Many investors find themselves stuck at the same question: should I take a long call or a covered call? At first glance, both sound alike. They involve options trading, both can make you create high premiums, and both seem like smart strategies.

So, the decision to which one you should pick depends on your view and comfort with risk. Let’s see the difference between long call and covered call in this blog.

What is a Long Call Option?

A long call option is a bullish options trading strategy move where you pay for the right to buy an asset, such as a stock, at a fixed or strike price before a set date. You are not forced to buy, but you keep that right until the option expires. You pay a premium upfront to secure this position.

What is a Covered Call Option?

A covered call option is a way to earn from stocks you already have. You sell a call option on your shares, agreeing to sell them at a price if the buyer decides to do the option trading. You must already own the shares to make this trade “covered.”

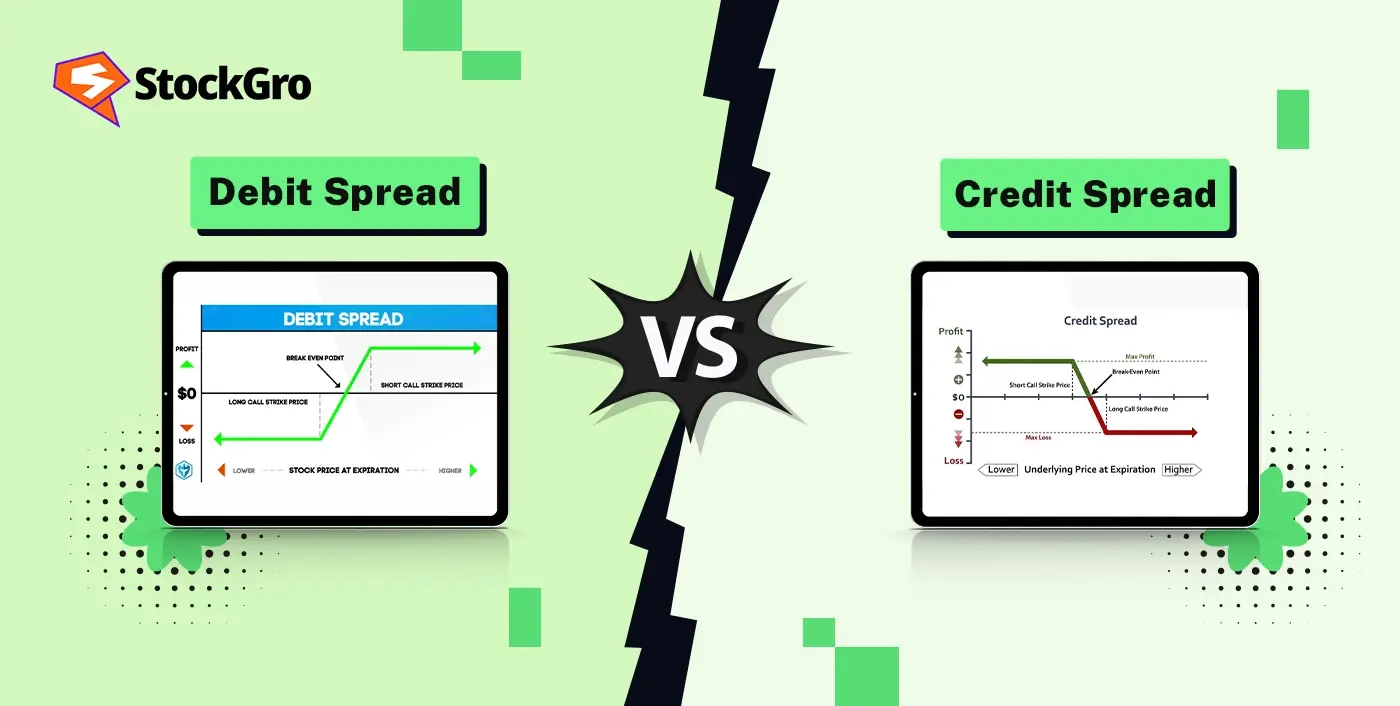

Difference Between Long Call and Covered Call

A long call is buying an option for bullish gains, while a covered call pairs 100 shares with selling a call option for income generation. Look for the difference between long call and covered call here:

| Feature | Long Call | Covered Call |

| Position | Buy a call option | Own stock + sell a call option |

| Market Outlook | Strongly bullish | Neutral to mildly bullish |

| Max Profit | Unlimited | Limited as capped at strike price |

| Max Loss | Premium paid | Stock value drop minus premium received |

| Premium Income | None | Yes, from selling the call |

| Risk | Lose only the premium | Stock can fall, but premium softens the hit |

| Main Aim | Gain big if stock jumps | Earn extra income from stock you already own |

Payoff Diagram Comparison

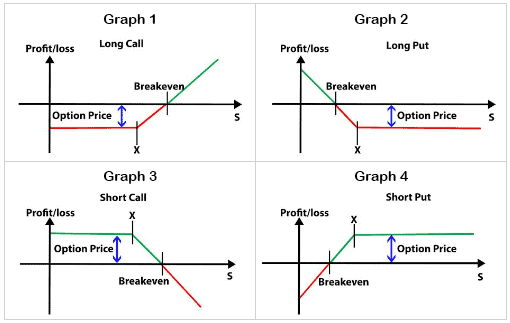

Here are four graphs showing profit and loss of option trades.

Graph 1: If you are taking a long call, you will pay a premium and get it if the stock is rising above the breakeven.

Graph 2: A long put is for those who want profits from the stock prices falling below breakeven.

Graph 3: A short call lets you collect the premium, but losses can grow if the stock price rises.

