The concept of a budget deficit, a situation where a government spends more than it earns, often sparks heated debate. Although it might seem simple in concept, it does have several consequences both for the economy and its investors in the long run.

In this article, we’re going to explore what a budget deficit is, why governments usually run them, and whether they help the economy in the long run or not.

What is a budget deficit?

A budget deficit, quite simply, is a situation in an economy where the government spends more than it earns in revenue from the country. Just like you strive to strike a balance between your budget and your monthly expenses, so does the government.

However, most times, governments spend more than they have, which leads to them running a deficit. This shortage of money is usually financed by government bonds, which increases the national debt.

Why do governments run deficits?

There are several reasons why governments around the world famously run (or have to run) large budget deficits:

- Slowdowns or dips in growth in the economy – When economic activity dips during the regular business cycle, tax revenues decline. As revenues are cut short but expenses largely remain the same, the gap increases. Governments might, hence, run deficits to stimulate the economy out of recession and increase consumer spending.

- Investments in future growth – Governments can’t care about short-term expenses and growth like other investors can; they need to have a hawkeye view of where the economy is heading and have to make sensible and timely investments or hedges accordingly. This might often lead to governments spending more money than they collected in some years or for several years together to safeguard the future of the economy in the long term.

- Emergencies – Unforeseen events like natural disasters or wars can necessitate increased spending, which could also lead to temporary deficits.

- Higher taxes in the future – Governments sometimes also strategise tax policy corresponding to historical budget deficits. A deficit that runs persistently often implies that governments will need to raise taxes in the future to pay off accumulated debt from issued government securities.

You may also like: IGST explained: Simplifying inter-state taxation in India - Higher interest rates or bond yields – In order to borrow large amounts, governments could also offer higher interest rates to investors and international banks that lend them money. Over time, while this helps to finance more spending, it also increases the cost of debt, putting a burden on future spending.

The impacts of running a budget deficit

The impact of a budget deficit is complex and depends on various factors, including its size, duration, and how the borrowed funds are used.

Potential benefits

- Governments could stimulate growth by managing their deficit well. If borrowing and running a deficit helps the economy grow sustainably in the long run, it is usually money well spent. Low unemployment and a boost in consumer demand are usually positive indicators of a positive growth cycle.

- Investing in the future is also important in the way of financing infrastructure projects for energy generation, agriculture, education, healthcare, etc. Laying the groundwork for long-term prosperity is essential.

Also Read: Union budget 2024: Expectations you must know

Potential downfalls

- Debt becomes more expensive over time both for the government and the private sector. If governments run deficits over long periods of time, expansion can spiral out of control and worst case, the government might have to default on its debt. That is never a good thing for the economy.

- Credit ratings take a hit if credit agencies believe that the government’s ability to pay back its debts on time is compromised in any way. With low credit ratings, the country’s currency might suffer against other world currencies, making imports more expensive.

India’s budget deficit

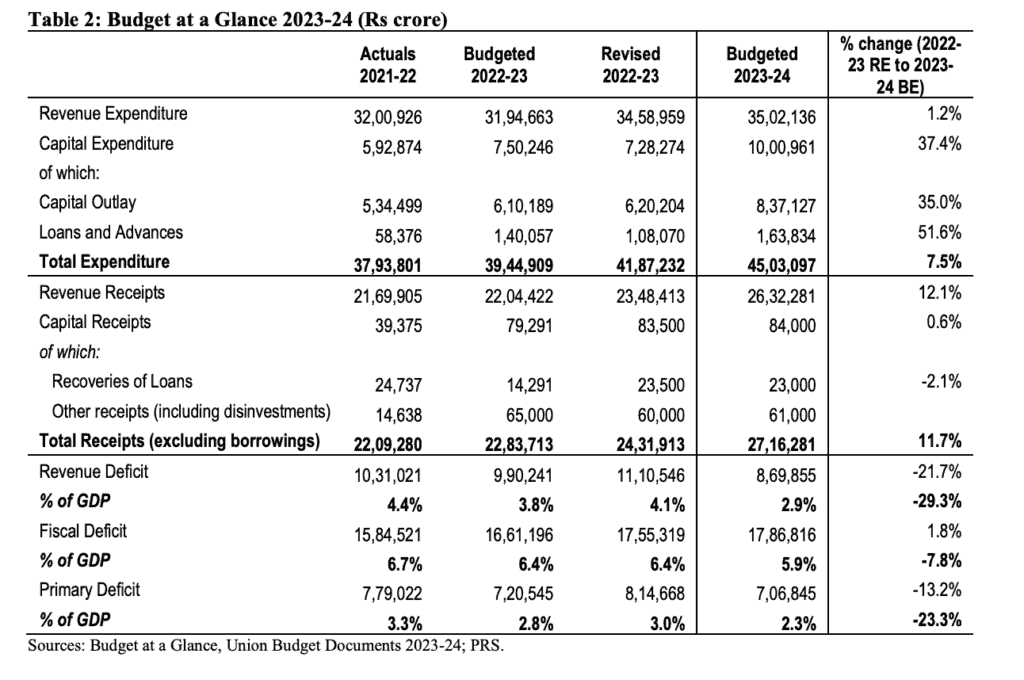

In the latest Union Budget released by India in recent weeks, we’ve seen that the country is still running a deficit for its budget. However, it is worth noting that the deficit decreased by a significant percentage, almost 22%, over last year.

By taking a look at the image above, you can make out how the government currently runs a fiscal deficit of almost 18 lakh crore (or US$217 billion), which is almost 6% of the entire GDP of the country.

Also Read: In Nirmala Sitharaman budget 2024: What it means for you

Conclusion

Ultimately, whether a budget deficit is good or bad for the economy depends very heavily on the larger circumstances surrounding that economy. While running a deficit, increasing expenses and cutting taxes is a good thing when trying to get an economy out of recession, it might be a poison pill for countries who are growing unsustainably.

Join India’s largest trading community and get expert-backed trade calls, live market trends, and stock research all in one place. Explore the StockGro app now!