Futures trading is one of the most dynamic sections of financial markets, and it has drawn both professional traders as well as institutional investors. As reported by the Futures Industry Association (FIA), the volume of global futures and options totalled 137.3 billion contracts in 2023, emphasising its increasing importance in contemporary funds.

Although futures provide potential benefits through speculation, hedging and portfolio diversification, they also present risks. It is important to understand how futures trading for beginners operates and the strategies that should be employed when using them as well as the regulations that govern them, before entering this market.

What Is Futures Trading?

So, what is futures trading? Futures trading is a mode of agreement comprising the purchase or sale of a standardised contract, in which a buyer is bound to purchase or the seller to deliver one unit of an underlying object at a specified price and at a specified date in the future. Futures do not represent ownership, as do stocks or bonds. Rather, they are the agreement to deal upon commodities (literally a new one), currencies, stock index, or interest rates in the future.

Charging also allows participants to hedge price risk or speculate on changes in price, and thus, the futures market is a staple of modern financial markets in derivative trading.

How Futures Contracts Work

The futures contract is at the core of futures trading, and it occurs in organised exchanges like NSE, BSE, and MCX. Each contract specifies:

- The underlying asset (e.g., Nifty 50 index, Sensex, crude oil, gold, or USD/INR).

- Contract size (lot size fixed by the exchange).

- Expiry date (last day of trading for that contract).

- Settlement type (cash settlement for indices and many commodities, or physical delivery for some contracts like gold).

With a trade on a futures contract, you are simply speculating on the price trend of the underlying. By going long, you gain when the price rises. By going short, you profit when it falls.

Types of Futures & Asset Classes

Futures cut a broad strategic range of markets. The common categories are:

- Commodity Futures: Energy (crude oil, natural gas), metals (gold, silver, copper), and agriculture (corn, wheat, soybeans).

- Financial Futures: Stock indices (Nifty 50, Sensex), interest rates (Treasury bonds), and currencies (USD/INR).

- Cryptocurrency Futures: Futures on Bitcoin and Ethereum are becoming increasingly popular, as those who simply want to gain exposure without the direct ownership of a currency are increasingly interested.

Key Terminology: Contract Size, Tick Value, Expiry

- Contract Size: The standardised quantity of the asset (e.g., one crude oil futures contract = 1,000 barrels).

- Tick Value: In Nifty 50 futures, the tick value is the minimum price fluctuation allowed. The tick size is ₹0.05, and with a lot size of 50 units, one tick value equals ₹2.50 (0.05 * 50).

- Expiry: Future contracts have a fixed maturity. Traders must close, roll over, or accept settlement before expiry.

Uses of Futures: Hedging vs Speculating

Futures are primarily used in two ways:

- Hedging: With hedge strategies, futures are used by businesses and investors to decrease risk. To illustrate further, an airline can hedge against the increased costs of fuel by purchasing crude oil futures.

- Speculating: In speculation, traders aim to gain profits based on price movements. Speculators bring liquidity to the market but bear more risk.

This dual use is why futures market is both practical and highly liquid.

Popular Futures Trading Strategies

Futures trading is dominated by several strategies, depending on goals of the trader:

Trend Following: This is where the trends are identified and made use of already established market trends through the use of technical indicators, which include the moving average and the oscillator. In trend following, traders would like to capture big directional moves in days or weeks making this one of the most popular futures approaches. Some traders wait for a confirmed breakout before entering to ride the momentum.

Spread Trading: In this, traders make a long and short position on a variety of futures contracts, e.g., crude oil and natural gas or wheat and corn. The concept is to profit from price differences or seasonal correlations rather than to bet on the outright trend of the market. Often, the profit is sought from price fluctuations within a defined range.

Hedging: Futures are commonly used to hedge against unfavourable price changes. To cite an example, there might be equity investors who short index futures to hedge against the loss in their portfolios and commodity producers using the futures to book their selling prices. In some cases, advanced order-flow strategies are also applied to gauge market depth before placing hedge positions.

Scalping and Day trading: Active traders use very short-term strategies to take advantage of quick rule changes in the price. Scalping involves holding positions for only seconds to minutes before closing, whereas day traders may buy and sell trades on a daily basis.

Step-by-Step: How to Trade Futures

1. Choose a Broker & Set Up an Account

The first step is to select a trustworthy broker with access to major futures exchanges, such as CME, ICE, or NSE. Not all brokers offer futures; therefore, it’s essential to verify the types of futures available, the trading futures platform, margin policies, and commission fees. After making a selection, you will have to overcome account opening formalities, which typically consist of the KYC check, income evidence, and risk disclosures, as futures are regarded as a high-risk instrument.

