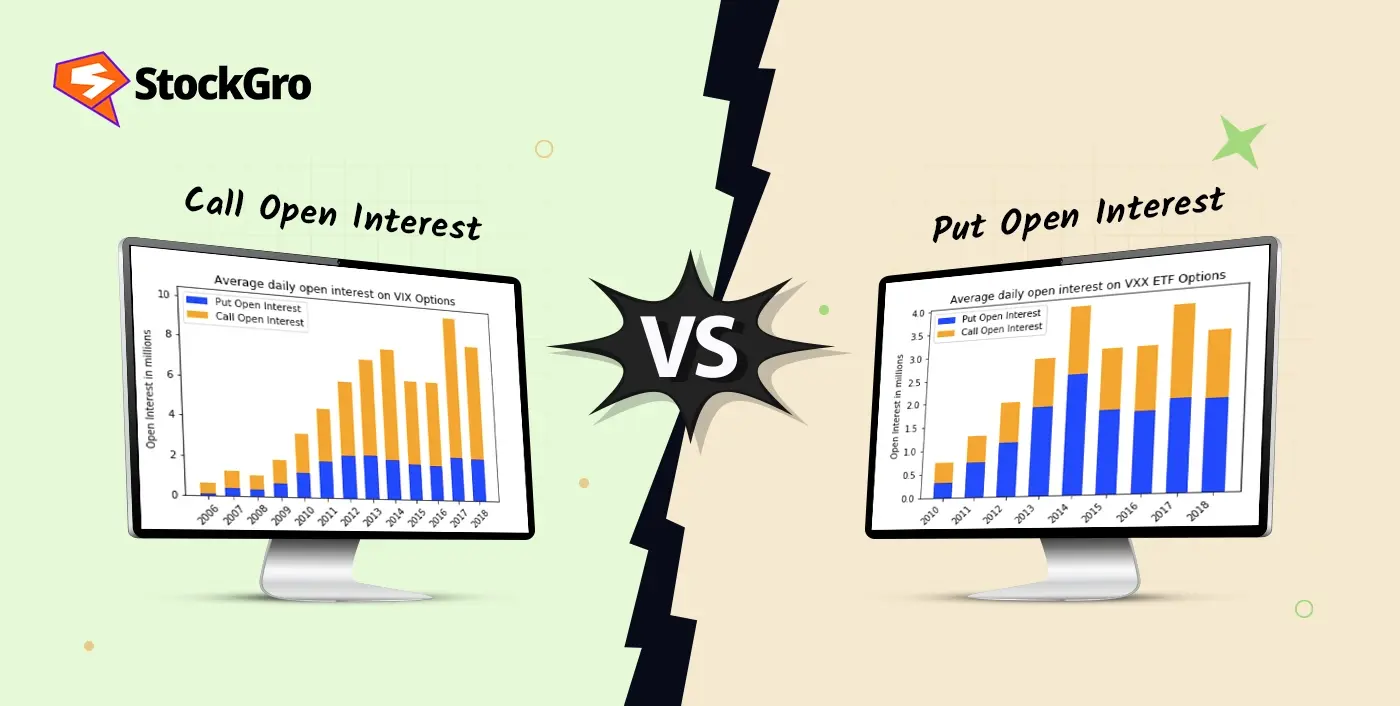

OI is even more valuable, however, when viewed independently of calls and puts. The tug-of-war between put and call OI can sometimes be an indicator of whether the market sentiment is leaning bullish, bearish, or neutral.

Now in this blog, we are going to learn open interest call vs put, the nuances of reading the data, as well as how traders find ways to utilize it to make more intelligent trading choices.

Understanding Call Open Interest

The call option provides the option holder with the right, but not the duty, to purchase the underlying entity at the agreed-upon strike price. Call open interest, then, is a gauge of the amount of call contracts outstanding.

The pattern is that high call OI at some strike prices usually indicates the resistance that traders anticipate the underlying stock or index to receive. E.g., assuming that a stock is trading at ₹980 and there is a large call OI at the ₹1000 strike, this can be an indication that many traders believe there are few chances of the stock breaking ₹1000.

What does OI tell us:

- Potential resistance levels: High call OI can cap price moves.

- Market sentiment: Rising call OI, along with rising prices indicates bullish confidence.

- Liquidity zones: Strikes with high call OI are often key trading levels.

Understanding Put Open Interest

In put options, a buyer has the right, but not the compulsion, to sell the underlying asset at a strike price. Open interest in options measures includes open put contracts.

At some strike prices, large put OI can be a hint of possible support. As an example, if the identical share at ₹980 points has major put OI at the ₹950 strike, it suggests that traders anticipate buyers to defend that strike and prevent it from falling further.

What put OI tells us:

- Support levels: Heavy put OI often acts as a floor for prices.

