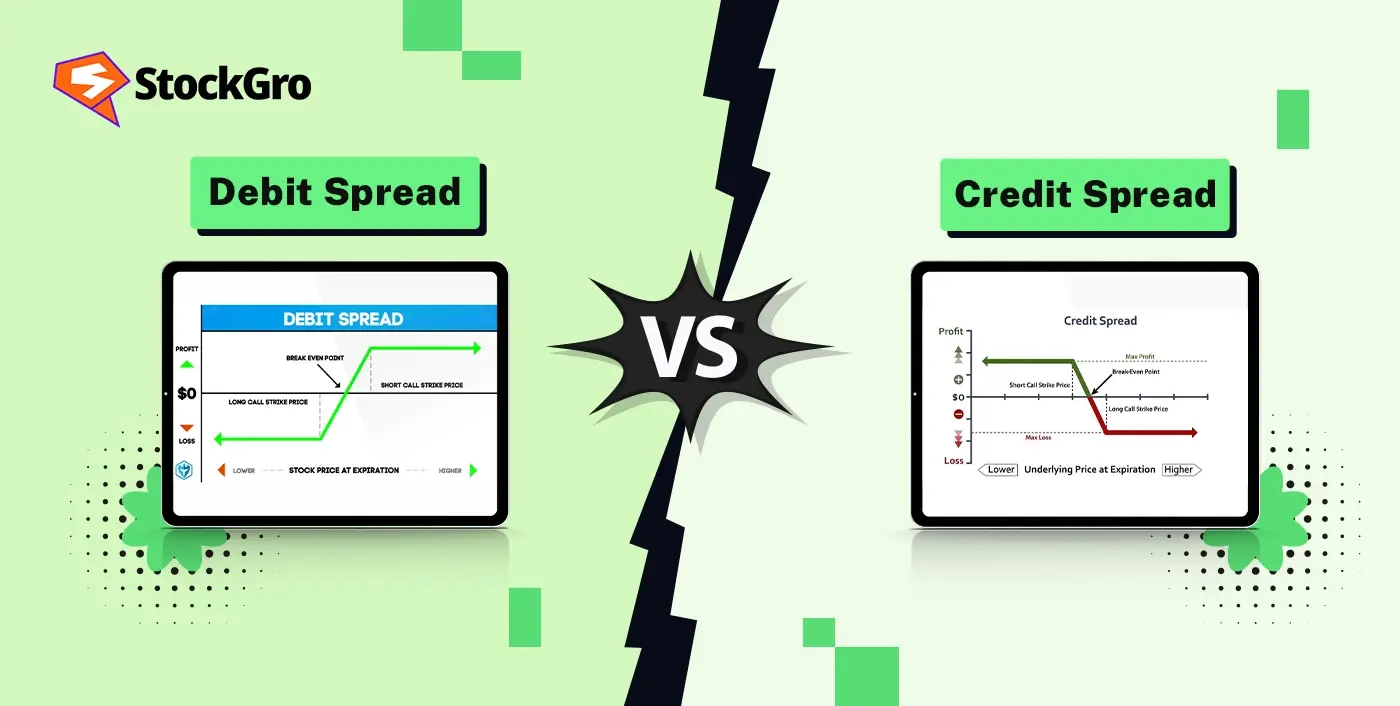

Retail traders in options trading often face a costly dilemma: pay high premiums for single options or take on big risks with uncovered positions. Debit spread and credit spread provide a way to manage both, but not knowing how they work can lead to poor results. The real question is whether you should pay a premium to enter or collect a premium and handle the obligations. The answer depends on your market view and risk appetite. This blog discusses the core difference between debit spread and credit spread in detail.

What is a Debit Spread?

A debit spread refers to an options method where buying and selling occur on the same security, same expiration date, but at separate strike levels. The option purchased is more expensive than the one sold, creating a net debit at the start. The aim is for the spread’s value to rise, so it can later be closed at a higher price. The risk stays restricted to the upfront debit paid, while the gain relies on how much the asset shifts in the predicted direction. This strategy is often applied when a moderate price move is anticipated.

What is a Credit Spread?

