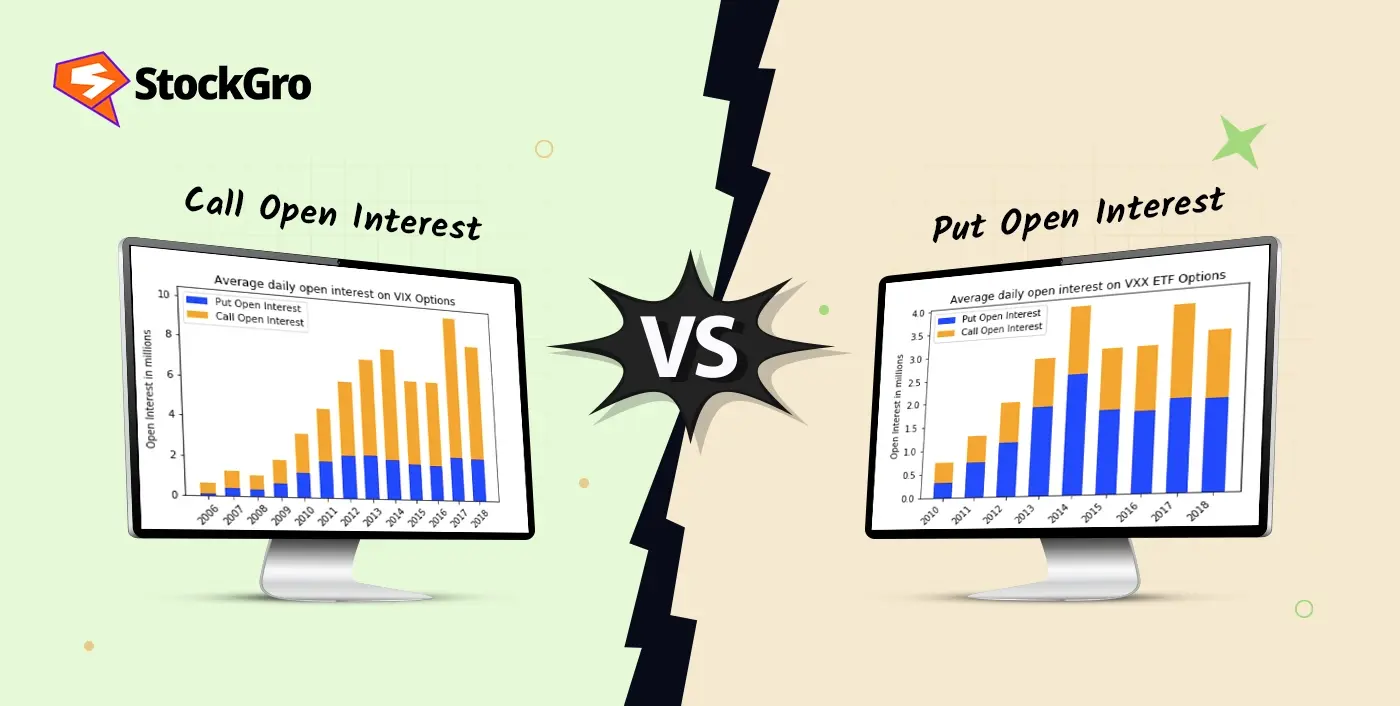

Option trading brings unique ways for investors to profit from market moves, even in a fluctuating direction. Strangle and straddle are two of the most prevalent strategies designed for such conditions. Both strategies let investors benefit from market swings, but the comparison of strangle Vs. straddle lies in different costs, mechanics, and risk profiles.

Knowing when to pick one between a strangle vs. straddle can really help you control losses and boost gains in your trading journey. Let’s discover the main facts of strangle vs. straddle, including their differences and how you can decide the right choice for your trading pattern.

Strangle vs Straddle: Which Option Strategy Should You Use?