- Market sentiment: Rising put OI with falling prices shows bearish conviction.

- Hedging activity: Institutional traders often use puts to hedge against market declines.

Call vs Put Open Interest: Key Differences

Call options give the right to buy at a set price within a time frame, while put options give the right to sell at a set price within a period. While both call and put OI reflect trader positions, here’s how to read open interest based on strike levels and price action.

| Feature | Call Open Interest (OI) | Put Open Interest (OI) |

| Represents | Number of outstanding call option contracts, which give the right (but not obligation) to buy the underlying asset at a set price. | Number of outstanding put option contracts, which give the right (but not obligation) to sell the underlying asset at a set price. |

| Market Indication | A build-up of call OI near certain strike prices often acts as resistance, as sellers of calls may defend those levels. | A build-up of put OI near certain strike prices often acts as support, as sellers of puts may try to protect those levels. |

| Sentiment Signal | If call OI is significantly higher, it can reflect a cautious or bearish outlook, as traders may be selling calls expecting limited upside. | If put OI is higher, it may point to cautious or bullish sentiment, as traders could be selling puts to gain premium while expecting prices to hold above support. |

| Trader Usage | Traders use Call OI to speculate on the upside (long call positions to take advantage of rallies), or as a vehicle to generate income (short call positions to obtain premium). | Put OI is utilized by traders to downside-speculate (purchase puts to make money when prices fall), or in situations where one is hedging a portfolio against a decline in the market. |

The combination of call and put OI acts together to paint a portrait of trader positioning to aid in determining the market mood and possible turning points.

How to Analyze Open Interest for Trading

Price and volume combine with OI analysis to become potent. Here’s how to read open interest in options trading:

- Price Up + OI Up = Strong Trend

Indicates new money entering, trend continuation likely. - Price Up + OI Down = Short Covering

Suggests traders are closing short positions, not fresh buying. - Price Down + OI Up = Weakness Building

Bears are adding positions; further downside is possible. - Price Down + OI Down = Long Unwinding

Indicates profit booking, not aggressive selling.

When viewing both puts and calls OI up and down strikes, traders can get a feel of support, resistance, and possible breakeven levels being anticipated by the market.

How Call vs Put OI Affects Price Movement

Open interest behaves as the walls around the price that are not seen. Extreme levels of call OI typically indicate resistance breaks, while extreme amounts of put OI usually signify support.

For example:

- If Nifty has huge call OI at 20,000 and put OI at 19,500, the index may trade in this range until one side breaks.

- If the call OI at 20,000 starts unwinding while put OI increases at 19,800, it may signal that resistance is weakening and the market could move higher.

Such pull and push game between call vs put OI has an impact on levels of the day, expiry trends and even the prevailing sentiments.

Example: Call vs Put Open Interest Chart

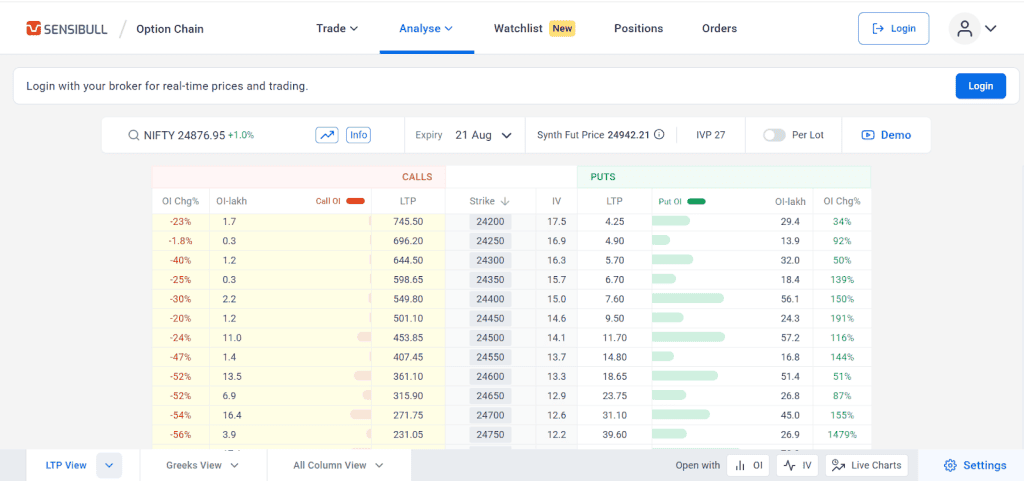

You can see the Call (red side) and Put (green side) option data for the 21st August expiry in this screenshot of the NIFTY Option Chainl. Important statistics such as the Last Traded Price (LTP), Implied Volatility (IV), Open Interest (OI in lakh contracts), and Change in OI (%) are detailed beside each strike price in the middle.