A credit spread is an options setup that combines buying and selling contracts on the same underlying, same expiration, but with differing strike prices. The option sold carries a higher premium than the one bought, creating a net credit at entry. The most suitable outcome is when both contracts lapse without value, enabling the trader to retain the received credit. The maximum profit is limited to the initial credit, and the potential loss equals the gap between strikes less the net debit incurred. This method is generally used when a sideways or limited price move is expected.

Debit vs Credit Spread: Difference

Debit spread vs credit spread differ mainly in how cash flows at entry and the type of market stance they represent. Here’s how debit vs credit option spreads compare:

| Feature | Debit spread | Credit spread |

| Initial transaction | Net outflow (premium paid) | Net inflow (premium received) |

| Position setup | Buy higher-premium option, sell lower-premium option | Sell higher-premium option, buy lower-premium option |

| Market outlook | Directional (bullish with calls, bearish with puts) | Neutral to moderately directional |

| Objective | Profit if spread widens in value | Profit if options expire worthless |

| Maximum profit | Difference between strike prices – net debit paid | Net credit received at entry |

| Maximum loss | Limited to net debit paid | Difference between strikes – net credit received |

| Break-even point | Long strike ± net debit (depending on call or put) | Short strike ± net credit (depending on call or put) |

| Impact of volatility | Gains if volatility rises after entry | Gains if volatility falls after entry |

| Effect of time decay | Works against the position as time passes | Works in favor by eroding option value |

| Cash flow timing | Outflow at entry, inflow if profitable exit | Inflow at entry, risk of outflow if position fails |

| Common use | Express moderate price expectation at lower cost | Generate income when price expected to stay in range |

Debit Spread Example

Let’s take an example to understand how a debit spread works. As of August 19, 2025, Tata Motors is priced at ₹697.20.

A bull call spread can be built by:

- Purchasing a ₹700 call option for ₹12

- Selling a ₹710 call option for ₹7

This results in a net debit of ₹5 per share. The maximum loss is restricted to 5, while the profit is also 5, being the strike gap subtracting the debit. Such a setup reflects a moderately bullish view with both risk and reward clearly defined.

Credit Spread Example

Now, we will also consider a credit spread example. On August 19, 2025, Zodiac Ventures was trading at ₹7.28.

A bear call spread can be structured by:

- Selling a ₹7.50 call option for ₹0.50

- Buying a ₹8.00 call option for ₹0.25

This generates a net credit of ₹0.25 per share. The maximum gain is ₹0.25 if the price stays below ₹7.50, while the maximum loss is capped at ₹0.25 (spread width minus credit). This approach suits a mildly bearish or neutral outlook, where the aim is for the sold option to expire worthless.

Debit vs Credit Spread: Risk and Reward

The way risk and reward work in spreads is clearly defined, but they differ based on whether the setup is a debit or a credit spread. Here’s how they compare:

Risks:

- In a debit spread, the maximum loss is the net debit paid at the time of entry. This means even if the price moves heavily against the position, the loss is capped at this upfront cost.

- A debit spread carries time decay risk, as the option bought loses value each day, which can reduce the spread’s price even if the market does not move much.

- Credit spreads carry the risk of the underlying moving strongly against the short strike. The maximum loss equals the strike price difference subtracting the credit received.

- Since credit spreads involve selling options, margin requirements are usually higher, and the risk of assignment before expiry can also arise.

- For both debit spread vs credit spread options, losses are capped, but the structure of risk is opposite, one pays upfront and risks losing it, while the other collects upfront and risks paying later.

Rewards:

- In a debit spread, the maximum reward is the strike price difference minus the debit paid. This happens when the underlying price rises completely in support of the long position.

- Debit spreads also benefit when implied volatility increases after entry, as this can raise the value of the long option more than the short one.

- In a credit spread, the maximum gain is the credit received at entry. This result occurs when both contracts expire without value.

- Time decay works as a reward factor in credit spreads, since the value of the sold option reduces daily, allowing the position to retain more of the credit.

- When comparing a credit spread vs debit spread strategy, the reward side reflects the core difference: debit spreads aim for directional gains, while credit spreads are designed to profit from stability or slow movement.

When to Use Debit Spreads vs Credit Spreads

Each spread suits a different type of market situation. Here’s when each is generally used:

- A debit spread is chosen when seeking to participate in a directional move without committing the full premium of a single option. It allows controlled exposure at a lower upfront cost.