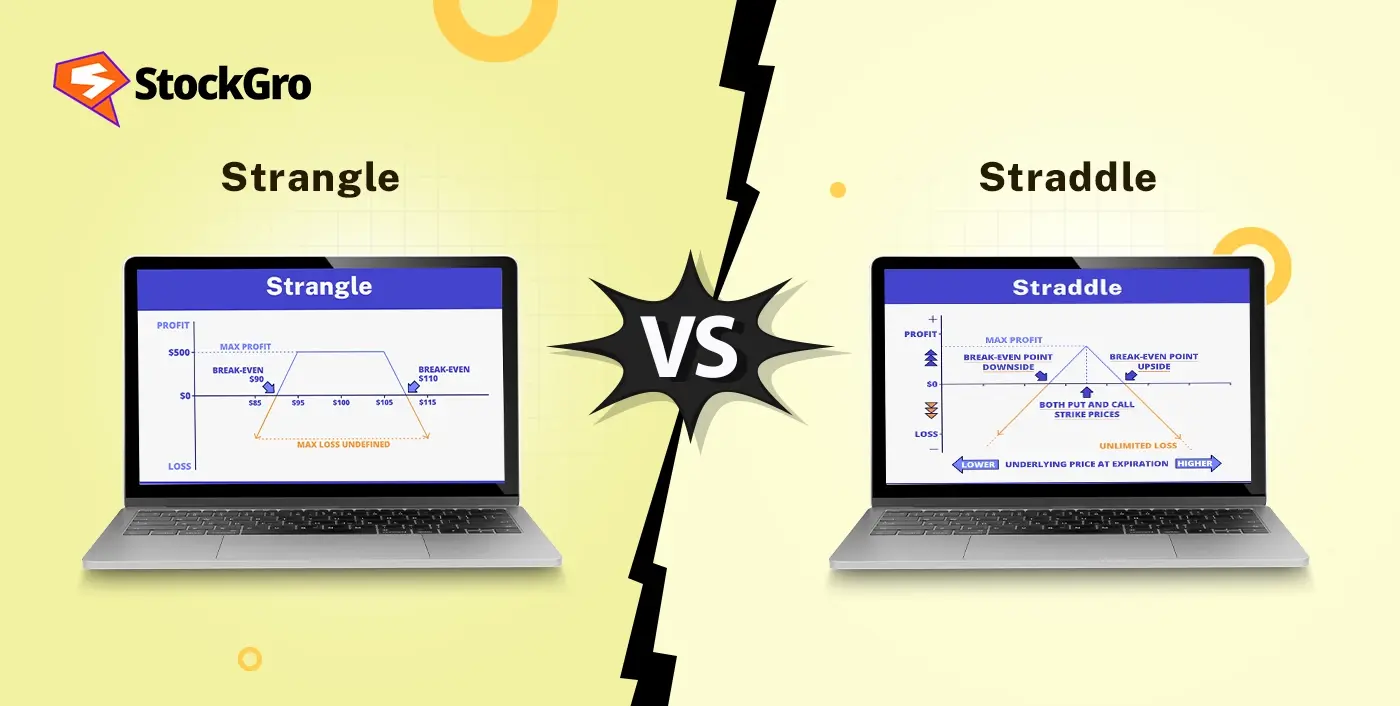

A straddle uses a call and put with the same strike price and expiration date, while a strangle uses the same expiration date but different strike prices. The core idea of both strategies involves buying calls and putting options to record moves in either direction. For strangle vs. straddle, picking the strike prices makes all the difference. For both call and put options, strangle applies diverse strike prices, normally one OTM call and one OTM put, while the straddle depends on the same strike prices.

- Straddles: Costly but easily triggered by movements.

- Strangles: Low-cost, but to deliver profit, it demands a bigger move.

Your choice for strangle vs straddle options trading depends on your budget for premiums and expectation of volatility.

What is a Straddle Option Strategy?

When you grab a call and a put option with similar strike prices and date of expiry, a straddle strategy takes place, where investors do this while anticipating a significant shift without knowing the direction.

- For instance, an XYZ stock is trading at ₹200, where you buy a ₹200 call and a ₹200 put, both expiring in one month.

- If XYZ hits up to ₹240, the call delivers strong profit while the put loses value.

- If XYZ fails at ₹160, the call expires worthless while the put profits significantly.

Here, the advantage is that you profit from volatility in either direction, but the high upfront premium can be the drawback, since both options are at-the-money.

What is a Strangle Option Strategy?

While purchasing a call and a put option with similar time decay but different strike prices, a strangle strategy is formed, with a call option beyond and a put option beneath the current OTM.

- For instance, stock XYZ is at ₹150. You buy a ₹160 call and a ₹140 put, both expiring in one month.

- If XYZ rises sharply above ₹160, your call delivers profit.

- Your put becomes profitable if XYZ drops beneath ₹140.

Here, the premium paid is not as much as a straddle, but the stock must move rapidly to exceed the chosen strikes.