The horizontal green bars on the right side show the Put OI buildup, while the shaded red bars on the left side show the Call OI buildup. In order to comprehend market mood and locate possible NIFTY support and resistance zones, it is essential to be able to visually evaluate where traders are adding positions (support from puts and resistance from calls).

Using Put Call Ratio for Market Sentiment

Put call ratio open interest is one of the easiest methods of gauging sentiment as a whole. It is estimated as:

PCR = Put Open Interest ÷ Call Open Interest

- PCR > 1: More puts than calls → bearish sentiment or excessive hedging.

- PCR < 1: More calls than puts → bullish sentiment.

- PCR ~ 1: Balanced market positioning.

As an illustration, the PCR will indicate a possible short-covering rally in case of a steep increase to above 1.2. On the other hand, a PCR of less than 0.7 may be indicative of too much bullishness that might be followed by a reduction.

Tips to Use Open Interest in Your Strategy

- Always combine OI with price action: OI alone is not enough; check if price movement supports the OI trend.

- Track changes, not absolute numbers: A sudden rise or fall in OI is more meaningful than static levels.

- Use OI clusters to define ranges: Identify where the highest call and put OI exist to mark resistance and support.

- Watch expiry dynamics: OI data is particularly useful near expiry, when traders roll over or close contracts.

- Pair with volume analysis: High volume with rising OI confirms strong conviction.

Conclusion

Open interest call vs put is not simply a data point; it is a window into the psychology of traders. As call OI may emphasise resistance, and put OI emphasise support, the relative proportion of the two will determine market sentiment. OI analysis, coupled with price and volume, and even put call ratio open interest, would assist traders in predicting movement in the market and not face false signals.

Open interest can transform raw data into useful insights to both new and existing traders. Not only can OI tell you where the money is in the market, but it can also help you to spot where the next move is. This can be valuable when intraday or formulating a positional strategy.

FAQs

Open interest options is the total volume of outstanding contracts (calls and puts); the volume of contracts that is currently out there, not settled, exercised, or closed. It gauges the inflow of money to a certain option strike or series. An increase in open interest can be indicative of increased participation and activity in the market, and a decrease in open interest shows positions are being liquidated.

Open interest is not necessarily in itself a bullish or bearish sign; it just indicates high activity and liquidity. It depends on the nature of the contracts as to whether they are calls or puts and on price direction. As an example, a call open interest at a wide strike can indicate resistance, which is traditionally bearish in case the prices fail to move high. Big put open interest can be considered as bullish support.

A high call open interest implies a large investment standing at specific strike prices in the form of call contracts. This is usually a resistance area as the sellers of calls might attempt to hold the price down below that area to continue to earn premium income. It can also present the possibility that traders are speculating on upside. Although it can also be seen as bullishness, practically, it can serve more of a cautionary tone, as massive call writing can be seen as a ceiling to rallying, and possibly preventing upside action above those strike prices.

Open interest can inform the trader which way participation, liquidity, and important support or resistance areas are performing in the market. As an example, call open interest at a strike can provide resistance, and put open interest can be a leading indicator of support. Variations in the open interest also may be used to predict whether new positions are being opened (trend continuation) or are being unwound (trend reversal).

Large put open interest indicates many traders have positions as holder writers on a given strike. This can be a zone of support as those with an interest in selling puts expect messages going higher than that price and may protect it. It may also indicate a bullish tone when writing is dominant as traders make gains when the underlying maintains. A large amount of put buying however, may be an indication of bearishness, and thus context and the overall market direction should be used to interpret.

The straight open interest does not directly determine the option prices, but rather traders behaviour and liquidity, which have a secondary effect on price. The presence of high open interest enhances liquidity so that bid-ask spread becomes thin and trading is more effective. Unexpected rises in the open interest as prices shift may indicate a powerful interest or discovering new positioning that might raise implied volatility and premium. On the other hand, a decrease in open interest can lessen liquidity, increase spreads and deteriorate trends.

The interpretation of call vs put OI is quite challenging and involves the comparison of outstanding contracts and the location of where the traders are placing their poses. The reason is that higher call OI usually becomes resistance as traders seem not to anticipate prices moving much higher beyond these strikes. Conversely, put open interest that is higher offers support, and traders expect prices not to fall.

Put-call open interest ratio (PCR-OI) is the relative measure of opened put contracts and opened call contracts. Computed as total put open interest/ total call open interest. The higher the ratio, the more likely put, which can be construed as bullish, as traders can be sold at anticipated support to generate income. A smaller ratio is evidence of higher calls, which is considered bearish.

High call OI suggests strong resistance and a potential price breakout if it is surpassed, leading to upward momentum.

Increasing put OI indicates rising bearish sentiment, with traders expecting a price decline. If the price rises, put option holders may incur losses.