- Debit spreads are useful when risk needs to be defined in advance, since the maximum possible loss is capped at the debit paid.

- They can be preferred when looking for a limited but focused payoff, as the profit potential is linked directly to the distance between strikes.

- A debit spread makes more sense when paying a known cost is acceptable in exchange for potential upside, even if the maximum reward is capped.

- They are often applied in cases where a moderate move is more likely than a large one, as a strong swing could be better captured by buying a single option instead.

- A credit spread is suitable when the underlying is expected to stay within a range or move gradually, since the objective is for both options to expire worthless.

- Credit spreads offer upfront income in the form of net credit, which is fully retained if the market stays within the expected boundaries.

- They can work well when time decay is expected to erode option value quickly, helping the sold leg lose value faster than the bought one.

- Credit spreads may be preferred when the focus is on collecting premiums consistently rather than waiting for a directional payoff.

- They are also considered in cases where the move against the position is expected to be limited, since losses are capped at the difference between strikes minus the credit.

The decision between a debit spread vs credit spread therefore comes down to whether the objective is to pay for potential movement or get paid for accepting controlled obligations if stability holds.

Taxes: Debit Spread vs Credit Spread

Both debit and credit spreads are treated as derivative trades under Indian tax rules, but the way they are recorded and reported creates some key differences. Here’s how they differ:

- Tax Classification: Profits from both debit and credit spreads are taxed as business income, not capital gains. These are added to overall income and taxed as per the applicable slab rate, while losses are treated as business losses.

- Loss Set-Off and Carry Forward: Spread-related losses are permitted to be offset against business income, though not allowed against salary. Unused losses may be carried ahead for up to eight years to offset against future business income.

- Turnover Calculation: For all option strategies, including debit and credit spreads, turnover is calculated as the sum of two components: the absolute profit or loss on closed positions, and the premium received on shorting/writing options. The calculation process remains the same for both spread types.

- Filing ITR: Income from both debit and credit spreads is reported under ITR-3 as business income.

- Tax Audit Requirement: If turnover from spread trades crosses the threshold set under Section 44AB, a tax audit is required. This rule applies equally to debit as well as credit spreads.

- Expense Deduction: Brokerage, internet costs, advisory tools, and related expenses can be claimed as business expenses, provided records and invoices are maintained.

- Advance Tax: If the overall tax liability from spread trading and other income exceeds ₹10,000 in a year, advance tax must be paid in quarterly installments. Non-payment can attract interest under Sections 234B and 234C.

Final Thoughts

Debit spread vs credit spread isn’t just a technical comparison, it’s about choosing between paying for controlled opportunity or earning for controlled risk. One locks in a cost to participate in price movement, while the other collects a premium with obligations attached. Both are structured to define outcomes in advance, leaving no surprises. Knowing how they differ allows traders to match strategy with market view, making spreads a versatile part of the options playbook.

FAQs

A debit spread involves buying one option and selling another of the same class with different strikes, resulting in a net premium paid. A credit spread has the opposite payout: you receive a net premium upfront by selling a higher premium option and buying a lower premium one.

With debit spreads, the maximum risk is limited to the net premium paid to establish the position. The loss occurs if the spread expires worthless; time decay and unfavorable market moves can also reduce profits or increase losses.

A debit spread can be bullish or bearish, depending on the structure. Bull call spreads (debit spreads using calls) are bullish, while bear put spreads (debit spreads using puts) are bearish.

With debit spreads, the maximum risk is limited to the net premium paid to establish the position. The loss occurs if the spread expires worthless; time decay and unfavorable market moves can also reduce profits or increase losses.

Credit spreads are best used when you expect the underlying price to stay within a certain range or move slightly in your favor. They are commonly deployed in neutral to mildly bullish or bearish markets and when implied volatility is higher.

A credit spread can also be bullish or bearish. Bull put spreads (credit spreads using puts) are bullish, while bear call spreads (credit spreads using calls) are bearish. The trading view depends on the option type and strike selection.

Credit spreads carry limited risk, usually capped at the difference between the strikes minus the net premium received. However, the loss can be larger than the profit, especially if the underlying moves sharply against the position or if margin calls occur.