Key Differences Between Strangle and Straddle

| Features | Straddle | Strangle |

| Strike Prices | Call and put options have similar strike prices, typically at-the-money (ATM), indicating a closer starting position to the current market price. | Call and put options have different strike prices, usually out-of-the-money (OTM), indicating more flexibility, but start further from the current price. |

| Costs | The higher premium is due to both options being ATM and holding more intrinsic value. | Lower premium since OTM options are low-priced to buy. |

| Breakeven Points | Closer to the latest price, slight movements can result in profits. | Far away from the latest price, so larger moves will lead to profits. |

| Profit Potential | Profit from either direction, strong moves up or down, can lead to huge profits. | Profit from both directions, but need a significant push to lead to profit. |

| Risk | Risk is limited to the total premium paid, but a high premium has a scope of bigger losses. | Risk is limited to the total premium paid, which is smaller, but losses can be higher due to further breakeven. |

| Best For | Investors anticipate strong volatility in the near term, such as major announcements, data releases, or earnings. | Investors expect significant moves but want a cheaper entry point, often with high volatility. |

Strangle vs Straddle: Risk & Reward Comparison

In the strangle vs straddle options, both of them share one important trait: the maximum risk is limited to the premium paid, while the probable profit is theoretically unlimited if the market moves significantly. But the risk-reward balance is different in strangle vs straddle, which makes traders choose one over the other.

Straddle:

- Usually more expensive as both the call and put options are at the same ATM strike price.

- A slight movement in either direction can lead to profit as the breakeven levels are relatively closer.

- This makes straddles attractive for traders seeking immediate volatility, like central bank interest rate directions, earnings announcements, or political developments.

- The trade-off is that the highest premium paid makes the strategy riskier if the market stays flat, as theta (time decay) quickly erodes option value.

- Essentially, you pay more beforehand, but don’t need a significant move to benefit.

Strangle:

- Less expensive as both the call and put options are not purchased at-the-money but out-of-the-money.

- The stock or index needs to have significant moves for the trade to turn profitable, as the breakeven points are further away.

- For traders expecting huge swings like during regulatory rulings, unpredictable elections, or sudden market shocks, this can be an appealing choice.

- If the move doesn’t happen, the lower premium makes it less risky, but you need to be patient and consistent for the price action to gradually reach the breakeven.

- In short, you pay less beforehand, but need a bigger move to succeed.

When to Use a Straddle

- Before quarterly results or corporate earnings reports: Market movements become significant to earnings surprises, and a straddle can catch those rapid moves.

- Before significant economic policy announcements or central bank meetings: When there are inflation updates, interest rate hikes, or policy updates that lead to sharp volatility.

- During the extreme hesitation period: Events like geopolitical tension or big economic shifts can affect rapid price fluctuations. A straddle is the perfect tool for temporary, medium-sized swings around known catalysts.

When to Use a Strangle

- With an already high implied volatility: If options are highly expensive, straddles may not be cost-effective, but strangles can be a cheaper alternative.

- Expecting a major breakout or crash without knowing the direction: For instance, around the global crisis, lawsuits, or elections, Strangle lets you participate without investing huge amounts of money.

- When trading longer time frames: If you believe the market will make a stronger move, strangles give you time at a lower cost. A strangle is a good choice when you want to spend less beforehand but bet on dramatic moves in the market.

Straddle vs Strangle: Real Examples

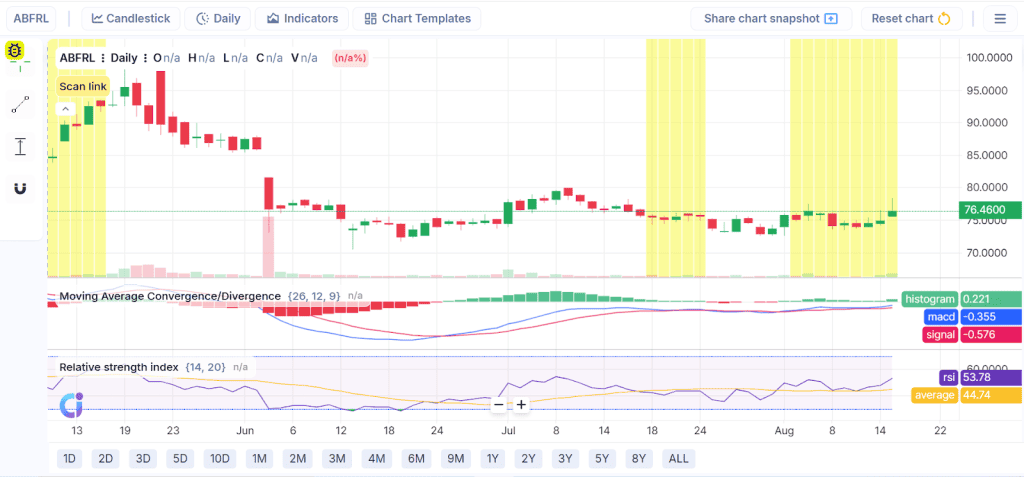

Long periods of consolidation, shown in yellow on this Aditya Birla Fashion and Retail Limited (ABFRL) daily chart, are the most noticeable feature. Option methods like straddles and strangles are good when prices suddenly rise following consolidation. The difference between a straddle and a strangle is that the former employs out-of-the-money strikes for both options, while the latter utilises at-the-money strikes for both options.