Graph 4: It shows how short puts help get premium if stock price drops sharply.

When to Use a Long Call

A long call option works best when you believe the price of an asset is gearing up for a sharp and timely jump. You are aiming to catch that upward swing without putting a large amount.

- Strong Upward View: You see signs that the price will climb well above the strike price.

- Smaller Investment, Bigger Reach: You want the chance to benefit from a large price move without buying the asset outright.

- Controlled Downside: You only risk the premium you paid. Even if the market turns the other way, your loss is limited.

- Price Swings: You expect more activity in the market that could make the option more valuable.

When to Use a Covered Call

A covered call option is most useful when you already hold shares and want to earn extra income from them while setting a price at which you are willing to sell.

- Sideways to Slightly Higher Market: You think the price will stay in the same range or climb at a measured pace for a while.

- Extra Income Stream: You collect a premium for selling the call while still holding your shares.

- Prepared to Sell: If the price rises above the strike, you are ready for your shares to be sold at that price.

- Market Conditions: This works well when you do not expect big market moves in the near term.

Example Scenarios

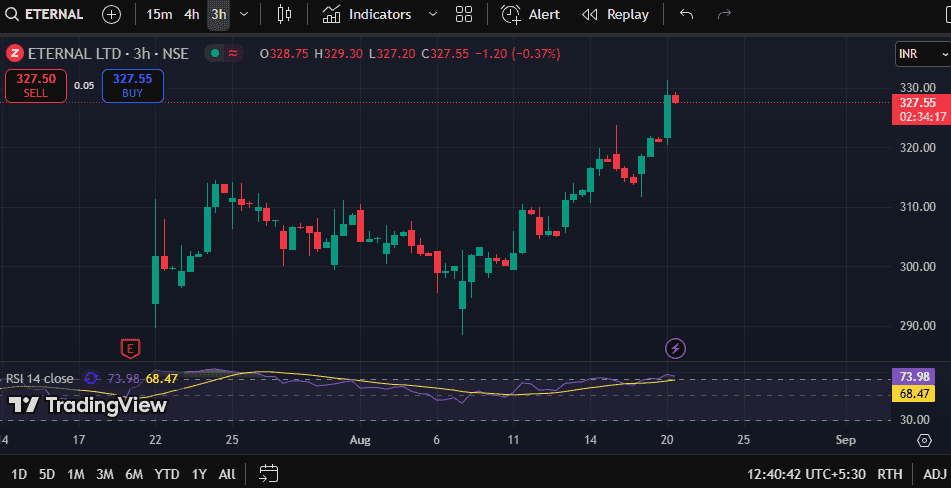

1. Buying the Stock (Long Position)

Let’s say you buy 100 shares of Eternal Ltd. at ₹327.80.

Your investment = ₹32,780.

- The stock getting a price of ₹350 helps you make: (₹350 – ₹327.80) × 100 = ₹2,220 profit.

- Eternal might drop to ₹300, give you: (₹327.80 – ₹300) × 100 = ₹2,780 loss.

2. Covered Call (Buy Stock and Sell Call Option)

Take 100 shares at ₹327.80. But what if you sell a 1-month call option at ₹340 for a premium of ₹8?

Look at this calculation of your net outflow:

- Stock cost = –₹32,780

- Option premium = +₹800

- Net outflow = ₹31,980

Pros and Cons of Each Strategy

Let’s see the pros and cons of long and covered calls.

Pros of Long Call

- Unlimited profit: If the stock rises more and more, your profit can keep climbing with no upper limit.

- Loss can be capped: The maximum loss can happen for the money you paid for the option.

- Lower capital: You can pay a few part of the full stock price as the option premium.

Cons of Long Call

- Time Decay: Any day when stock isn’t showing any movement, won’t give you any option return.

- Risk: If the stock never climbs above the strike price before expiry, the option becomes worthless.

- Needs Strong Price Movement: A small rise in the stock is not enough.

Pros of Covered Calls

- Steady Income: Each time you sell a call, you collect a premium. The money is yours, no matter how the stock moves in the short term.

- Support Against Losses: If your stock dips a little, the money you earned helps soften the blow.

- Lower Risk: Because you already hold the shares, your risk is capped.

Cons of Covered Calls

- Profit Cap: If the stock shoots up, you’ll still have to sell at the strike price.

- High Capital Requirement: Since you must own the stock first, you need more money upfront.

- Tax Complications: Premiums and forced share sales can create taxable events.

Final Thoughts

So, now you know the difference between long call and covered call. Long calls and covered calls are built for different premiums. You pay a small amount, and if the price shoots up, your profit can be big, while your loss is capped at that entry cost. This is what a long call is. A covered call feels different. Here, you already own the shares and sell an option on them. You pocket extra income, but if the stock jumps too high, your profit is capped.

FAQs

If you are buying a call option, it means you are paying a premium. Your loss is limited to that premium, but if the stock jumps, your profit can grow without limit. You get premium income, but your profit stops at the strike price.

Yes. The maximum you can lose is the premium you paid. If the stock does not rise above the strike price before expiry, the option expires worthless, and your entire premium is gone.

If you expect the stock to stay flat or rise just a little, go for a covered call strategy. You can also use it when you want to earn income on shares you already own. Also, avoid it if you believe the stock will rise sharply or fall hard.

If you are an investor, use long calls when you expect a strong upward move in the stock or want to benefit from a rise without spending as much as buying shares. You can also go for it if you want limited risk and open profit potential if the move happens.

A long call can give you big profits if the stock rises, but there is a real chance of losing all your premium. A covered call can earn steady income with lower risk, but your upside is capped.