2. Select a Market & Contract

Futures can be traded in a variety of asset classes, including equities, commodities, currencies, interest rates, and many more. As a trader, ensure you determine the contract that suits your goals and risk-taking capacity. An example is that equities index contracts (such as S&P 500 or Nifty 50) would be of interest to a fund manager who wants exposure to the stock market, whereas crude oil would be of interest to an energy-focused fund manager

3. Deposit Margin

Futures trading only needs a margin deposit compared to buying stocks, which requires a deposit of 100 per cent of the stock’s value. The first collateral is this initial margin, which serves as collateral to offset a possible loss. Brokers can impose a maintenance margin requirement. If your account value falls below this amount by a specified amount, you will receive a margin call and must deposit additional funds to maintain the position.

4. Enter the Trade

After financing, you make a decision on whether to be long (enter the futures if you are expecting an increase in prices) or short (sell the futures if you are expecting the prices to decrease). Your trading futures platform allows orders to be made with options such as market order, limit order or stop-loss orders to control how orders are executed. Since futures are standard, there is no confusion as regards to the contract terms and you can just specify the direction and the size.

5. Monitor Positions

Future contracts are marked-to-market each business day, in which gains and losses are settled daily according to the closing prices. This will be transparent, but it also means that it must be monitored. A profitable shift will add balance to your account, whereas an unfavourable one may cause a margin call. To mitigate exposure, most traders utilise stop-loss levels, technical indicators, or hedges.

6. Close, Roll, or Settle

As expiry approaches, you must decide your next move:

- Close the position: Exit by taking the opposite side of the trade (sell if long, buy if short).

- Roll forward: Shift your position into a later expiry contract if you wish to maintain exposure.

- Physical or cash settlement: Some contracts involve delivery (like commodities), while others are cash-settled (like index futures). Most retail traders square off before expiry to avoid delivery obligations.

Risk Management of Futures Trading

Futures trading is leveraged, which amplifies both profits and losses. Effective risk management includes:

- Position Sizing: Never risk more than a fixed percentage of capital.

- Stop-Loss Orders: Automatically exit losing trades to cap losses.

- Diversification: Avoid overexposure to a single market.

- Margin Monitoring: Keep track of variation margin requirements to prevent forced liquidation.

Pros & Cons of Futures Trading

Pros

- High Liquidity Across Major Contracts: The most traded futures, such as crude oil, gold, and stock indices, have enormous trading volumes on a liquid daily basis. This guarantees low bid-ask spreads and fast order execution, and low slippage.

- Ability to Profit in Both Rising and Falling Markets: Unlike stock market trading, futures enable traders to trade long when they are optimistic about price increases and short when they anticipate price declines. This versatility enables them to adapt in any market.

- Leverage Magnifies Returns on Small Capital: Futures involve margin deposits-only a percentage of the contract balance. This enables traders can utilise huge positions on small amounts of initial trading capital, which will increase the potential gains.

- Transparent Pricing on Regulated Exchanges: Futures are traded in a centralised and regulated exchange, such as CME or NSE, where standardised prices ensure transparency, reducing manipulation and promoting fairness.

Cons

- Leverage Increases the Risk of Significant Losses: Leverage tends to increase returns but also risks of making heavy losses. A small unfavourable movement will see the margin wiped out, and risk management is essential.

- Contracts Have Expiry, Requiring Rollovers: Futures are time-bound instruments. Traders who wish to hold on to trades after a contract expires will be required to roll them onto a new contract that comes with costs and execution risk.

- Not Suitable for Long-Term Passive Investors: As futures are tailored to active trading futures and hedging, they cannot suit the long-term passive actions of investors, which are reflected by the buy-and-hold policy.

- Complex Instruments, Requiring Skill and Discipline: Comprehending margin requirement, mark-to-market adjustments, and contract specifications involves a large amount of knowledge of the market and discipline. It can be steep and sometimes beginners can only be accommodated.