As you can observe from this graph, the price has been fluctuating within a narrow band of ₹75-₹77 for multiple sessions now, after falling from earlier highs. Traders often set up straddles or strangles in this type of squeeze, hoping for a breakout in either direction. Both approaches have a chance to work here because the Relative Strength Index (RSI) is going up and the Moving Average Convergence/Divergence (MACD) is going down, both of which indicate that momentum may be gathering.

Trading using a strangle would be more cost-effective, but trading with a straddle would make the trader more responsive to short-term price changes.

Pros and Cons: Strangle vs Straddle

Straddle – Pros

- Captures minor changes: Since both the call and put are purchased at a similar strike price, even minor price swings in either direction can be profitable.

- Closer breakeven points: With a central strike price, the stock doesn’t need to move drastically before you start gaining profit

- Clear structure: Easy setup and monitoring make it perfect for traders with straightforward strategies.

Straddle – Cons

- Huge premium cost: Buying at-the-money options is costly, increasing the upfront risk and cost.

- Theta works against you: Options lose value as expiry nears, and with the similar strike price for both the options, the premium quickly erodes if the price doesn’t move rapidly.

- Higher risk of small loss: With low volatility, the premium outlay can quickly become a loss.

Strangle – Pros

- Inexpensive implement: Out-of-the-money options are cheaper than at-the-money, making it more affordable for investors with a minimum budget.

- Huge flexibility: You can choose a price depending on volatility, budget, and risk tolerance.

- Potential for huge gains: Works well when you expect significant moves in the stocks, particularly around news or events.

Strangle – Cons

- Needs bigger moves to profit: Since the options are out-of-the-money, the stock must move significantly before you break even.

- Additional breakeven points: The stock has to move more to gain profit as strikes are farther from the latest price.

- More indecision: Strangles can expire with zero value, offering barely any scope of recovery, if the predictable volatility doesn’t happen.

Tips for Choosing the Right Strategy

- Authenticate implied volatility: Implied volatility, when high, can result in costly straddles. Choose a strangle instead.

- Analyse event impact: If the event is expected to show slight movement, choose straddle. Strangle works better for extreme swings.

- Understand your budget: Straddle demands a huge budget, while Strangle offers a low-cost entry.

- Set exit rules: For risk management, use stop-losses or definite profit-taking levels.

- Match with a trading pattern: Straddles are great for active, temporary traders, while strangles fit patient traders waiting for big moves.

Conclusion

For trading volatility, straddles and strangles are potential tools. Both limit your ultimate risk to the premium paid while letting infinite upside potential. For strangle vs straddle, the real decision lies in cost vs movement expectations. For immediate and moderate volatility, if you’re ready to pay more beforehand, choose a straddle. But you must pick a strangle if you expect a large market move and want to enter with a low budget.

Knowing how they work, what the risks are, and when to use them can help decide between strangle vs straddle to fit your trading journey.

FAQs

Neither strategy is comprehensively “better”, as it is entirely dependent on the market situation and trader’s outlook. A straddle is better when you expect significant volatility soon, as it profits from harsh moves in either direction with closer breakeven points. However, it costs more since premiums are higher. A strangle is cheaper but demands huge price swings to become profitable. Traders typically pick straddles for near-term events and strangles when anticipating strong moves at a lower cost.

The perfect time to implement a straddle strategy is while anticipating a sharp stock price movement without knowing the direction, like earnings announcements, policy modifications, or significant economic reports that could trigger high volatility. Smaller price shifts can bring profits, since both call and put options are at the money. However, the strategy is expensive due to higher premiums, making it more suited for traders confident about upcoming market turbulence.

A strangle strategy works best when you expect a very large price swing in either direction but want to minimise costs beforehand. Since both choices are out-of-the-money, the premiums are low-priced. Traders often use it during high volatility and high-cost straddles. Say, traders may pick strangles around elections, mergers, or unpredictable announcements, where they believe the market could strongly move in either direction, but don’t want to pay high premiums.

Choosing strangle vs straddle strategies involves limited risk, as losses cannot exceed the total premium paid. However, strangles have breakeven points further from the current price, so the chance of losing the premium is slightly higher. Straddles, though more expensive, allow profitability with smaller moves. In that sense, strangles can feel riskier due to a lower probability of success, while straddles carry higher monetary risk because of costlier premiums. Ultimately, “risk” depends on probability versus cost.

Yes, you can lose money on a straddle if the underlying asset fails to move significantly in either direction. Since straddles involve buying both an at-the-money call and put, the mutual premium can be high-priced. If the strike price doesn’t move much until expiration, both options lose value and the trader pays the premium paid. Essentially, a lack of volatility results in a loss. The strategy works only when price swings exceed the breakeven levels.