Real Trading Example

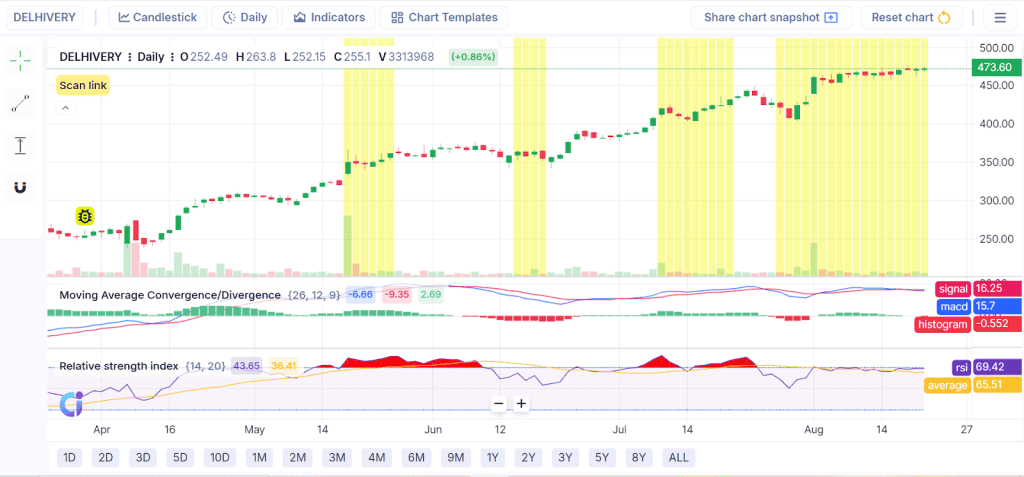

The Delhivery daily chart shows a robust upward trend, with prices rising consistently from approximately ₹250 to roughly ₹475 over the study period. Notable for their frequent preceding of breakouts, futures traders should keep an eye on the various yellow-highlighted candlestick phases of consolidation. The recent flattening of the MACD signal indicates weakening strength, in contrast to the bullish crossover earlier in the rally, which was in line with the momentum that drove prices higher.

Futures traders may see the stock’s proximity to the overbought zone, where the Relative Strength Index (RSI) is now sitting, as a hint to be cautious or book profits. This chart shows how futures traders might have managed risk by adding positions during range phases, riding rallies on breakouts, and adjusting positions depending on RSI and MACD signals.

Regulatory Framework

Futures trading is also highly regulated to ensure transparency and to isolate risk within the system.

- In the US, the Commodity Futures Trading Commission (CFTC) regulates futures markets.

- Exchanges such as CME Group impose margin guidelines as well as clearing house standards.

- In India, the Securities and Exchange Board of India (SEBI) regulates futures under the Securities Contracts Regulation Act.

Strong regulation will protect the investor, but this comes with a lot of compliance.

Futures Trading vs Derivative Trading

Futures, in turn, are a subset of derivatives. All futures are considered to be derivatives, but not all derivative trading is futures.

- Futures: Standardised, exchange-listed contracts, with fixed terms.

- Other Derivatives: Options, swaps, and forwards, which could be over-the-counter (OTC) and customisable.

In brief, futures are clear, liquid, and regulated, whereas alternative derivatives can be flexible but come with counterparty risks.

Conclusion

Futures trading is a useful financial instrument that trades off risk management with speculation. Futures can be used to hedge commodity prices, diversify a portfolio, and act as a speculation in directional market moves. However, this type of leverage, which attracts people, is also risky.

Futures trading needs discipline, risk management, and a strategy. Futures can become a valuable investment as well as a hedge against uncertainty.

FAQs

Futures trading is the buying or selling of standardised contracts, which compel a party to buy or sell an asset at a specific price and at a given date. Traders can either trade long (buy) in case the prices are expected to go up or short (sell) in case the prices are expected to drop. Unlike conventional investing, futures involve only margin deposits rather than the full value of the assets involved; as such, there is a more amplified risk of profit and loss.

The problem of futures trading is that the largest risk taken is leverage; small changes in prices can cause drastic gains or losses. Volatility in the market may issue margin calls, which can require traders to provide more capital. Less-traded contracts exhibit illiquidity risk, due to which the exit of positions is not easy. Rollovers cause additional expenses to long-term traders. Futures also subject traders to slippage, execution lag, and emotional pressure, where discipline strategies and tight risk management are key survival factors in this high-stressing, high-reward environment.

Futures contracts are an obligation to buy or sell at a specific price and time as opposed to options that grant a right but do not entail an obligation. Futures are standardised and traded on exchanges, are transparent and liquid, whereas forwards are private, customisable arrangements that trade over-the-counter (with underlying counterparty risk). Options are paid in full, and futures only in margin. Essentially, futures offer fixed limit liability, magnification, and standardisation, in contrast to the adaptability of options and the tailoring of forwards.

Prominent examples of futures strategies include trend following, where traders follow established price movements using technical indicators. The concept of spread trading is to have positions in both long and short, related contracts, with the aim of taking advantage of price differences. Investors and businesses hedge a portfolio or operations against the negative movements in the market. Day trading and scalping concentrate on the short-term price changes, achieving a number of small profits. Swing trading is a blend of both the short and the medium term.

Futures on offer are broad-based with respect to commodities, financials, and currencies. Some commodity futures are energy (crude oil, natural gas), metals (gold, silver, copper), and agriculture (wheat, coffee, soybeans). Financial futures track indices such as equity and government bonds, and interest rates to provide portfolio hedging vehicles. Currency futures allow one to bet on or defensively cover exchange rates such as USD/EUR or USD/JPY.